Great Reset

UN secretary-general calls for ‘global governance’ in ‘new multipolar order’ at 2024 Davos summit

U.N. Secretary-General Antonio Guterres

From LifeSiteNews

Antonio Guterres expressed confidence in building a new world order with ‘new opportunities for leadership.’

The Secretary-General of the United Nations (U.N.) called for “global governance” in “a new multipolar global order” at the World Economic Forum (WEF) meeting.

BREAKING – UN Secretary-General Antonio Guterres calls for “global governance” in “a new multipolar global order”

“I am confident we can build a new multipolar global order”

He called for “multilateralism” that requires “effective mechanisms of global governance”#WEF24 pic.twitter.com/rjmWxhYrop

— Andreas Wailzer (@Andreas_Wailzer) January 17, 2024

During his special address, U.N. Secretary-General Antonio Guterres said he is “confident we can build a new multipolar global order with new opportunities for leadership and with balance and justice in its national relations.”

“But multipolarity creates complexity,” he continued. “Left to itself, it could deepen frontlines between north and south, east and west, developed and developing economies, within the G20 and between the G20 and everyone else.”

“And the only way to manage this complexity and avoid a slide into chaos is through a reformed, inclusive networked multilateralism.”

“This requires strong multilateral institutions and frameworks and effective mechanisms of global governance.”

“Without them, further fragmentation is inevitable, and the consequences are clear” Guterres stated.

“We see an epidemic of impunity around the world. We see some countries doing whatever it takes to further their own interests at all costs, from Russia’s invasion of Ukraine to Sudan and, more recently, Gaza.”

Guterres lamented that “parties to the conflict are ignoring international law, trampling on the Geneva Conventions, and even violating the United Nations Charter.”

Addressing the role of governments and private companies in the regulation of Artificial Intelligence, he called for a “governance model that is networked and adaptive” where the U.N. “plays a central, convening role.”

“The private sector is in the lead on AI expertise and resources, and you need the private sector’s full engagement in our multi-stakeholder effort to develop a governance model that is networked and adaptive,” he said.

“I believe the U.N. should play a central, convening role. The advisory board I created on Artificial Intelligence has already made preliminary recommendations on AI governance that adapt the benefits of this incredible new technology while mitigating its risks.”

Censorship Industrial Complex

Former residential school student refutes ‘genocide’ claims, recalls positive experience

From LifeSiteNews

An Indigenous whistleblower condemned the media-driven narrative about ‘mass’ graves at residential schools that led to church burnings across Canada.

An Indigenous whistleblower shared his positive experience at a Residential school, debunking the claim that the schools abused and murdered their students.

In an April 5 interview with Rebel News reporter Drea Humphrey, a Kamloops Band member and former Kamloops Indian Residential School student revealed that there was no”genocide” at the schools and many students benefited from the institution.

“A lot of the students were happy to be there,” the Band member, whose identity was kept anonymous, said. “They were away from abusive families, dysfunctional families, alcoholism. So, they were happy to be there.”

The former student revealed that he was treated well during his time at the residential schools in the 1970s. He also described the priests and nuns who ran the school as good people, referring to Father Noonan, the principal at the time, as “a real nice guy.”

Residential schools, while run by both the Catholic Church and other Christian churches, were mandated and set up by the federal government and ran from the late 19th century until the last school closed in 1996.

While some children did tragically die at the once-mandatory boarding schools, evidence has revealed that many of the children passed away as a result of unsanitary conditions due to underfunding by the federal government, not the Catholic Church.

As a consequence, since 2021, when the mainstream media ran with inflammatory and dubious claims that hundreds of children were buried and disregarded by Catholic priests and nuns who ran some of the schools, over 100 churches have been burned or vandalized across Canada in seeming retribution.

However, to date, there have been no mass graves discovered at any residential schools across Canada.

The Band member revealed that the Kamloops Band knows they “made a mistake” in labeling the ground anomalies as “unmarked graves.”

In fact, according to the Band member, in the 1990s, the Band used the supposed location of the 215 child graves for their new Powwow Arbour and Heritage Park. The project was only allowed to continue after studies concluded that there were no artifacts or archaeological remains at the site.

Therefore, if there were mass graves at that location, they would have been discovered in the 1990s, not in 2021.

The Band member revealed that he does not believe a “genocide” took place at residential schools, while condemning the church burnings across Canada.

“When I was growing up religion and church meant community and family,” he explained. “It seems like the Liberals want to destroy family so the way to do that is to attack religion.”

“Attacking religion was a good excuse to burn the churches,” he said.

Regardless of his testimony and the lack of evidence to support the claim, mainstream media outlets perpetuate the “mass graves” narrative and even threaten to punish those who oppose it. In November, CBC subtly suggested that “residential school denialism” should be criminalized.

