CBDC Central Bank Digital Currency

WEF report: Digital ID has become a standard feature for everyday life in Pakistan

From LifeSiteNews

A WEF report, co-authored by the U.N. and World Bank, states that digital public infrastructure ‘is transforming lives in Pakistan,’ ushering in a need for digital ID such that adults in Pakistan cannot lead normal lives without it.

Digital identity sits at the heart of Pakistan’s Digital Public Infrastructure (DPI) transformation and is now a standard feature in every adult’s life, according to the WEF Agenda.

Published on the World Economic Forum (WEF) Agenda blog and co-written by representatives from the World Bank and the United Nations’ Better Than Cash Alliance, the story “Digital public infrastructure is transforming lives in Pakistan. Here’s how” highlights how adults in Pakistan cannot lead a normal life without having a digital identity, which is a key component of DPI.

1/6

🌟 Exciting Update! 🌟 We are thrilled to introduce Pakistan’s first locally assembled digital identity kit, a result of the collaborative efforts between NADRA Technologies Limited (NTL) and the National Radio and Telecommunication Corporation (NRTC). pic.twitter.com/gUsUdBVnWm— NADRA (@NadraPak) May 17, 2024

“At the heart of Pakistan’s digital transformation is the National Database and Registration Authority (NADRA), established to overhaul the country’s identity systems,” the authors write, adding:

This was a foundational change, positioning Pakistan among a select group of nations equipped to manage comprehensive digital identities for over 240 million citizens.

The NADRA-issued Computerized National Identity Card (CNIC) is now a standard feature in every adult Pakistani’s life, facilitating a range of routine tasks such as opening bank accounts, purchasing airline tickets, acquiring driver’s licenses, and qualifying for social protection, thereby ensuring seamless identity authentication for every citizen.

Digital Public Infrastructure is a civic technology stack consisting of three components:

- Digital Identity,

- Fast Digital Payment Systems (e.g. programmable Central Bank Digital Currencies [CBDCs]),

- Data Exchanges Between Public and Private Entities.

Now, “Pakistan is set to launch several ambitious DPI initiatives, including expanding the RAAST payment system, implementing a nationwide digital health records system, and launching a blockchain-based land registry,” according to the WEF Agenda.

From the State Bank of Pakistan, RAAST is the country’s first instant payment system that enables end-to-end digital payments among individuals, businesses, and government entities instantaneously.

In 2020 the State Bank of Pakistan partnered with non-profit Karandaaz, which is a “prime delivery partner of the Bill and Melinda Gates Foundation.”

In 2021 the Bill and Melinda Gates Foundation granted Karandaaz $4 million “to integrate the Ehsaas Program (biggest Government to Person Program in Pakistan) with RAAST-Pakistan’s Instant Payment System to enable interoperability and choice for the beneficiaries.”

Contributing to the WEF blog post are the World Bank’s technical advisor for Digital Public Infrastructure and Digital ID Tariq Malik, along with the U.N.-based Better Than Cash Alliance’s head of Asia Pacific Prerna Saxena and Pakistan lead Raza Matin.

The U.N.’s Better Than Cash Alliance advocates for “responsible digital payments” and repeatedly states it does not want to abolish physical cash.

However, the Better Than Cash Alliance does want more women to have accounts in their own name, which could also lead to more citizens being tracked, traced, and taxed in the digital system:

We do not want to abolish physical cash, but rather wish to ensure that people have choice in how they make and receive payments. It is important for people to have digital payment options that are responsible and ‘better than cash’ – for example, a woman can have a payment account in her own name, which she manages. To be clear, we do not want to prevent people from using cash, as sometimes it is the best or only payment option.

Speaking at the World Bank Group’s inaugural Global Digital Summit last March, World Bank President Ajay Banga said that digital identity should be embraced worldwide, and that governments should be the owners, so they can guarantee privacy and security for their citizens.

According to Banga, once everyone is hooked-up to a digital ID, then it can be linked to existing infrastructure run by private companies.

