Tariff,” U.S. presidential candidate Donald Trump was fond of saying with a smirk, “it’s my favorite word.” It was enough to curdle the blood and wobble the knees of political leaders, trade officials and business groups around the world – not least in export-dependent Canada. This was one Trumpian campaign line not swatted aside by critics as bombast, trolling, dog-whistling to the “extreme right” or unhinged fantasy. And with evident good reason.

After all, it was President #45 who after rising to political prominence largely on his promise to go after “bad trade deals” had upended 70 years of U.S. trade policy by imposing tariffs on Chinese (and some Canadian) imports and demanding to renegotiate the North American Free Trade Agreement. It was returning candidate Trump who picked as his running mate J.D. Vance, whose life story growing up amidst family wreckage in rural Ohio is almost the embodied result of a hollowed-out manufacturing economy, and who today is an articulate frontman for the something-less-than-free school of international trade. And it is President-elect Trump who has nominated prominent advocates of “America-first” trade policy – in which tariffs are central – to become his Secretary of Commerce and Secretary of the Treasury.

Tariff king: Consistent with his first presidency, U.S. President-elect Donald Trump has vowed to pursue an “America-first” trade policy this time. Shown, Trump speaking during an America First Policy Institute gala at his Mar-a-Lago, Florida estate, November 2024. (Source of photo: AP Photo/Alex Brandon)

Tariff king: Consistent with his first presidency, U.S. President-elect Donald Trump has vowed to pursue an “America-first” trade policy this time. Shown, Trump speaking during an America First Policy Institute gala at his Mar-a-Lago, Florida estate, November 2024. (Source of photo: AP Photo/Alex Brandon)

Few sectors in any country stand to suffer greater damage from U.S. tariffs than Canadian energy. Canada’s fossil fuel production is at record levels, with crude oil averaging 5.8 million barrels per day so far this year and natural gas well over 18 billion cubic feet per day. Exports of these key commodities (plus natural gas “liquids” like ethane and propane) are valued at more than $134 billion per year – another measure has it at US$160 billion – with exports of petrochemicals generating billions more. Canada’s oil and gas sector is directly responsible for $210 billion of the nation’s GDP and 25 percent of its exports.

Yet while the industry today is a marvel of leading technology, deep expertise and operating efficiency, Canadian energy remains costly to produce, heavily taxed and saddled with ever-increasing regulations, such as the recently announced federal “emissions cap”. Moreover, the remoteness of the Western Canada Sedimentary Basin – the world-scale producing region that covers most of Alberta plus northeast B.C., southern Saskatchewan and a corner of Manitoba – imposes costs not incurred by U.S. producers. Constraints on export capacity effectively trap oil and gas within Western Canada, dampening regional benchmark commodity prices. And the industry remains over-dependent on the U.S. market; the expanded Trans Mountain pipeline will enable at best 20 percent of Canada’s crude oil production to access offshore markets, while the country’s first liquefied natural gas (LNG) export terminal is not yet operational.

This critical industry thus sits exposed and vulnerable to U.S. tariffs. A levy of 10-20 percent – the rate Trump has said he wants to slap on all imports – would be catastrophic, reducing Canada’s energy exports by an estimated 22 percent, causing domestic pricing to collapse and, with it, any new capital investment. Thousands would lose their jobs and government deficits would soar. Rory Johnston, a Toronto-based oil market researcher and founder of Commodity Context, describes Canada as “uniquely vulnerable to market pressure posed by U.S. refineries.”

“Uniquely vulnerable”: Canada’s oil and natural gas production is setting records and generating 25 percent of the country’s overall export earnings; a 10-20 percent U.S. import tariff could wreak catastrophic damage. (Sources: (graph) CAPP; (left photo) MikoFox, licensed under CC BY-NC-SA 2.0; (right photo) Green Energy Futures, licensed under CC BY-NC-SA 2.0)

“Uniquely vulnerable”: Canada’s oil and natural gas production is setting records and generating 25 percent of the country’s overall export earnings; a 10-20 percent U.S. import tariff could wreak catastrophic damage. (Sources: (graph) CAPP; (left photo) MikoFox, licensed under CC BY-NC-SA 2.0; (right photo) Green Energy Futures, licensed under CC BY-NC-SA 2.0)

But is the threat of such a tariff imminent – or even credible? The evidence to date – partial and indirect though it may be – suggests not. More profoundly, the logic of U.S. self-interest and of Trump’s stated policy objectives points away from tariffs on Canadian oil and natural gas.

