Alberta

UNESCO announces Alberta’s 6th World Heritage Site – Writing-on-Stone / Aisinai

| From the Province of Alberta: Writing-on-Stone/Áísínai’pi is now Alberta’s sixth World Heritage Site. UNESCO has announced the addition of Writing-on-Stone/Áísínai’pi as Alberta’s sixth World Heritage Site. The United Nations Educational, Scientific and Cultural Organization (UNESCO) announced the addition of this site at the 43rd session of its World Heritage Committee in Baku, Azerbaijan. The nomination was prepared by the Government of Alberta in partnership with the Blackfoot Confederacy and with ongoing support from the Government of Canada. “Writing-on-Stone/Áísínai’pi is the site of many natural wonders and a testament to the remarkable ingenuity and creativity of the Blackfoot people. It’s easy to see why the site is seen by many as an expression of the confluence of the spirit and human worlds. I hope all Albertans will take the time to explore this extraordinary part of the province and all it has to offer.” Jason Nixon, Minister of Environment and Parks More than 60,000 people visit Writing-on-Stone each year to experience the landscape and its rich history. “Writing-on-Stone is an Alberta treasure that draws thousands of visitors annually to take part in interpretive tours and activities led by knowledgeable and passionate staff who love to share the park’s unique history.” Tanya Fir, Minister of Economic Development, Trade and Tourism Writing-on-Stone/Áísínai’pi contains the most significant concentration of protected First Nations petroglyphs (rock carvings) and pictographs (rock paintings) on the Great Plains of North America. Some of the carvings and paintings date back 2,000 years. “The designation of Writing-on-Stone/Áísínai’pi as a UNESCO World Heritage Site provides the Blackfoot Confederacy a basis for its future generations as to the strength and truth of our continuing relationship to this land and to our traditions, ceremonies and cultural practices.” Martin Heavy Head, Mookaakin Cultural and Heritage Society/ Blackfoot Confederacy Elder The inscription coincides with 2019 being designated as the International Year of Indigenous Languages by the United Nations. Quick facts Alberta’s six UNESCO World Heritage Sites are: Writing-on-Stone/Áísínai’pi Head-Smashed-In Buffalo Jump Dinosaur Provincial Park Waterton-Glacier International Peace Park The Canadian Rocky Mountain Parks Wood Buffalo National Park Áísínai’pi is the Blackfoot word for ‘it is pictured/written.’ Pursuing World Heritage Site designation was identified as an objective in the 1997 Writing-on-Stone Provincial Park Management Plan. Writing-on-Stone/Áísínai’pi was placed on Canada’s Tentative List for World Heritage Sites in 2004. The park received federal designation as Áísínai’pi National Historic Site of Canada in 2004. Key provincial agencies involved in developing the nomination include: Alberta Environment and Parks, and Alberta Culture, Multiculturalism and Status of Women (Royal Alberta Museum, Archaeological Survey of Alberta), with ongoing advice from Elders of the Mookaakin Cultural and Heritage Society/Blackfoot Confederacy. |

Alberta

Open letter to Ottawa from Alberta strongly urging National Economic Corridor

Canada’s wealth is based on its success as a trading nation. Canada is blessed with immense resources spread across a vast country. It has succeeded as a small, open economy with an enviable standard of living that has been able to provide what the world needs.

Canada has been stuck in a situation where it cannot complete nation‑building projects like the Canadian Pacific Railway that was completed in 1885, or the Trans Canada Highway that was completed in the 1960s. With the uncertainty of U.S. tariffs looming over our country and province, Canada needs to take bold action to revitalize the productivity and competitiveness of its economy – going east to west and not always relying on north-south trade. There’s no better time than right now to politically de-risk these projects.

A lack of leadership from the federal government has led to the following:

- Inadequate federal funding for trade infrastructure.

- A lack of investment is stifling the infrastructure capacity we need to diversify our exports. This is despite federally commissioned reports like the 2022 report by the National Supply Chain Task Force indicating the investment need will be trillions over the next 50 years.

- Federal red tape, like the Impact Assessment Act.

- Burdensome regulation has added major costs and significant delays to projects, like the Roberts Bank Terminal 2 project, a proposed container facility at Vancouver, which spent more than a decade under federal review.

- Opaque funding programs, like the National Trade Corridors Fund (NTCF).

- Which offers a pattern of unclear criteria for decisions and lack of response. This program has not funded any provincial highway projects in Alberta, despite the many applications put forward by the Government of Alberta. In fact, we’ve gone nearly 3 years without decisions on some project applications.

- Ineffective policies that limit economic activity.