“Creating a digital identity platform for citizenry is kind of foundational, and I believe your government should be the owner of your digital ID; private companies should not own that,” said the World Bank president, adding, “it is the social contract of the citizens of their countries to have an identity, a currency, and safety. We should not take that away from them.”

World Bank Pres Ajay Banga: "Creating a digital identity platform for citizenry is foundational; your govt should be the owner of your digital ID.. If you want this to be embraced around the world.. get a digital ID & move from there" Global Digital Summit https://t.co/Sa1GzCnloQ pic.twitter.com/kKClx5iUuT

— Tim Hinchliffe (@TimHinchliffe) March 11, 2024

“They should have the digital identity; that digital identity should guarantee the privacy of that citizen; it should help them with their security, but the government should give the identity,” said Banga, adding:

Once you do that, then connecting them to the infrastructure that a private company, either Ericsson or Verizon, or combinations of them – in fact mostly it’s a combination – then the question is, ‘What do you do with it that requires a digital ID?’ so you can start connecting with that citizen.

For Banga and other unelected globalists, digital identity is the key to unlocking access to goods and services through public-private partnerships – the fusion of corporation and state.

Last year, the United Nations partnered with the Bill and Melinda Gates Foundation to launch the 50-in-5 Digital Public Infrastructure campaign to accelerate digital ID, digital payments systems, and data sharing among 50 countries by 2028.

International journalist, Alex Newman: Unelected globalists—including Bill Gates, the UN and the WEF—are "building a giant digital gulag for all of humanity".

"They are using [digital ID, CBDCs and digital health certificates] to build a control system that will not just be able… pic.twitter.com/LPzjjz6U1n

— Wide Awake Media (@wideawake_media) May 16, 2024

Last week, former British prime minister-turned globalist technocracy enthusiast Tony Blair said that digital ID was essential to modern infrastructure but would require “a little work of persuasion.”

Tony Blair on "Digital ID is an essential part of a modern digital infrastructure […] Although, we have a little work of persuasion to do here!" https://t.co/XXGXivHnXv pic.twitter.com/SQ2JwqqexM

— Tim Hinchliffe (@TimHinchliffe) July 9, 2024

Speaking on a panel about Digital Public Infrastructure at the International Monetary Fund’s (IMF) 2023 Spring Meetings, Infosys co-founder and ex-chair of the Unique Identification Authority of India (UIDAI), Nandan Nilekani, said that everybody should have a digital ID, a bank account, and a smartphone as they were the “tools of the New World” for digital public infrastructure.

"What are the tools of the New World? Everybody should have a digital ID; everybody should have a bank account; everybody should have a smartphone. Then, anything can be done. Everything else is built on that": @NandanNilekani to @IMFNews #DigitalID #DigitalIdentity #IMFmeetings pic.twitter.com/6HIAqfBigz

— Tim Hinchliffe (@TimHinchliffe) April 19, 2023

India is the globalists’ shining example of what DPI should look like in practice.

Following the B20 India Summit last year, the leaders of the B20 published their annual communique, with a section dedicated to DPI rollouts.

The B20 India communique called on G20 nations to rollout DPI, with the first policy action being to “Promote the digitization of identities at the individual, enterprise, and farm levels that are both interoperable and recognized across borders.“

As a key performance indicator for digital ID rollouts, the B20 recommended that “G20 nations develop guidelines for unique single digital identification for MSME [micro, small, and medium-sized enterprises] and individuals that can be securely accessed (based on consent) by different government and private stakeholders for identity verification and information access within 3 years.”

Speaking at the WEF Global Technology Governance Summit in April 2021, Ukraine’s Minister of Digital Transformation Mykhailo Fedorov said that his government’s goal was to create a digital ID system that would make Ukraine the most convenient State in the world by operating like a digital service provider.

“We have to make a product that is so convenient that a person will be able to disrupt their stereotypes, to breakthrough from their fears, and start using a government-made application,” said Fedorov.

“Our goal is to enable all life situations with this digital ID,” he added.

While Ukraine has sought to enable all life situations with its digital ID, the WEF reports that digital identity “is now a standard feature in every adult Pakistani’s life.”