First the evidence. Trump had barely been declared victor in the November 5 Presidential election before voices on both sides of the border began talking about creating a tariff “exemption” for Canadian fossil fuels. Wilbur Ross, Secretary of Commerce in Trump’s first term, called fears of such a tariff “overblown” and said he “can’t imagine” his former boss imposing them. Alberta Premier Danielle Smith also said she was “not worried”. Then again, she also wrangled for herself invitations to key events such as next month’s meeting of the Western Governors’ Association, as well as Trump’s Inauguration in January, to make sure Alberta’s message gets through.

Similar views have been expressed by other knowledgeable sources from industry, trade and investment organizations. They note that Trump has done this very thing before; the renegotiated U.S.-Mexico-Canada Agreement of 2019 notably excused oil and natural gas flows from any tariffs. A further favourable indication is Alberta’s recent admission to the U.S. Governors’ Coalition for Energy Security, a group of 12 states that have banded together to cooperate on policies that promote reliable and affordable energy.

Guys who get it: Among Trump’s Cabinet nominees are North Dakota Governor Doug Burgum (left) and Liberty Energy CEO Chris Wright (right), both known for their vigorous support of oil and natural gas development and free North American trade in energy products. (Sources of photos: (left) Gage Skidmore, licensed under CC BY-SA 2.0; (right) Gage Skidmore, licensed under CC BY-SA 3.0)

Guys who get it: Among Trump’s Cabinet nominees are North Dakota Governor Doug Burgum (left) and Liberty Energy CEO Chris Wright (right), both known for their vigorous support of oil and natural gas development and free North American trade in energy products. (Sources of photos: (left) Gage Skidmore, licensed under CC BY-SA 2.0; (right) Gage Skidmore, licensed under CC BY-SA 3.0)

Another positive sign is that alongside Trump’s pro-tariff Cabinet picks have come nominations of individuals with a deep understanding of North America’s petroleum sector. Douglas Burgum, a successful software entrepreneur and currently Governor of North Dakota, is slated to become Secretary of the Interior, chairman of the newly created National Energy Council and a member of the U.S. National Security Council. Burgum’s primary mandate is to promote innovation and investment by cutting through the thicket of new restrictions on oil and gas development that President Joe Biden had imposed. Chris Wright, founder of Liberty Energy and an unashamed industry booster, has been nominated to become what one U.S. commentator describes as “the most knowledgable secretary of energy the nation has ever had.” Lee Zeldin, another pro-industry figure, has been tapped to head the Environmental Protection Agency.

The fundamental objective underlying all of Trump’s trade policy is to strengthen American manufacturing. It is something he has articulated since before entering politics in 2015; it can accordingly be regarded as sincere.

Equally noteworthy is that, in contrast to the widespread and bipartisan clamouring for tariffs on Chinese imports, nobody in the U.S. is demanding that Trump target Canadian energy. Even Bernie Sanders, the avowedly socialist Senator from Vermont who wants a “windfall tax” and higher government royalties imposed on all oil producers, appears indifferent to import tariffs. And while U.S. environmental groups don’t like any free trade in oil and gas, they devote most of their energy to pushing their government towards restrictive European/Canadian-style climate-change policies or a new UN “climate damages tax.” The American fossil fuel sector, meanwhile, is not only in favour of tariff-free trade in energy products – including with Canada – it opposes tariffs on anything.

The evidence to date, however hopeful it may seem, remains inconclusive. Trump prides himself on his unconventional and unpredictable nature. This is what causes America’s adversaries – most notably Communist China – the greatest consternation. Regardless of his previous decisions on trade issues, if Trump thinks imposing tariffs on Canadian energy imports make sense now, he will do so.

“Manufacturing superpower”: The fundamental objective underlying Trump’s trade policy is to reverse the long slide of American industry through decades of globalization – mainly by targeting offshore manufacturing. Shown at top and middle, Trump at campaign event at Dane Manufacturing in Waunakee, Wisconsin, October 2024; at bottom, an assembly line for automobile engines. (Sources of photos: (top and middle) AP Photo/Charlie Neibergall; (bottom) Alliance Employment Services)

“Manufacturing superpower”: The fundamental objective underlying Trump’s trade policy is to reverse the long slide of American industry through decades of globalization – mainly by targeting offshore manufacturing. Shown at top and middle, Trump at campaign event at Dane Manufacturing in Waunakee, Wisconsin, October 2024; at bottom, an assembly line for automobile engines. (Sources of photos: (top and middle) AP Photo/Charlie Neibergall; (bottom) Alliance Employment Services)