MAiD

Disability rights panel calls out Canada, US states pushing euthanasia on sick patients

From LifeSiteNews

Physician-assisted suicide programs in the US and Canada are discriminating against patients with serious medical conditions according to a panel discussion at the Religion News Association.

Physician-assisted suicide programs in the United States and Canada are discriminating against patients with serious medical conditions even when their cases are not terminal, in many cases pushing to end their lives for financial reasons rather than medical.

Catholic News Agency reported that a panel of disability-rights advocates recently examined the landscape of the issue during the Religion News Association’s 2025 annual conference. During the panel, Patients Rights Action Fund (PRAF) executive director Matt Vallière accused state euthanasia programs of discriminating against patients with life-threatening conditions in violation of the Americans with Disabilities Act, noting that when a state will “will pay for every instance of assisted suicide” but not palliative care, “I don’t call that autonomy, I call that eugenics.”

Inclusion Canada CEO Krista Carr, meanwhile, discussed her organization’s lawsuit against the expansion of Canada’s medical assistance in dying (MAID) program to “people with an incurable disease or disability who are not dying, so they’re not at end of life and their death is not reasonably foreseeable.”

More astonishingly, she added, this “funded right” to lethal injection is slated to be expanded to mental illness in 2027.

“By setting out a timeline of three years, it’s an indication that the systems need to move towards readiness in two years. There’s the opportunity to do another review, and to assess the readiness of the system through a parliamentary process,” Health Minister Mark Holland said in February of the move, which Dying with Dignity Canada presents as a matter of “equality” for “those whose sole underlying condition is a mental illness.”

“It’s being called a choice,” but “it’s not a choice,” Carr said. Rather, these programs are pushing the “choice” on patients in “a desperate situation where they can’t get the support they need.”

As LifeSiteNews recently covered, the “most recent reports show that (medical assistance in dying) is the sixth highest cause of death in Canada. However, it was not listed as such in Statistics Canada’s top 10 leading causes of death from 2019 to 2022.”

In America, nine states plus the District of Columbia currently allow assisted suicide.

Support is available to talk those struggling with suicidal thoughts out of ending their lives. The American Suicide & Crisis Lifeline and the Canadian Suicide Crisis Helpline can both be reached by calling or texting 988.

-

Business2 days ago

Business2 days agoStocks soar after Trump suspends tariffs

-

COVID-192 days ago

COVID-192 days agoBiden Admin concealed report on earliest COVID cases from 2019

-

Business2 days ago

Business2 days agoScott Bessent Says Trump’s Goal Was Always To Get Trading Partners To Table After Major Pause Announcement

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoResearchers Link China’s Intelligence and Elite Influence Arms to B.C. Government, Liberal Party, and Trudeau-Appointed Senator

-

Business1 day ago

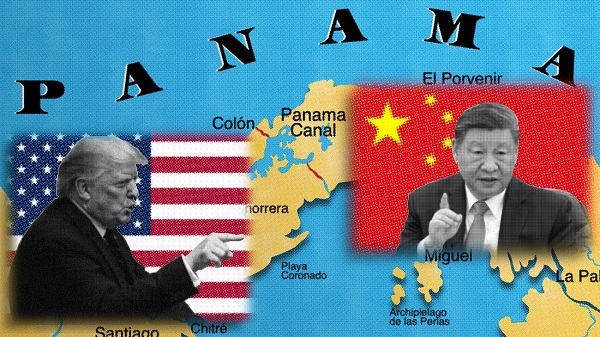

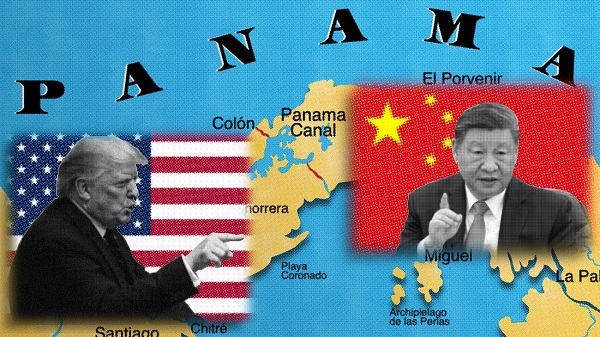

Business1 day agoTimeline: Panama Canal Politics, Policy, and Tensions

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoThe status quo in Canadian politics isn’t sustainable for national unity

-

COVID-191 day ago

COVID-191 day agoFauci, top COVID officials have criminal referral requests filed against them in 7 states

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP memo warns of Chinese interference on Canadian university campuses to affect election