Automotive

U.S. politics looms large over Trudeau/Ford EV gamble

From the Fraser Institute

Political developments in the U.S. over the past few years have substantially increased the risk of any investment that relies on unrestricted access to the U.S. market

Last week, the Trudeau government and the Ford government announced a new multi-billion dollar taxpayer-funded subsidy for Honda to expand its Alliston, Ontario plant to manufacture electric vehicles (EV) and host a large EV battery plant. Eventually, the direct and indirect subsidies could total $10 billion from the two governments.

The Honda announcement follows earlier deals with Northvolt, Stellantis and Volkswagen to build and operate EV battery and auto assembly plants in Ontario. According to the Parliamentary Budget Officer, these three deals may total $50.7 billion after accounting for the cost of government borrowing to finance the subsidies and foregone corporate tax revenue from tax abatements tied to production.

Clearly, if future taxpayers across the country (not just in Ontario) are to avoid a huge additional tax burden or suffer reductions in government services, a lot needs to go right for Canada’s EV industry.

In particular, there must emerge sufficient market demand for EVs so these “investments” in the EV auto sector will be fully paid for by future tax revenues from corporate and personal income taxes levied on companies and workers in the EV sector. During their joint announcement of the Honda deal, both Prime Minister Trudeau and Premier Ford ignored this elephant in the room while claiming that the Honda deal will mean 240,000 vehicles a year manufactured at the site and 4,200 jobs preserved, while adding another 1,000 jobs.

By way of perspective, in 2023 around 185,000 EV vehicles were sold in Canada—about 11 per cent of all new cars sold in Canada that year. This is considerably less than the target capacity of the Honda complex and the total expected production capacity of Canada’s EV sector once all the various announced subsidized production facilities are in operation. In contrast, 1.2 million EVs were sold in the United States.

The demand for EVs in Canada will likely grow over time, especially given the increased incentive the federal government now has to ensure, through legislation or regulation, that Canadians retire their gas-powered vehicles and replace them with EVs. However, the long-run financial health of Canada’s EV sector requires continued access to the much larger U.S. market. Indeed, Honda’s CEO said his company chose Canada as the site for their first EV assembly plant in part because of Canada’s access to the U.S. market.

But political developments in the U.S. over the past few years have substantially increased the risk of any investment that relies on unrestricted access to the U.S. market. The trade protectionist bent of Donald Trump, the Republican nominee in the upcoming presidential election, is well known and he reportedly plans to impose a broad 10 per cent tariff on all manufactured imports to the U.S. if elected.

While the Canada-U.S.-Mexico Free Trade Agreement ostensibly gives Canadian-based EV producers tariff-free access to the U.S. market, Trump could terminate the treaty or at least insist on major changes in specific Canadian trade policies that he criticized during his first term, including supply management programs for dairy products. The trade agreement is up for trilateral review in 2025, which would allow a new Trump administration to demand political concessions such as increased Canadian spending on defence, in addition to trade concessions.

Nor would the re-election of President Joe Biden immunize Canada from protectionist risks. Biden has been a full-throated supporter of unionized U.S. auto workers and has staked his administration’s legacy on the successful electrification of the U.S. transportation sector through domestic production. Given his government’s financial commitment to growing a domestic EV sector, Biden might well impose trade restrictions on Canada if Canadian exports start to displace domestic production in the U.S.

In short, Canadian politicians, most notably Justin Trudeau and Doug Ford, have staked the future of Canada’s heavily subsidized domestic EV sector on the vagaries of the U.S. political process, which is increasingly embracing “America First” industrial policies. This may turn out to be a very costly gamble for Canadian taxpayers.

Author:

Automotive

Power Struggle: Electric vehicles and reality

From Resource Works

Tension grows between ambition and market truths

Host Stewart Muir talks on Power Struggle with Brian Maas, president of the California New Car Dealers Association, and Maas introduces us to a U.S. problem that Canada and B.C. also face right now. “The problem is there are mandates that apply in California and 11 other states that require, for the 2026 model year, 35% of all vehicles manufactured for sale in our state must be zero-emission, even though the market share right now is 20%. “So we’ve got a mandate that virtually none of the manufacturers our dealers represent are going to be able to meet.”

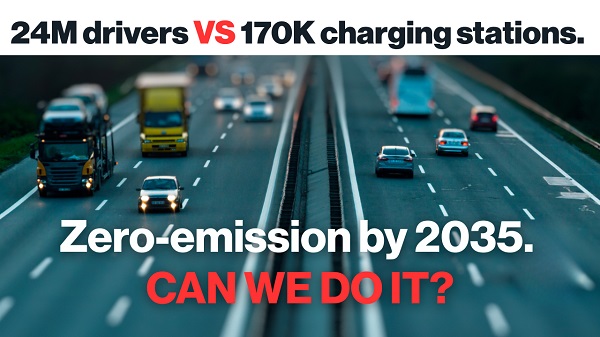

Maas adds: “We’re trying to communicate with policymakers that nobody’s opposed to the eventual goal of electrification. California’s obviously led that effort, but a mandate that nobody can comply with and one that California voters are opposed to deserves to be recalibrated.” Meanwhile, in Canada, the same objections apply to the federal government’s requirement, set in 2023, that 100% of new light-duty vehicles sold must be zero-emission vehicles, ZEVs (electric or plug-in hybrid) by 2035, with interim targets of 20 per cent by 2026 and 60 per cent by 2030. There are hefty penalties for dealers missing the targets.