Logic and self-interest, however, also point away from such tariffs. The fundamental objective underlying all of Trump’s trade policy is to strengthen American manufacturing. It is something he has articulated since before entering politics in 2015; it can accordingly be regarded as sincere. Trump wants to halt and if possible reverse that sector’s long slide through decades of offshoring and globalization that crippled or wiped out whole industries all over the U.S., especially in the Midwest heartland. These are the places Trump promised to help, this lies at the core of his slogan “Make America Great Again”, and these are many of the people who sent him to the White House the first time and stuck by him through the depths of his ignominy following his second, failed Presidential run. This year, Trump ran on a platform to transform his country back into “it’s my favorite word.”.

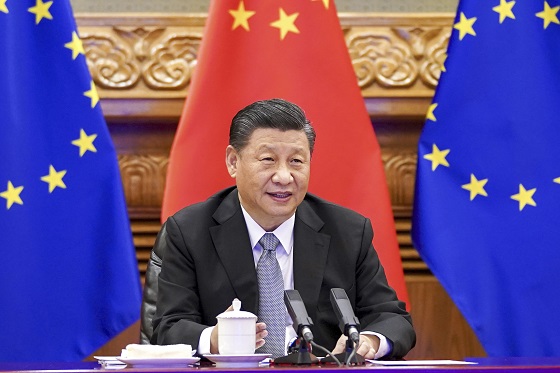

To accomplish that dramatic – some would say grandiose if not unachievable – objective, Trump intends to punish countries that use subsidies, favouritism and other policies to unfairly advantage their own industries and flood the U.S. with underpriced goods, harming domestic producers and preventing new ones from starting up. China may be hit with tariffs as high as 60 percent. He will also target imports believed to threaten U.S. national security (such as electric vehicles vulnerable to hacking by foreign enemies) while working to reduce dependence on imports of strategic materials or components critical in wartime. And he wants to close loopholes allowing China to bypass U.S. tariffs by locating production in proxy countries – especially the two countries adjoining the U.S.

Mexico has gone quite far down the road of partnering with Chinese companies, and Trump’s key advisors have warned that Mexico will be held to account for it. Canada is certain to be scrutinized as well, but can probably allay similar U.S. concerns by avoiding becoming a backdoor and way-station for Chinese goods, something Deputy Prime Minister Chrystia Freeland already promised last week. This will require several key policy commitments, as well as competent, rigorous enforcement (always a questionable assumption for this Liberal government). It will also be necessary to continue matching U.S. tariff-related moves against China, as Canada did earlier this fall in imposing tariffs on Chinese EVs and aluminum.

Closing the back door: Trump is determined to eliminate loopholes allowing China to bypass U.S. tariffs through “transshipment”, i.e., locating assembly plants in Mexico or Canada. Shown at top, Chinese company setting up facility in northern Mexico; at bottom, transshipment occurring in Texas. (Sources of photos: (top) Kosuke Shimizu/Nikkei; (bottom) T. Hammonds MSW, licensed under CC BY-NC-SA 2.0)

Closing the back door: Trump is determined to eliminate loopholes allowing China to bypass U.S. tariffs through “transshipment”, i.e., locating assembly plants in Mexico or Canada. Shown at top, Chinese company setting up facility in northern Mexico; at bottom, transshipment occurring in Texas. (Sources of photos: (top) Kosuke Shimizu/Nikkei; (bottom) T. Hammonds MSW, licensed under CC BY-NC-SA 2.0)

In addition to tariffs, Trump’s critical policies in restoring American manufacturing competitiveness will be reducing taxes, lifting the regulatory burden and, as his campaign platform puts it, ensuring the flow of “Reliable and Abundant Low Cost Energy”. By “energy” one should mainly read “crude oil and natural gas” – something Trump describes over and over as “liquid gold”. (Ending the demonization of coal is also a part; as well there is likely to be a modest revival in nuclear power.) In addition to supporting American industry, cheap energy is intended to help ease inflation and improve the lot of hard-pressed consumers, homeowners and wage-earners.

Among the associated promises and policies Trump has mentioned are to cancel the Biden Administration’s planned pro-electric vehicle policies (similar in effect to Canada’s outright mandate) and its moratorium on new LNG export facilities, end permitting of offshore wind turbines, reopen offshore areas to oil and gas drilling, unlock Alaska’s National Petroleum Reserve, reopen federal lands to drilling and hydraulic fracturing, pull the U.S. out of the Paris Climate Accord (for the second time, in Trump’s case) and otherwise end the Biden-era’s “Green New Deal”, which Trump derides as a “green new scam”.

