Fraser Institute

Urban Population Densities in Canada and Abroad—an Update

From the Fraser Institute

By Steven Globerman and Milagros Palacios

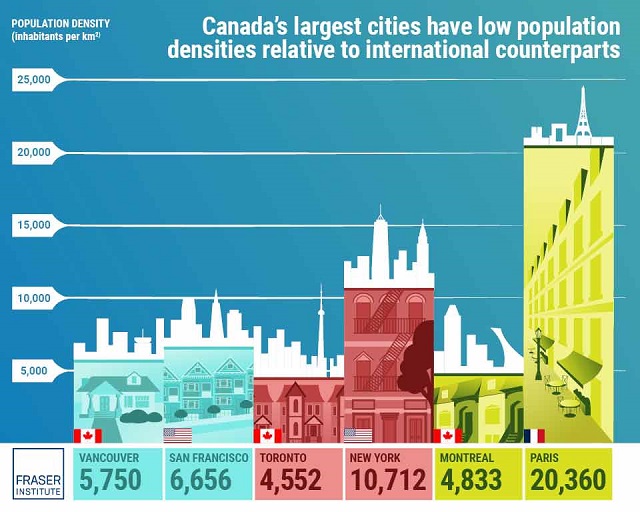

Canadian cities—including Toronto and Vancouver, which are experiencing high and increasing housing costs—can accommodate much more housing supply as they have much lower population densities than other major comparable urban centres around the world, finds a new study by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Compared to their international peers, Canadian cities have much lower levels of density, which means there’s an opportunity to expand the supply of housing and perhaps make housing more affordable, too,” said Steven Globerman, Fraser Institute senior fellow and co-author of Urban Population Densities in Canada and Abroad—an Update.

The study, which compares population densities in 30 metropolitan centres in highincome developed countries, finds that Canadian cities are among the least-dense.

Even Vancouver—Canada’s densest major city with 5,750 people per square kilometre—ranks 13th out of 30, and is significantly less dense than San Francisco (6,656 people per square kilometre), a comparable west coast city. In Toronto, there are 4,552 people per square kilometre. In fact, Toronto’s population could double and the city would still be less dense than New York City (10,712). And crucially, Toronto and Vancouver are significantly less dense than many other major cities around the world, including London (10,663) Tokyo (15,531) and Paris (20,360).

“Some of the most desirable, liveable cities in the world have much higher population densities than Canada’s biggest cities,” Globerman said. “Canadian cities can become significantly more dense, and possibly more affordable, without necessarily sacrificing living standards.”

- Affordable housing in cities is a major public-policy issue in Canada.

- Zoning and related restrictions on increased construction of multi-family housing in urban centres have been identified by the federal government and several provincial governments as major impediments to affordable housing.

- Governments are promoting increased population density in urban areas through financial incentives and other initiatives but face opposition from homeowners and other interest groups concerned that density will bring a diminished quality of living.

- In fact, urban population densities in Canada are relatively low compared to medium- and large-sized cities in other wealthy countries.

- Moreover, there is no consistent evidence showing that increased urban density leads to a lower quality of living.

Authors:

Alberta

Net Zero goal is a fundamental flaw in the Ottawa-Alberta MOU

From the Fraser Institute

By Jason Clemens and Elmira Aliakbari

The challenge of GHG emissions in 2050 is not in the industrial world but rather in the developing world, where there is still significant basic energy consumption using timber and biomass.

The new Memorandum of Understanding (MOU) between the federal and Alberta governments lays the groundwork for substantial energy projects and infrastructure development over the next two-and-a-half decades. It is by all accounts a step forward, though, there’s debate about how large and meaningful that step actually is. There is, however, a fundamental flaw in the foundation of the agreement: it’s commitment to net zero in Canada by 2050.

The first point of agreement in the MOU on the first page of text states: “Canada and Alberta remain committed to achieving net zero greenhouse gas emissions by 2050.” In practice, it’s incredibly difficult to offset emissions with tree planting or other projects that reduce “net” emissions, so the effect of committing to “net zero” by 2050 means that both governments agree that Canada should produce very close to zero actual greenhouse gas (GHG) emissions. Consider the massive changes in energy production, home heating, transportation and agriculture that would be needed to achieve this goal.

So, what’s wrong with Canada’s net zero 2050 and the larger United Nations’ global goal for the same?

