Fraser Institute

U.S. election should focus or what works and what doesn’t work

From the Fraser Institute

As Republicans and Democrats make their final pitch to voters, they’ve converged on some common themes. Kamala Harris wants to regulate the price of food. Donald Trump wants to regulate the price of credit. Harris wants the tax code to favour the 2.5 per cent of workers who earn tips. So does Trump. Harris wants the government to steer more labour and capital into manufacturing. And so does Trump.

With each of these proposals, the candidates think the United States would be better off if the government made more economic decisions and—by implication—if individual citizens made fewer economic decisions. Both should pay closer attention to Zimbabwe. Yes, Zimbabwe.

Why does a country with abundant natural resources, rich culture and unparalleled beauty have one-sixth the average income of neighbouring Botswana? While we’re at it, why do twice as many children die in infancy in Azerbaijan as across the border in Georgia? Why do Hungarians work 20 per cent longer than their Austrian neighbours but earn 45 per cent less? Why is extreme poverty 200 times more common in Laos than across the Mekong River in Thailand?

Or how about this one: Why were more than one-quarter of Estonians formerly exposed to dangerous levels of air pollution when the country was socialist while today nearly every Estonian breathes clean air in what is ranked the cleanest country in the world.

These are anecdotes. However, the plural of anecdote is data, and through careful and systematic study of the data, we can learn what works and what doesn’t. Unfortunately, the populist economic policies in vogue among Democrats and Republicans do not work.

What does work is economic freedom.

Economic freedoms are a subset of human freedoms. When people have more economic freedom, they are allowed to make more of their own economic choices—choices about work, about buying and selling goods and services, about acquiring and using property, and about forming contracts with others.

For nearly 30 years, the Fraser Institute has been measuring economic freedom across countries. On one hand, governments can stop people from making their own economic choices through taxes, regulations, barriers to trade and manipulation of the value of money (see the proposals of Harris and Trump above). On the other hand, governments can enable individual economic choice by protecting people and their property.

The index published in Fraser’s annual Economic Freedom of the World report incorporates 45 indicators to measure how governments either prevent or enable individual economic choice. The result reveals the degree of economic freedom in 165 countries and territories worldwide, with data going back to 1970.

According to the latest report, comparatively wealthy Botswanans rank 84 places ahead of Zimbabweans in terms of the economic freedom their government permits them. Georgians rank 107 places ahead of Azerbaijanis, Thais rank 60 places ahead of Laotians, and Austrians are 32 places ahead of Hungarians.

The benefits of economic freedom go far beyond anecdotes and rankings. As Estonia—once one of the least economically free places in the world and now among the freest—dramatically shows, freer countries tend not only to be more prosperous but greener and healthier.

In fact, economists and other social scientists have conducted nearly 1,000 studies using the index to assess the effect of economic freedom on different aspects of human wellbeing. Their statistical comparisons include hundreds and sometimes thousands of data points and carefully control for other factors like geography, natural resources and disease environment.

Their results overwhelmingly support the idea that when people are permitted more economic freedom, they prosper. Those who live in freer places enjoy higher and faster-growing incomes, better health, longer life, cleaner environments, more tolerance, less violence, lower infant mortality and less poverty.

Economic freedom isn’t the only thing that matters for prosperity. Research suggests that culture and geography matter as well. While policymakers can’t always change people’s attitudes or move mountains, they can permit their citizens more economic freedom. If more did so, more people would enjoy the living standards of Botswana or Estonia and fewer people would be stuck in poverty.

As for the U.S., it remains relatively free and prosperous. Whatever its problems, decades of research cast doubt on the notion that America would be better off with policies that chip away at the ability of Americans to make their own economic choices.

Author:

Community

Charitable giving on the decline in Canada

From the Fraser Institute

By Jake Fuss and Grady Munro

There would have been 1.5 million more Canadians who donated to charity in 2023—and $755.5 million more in donations—had Canadians given to the same extent they did 10 years prior

According to recent polling, approximately one in five Canadians have skipped paying a bill over the past year so they can buy groceries. As families are increasingly hard-pressed to make ends meet, this undoubtedly means more and more people must seek out food banks, shelters and other charitable organizations to meet their basic necessities.