Reprinted with permission from The Sociable.

Carbon Tax

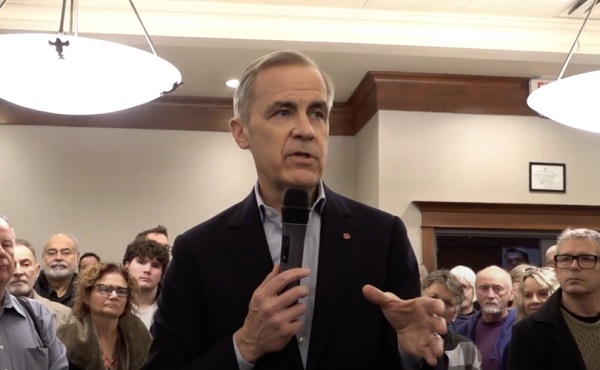

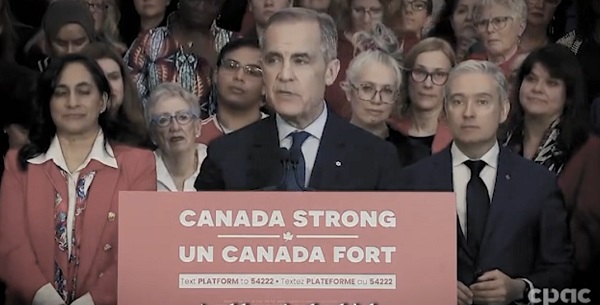

Mark Carney has history of supporting CBDCs, endorsed Freedom Convoy crackdown

From LifeSiteNews

Carney also said last week that he is willing to use all government powers, including “emergency powers,” to enforce his energy plan if elected prime minister.

World Economic Forum-linked Liberal Party leadership frontrunner Mark Carney has a history of supporting central bank digital currencies, and in 2022 supported “choking off the money” donated to the Freedom Convoy.

In his 2021 book Value(s), Carney said that the “future of money” is a “central bank stablecoin, known as a central bank digital currency or CBDC.”

He noted in his book that such a currency would be similar to current cryptocurrencies such as Bitcoin, but without the private nature afforded to it by its decentralization.

“It is simply untenable in democracies that the core of the monetary system could be based on forms of electronic private money whose creators control large blocks of the currency, like Bitcoin,” he wrote. “Cryptocurrencies are not the future of money.”

Carney noted that a CBDC, if “properly designed,” could serve “all the functions to which private cryptocurrencies and stablecoins aspire while addressing the fundamental legal and governance issues that will, in time, undermine those alternatives.”

Expanding on his worldview in relation to CBDCs, Carney suggested that “fear” can be taken advantage of to shape the future of money.

“With fear on the march, people were willing to surrender to Hobbes’ ‘Leviathan’ such basic rights as the freedom to leave their homes,” he wrote. “And so it is with money. People will support the delegation to independent central banks of the tough decisions that are necessary to maintain the value of money provided the authorities deliver monetary and financial stability.”

Some Canadians are alarmed by the prospect of CBDCs, a fear that only worsened after the Liberals under Prime Minister Justin Trudeau froze hundreds of bank accounts it deemed were importantly linked to the 2022 Freedom Convoy.

During the Freedom Convoy, Carney wrote in an op-ed for the Globe and Mail, “Those who are still helping to extend this occupation must be identified and punished to the full force of the law,” adding that “Drawing the line means choking off the money that financed this occupation.”

Carney is a former head of the Bank of Canada and Bank of England. His ties to globalist groups have led to Conservative Party leader Pierre Poilievre calling him the World Economic Forum’s “golden boy.”

In addition to his comments on CBDCs, Carney has a history of promoting anti-life and anti-family agendas, including abortion and LGBT-related efforts. He has also previously endorsed the carbon tax and even criticized Trudeau when the tax was exempted from home heating oil to reduce costs for some Canadians.

Carney also said last week that he is willing to use all government powers, including “emergency powers,” to enforce his energy plan if elected prime minister.