- Measures that pit environmental and economic objectives in stark opposition to one another instead of seeking innovative win-win solutions hinder Canada’s overall productivity and investment climate. One example is the moratorium on shipping crude through northern B.C. waters, which effectively ended Enbridge’s Northern Gateway proposal and has limited Alberta’s ability to ship its oil to Asian markets.

In a federal leadership vacuum, Alberta has worked to advance economic corridors across Canada. In April 2023, Alberta, Saskatchewan and Manitoba signed an agreement to collaborate on joint infrastructure networks meant to boost trade and economic growth across the Prairies. Alberta also signed a similar economic corridor agreement with the Northwest Territories in July 2024. Additionally, Alberta would like to see an agreement among all 7 western provinces and territories, and eventually the entire country, to collaborate on economic corridors.

Through our collaboration with neighbouring jurisdictions, we will spur the development of economic corridors by reducing regulatory delays and attracting investment. We recognize the importance of working with Indigenous communities on the development of major infrastructure projects, which will be key to our success in these endeavours.

However, provinces and territories cannot do this alone. The federal government must play its part to advance our country’s economic corridors that we need from coast to coast to coast to support our economic future. It is time for immediate action.

Alberta recommends the federal government take the following steps to strengthen Canada’s economic corridors and supply chains by:

- Creating an Economic Corridor Agency to identify and maintain economic corridors across provincial boundaries, with meaningful consultation with both Indigenous groups and industry.

- Increasing federal funding for trade-enabling infrastructure, such as roads, rail, ports, in-land ports, airports and more.

- Streamlining regulations regarding trade-related infrastructure and interprovincial trade, especially within economic corridors. This would include repealing or amending the Impact Assessment Act and other legislation to remove the uncertainty and ensure regulatory provisions are proportionate to the specific risk of the project.

- Adjusting the policy levers that that support productivity and competitiveness. This would include revisiting how the federal government supports airports, especially in the less-populated regions of Canada.

To move forward expeditiously on the items above, I propose the establishment of a federal/provincial/territorial working group. This working group would be tasked with creating a common position on addressing the economic threats facing Canada, and the need for mitigating trade and trade-enabling infrastructure. The group should identify appropriate governance to ensure these items are presented in a timely fashion by relative priority and urgency.

Alberta will continue to be proactive and tackle trade issues within its own jurisdiction. From collaborative memorandums of understanding with the Prairies and the North, to reducing interprovincial trade barriers, to fostering innovative partnerships with Indigenous groups, Alberta is working within its jurisdiction, much like its provincial and territorial colleagues.

We ask the federal government to join us in a new approach to infrastructure development that ensures Canada is productive and competitive for generations to come and generates the wealth that ensures our quality of life is second to none.

-

Devin Dreeshen

Devin Dreeshen was sworn in as Minister of Transportation and Economic Corridors on October 24, 2022.

Alberta

Premier Smith and Health Mininster LaGrange react to AHS allegations

Alberta Premier Danielle Smith and Health Minister Adriana LaGrange respond to allegations of political interference in the issuing of health-care contracts.

-

Bruce Dowbiggin2 days ago

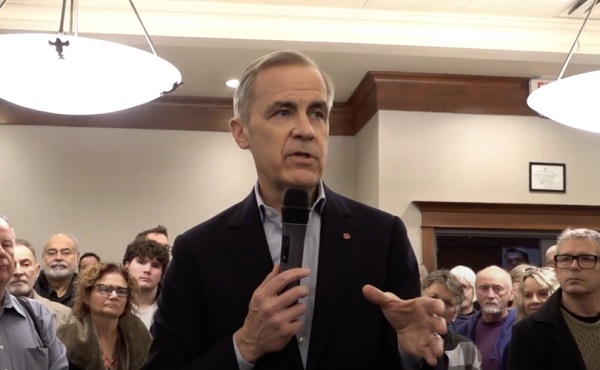

Bruce Dowbiggin2 days agoWith Carney On Horizon This Is No Time For Poilievre To Soften His Message

-

COVID-192 days ago

COVID-192 days agoRed Deer Freedom Convoy protestor Pat King given 3 months of house arrest

-

Media2 days ago

Media2 days agoMatt Walsh: CBS pushes dangerous free speech narrative, suggests it led to the Holocaust

-

illegal immigration2 days ago

illegal immigration2 days agoTrump signs executive order cutting off taxpayer-funded benefits for illegal aliens

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoBipartisan US Coalition Finally Tells Europe, and the FBI, to Shove It

-

Carbon Tax1 day ago

Carbon Tax1 day agoMark Carney has history of supporting CBDCs, endorsed Freedom Convoy crackdown

-

International2 days ago

International2 days agoSenate votes to confirm Kash Patel as Trump’s FBI director

-

Business18 hours ago

Business18 hours agoArgentina’s Javier Milei gives Elon Musk chainsaw