Digital ID

World Bank president advocates global digital ID scheme at tech summit

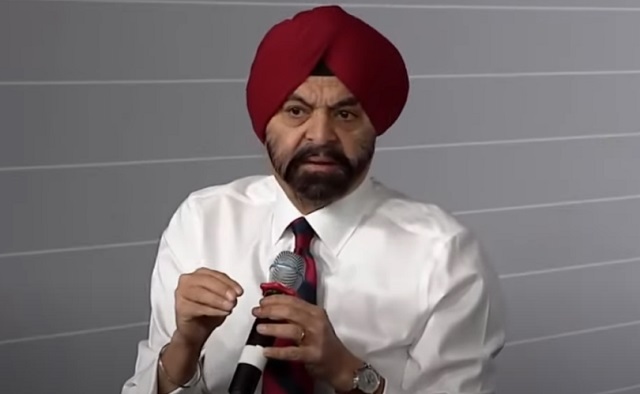

World Bank President Anjay Banga

From LifeSiteNews

Once digital identity is established and connected with public-private infrastructure, then everything else can be built on top of it, including access to financial services, insurance, healthcare, education, and the process of starting a new business – digital ID would be required for everything.

The president of the World Bank calls on governments to launch digital identity schemes, so that they can be linked with the private sector and existing infrastructures.

Speaking at the World Bank Group’s inaugural Global Digital Summit last week, World Bank president Ajay Banga said that digital identity should be embraced worldwide, and that governments should be the owners, so they can guarantee privacy and security for their citizens.

According to Banga, once everyone is hooked-up to a digital ID, then it can be linked to existing infrastructure run by private companies.

“Creating a digital identity platform for citizenry is kind of foundational, and I believe your government should be the owner of your digital ID; private companies should not own that,” said the World Bank president, adding, “it is the social contract of the citizens of their countries to have an identity, a currency, and safety. We should not take that away from them.”

World Bank Pres Ajay Banga: "Creating a digital identity platform for citizenry is foundational; your govt should be the owner of your digital ID.. If you want this to be embraced around the world.. get a digital ID & move from there" Global Digital Summit https://t.co/Sa1GzCnloQ pic.twitter.com/kKClx5iUuT

— Tim Hinchliffe (@TimHinchliffe) March 11, 2024

They should have the digital identity; that digital identity should guarantee the privacy of that citizen; it should help them with their security, but the government should give the identity.

Once you do that, then connecting them to the infrastructure that a private company, either Ericsson or Verizon, or combinations of them – in fact mostly it’s a combination – then the question is, ‘What do you do with it that requires a digital ID?’ so you can start connecting with that citizen.

For Banga and other unelected globalists, digital identity is the key to unlocking access to goods and services through public-private partnerships – the fusion of corporation and state.

Once governments launch their digital identity schemes, the World Bank president says they should be connected to private companies and existing infrastructures.

“Now the question is that you connect with that citizen, you must ensure that governments guarantee the privacy of that citizen,” said Banga.

“Because if you don’t do that, you will run into trouble with the acceptance of the idea.

“So, if you want this to be embraced around the world, yes, get the infrastructure, get a digital ID […] get that going and then move from there,” he added.

[Source: World Economic Forum]

[Source: World Economic Forum]

Once digital identity is established and connected with public-private infrastructure, then everything else can be built on top of it, including access to financial services, insurance, healthcare, education, and the process of starting a new business – digital ID would be required for everything.

The World Bank president’s words echo those of India’s digital ID architect Nandan Nilekani, who said at last year’s International Monetary Fund (IMF) Spring Meetings, “If you think, ‘what are the tools of the New World?’ – Everybody should have a digital ID; everybody should have a bank account; everybody should have a smartphone.”

“Then, anything can be done. Everything else is built on that.”

"What are the tools of the New World? Everybody should have a digital ID; everybody should have a bank account; everybody should have a smartphone. Then, anything can be done. Everything else is built on that": @NandanNilekani to @IMFNews #DigitalID #DigitalIdentity #IMFmeetings pic.twitter.com/6HIAqfBigz

— Tim Hinchliffe (@TimHinchliffe) April 19, 2023

Nilekani is a staunch advocate of digital public infrastructure (DPI), which consists of three components: digital identity, digital payments systems, and mass data sharing.

Last year, the G20 India Leaders’ Declaration stated:

We endorse the voluntary and nonbinding G20 Policy Recommendations for Advancing Financial Inclusion and Productivity Gains through Digital Public Infrastructure. We take note of the significant role of digital public infrastructure in helping to advance financial inclusion in support of inclusive growth and sustainable development.

Prior to the G20 Summit, the B20 India Communique recommended that members, “Roll out digital public infrastructure to boost financial inclusion and healthcare access.”