Let’s first understand the global context of GHG reductions based on a recent study by internationally-recognized scholar Vaclav Smil. Two key insights from the study. First, despite trillions being spent plus international agreements and regulatory measures starting back in 1997 with the original Kyoto agreement, global fossil fuel consumption between then and 2023 increased by 55 per cent.

Second, fossil fuels as a share of total global energy declined from 86 per cent in 1997 to 82 per cent in 2022, again, despite trillions of dollars in spending plus regulatory requirements to force a transition away from fossil fuels to zero emission energies. The idea that globally we can achieve zero emissions over the next two-and-a-half decades is pure fantasy. Even if there is an historic technological breakthrough, it will take decades to actually transition to a new energy source(s).

Let’s now understand the Canada-specific context. A recent study examined all the measures introduced over the last decade as part of the national plan to reduce emissions to achieve net zero by 2050. The study concluded that significant economic costs would be imposed on Canadians by these measures: inflation-adjusted GDP would be 7 per cent lower, income per worker would be more than $8,000 lower and approximately 250,000 jobs would be lost. Moreover, these costs would not get Canada to net zero. The study concluded that only 70 per cent of the net zero emissions goal would be achieved despite these significant costs, which means even greater costs would be imposed on Canadians to fully achieve net zero.

It’s important to return to a global picture to fully understand why net zero makes no sense for Canada within a worldwide context. Using projections from the International Energy Agency (IEA) in its latest World Energy Outlook, the current expectation is that in 2050, advanced countries including Canada and the other G7 countries will represent less than 25 per cent of global emissions. The developing world, which includes China, India, the entirety of Africa and much of South America, is estimated to represent at least 70 per cent of global emissions in 2050.

Simply put, the challenge of GHG emissions in 2050 is not in the industrial world but rather in the developing world, where there is still significant basic energy consumption using timber and biomass. A globally-coordinated effort, which is really what the U.N. should be doing rather than fantasizing about net zero, would see industrial countries like Canada that are capable of increasing their energy production exporting more to these developing countries so that high-emitting energy sources are replaced by lower-emitting energy sources. This would actually reduce global GHGs while simultaneously stimulating economic growth.

Consider a recent study that calculated the implications of doubling natural gas production in Canada and exporting it to China to replace coal-fired power. The conclusion was that there would be a massive reduction in global GHGs equivalent to almost 90 per cent of Canada’s total annual emissions. In these types of substitution arrangements, the GHGs would increase in energy-producing countries like Canada but global GHGs would be reduced, which is the ultimate goal of not only the U.N. but also the Carney and Smith governments as per the MOU.

Finally, the agreement ignores a basic law of economics. The first lesson in the very first class of any economics program is that resources are limited. At any given point in time, we only have so much labour, raw materials, time, etc. In other words, when we choose to do one project, the real cost is foregoing the other projects that could have been undertaken. Economics is mostly about trying to understand how to maximize the use of limited resources.

The MOU requires massive, literally hundreds of billions of dollars to be used to create nuclear power, other zero-emitting power sources and transmission systems all in the name of being able to produce low or even zero-emitting oil and gas while also moving to towards net zero.

These resources cannot be used for other purposes and it’s impossible to imagine what alternative companies or industries would have been invested in. What we do know is that workers, entrepreneurs, businessowners and investors are not making these decisions. Rather, politicians and bureaucrats in Ottawa and Edmonton are making these decisions but they won’t pay any price if they’re wrong. Canadians pay the price. Just consider the financial fiasco unfolding now with Ottawa, Ontario and Quebec’s subsidies (i.e. corporate welfare) for electric vehicle batteries.

Understanding the fundamentally flawed commitment to Canadian net zero rather than understanding a larger global context of GHG emissions lays at the heart of the recent MOU and unfortunately for Canadians will continue to guide flawed and expensive policies. Until we get the net zero policies right, we’re going to continue to spend enormous resources on projects with limited returns, costing all Canadians.

Alberta

Carney forces Alberta to pay a steep price for the West Coast Pipeline MOU

From the Fraser Institute

The stiffer carbon tax will make Alberta’s oil sector more expensive and thus less competitive at a time when many analysts expect a surge in oil production. The costs of mandated carbon capture will similarly increase costs in the oilsands and make the province less cost competitive.

As we enter the final days of 2025, a “deal” has been struck between Carney government and the Alberta government over the province’s ability to produce and interprovincially transport its massive oil reserves (the world’s 4th-largest). The agreement is a step forward and likely a net positive for Alberta and its citizens. However, it’s not a second- or even third-best option, but rather a fourth-best option.

