Opinion

Will any of 50+candidates address change in the October 16 2017 municipal election.

Change is Constant. Will we accept that?

Is the status quo acceptable for sustainable development, when the city’s population has, in fact, declined by 1% in 1 year?

Should we accept having all 6 high schools south of the river? Should we accept 5 high schools along 30 Ave? Should we accept having no high schools north of the river forcing 30% of the population to commute across the river?

Red Deer region has the poorest air quality in Alberta, is there a plan?

Red Deer has been cited for having often times the second highest crime rate, per capita. Again, is there a plan?

Businesses are leaving the city proper to open up in areas abutting the city like Gasoline Alley, why? Is anyone asking?

Should we accept 10 recreational facilities on the south side where we have; the Downtown Recreation Centre, Michener Aquatic Centre, Downtown Arena, Centrium complex, Collicutt Recreation Centre, Pidherney Curling Centre, Kinex Arena, Kinsmen Community Arenas, Red Deer Curling Centre, and the under-construction Gary W. Harris Centre. The city is also talking about replacing the downtown recreation centre with an expanded 50m pool. While only having the Dawe Centre on the north side?

On October 16 2017 we will be voting for a Mayor, 8 city councillors and either 7 public school board trustees or 5 separate school board trustees.

The last election in 2013 we had 5 people running for mayor, 30 people running for council, 14 people running for public school board and 7 people run for the separate school board, 56 people in total.

This year we may have more choices. The incumbents will all have an advantage over the other candidates, and I have yet to hear of any incumbents deciding to not run again.

So the questions previously asked are important. Will the incumbents offer any explanations for the declining populations, the unequal distribution of high schools and recreational facilities? Will they blame the provincial economy?

Penhold is growing and looking to annex enough land to double it’s footprint. Blackfalds increased it’s population by 700 in 1 year. Are they not affected by the same economy? Sylvan Lake, Penhold and Blackfalds which has less population together as Red Deer has north of the river but they are each in line to have a high school, while there is no plans to build a high school north of the river in Red Deer.

The land north of 11a is up for development, and if the city starts to grow again, we could see 55,000 residents north of the river but no high school. Is that acceptable?

Talking about developing north of 11a, there is Hazlett Lake. Largest lake in Red Deer. Remember, Hazlett Lake is a natural lake that covers a surface area of 0.45 km2 (0.17 mi2), has an average depth of 3 meters (10 feet). Hazlett Lake has a total shore line of 4 kilometers (2 miles). It is 108.8 acres in size. Located in the north-west sector of Red Deer. It is highly visible from Hwy 2 and Hwy 11A, and could help with tourism and with the needs of Red Deer’s own citizens.

The Collicutt Centre was built in the south-east corner of Red Deer and it facilitated growth in Red Deer. Blackfalds, Penhold and Sylvan Lake all followed suit, built new recreational complexes and enjoyed phenomenal growth soon after. So build a “Collicutt 2” in the north-west by Hazlett Lake to help facilitate growth in the north west. Will the candidates even consider these ideas or will they settle on the status quo?

During the last 9 elections we have heard about developing the land along the river, moving the public works and building a beautiful 23 acre neighbourhood with a 23 million dollar footbridge to Bower Ponds so pedestrians do not have to walk 300 metres to Taylor Bridge. It will come up in the next 4 elections before it is completed.

We will again hear how beautiful our trails are, and the importance of downtown revitalization. We could get the material from candidates in the last 9 elections.

Has Red Deer hit a glass ceiling? 99,800 residents, schools in the east, facilities downtown, industry in the north-west?

For 2 weeks in 2019, we will have 35,000 visitors, and it will only cost 70 million dollars. Is that it? No plans, no answers, no vision, just the status quo and 2 weeks in 2019?

Change is constant, and the world is changing, is Red Deer changing?

I believe Red Deer is changing and needs to address these issues and many more. I believe that it is important to offer something for the future and not campaign on the past. Do not accept platitudes and rhetoric and look for answers to questions that may not have been asked yet.

I need to hear a plan, and I need to see a vision not just hear words and see a smile. Red Deer needs it, now more than ever, because Red Deer is shrinking, like never before. Yesterday’s words are not sufficient in today’s world. Remember that.