During his election-night acceptance speech, Trump pointedly told Robert F. Kennedy, Jr., his pick to be Secretary of Health and Human Services and formerly a vocal anti-oil activist, to keep his nose completely out of energy issues. Chris Wright, his recently announced nominee to be Secretary of Energy, has written a 180-page paper which contends that “Zero Energy Poverty by 2050 is a better goal than Net Zero 2050.”

Trump’s energy policy includes cancelling President Joe Biden’s moratorium on new liquefied natural gas (LNG) export facilities, reopening offshore areas to oil and gas drilling and unlocking Alaska’s National Petroleum Reserve. Shown at left, Trump visits the Cameron LNG liquefaction terminal in Hackberry, Louisiana, 2019; at middle, an oil drilling platform at Green Canyon in the Gulf of Mexico; at right, the National Petroleum Reserve. (Source of right photo: mypubliclands, licensed under CC BY 2.0)

Trump’s energy policy includes cancelling President Joe Biden’s moratorium on new liquefied natural gas (LNG) export facilities, reopening offshore areas to oil and gas drilling and unlocking Alaska’s National Petroleum Reserve. Shown at left, Trump visits the Cameron LNG liquefaction terminal in Hackberry, Louisiana, 2019; at middle, an oil drilling platform at Green Canyon in the Gulf of Mexico; at right, the National Petroleum Reserve. (Source of right photo: mypubliclands, licensed under CC BY 2.0)

Trump’s energy policy, in short, is “drill, baby, drill” – often written in all-caps. Where might Canadian-produced oil and natural gas fit into this picture? Right in the middle, as it turns out – figuratively and literally.

It cannot be said often or loudly enough: inexpensive, reliable and plentiful energy is essential to economic competitiveness, national prosperity and modern civilization. But many Western governments – Canada’s among them – act as if it is optional. Right now, industries in authoritarian China use low-cost coal-fired electricity to produce the pricey solar panels and wind turbines that are exported to Western countries where they produce exorbitantly expensive electricity that in turn renders their domestic industries uncompetitive. Industrial users in Great Britain, for example, currently pay five-and-a-half times as much for electricity as those in the U.S., while German industry pays more than three times as much. Both countries are seeing their industrial base evaporate before their eyes. If Canada remains on its current policy path, it will be next.

Oil and natural gas are critical inputs that make American manufacturers more competitive, reduce the operating costs of nearly any business and allow American consumers to pay less to fuel their vehicles and heat/cool their homes. Canadian oil and natural gas not only do not undermine Trump’s economic and trade policies, they strengthen and advance them.

Trump is unshakeably determined to avoid that for his country – and this is where Canadian energy enters the picture. Crucially, Canadian fossil fuels are not manufactured goods except in the narrowest technical sense. Unlike cars, smartphones, toys, shoes or furniture, they are commodities rather than finished products. They aren’t produced with unfair subsidies. They don’t contain secret chips enabling the Chinese to spy on U.S. military bases. They don’t threaten to displace or bankrupt age-old American companies, throw thousands of employees out of work or transform once-thriving cities into ghostly husks.

They are the very opposite: critical inputs that, by being priced competitively, make American manufacturers more competitive, reduce the operating costs of nearly any business and allow American consumers to pay less to fuel their vehicles and heat/cool their homes. Canadian oil and natural gas not only do not undermine Trump’s economic and trade policies, they strengthen and advance them.

Integrated system: Western Canada’s producing region supplies the U.S. heartland with crude oil and natural gas, where it can be refined and distributed, meeting the Trump test of (as his campaign platform puts it) “Reliable and Abundant Low Cost Energy”. Shown at top, an oil refinery in Rosemount, Minnesota. (Sources: (photo) Pexels; (map) CAPP)

Integrated system: Western Canada’s producing region supplies the U.S. heartland with crude oil and natural gas, where it can be refined and distributed, meeting the Trump test of (as his campaign platform puts it) “Reliable and Abundant Low Cost Energy”. Shown at top, an oil refinery in Rosemount, Minnesota. (Sources: (photo) Pexels; (map) CAPP)

This beneficial role is accentuated by some geographical quirks. Although North America’s vast interlinked system of energy pipelines is a near-miracle of technology, operating efficiency and reliability, it is not perfect or seamless. Major consuming regions tend to get most of their oil, natural gas and liquids from the nearest producing region; why ship the stuff farther than you must? Consequently, the U.S. Midwest and portions of the “near South” and northeast are heavily supplied from Canada.