The agreement is deeply rooted in the development of a particular technology—the Pathways carbon capture, utilization and storage (CCUS) project, in exchange for relief from the counterproductive regulations and rules put in place by the Trudeau government. That relief, however, is attached to a requirement that Alberta commit to significant spending and support for Ottawa’s activist industrial policies. Also, on the critical issue of a new pipeline from Alberta to British Columbia’s coast, there are commitments but nothing approaching a guarantee.

Specifically, the agreement—or Memorandum of Understanding (MOU)—between the two parties gives Alberta exemptions from certain federal environmental laws and offers the prospect of a potential pathway to a new oil pipeline to the B.C. coast. The federal cap on greenhouse gas (GHG) emissions from the oil and gas sector will not be instituted; Alberta will be exempt from the federal “Clean Electricity Regulations”; a path to a million-barrel-per day pipeline to the BC coast for export to Asia will be facilitated and established as a priority of both governments, and the B.C. tanker ban may be adjusted to allow for limited oil transportation. Alberta’s energy sector will also likely gain some relief from the “greenwashing” speech controls emplaced by the Trudeau government.

In exchange, Alberta has agreed to implement a stricter (higher) industrial carbon-pricing regime; contribute to new infrastructure for electricity transmission to both B.C. and Saskatchewan; support through tax measures the building of a massive “sovereign” data centre; significantly increase collaboration and profit-sharing with Alberta’s Indigenous peoples; and support the massive multibillion-dollar Pathways project. Underpinning the entire MOU is an explicit agreement by Alberta with the federal government’s “net-zero 2050” GHG emissions agenda.

The MOU is probably good for Alberta and Canada’s oil industry. However, Alberta’s oil sector will be required to go to significantly greater—and much more expensive—lengths than it has in the past to meet the MOU’s conditions so Ottawa supports a west coast pipeline.

The stiffer carbon tax will make Alberta’s oil sector more expensive and thus less competitive at a time when many analysts expect a surge in oil production. The costs of mandated carbon capture will similarly increase costs in the oilsands and make the province less cost competitive. There’s additional complexity with respect to carbon capture since it’s very feasibility at the scale and time-frame stipulated in the MOU is questionable, as the historical experience with carbon capture, utilization and storage for storing GHG gases sustainably has not been promising.

These additional costs and requirements are why the agreement is the not the best possible solution. The ideal would have been for the federal government to genuinely review existing laws and regulations on a cost-benefit basis to help achieve its goal to become an “energy superpower.” If that had been done, the government would have eliminated a host of Trudeau-era regulations and laws, or at least massively overhauled them.

Instead, the Carney government, and now with the Alberta government, has chosen workarounds and special exemptions to the laws and regulations that still apply to everyone else.

Again, it’s very likely the MOU will benefit Alberta and the rest of the country economically. It’s no panacea, however, and will leave Alberta’s oil sector (and Alberta energy consumers) on the hook to pay more for the right to move its export products across Canada to reach other non-U.S. markets. It also forces Alberta to align itself with Ottawa’s activist industrial policy—picking winning and losing technologies in the oil-production marketplace, and cementing them in place for decades. A very mixed bag indeed.

-

Opinion1 day ago

Opinion1 day agoLandmark 2025 Study Says Near-Death Experiences Can’t Be Explained Away

-

Focal Points1 day ago

Focal Points1 day agoSTUDY: TikTok, Instagram, and YouTube Shorts Induce Measurable “Brain Rot”

-

Alberta1 day ago

Alberta1 day agoRed Deer’s Jason Stephan calls for citizen-led referendum on late-term abortion ban in Alberta

-

Business1 day ago

Business1 day agoBlacked-Out Democracy: The Stellantis Deal Ottawa Won’t Show Its Own MPs

-

Health1 day ago

Health1 day agoTens of thousands are dying on waiting lists following decades of media reluctance to debate healthcare

-

Agriculture15 hours ago

Agriculture15 hours agoHealth Canada pauses plan to sell unlabeled cloned meat

-

Artificial Intelligence8 hours ago

Artificial Intelligence8 hours agoGoogle denies scanning users’ email and attachments with its AI software

-

Indigenous1 day ago

Indigenous1 day agoIndigenous activist wins landmark court ruling for financial transparency