Then in November 2023, the United Nations, the Bill and Melinda Gates Foundation, and their partners launched the 50-in-5 campaign to help “50 countries design, launch, and scale components of their digital public infrastructure” within the next five years.

Ahead of last month’s vote on an update to the European digital identity framework, a small number of MEPs spoke out against the adoption of an EU-wide digital identity wallet, calling it an insult to democracy that was creating a QR code society and leading to a Chinese-style system of social credit.

Reprinted with permission from The Sociable.

Banks

Liberal border bill could usher in cashless economy by outlawing cash payments

From LifeSiteNews

Bill C-2 has raised concerns from legal organizations that warn it could lead to a cashless economy in Canada by banning cash payments over $10,000.

The Liberals’ proposed border legislation may quietly usher in a cashless economy by banning cash payments.

On June 3, the Liberal Party introduced Bill C-2 to strengthen border security and outlaw cash payments over $10,000. Legal organizations have since warned that this is the first step to a cashless economy and digital ID system in Canada.

“Part 11 amends the Proceeds of Crime (Money Laundering) and Terrorist Financing Act to prohibit certain entities from accepting cash deposits from third parties and certain persons or entities from accepting cash payments, donations or deposits of $10,000 or more,” the legislation proposes.

While the bill purports to strengthen border security and restore Canada-U.S. relations, many have warned that government regulation of cash payments is a slippery slope.

In a June 4 X post, the Justice Centre for Constitutional Freedoms (JCCF) warned that “If Bill C-2 passes, it will become a Criminal Code offence for businesses, professionals, and charities to accept cash donations, deposits, or payments of $10,000 or more. Even if the $10,000 payment or donation is broken down into several smaller cash transactions, it will still be a crime for a business or charity to receive it.”

The JCCF pointed out that while cash payments of $10,000 are not common for Canadians, the government can easily reduce “the legal amount to $5,000, then $1,000, then $100, and eventually nothing.”

“Restricting the use of cash is a dangerous step towards tyranny and totalitarianism,” the organization warned. “Cash gives citizens privacy, autonomy, and freedom from surveillance by government and by banks, credit card companies, and other corporations.”

“If we cherish our privacy, we need to defend our freedom to choose cash, in the amount of our choosing,” it continued. “This includes, for example, our right to pay $10,000 cash for a car, or to donate $10,000 (or more) to a charity.”

“Law enforcement already has the tools to fight crime,” JCCF declared. “Perhaps they need a bigger budget to hire more people, or perhaps they need to use existing tools more effectively. In a free society, violating our right to use cash is not the answer.”

A move to restrict Canadians’ use of cash is especially concerning as citizens already saw what a Liberal government will do to those who oppose its narrative during the 2022 Freedom Convoy.

In winter 2022, the Liberal government, under former Prime Minister Justin Trudeau, froze the bank accounts of those who donated to the Freedom Convoy, which featured thousands of Canadians camping in front of Parliament to protest COVID mandates.

Similarly, Liberal Prime Minister Mark Carney’s move to restrict Canadians is hardly surprising considering his close ties to the World Economic Forum and push for digital currency.

In a 2021 article, the National Post noted that “since the advent of the COVID pandemic, Carney has been front and centre in the promotion of a political agenda known as the ‘Great Reset,’ or the ‘Green New Deal,’ or ‘Building Back Better.’

“Carney’s Brave New World will be one of severely constrained choice, less flying, less meat, more inconvenience and more poverty,” the outlet continued.

In light of Carney’s new leadership over Canadians, many are sounding alarm over his distinctly anti-freedom ideas.

Exposing Mark Carney:

“Should sex be up for sale” 😮

“Should there be a market for the right to have children?” 🤯 pic.twitter.com/Q4hftgGIMc

— Mario Zelaya (@mario4thenorth) March 21, 2025

Carney, whose ties to globalist groups have had Conservative Party leader Pierre Poilievre call him the World Economic Forum’s “golden boy”. He has also previously endorsed the carbon tax and even criticized Trudeau when the tax was exempted from home heating oil in an effort to reduce costs for some Canadians.

Carney, who as reported by LifeSiteNews, has admitted he is an “elitist” and a “globalist.” Just recently, he criticized U.S. President Donald Trump for targeting woke ideology and has vowed to promote “inclusiveness” in Canada.

Carney also said that he is willing to use all government powers, including “emergency powers,” to enforce his energy plan.

Brownstone Institute

RCMP seem more interested in House of Commons Pages than MP’s suspected of colluding with China

From the Brownstone Institute

By

Canadians shouldn’t have information about their wayward MPs, but the RCMP can’t have too much biometric information about regular people. It’s always a good time for a little fishing. Let’s run those prints, shall we?