If this supply were to be curtailed or disrupted by tariffs or other measures, manufacturers in these dependant regions would suffer immediately as wholesale and consumer prices jumped substantially. Regional oil refineries, gas/liquids facilities and petrochemical plants would pay more for their feedstock, face shortages as Canadian producers “shut in” no-longer-profitable production, and/or would operate below capacity or inefficiently as they sourced sub-optimal feedstock from elsewhere.

Even a 10 percent tariff would raise the average retail gasoline price across the U.S. by 5 percent, according to commodity pricing analysts at Montreal-based BCA Research. But the regional effects would be much greater. Regional prices not only for gasoline and heating fuel, but on any goods related to oil and natural gas, would rise far more than is implied by a mere 10-20 percent import tariff. And keep in mind, much of this region is MAGA country. Over time, some pipelines that currently ship product out of the Midwest might need to be “reversed”, no longer exporting to the Gulf of Mexico and Northeast regions but drawing energy from them. The U.S. might even need to increase imports from geopolitical adversaries like Venezuela or dodgy and corrupt African states.

All of this would be damaging not only to American consumers, business and manufacturing industries, but to U.S. foreign policy and even to the U.S. energy industry itself, the ostensible “competitor” that one might intuitively think stands to benefit from import tariffs. It hardly needs to be said that this would run counter to the new Administration’s objectives.

Despite being dubbed “dirty oil”, “unsustainable” and a “sunset industry”, the energy sector has led America’s productivity gains over the last decade while providing well-paying jobs to hundreds of thousands of Americans – including Hispanics, Blacks and American Indians. (Source of bottom photo: Sahara Group)

Despite being dubbed “dirty oil”, “unsustainable” and a “sunset industry”, the energy sector has led America’s productivity gains over the last decade while providing well-paying jobs to hundreds of thousands of Americans – including Hispanics, Blacks and American Indians. (Source of bottom photo: Sahara Group)

In addition to its roles in supporting manufacturing and consumers, America’s oil and gas industry is seen by Trump and key members of his nascent Administration as a competitive advantage for the economy as a whole, as a major source of wealth-creation in its own right and as a geopolitical weapon. For this to make sense, one needs to know a few things about this industry. In contrast to its image as “dirty oil”, “unsustainable” or a “sunset industry”, oil and natural gas is among the most technologically advanced, innovative, entrepreneurial and dynamic industries in the economy. This sector led the entire American economy in productivity gains over the previous decade, as the accompanying graph indicates.

The million or more jobs it provides across the continent are by turns technically intricate, dangerous, physically hard, intellectually stimulating – and very lucrative. Just as more and more Canadian First Nations are becoming proponents of natural resource development because they recognize the benefits to themselves, the U.S. industry provides jobs to hundreds of thousands of Hispanics, Blacks and American Indians – an impressive number of whom just voted for Trump.

This is all thanks to one of the most remarkable industrial turnarounds in history: America’s transformation from an insatiable importer of oil and natural gas, its domestic production sagging by the year towards apparent oblivion, its producing sector increasingly demoralized and decrepit, into a country that’s not only energy self-sufficient but has leapfrogged to a net exporter. All in the dizzying time-frame of barely a dozen years, starting in 2008, the year U.S. crude oil production reached its nadir of a mere 5 million barrels per day. (Not long after, just as U.S. oil production was showing sparks of revival, President Barack Obama contemptuously declared that, “Anybody who tells you that we can drill our way out of this problem doesn’t know what they’re talking about, or just isn’t telling you the truth.”)

By last year the average rate had soared to 12.9 million barrels per day which, the U.S. Energy Information Administration recently pointed out, represented “more crude oil than any country, ever.” U.S. production isn’t just higher than Saudi Arabia and Russia’s – it’s nearly 30 percent higher. How this came about is its own story. But suffice it to say that Canadian visionaries and companies played an important role. So, interestingly, did prospective energy secretary Wright and his company, Liberty Energy, which helped pioneer the development of formerly inaccessible shale reservoirs by using horizontally drilled wells completed with multiple hydraulic fractures. In short, this transformation has fundamentally changed the energy game for the U.S., domestically and internationally.