Market researchers note that it now takes 55 days to sell an electric vehicle in Canada, up from 22 days in the first quarter of 2023. The researchers cite a lack of desirable models and high consumer prices despite government subsidies to buyers in six provinces that run as high as $7,000 in Quebec.

In the U.S. The Wall Street Journal reports that, on average, electric vehicles and plug-in hybrids sit in dealer lots longer than gasoline-powered cars and hybrids, despite government pressure to switch to electric. (The Biden administration ruled that two-thirds of new vehicles sold must be electric by 2032.) For Canada, the small-c conservative Fraser Institute reports: “The targets were wild to begin with. As Manhattan Institute senior fellow Mark P. Mills observed, bans on conventional vehicles and mandated switches to electric means, consumers will need to adopt EVs at a scale and velocity 10 times greater and faster than the introduction of any new model of car in history.”

When Ottawa scrapped federal consumer subsidies earlier this year, EV manufacturers and dealers in Canada called on the feds to scrap the sales mandates. “The federal government’s mandated ZEV sales targets are increasingly unrealistic and must end,” said Brian Kingston, CEO of the Canadian Vehicle Manufacturers’ Association. “Mandating Canadians to buy ZEVs without providing them the supports needed to switch to electric is a made-in-Canada policy failure.” And Tim Reuss, CEO of the Canadian Automobile Dealers Association, said: “The Liberal federal government has backed away from supporting the transition to electric vehicles and now we are left with a completely unrealistic plan at the federal level. “There is hypocrisy in imposing ambitious ZEV mandates and penalties on consumers when the government is showing a clear lack of motivation and support for their own policy goals.”

In B.C., sales growth of ZEVs has recently slowed, and the provincial government is considering easing its ZEV targets. “The Energy Ministry acknowledged that it will be ‘challenging’ to reach the target that 90 per cent of new vehicles be zero emission by 2030.” Nat Gosman, an assistant deputy minister in the B.C. energy ministry, cited reasons for the slowdown that include affordability concerns due to a pause in government rebates, supply chain disruptions caused by U.S. tariffs, and concerns about reliability of public charging sites.

Barry Penner, chair of the Energy Futures Institute and a former B.C. Liberal environment minister, said the problem is that the government has “put the cart before the horse” when it comes to incentivizing people to buy electric vehicles. “The government imposed these electric vehicle mandates before the public charging infrastructure is in place and before we’ve figured out how we’re going to make it easy for people to charge their vehicles in multi-family dwellings like apartment buildings.”

Penner went on to write an article for Resource Works that said: “Instead of accelerating into economically harmful mandates, both provincial and federal governments should recalibrate. We need to slow down, invest in required charging infrastructure, and support market-based innovation, not forced adoption through penalties. “A sustainable energy future for BC and Canada requires smart, pragmatic policy, not economic coercion. Let’s take our foot off the gas and realign our policies with reality, protect jobs, consumer affordability, and real environmental progress. Then we can have a successful transition to electric vehicles.”

Back to Power Struggle, and Brian Maas tells Stewart: “I think everybody understands that it’s great technology and I think a lot of Californians would like to have one. . . . The number one reason consumers cited for not making the transition to a zero-emission vehicle is the lack of public charging infrastructure. We’re woefully behind what would be required to move to 100% environment. “And if you live in a multifamily dwelling, an apartment building or something like that, you can’t charge at home, so you would have to rely on a public charger. Where do you go to get that charged?

“The state’s Energy Commission has said we need a million public chargers by 2030 and two million public chargers by 2035. We only have 178,000 now and we’re adding less than 50,000 public chargers a year. We’re just not going to get there fast enough to meet the mandate that’s on the books now.”

In Canada, Resource Works finds there now are more than 33,700 public charging ports, at 12,955 locations. But Ottawa says that to support its EV mandate, Canada will need about 679,000 public ports. “This will require the installation of, on average, 40,000 public ports each year between 2025 and 2040.”

And we remind readers of Penner’s serious call on governments to lighten the push on the accelerator when it comes to ZEV mandates: “Let’s take our foot off the gas and realign our policies with reality, protect jobs, consumer affordability, and real environmental progress. Then we can have a successful transition to electric vehicles.”

- Power Struggle YouTube video: https://ow.ly/8J4T50WhK5i

- Audio and full transcript: https://ow.ly/Np8550WhK5j

- Stewart Muir on LinkedIn: https://ow.ly/Smiq50UWpSB

- Brian Maas on LinkedIn: https://ow.ly/GuTh50WhK8h

- Power Struggle on LinkedIn: https://ow.ly/KX4r50UWpUa

- Power Struggle on Instagram: https://ow.ly/3VIM50UWpUg

- Power Struggle on Facebook: https://ow.ly/4znx50UWpUs

- Power Struggle on X: https://ow.ly/tU3R50UWpVu

Automotive

Electric vehicle sales are falling hard in BC, and it is time to recognize reality.