The Liberal Party of Canada will choose its next leader, who will automatically become prime minister, on March 9, after Prime Minister Justin Trudeau announced that he plans to step down as Liberal Party leader once a new leader has been chosen.

In contrast to Carney, Poilievre has promised that if he is elected prime minister, he would stop any implementation of a “digital currency” or a compulsory “digital ID” system.

When it comes to a digital Canadian dollar, the Bank of Canada found that Canadians are very wary of a government-backed digital currency, concluding that a “significant number” of citizens would resist the implementation of such a system.

Business

Black Rock latest to leave Net Zero Alliance

From The Center Square

By

US House committee investigating 60 companies over ESG policies

Blackrock Inc. is the latest to announce it has left a United Nations-backed Net-Zero Banking Alliance (NZBA), among several within one month and not soon after Donald Trump was elected president. It did so as it and roughly 60 companies are being investigated by Congress for allegedly colluding as a “woke ESG cartel” to “impose radical environmental, social, and governance goals on American companies.”

Last month, Goldman Sachs was the first to withdraw from the alliance, followed by Wells Fargo, The Center Square reported. Citigroup, Bank of America, Morgan Stanley and JPMorgan next announced their departure.

According to the “bank-led and UN-convened” alliance, global banks joined, pledging to align their lending, investment and capital markets activities with a net-zero greenhouse gas emissions target by 2050.

Major U.S. banks began leaving the alliance after President-elect Donald Trump vowed to increase domestic oil and natural gas production and pledged to go after “woke” companies.

They also announced their departure two years after 19 state attorneys general launched an investigation into them for alleged deceptive trade practices connected to ESG.

While the companies haven’t appeared to seem daunted by state investigations, Trump’s reelection appears to be a different matter.

“BlackRock has hung in there as long as it could, but the pressure has become too great, and the reputational and legal risks too high, just before Trump takes office. It won’t be the last financial organization to quit a net zero initiative,” Hortense Bioy, Morningstar Analytics director of sustainable investing research, told Bloomberg News.

Texas Comptroller Glenn Hegar has expressed skepticism about companies claiming to withdraw from ESG commitments, noting there is often doublespeak in announcements, The Center Square reported. This includes statements made by Goldman Sachs, JPMorgan and Blackrock.

Blackrock claims its “participation in NZAMi didn’t impact the way we managed client portfolios. Therefore, our departure doesn’t change the way we develop products and solutions for clients or how we manage their portfolios. … Our commitment to helping our clients achieve their investment goals remains unwavering,” Bloomberg reported.

Last month, the U.S. House Judiciary Committee announced it was investigating more than 60 US-based asset managers’ involvement in the alliance, including BlackRock, Inc., JP Morgan Asset Management, Rockefeller Asset Management, State Street Global Advisors, among others.

The committee also issued a report, “Climate Control: Exposing the Decarbonization Collusion in Environmental, Social, and Governance (ESG) Investing,” saying it found “direct evidence of a ‘climate cartel’ consisting of left-wing activists and major financial institutions that collude to impose radical environmental, social, and governance goals on American companies.”

Under the Trump administration, the committee will continue to investigate if “existing civil and criminal penalties and current antitrust law enforcement efforts are sufficient to deter anticompetitive collusion to promote ESG-related goals in the investment industry.” It also maintains that the companies “must answer for their involvement in prioritizing woke investments over their own fiduciary duties.”

The committee sent letters to dozens of entities in 12 states and the District of Columbia requesting them to provide information by Jan. 10. The majority are located in New York, Massachusetts and California.

-

Alberta2 days ago

Alberta2 days agoProvince to expand services provided by Alberta Sheriffs: New policing option for municipalities

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoIs HNIC Ready For The Winnipeg Jets To Be Canada’s Heroes?

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

Alberta2 days ago

Alberta2 days agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNo Matter The Winner – My Canada Is Gone

-

Health2 days ago

Health2 days agoHorrific and Deadly Effects of Antidepressants

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCampaign 2025 : The Liberal Costed Platform – Taxpayer Funded Fiction

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoA Perfect Storm of Corruption, Foreign Interference, and National Security Failures