Since its nadir at 5 million barrels per day (mmbpd) in 2008, U.S. crude oil production has soared to an average of 12.9 mmbpd in 2023 – more than any other country in history and trumping Saudi Arabia and Russia. Concurrently, exports of liquefied natural gas have zoomed from zero a decade ago to 12 billion cubic feet per day. (Sources of graphics: (top) eia.gov; (bottom) S&P Global, retrieved from The New York Times)

Since its nadir at 5 million barrels per day (mmbpd) in 2008, U.S. crude oil production has soared to an average of 12.9 mmbpd in 2023 – more than any other country in history and trumping Saudi Arabia and Russia. Concurrently, exports of liquefied natural gas have zoomed from zero a decade ago to 12 billion cubic feet per day. (Sources of graphics: (top) eia.gov; (bottom) S&P Global, retrieved from The New York Times)

Here again, imported Canadian energy is neither a competitive threat nor a hindrance – but a source of economic value. The quirks of geography combined with the refusal of successive Canadian governments to ensure that Canada’s oil and natural gas could access global markets have created what amounts to a gargantuan, continent-spanning arbitrage mechanism that enriches American companies, investors and governments. In brief, cheap Canadian crude oil, natural gas and liquids are drawn into the U.S. from the north, enabling domestically produced crude oil, natural gas, liquids, refined fuels and petrochemicals to be exported from the vast Gulf of Mexico energy complex to hungry global markets, where they access premium international prices.

This has become a multi-hundred-billion-dollar opportunity that American entrepreneurs and financiers have exploited with alacrity. Vast investments in LNG export facilities have taken the U.S. from zero LNG as recently as 2014 to approximately 12 billion cubic feet per day this year, a figure forecast to zoom to 20 billion cubic feet per day within two years (the U.S. will thus be exporting more gas than Canada produces in its entirety). U.S. net exports of refined fuels (much more valuable than crude oil) are generating more than US$60 billion annually. The associated processing and export facilities themselves employ thousands.

Trump’s ‘liquid gold’ will soothe American consumers, grease the skids of American manufacturing, fill the financial tanks of American investors and set economic bonfires upon America’s enemies.

Clearly, the more Canadian oil and natural gas can be imported from the north, the more American energy – including value-added refined/processed products – can flow from the Gulf of Mexico outward to the world. Indeed, Trump himself has said he would like to reinstate the federal permit for the much-fought-over, 800,000-barrel-per-day Keystone XL pipeline, which he approved early in his first term but was then cancelled by Biden.

The stunning U.S. energy turnaround in barely 15 years plus the current prospect of enormous further growth enable Trump and his policymakers to credibly talk about elevating the U.S. to global “energy dominance”. That is to say, an America liberated from dependency on imported oil not only can act unconstrained by the need to placate oil-producing nations that don’t share U.S. interests, but can use its own energy exports to enrich itself and support allied countries. It can also stare down oil-producing adversaries like Iran and Russia, leaving them weaker, contained and less able to fund wars, terrorism and other foreign mischief. Trump’s stated policy to curtail oil production misused by dictatorships in Iran and Venezuela also implies that Canadian energy exports will be more highly sought-after than ever. More Canadian energy strengthens U.S. energy dominance and weakens its enemies by helping to hold down international commodity prices.

Golden opportunity: The Trump Administration’s stated goal of global “energy dominance” appears achievable, weakening its oil-producing adversaries while holding open the door to Canada – if Canada’s political leadership is intelligent enough to seize the moment. Shown, Trump shakes hands with UFC Champion Jon Jones at Madison Square Garden, New York, 11 days after his election victory. (Source of photo: AP Photo/Evan Vucci)

Golden opportunity: The Trump Administration’s stated goal of global “energy dominance” appears achievable, weakening its oil-producing adversaries while holding open the door to Canada – if Canada’s political leadership is intelligent enough to seize the moment. Shown, Trump shakes hands with UFC Champion Jon Jones at Madison Square Garden, New York, 11 days after his election victory. (Source of photo: AP Photo/Evan Vucci)

The U.S. is already the world’s energy giant. Its goal of “energy dominance” is therefore serious and realistic. Standing atop it all will be Trump, the energy dominator: his “liquid gold” will soothe American consumers, grease the skids of American manufacturing, fill the financial tanks of American investors and set economic bonfires upon America’s enemies. That simply does not sound like an Administration about to place tariffs on the very imports that will help it make this happen. Far more likely, the 47th President’s energy policy will offer Canada a golden opportunity to play a supportive role as a neighbour, friend, trading partner and ally – and to profit greatly from doing so.

George Koch is Editor-in-Chief of C2C Journal.

Source of main image: heritage.org.