And each year, Canadians across the country donate their time and money to charities to help those in need—particularly around the holiday season. Yet at a time when the relatively high cost of living means these organizations need more resources, new data published by the Fraser Institute shows that the level of charitable giving in Canada is actually falling.

Specifically, over the last 10 years (2013 to 2023, the latest year of available data) the share of tax-filers who reported donating to charity fell from 21.9 per cent to 16.8 per cent. And while fewer Canadians are donating to charity, they’re also donating a smaller share of their income—during the same 10-year period, the share of aggregate income donated to charity fell from 0.55 per cent to 0.52 per cent.

To put this decline into perspective, consider this: there would have been 1.5 million more Canadians who donated to charity in 2023—and $755.5 million more in donations—had Canadians given to the same extent they did 10 years prior. Simply put, this long-standing decline in charitable giving in Canada ultimately limits the resources available for charities to help those in need.

On the bright side, despite the worrying long-term trends, the share of aggregate income donated to charity recently increased from 0.50 per cent in 2022 to 0.52 per cent in 2023. While this may seem like a marginal improvement, 0.02 per cent of aggregate income for all Canadians in 2023 was $255.7 million.

The provinces also reflect the national trends. From 2013 to 2023, every province saw a decline in the share of tax-filers donating to charity. These declines ranged from 15.4 per cent in Quebec to 31.4 per cent in Prince Edward Island.

Similarly, almost every province recorded a drop in the share of aggregate income donated to charity, with the largest being the 24.7 per cent decline seen in P.E.I. The only province to buck this trend was Alberta, which saw a 3.9 per cent increase in the share of aggregate income donated over the decade.

Just as Canada as a whole saw a recent improvement in the share of aggregate income donated, so too did many of the provinces. Indeed, seven provinces (except Manitoba, Nova Scotia and Newfoundland and Labrador) saw an increase in the share of aggregate income donated to charity from 2022 to 2023, with the largest increases occurring in Saskatchewan (7.9 per cent) and Alberta (6.7 per cent).

Canadians also volunteer their time to help those in need, yet the latest data show that volunteerism is also on the wane. According to Statistics Canada, the share of Canadians who volunteered (both formally and informally) fell by 8 per cent from 2018 to 2023. And the total numbers of hours volunteered (again, both formal and informal) fell by 18 per cent over that same period.

With many Canadians struggling to make ends meet, food banks, shelters and other charitable organizations play a critical role in providing basic necessities to those in need. Yet charitable giving—which provides resources for these charities—has long been on the decline. Hopefully, we’ll see this trend turn around swiftly.

Alberta

Schools should go back to basics to mitigate effects of AI

From the Fraser Institute

Odds are, you can’t tell whether this sentence was written by AI. Schools across Canada face the same problem. And happily, some are finding simple solutions.

Manitoba’s Division Scolaire Franco-Manitobaine recently issued new guidelines for teachers, to only assign optional homework and reading in grades Kindergarten to six, and limit homework in grades seven to 12. The reason? The proliferation of generative artificial intelligence (AI) chatbots such as ChatGPT make it very difficult for teachers, juggling a heavy workload, to discern genuine student work from AI-generated text. In fact, according to Division superintendent Alain Laberge, “Most of the [after-school assignment] submissions, we find, are coming from AI, to be quite honest.”

This problem isn’t limited to Manitoba, of course.

Two provincial doors down, in Alberta, new data analysis revealed that high school report card grades are rising while scores on provincewide assessments are not—particularly since 2022, the year ChatGPT was released. Report cards account for take-home work, while standardized tests are written in person, in the presence of teaching staff.

Specifically, from 2016 to 2019, the average standardized test score in Alberta across a range of subjects was 64 while the report card grade was 73.3—or 9.3 percentage points higher). From 2022 and 2024, the gap increased to 12.5 percentage points. (Data for 2020 and 2021 are unavailable due to COVID school closures.)

In lieu of take-home work, the Division Scolaire Franco-Manitobaine recommends nightly reading for students, which is a great idea. Having students read nightly doesn’t cost schools a dime but it’s strongly associated with improving academic outcomes.

According to a Programme for International Student Assessment (PISA) analysis of 174,000 student scores across 32 countries, the connection between daily reading and literacy was “moderately strong and meaningful,” and reading engagement affects reading achievement more than the socioeconomic status, gender or family structure of students.