Forget the members of Parliament who may have colluded with foreign governments. The real menace, the RCMP seem to think, are House of Commons pages. MPs suspected of foreign election interference should not be identified, the Mounties have insisted, but House of Commons staff must be fingerprinted. Serious threats to the country are hidden away, while innocent people are subjected to state surveillance. If you want to see how the managerial state (dys)functions, Canada is the place to be.

In June, the National Security and Intelligence Committee of Parliamentarians (NSICOP) tabled its redacted report that suggested at least 11 sitting MPs may have benefitted from foreign election interference. RCMP Commissioner Mike Duheme cautioned against releasing their identities. Canadians remained in the dark until Oct. 28 when Kevin Vuong, a former Liberal MP now sitting as an Independent, hosted a news conference to suggest who some of the parliamentarians may be. Like the RCMP, most of the country’s media didn’t seem interested.

But the RCMP are very interested in certain other things. For years, they have pushed for the federal civil service to be fingerprinted. Not just high security clearance for top-secret stuff, but across government departments. The Treasury Board adopted the standard in 2014 and the House of Commons currently requires fingerprinting for staff hired since 2017. The Senate implemented fingerprinting this year. The RCMP have claimed that the old policy of doing criminal background checks by name is obsolete and too expensive.

But stated rationales are rarely the real ones. Name-based background checks are not obsolete or expensive. Numerous police departments continue to use them. They do so, in part, because name checks do not compromise biometric privacy. Fingerprints are a form of biometric data, as unique as your DNA. Under the federal Identification of Criminals Act, you must be in custody and charged with a serious offence before law enforcement can take your prints. Canadians shouldn’t have information about their wayward MPs, but the RCMP can’t have too much biometric information about regular people. It’s always a good time for a little fishing. Let’s run those prints, shall we?

It’s designed to seem like a small deal. If House of Commons staff must give their fingerprints, that’s just a requirement of the job. Managerial bureaucracies prefer not to coerce directly but to create requirements that are “choices.” Fingerprints aren’t mandatory. You can choose to provide them or choose not to work on the Hill.

Sound familiar? That’s the way Covid vaccine mandates worked too. Vaccines were never mandatory. There were no fines or prison terms. But the alternative was to lose your job, social life, or ability to visit a dying parent. When the state controls everything, it doesn’t always need to dictate. Instead, it provides unpalatable choices and raises the stakes so that people choose correctly.

Government intrudes incrementally. Digital ID, for instance, will be offered as a convenient choice. You can, if you wish, carry your papers in the form of a QR code on your phone. Voluntary, of course. But later there will be extra hoops to jump through to apply for a driver’s licence or health card in the old form.

Eventually, analogue ID will cost more, because, after all, digital ID is more automated and cheaper to run. Some outlets will not recognize plastic identification. Eventually, the government will offer only digital ID. The old way will be discarded as antiquated and too expensive to maintain. The new regime will provide the capacity to keep tabs on people like never before. Privacy will be compromised without debate. The bureaucracy will change the landscape in the guise of practicality, convenience, and cost.

Each new round of procedures and requirements is only slightly more invasive than the last. But turn around and find you have travelled a long way from where you began. Eventually, people will need digital ID, fingerprints, DNA, vaccine records, and social credit scores to be employed. It’s not coercive, just required for the job.

Occasionally the curtain is pulled back. The federal government unleashed the Emergencies Act on the truckers and their supporters in February 2022. Jackboots in riot gear took down peaceful protesters for objecting to government policy. Authorities revealed their contempt for law-abiding but argumentative citizens. For an honest moment, the government was not incremental and insidious, but enraged and direct. When they come after you in the streets with batons, at least you can see what’s happening.

We still don’t know who colluded with China. But we can be confident that House of Commons staffers aren’t wanted for murder. The RCMP has fingerprints to prove it. Controlling the people and shielding the powerful are mandates of the modern managerial state.

Republished from the Epoch Times

-

Crime2 days ago

Crime2 days ago“This is a total fucking disaster”

-

Fraser Institute1 day ago

Fraser Institute1 day agoBefore Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million annually

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV

-

Daily Caller2 days ago

Daily Caller2 days ago‘I Know How These People Operate’: Fmr CIA Officer Calls BS On FBI’s New Epstein Intel

-

MAiD2 days ago

MAiD2 days agoCanada’s euthanasia regime is already killing the disabled. It’s about to get worse

-

Daily Caller2 days ago

Daily Caller2 days agoBlackouts Coming If America Continues With Biden-Era Green Frenzy, Trump Admin Warns

-

Red Deer2 days ago

Red Deer2 days agoJoin SPARC in spreading kindness by July 14th

-

Business1 day ago

Business1 day agoPrime minister can make good on campaign promise by reforming Canada Health Act