Daily Caller

Daily Caller EXCLUSIVE: Trump’s Broad Ban On Risky Gain-Of-Function Research Nears Completion

From the Daily Caller News Foundation

By Emily Kopp

President Donald Trump could sign a sweeping executive order banning gain-of-function research — research that makes viruses more dangerous in the lab — as soon as May 6, according to a source who has worked with the National Security Council on the issue.

The executive order will take a broad strokes approach, banning research amplifying the infectivity or pathogenicity of any virulent and replicable pathogen, according to the source, who requested anonymity to speak candidly about the anticipated executive action. But significant unresolved issues remain, according to the source, including whether violators will be subject to criminal penalties as bioweaponeers.

The executive order is being steered by Gerald Parker, head of the White House Office of Pandemic Preparedness and Response Policy, which has been incorporated into the NSC. Parker did not respond to requests for comment.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here. Thank you!

In the process of drafting the executive order, Parker has frozen out the federal agencies that have for years championed gain-of-function research and staved off regulation — chiefly Anthony Fauci’s former institute, the National Institute of Allergy and Infectious Diseases at the National Institutes of Health.

The latest policy guidance on gain-of-function research, unveiled under the Biden administration in 2024, was previously expected to go into effect May 6. According to a March 25 letter cosigned by the American Society for Microbiology, the Association for Biosafety and Biosecurity International, and Council on Governmental Relations, organizations that conduct pathogen research have not received direction from the NIH on that guidance — suggesting the executive order would supersede the May 6 deadline.

The 2024 guidance altered the scope of experiments subject to more rigorous review, but charged researchers, universities and funding agencies like NIH with its implementation, which critics say disincentivizes reporting. Many scientists say that researchers and NIH should not be the primary entities conducting cost–benefit analyses of pandemic virus studies.

Parker previously served as the head of the National Science Advisory Board for Biosecurity (NSABB), a group of outside experts that advises NIH on biosecurity matters, and in that role recommended that Congress stand up a new government agency to advise on gain-of-function research. Former Centers for Disease Control and Prevention Director Robert Redfield has also endorsed moving gain-of-function research decision making out of the NIH to an independent commission.

“Given the well documented lapses in the NIH review process, policymakers should … remove final approval of any gain-of function research grants from NIH,” Redfield said in a February op-ed.

It remains to be seen whether the executive order will articulate carveouts for gain-of-function research without risks of harm such as research on non-replicative pseudoviruses, which can be used to study viral evolution without generating pandemic viruses.

It also remains to be seen whether the executive order will define “gain-of-function research” tightly enough to stand up to legal scrutiny should a violator be charged with a crime.

Risky research on coronaviruses funded by the NIH at the Wuhan Institute of Virology through the U.S. nonprofit EcoHealth Alliance typifies the loopholes in NIH’s existing regulatory framework, some biosecurity experts say.

Documents obtained through the Freedom of Information Act in 2023 indicated that EcoHealth Alliance President Peter Daszak submitted a proposal to the Pentagon in 2018 called “DEFUSE” describing gain-of-function experiments on viruses similar to SARS-CoV-2 but downplayed to his intended funder the fact that many of the tests would occur in Wuhan, China.

Daszak and EcoHealth were both debarred from federal funding in January 2025 but have faced no criminal charges.

“I don’t know that criminal penalties are necessary. But we do need more sticks in biosafety as well as carrots,” said a biosecurity expert who requested anonymity to avoid retribution from his employer for weighing in on the expected policy. “For instance, biosafety should be a part of tenure review and whether you get funding for future work.”

Some experts say that it is likely that the COVID-19 crisis was a lab-generated pandemic, and that without major policy changes it might not be the last one.

“Gain-of-function research on potential pandemic pathogens caused the COVID-19 pandemic, killing 20 million and costing $25 trillion,” said Richard Ebright, a Rutgers University microbiologist and longtime critic of high-risk virology, to the Daily Caller News Foundation. “If not stopped, gain-of-function research on potential pandemic pathogens likely will cause future lab-generated pandemics.”

John Stossel

Climate Change Myths Part 1: Polar Bears, Arctic Ice, and Food Shortages

From StosselTV

Climate zealots tell us the end is near. It’s the era of “global BOILING!” says the UN Secretary General. Climate alarmists say the Arctic will soon be ice-free and cities will be underwater! But what do the facts say?