From Energy Now

By Barry Penner

Get the Latest Canadian Focused Energy News Delivered to You! It’s FREE: Quick Sign-Up Here

British Columbia’s electric vehicle (EV) sales mandates were created with good intentions, but the collision with reality is now obvious.

Although we are still in 2025, the 26 percent zero-emission vehicle sales mandate is already hitting our dealerships. That’s because it applies to the 2026 model year, and many of those models are starting to arrive across the province now.

While 26 percent sounds moderate compared to 90 percent by 2030, or 100 percent by 2035, as also required by BC law, the facts on the ground are grim.

According to S&P Global Mobility data, EV sales in BC have plummeted to around 15.4 percent as of June 2025, down from nearly 25 percent in mid-2024. This decline happened fast after both federal, up to $5,000, and provincial governments, up to $4,000 in BC, stopped funding their EV rebate programs earlier this year. So, the very incentives that made expensive electric vehicles accessible to middle-income buyers disappeared just when they were needed most.

Government polling shows 60 percent of British Columbians say cost is their biggest barrier to buying electric vehicles. And yet, both levels of government pulled the financial support while maintaining the sales mandates, with penalties of up to $20,000 per non-compliant vehicle. This is not just bad policy, it’s economic punishment for our auto sector.

Flavio Volpe, president of the Automotive Parts Manufacturers’ Association, pointed out the severe consequences for automakers. Federally, failing to meet the EV sales targets could mean astronomical penalties. A company selling 300,000 vehicles a year that misses its target by 10 percent could face a $600 million fine. These are not theoretical risks; they are real and could mean manufacturers reduce their Canadian presence, potentially costing thousands of auto jobs.

And powering an all-electric vehicle fleet is no small task. The organization of which I am chair, the Energy Futures Institute, modelled BC’s electricity needs under the 2035 mandate scenario and found full implementation would require an extra two Site C dams’ worth of electricity. We’ve already been importing 20 to 25 percent of our electricity annually for the past few years, often from fossil fuels, which contradicts our clean energy goals.

Electric vehicles represent an important technological advance, but the path matters. With governments forcing unattainable mandates, they are creating resentment amongst potential buyers and a political backlash against EVs themselves.

Energy Futures recently learned that the BC government is undertaking a technical review of the Zero-Emission Vehicle Act, quietly acknowledging that sales targets are increasingly seen as next to impossible. Under consideration is a change to the targets themselves, along with adjustments to compliance ratios and eligibility rules for plug-in hybrids.

The market shift to regular hybrids, which you don’t plug in, is not supported by rebates, but is happening nevertheless. However, these vehicles, such as the Toyota Prius, are not considered “clean” enough under BC legislation and could attract a penalty of $20,000 each.

This only makes things worse for consumers who are already stretched. Punitive mandates create market distortions, restrict consumer choice, and drive up vehicle prices for everyone, especially lower-income families who rely on affordable used cars.

Instead of accelerating into economically harmful mandates, both provincial and federal governments should recalibrate. Ottawa’s Environment Minister Julie Dabrusin’s statement earlier this month to renew consumer rebates is a good start, if the government is determined to interfere with the marketplace. But rebates alone won’t be enough. We need to slow down, invest in required charging infrastructure, and support market-based innovation, not forced adoption through penalties.

A sustainable energy future for BC and Canada requires smart, pragmatic policy, not economic coercion. Let’s take our foot off the gas and realign our policies with reality, protect jobs, consumer affordability, and real environmental progress. Then we can have a successful transition to electric vehicles.

Barry Penner is chair of the Energy Futures Institute, former president of the Pacific Northwest Economic Region and former four-term B.C. MLA and cabinet minister.

-

COVID-192 days ago

COVID-192 days agoOntario man launches new challenge against province’s latest attempt to ban free expression on roadside billboards

-

COVID-1923 hours ago

COVID-1923 hours agoNew Peer-Reviewed Study Affirms COVID Vaccines Reduce Fertility

-

Business19 hours ago

Business19 hours agoOttawa Funded the China Ferry Deal—Then Pretended to Oppose It

-

Alberta2 days ago

Alberta2 days agoAlberta Next Takes A Look At Alberta Provincial Police Force

-

MAiD21 hours ago

MAiD21 hours agoCanada’s euthanasia regime is not health care, but a death machine for the unwanted

-

Alberta22 hours ago

Alberta22 hours agoThe permanent CO2 storage site at the end of the Alberta Carbon Trunk Line is just getting started

-

Alberta2 days ago

Alberta2 days agoCanadian Oil Sands Production Expected to Reach All-time Highs this Year Despite Lower Oil Prices

-

International2 days ago

International2 days agoPresident Xi Skips Key Summit, Adding Fuel to Ebbing Power Theories