All of this points to an undeniable shift in education—that is, teachers are losing a once-valuable tool (homework) and shifting more work back into the classroom. And while new technologies will continue to change the education landscape in heretofore unknown ways, one time-tested winning strategy is to go back to basics.

And some of “the basics” have slipped rapidly away. Some college students in elite universities arrive on campus never having read an entire book. Many university professors bemoan the newfound inability of students to write essays or deconstruct basic story components. Canada’s average PISA scores—a test of 15-year-olds in math, reading and science—have plummeted. In math, student test scores have dropped 35 points—the PISA equivalent of nearly two years of lost learning—in the last two decades. In reading, students have fallen about one year behind while science scores dropped moderately.

The decline in Canadian student achievement predates the widespread access of generative AI, but AI complicates the problem. Again, the solution needn’t be costly or complicated. There’s a reason why many tech CEOs famously send their children to screen-free schools. If technology is too tempting, in or outside of class, students should write with a pencil and paper. If ChatGPT is too hard to detect (and we know it is, because even AI often can’t accurately detect AI), in-class essays and assignments make sense.

And crucially, standardized tests provide the most reliable equitable measure of student progress, and if properly monitored, they’re AI-proof. Yet standardized testing is on the wane in Canada, thanks to long-standing attacks from teacher unions and other opponents, and despite broad support from parents. Now more than ever, parents and educators require reliable data to access the ability of students. Standardized testing varies widely among the provinces, but parents in every province should demand a strong standardized testing regime.

AI may be here to stay and it may play a large role in the future of education. But if schools deprive students of the ability to read books, structure clear sentences, correspond organically with other humans and complete their own work, they will do students no favours. The best way to ensure kids are “future ready”—to borrow a phrase oft-used to justify seesawing educational tech trends—is to school them in the basics.

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoDeath by a thousand clicks – government censorship of Canada’s internet

-

Daily Caller2 days ago

Daily Caller2 days agoChinese Billionaire Tried To Build US-Born Baby Empire As Overseas Elites Turn To American Surrogates

-

Great Reset2 days ago

Great Reset2 days agoViral TikTok video shows 7-year-old cuddling great-grandfather before he’s euthanized

-

Digital ID2 days ago

Digital ID2 days agoCanada releases new digital ID app for personal documents despite privacy concerns

-

Community2 days ago

Community2 days agoCharitable giving on the decline in Canada

-

Alberta15 hours ago

Alberta15 hours agoAlberta’s huge oil sands reserves dwarf U.S. shale

-

Alberta2 days ago

Alberta2 days agoSchools should go back to basics to mitigate effects of AI

-

Bruce Dowbiggin2 days ago

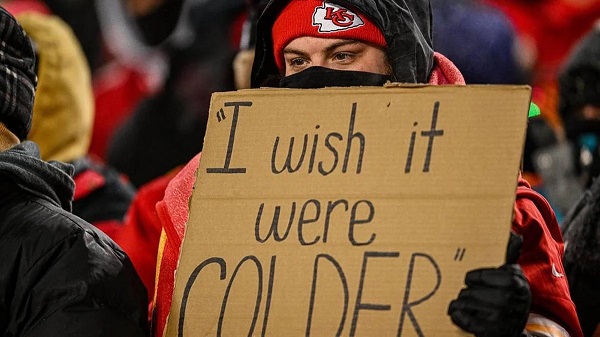

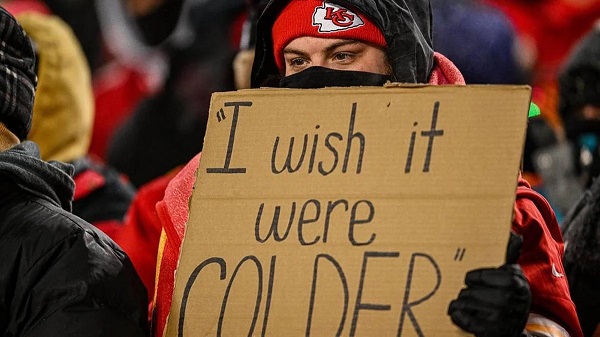

Bruce Dowbiggin2 days agoNFL Ice Bowls Turn Down The Thermostat on Climate Change Hysteria