The facts say that the climate change fanatics’ catastrophic claims are wrong.

In this video and the next, we’ll debunk 7 myths about climate change.

First up: melting ice, polar bear extinction, and climate change famines.

Here are the sources for this video:

No new record low summer ice extent observed since 2012. https://agupubs.onlinelibrary.wiley.c…

Satellite data show average annual sea ice volume largely stable since 2010: https://psc.apl.uw.edu/wordpress/wp-c…

Total arctic ice mass: http://psc.apl.uw.edu/research/projec…

Polar Bear Estimates 1993-today: https://www.iucn-pbsg.org/wp-content/…

1981: https://portals.iucn.org/library/site…

1960s: https://www.google.com/books/edition/…

Global agricultural output: https://ourworldindata.org/grapher/ag…

NASA Greening study: https://www.nasa.gov/centers-and-faci…

Malnutrition deaths: https://ourworldindata.org/grapher/ma…

Coffee production: https://www.fao.org/faostat/en/#compare

After 40+ years of reporting, I now understand the importance of limited government and personal freedom. ”

——————————————

Libertarian journalist John Stossel created Stossel TV to explain liberty and free markets to young people.

Prior to Stossel TV he hosted a show on Fox Business and co-anchored ABC’s primetime newsmagazine show, 20/20.

Stossel’s economic programs have been adapted into teaching kits by a non-profit organization, “Stossel in the Classroom.” High school teachers in American public schools now use the videos to help educate their students on economics and economic freedom. They are seen by more than 12 million students every year.

Stossel has received 19 Emmy Awards and has been honored five times for excellence in consumer reporting by the National Press Club. Other honors include the George Polk Award for Outstanding Local Reporting and the George Foster Peabody Award.

_ _ _ _ _ _

In order not to miss the next video from Stossel TV, sign up here: https://johnstossel.activehosted.com/f/1

_ _ _ _ _ _

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP Whistleblowers Accuse Members of Mark Carney’s Inner Circle of Security Breaches and Surveillance

-

Also Interesting2 days ago

Also Interesting2 days agoBetFury Review: Is It the Best Crypto Casino?

-

Autism2 days ago

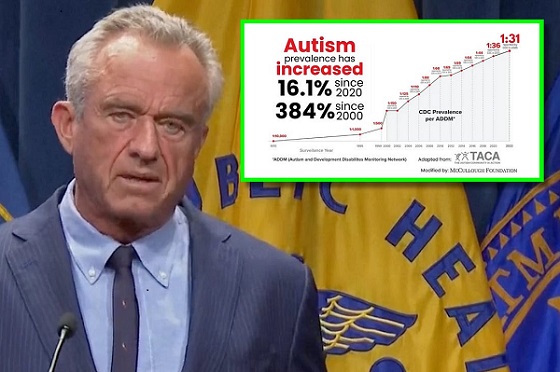

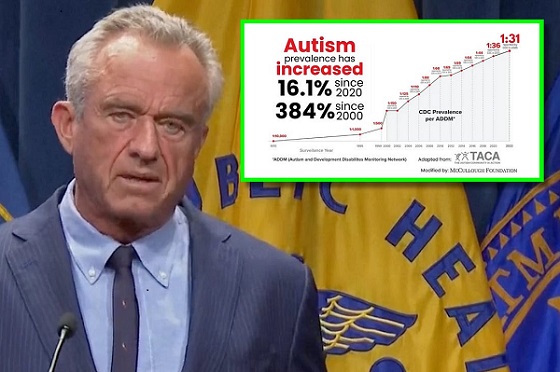

Autism2 days agoRFK Jr. Exposes a Chilling New Autism Reality

-

COVID-192 days ago

COVID-192 days agoCanadian student denied religious exemption for COVID jab takes tech school to court

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBureau Exclusive: Chinese Election Interference Network Tied to Senate Breach Investigation

-

International2 days ago

International2 days agoUK Supreme Court rules ‘woman’ means biological female

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNeil Young + Carney / Freedom Bros

-

Health2 days ago

Health2 days agoWHO member states agree on draft of ‘pandemic treaty’ that could be adopted in May