Fraser Institute

Trudeau’s legacy includes larger tax burden for middle-class Canadians

From the Fraser Institute

By Jake Fuss and Grady Munro

On Monday outside Rideau Cottage in Ottawa, after Prime Minister Justin Trudeau told Canadians he plans to resign, a reporter asked Trudeau to name his greatest accomplishments. In response, among other things, Trudeau said his government “reduced” taxes for the “middle class.” But this claim doesn’t withstand scrutiny.

After taking office in 2015, the Trudeau government reduced the second-lowest personal income tax rate from 22.0 per cent to 20.5 per cent—a change that was explicitly sold by Trudeau as a tax cut for the middle class. However, this change ultimately didn’t lower the amount of taxes paid by middle-class Canadians. Why?

Because the government simultaneously eliminated several tax credits—which are intended to reduce the amount of income taxes owed—including income splitting, the children’s fitness credit, children’s arts tax credit, and public transit tax credits. By eliminating these tax credits, the government helped simplify the tax system, which is a good thing, but it also raised the amount families pay in income taxes.

Consequently, most middle-income families now pay higher taxes. Specifically, a 2022 study published by the Fraser Institute found that nearly nine in 10 (86 per cent) middle-income families (earning household incomes between $84,625 and $118,007) experienced an increase in their federal personal income taxes as a result of the Trudeau government’s tax changes.

The study also found that other income groups experienced tax increases. Nearly three-quarters (73 per cent) of families with a household income between $54,495 and $84,624 paid higher taxes as a result of the tax changes. And across all income groups, 61 per cent of Canadian families faced higher personal income taxes than they did in 2015.

The Trudeau government also introduced a new top tax bracket on income over $200,000—which raised the top federal personal income tax rate from 29 per cent to 33 per cent—and other tax changes that increased the tax burden on Canadians including the recent capital gains tax hike. Prior to this hike, investors who sold capital assets (stocks, second homes, cottages, etc.) paid taxes on 50 per cent of the gain. Last year, the Trudeau government increased that share to 66.7 per cent for individual capital gains above $250,000 and all capital gains for corporations and trusts.

According to the Trudeau government, this change will only impact the “wealthiest” Canadians, but in fact it will impact many middle-class Canadians. For example, in 2018, half of all taxpayers who claimed more than $250,000 of capital gains in a year earned less than $117,592 in normal income. These include Canadians with modest annual incomes who own businesses, second homes or stocks, and who may choose to sell those assets once or infrequently in their lifetimes (when they retire, for example). These Canadians will feel the real-world effects of Trudeau’s capital gains tax hike.

While reflecting on his tenure, Prime Minister Trudeau said he was proud that his government reduced taxes for middle-class Canadians. In reality, taxes for middle-class families have increased since he took office. That’s a major part of his legacy as prime minister.

Business

Trumpian chaos—where we are now and what’s coming for Canada

From the Fraser Institute

As we pause to catch our breath amid the ongoing drama of President Donald Trump’s whack-a-mole tariff war, there’s both good and bad news from a Canadian perspective.

On the positive side, Canada (together with Mexico) was not specifically targeted when the president outlined the details of his so-called “reciprocal” tariffs on April 2. These new levies—ranging from 10 per cent to more than 40 per cent, depending on the country—will affect most categories of exports from virtually every U.S. trading partner, but fortunately not America’s two co-signatories to the Canada-U.S.-Mexico Agreement (CUSMA). Instead, apart from a handful of significant economic sectors (discussed below), Canadian exporters, for the moment, will be able to sell tariff-free into the U.S. market, provided they are compliant with the rules and paperwork requirements stipulated in CUSMA. That’s a ray of sunshine in an otherwise dark sky.

On April 9, the president agreed to a 90-day pause on his sweeping reciprocal tariffs, perhaps because of plunging U.S. and global stock markets and mounting fears of economic calamity. At the same time, he announced a jaw-dropping 125 per cent tariff on imports from China, which then immediately retaliated with steep duties of its own on all U.S. goods entering the country.

The risk remains that when the dust settles, the U.S will end up applying much higher tariffs on imports from most of the world. Should President Trump adopt the reciprocal levies announced on April 2 and stick with the 125 per cent tariff on imports from China, Yale University researchers estimate that the average effective U.S. tariff rate will soar to 25.3 per cent—more than 10 times higher than the average over the preceding 25 years. That’s one measure of the disruption that Trump has visited upon the international trading system.

For Canada, the average U.S. tariff would be lower, between 4 and 5 per cent, reflecting the benefits of CUSMA, albeit somewhat offset by the negative impact of the 25 per cent levies the U.S. is imposing on all imports of steel, aluminum, and motor vehicles and parts, along with separate punitive duties on softwood lumber imported from Canada. American tariffs on these Canadian export sectors will undoubtedly exact a toll on our economy. But the damage would be considerably greater if Canada was subject to across-the-board U.S. reciprocal tariffs.

Where does all of this leave Canada’s $3.3 trillion economy as of the second quarter of 2025?

Late last year, most forecasters were expecting a modest pick-up in growth after a notably lacklustre 2024, mainly thanks to lower interest rates and reduced borrowing costs for households and businesses. However, that widely-shared view didn’t account for President Trump’s wholesale assault on the global economic system—“a new economic crisis,” as Bank of Canada Governor Tiff Macklem described the situation in late March.

Back in February, the central bank took a stab at modelling the effects of matching U.S. and Canadian tariffs of 25 per cent, levied on all bilateral goods trade (apart from energy where a lower tariff rate was assumed). Its projections pointed to a permanent loss of Canadian economic output (real GDP) on the order of 2-3 per cent, a double-digit percentage decline in business investment, weaker consumption and a substantial fall in the value of Canadian exports over 2025/26. The Bank’s modelling also foresaw a lower Canadian dollar and a temporary jump in inflation, with the latter due primarily to Canada’s assumed retaliatory tariffs.

The macroeconomic scenario outlined in the Bank of Canada’s January study was dire enough, signalling a Canadian recession stretching over most of 2025 and well into 2026. But seen through today’s lens, the Bank’s earlier analysis looks too optimistic, as it failed to incorporate the worldwide dimensions of President Trump’s tariff barrage, including the scale of the retaliation planned by America’s aggrieved trading partners.

Even if it escapes the worst of Trump’s tariffs, Canada stands to suffer from a gruesome mix of slower global growth, a probable U.S. recession, and falling prices for oil, minerals and other natural resource products, which collectively comprise around half of the country’s international exports. Already there has been a marked erosion of Canadian business confidence, as reported in the Bank of Canada’s spring Business Outlook Survey, with one-third of firms now expecting a recession and hiring intentions sinking to the lowest level in a decade. Most respondents to the Bank’s survey also anticipate rising business input costs and higher Canadian inflation in 2025.

Worryingly, the latest Bank of Canada survey was completed in February; since then, the intensity of the Trumpian chaos has continued to increase. Among other things, the uncertainty that is an inevitable by-product of the president’s shambolic policymaking is having a decisively negative impact on business investment in many industries—in Canada, to be sure, but also in the United States. As two American business analysts recently observed: “With tariff policy shifting not day by day, but hour by hour… business investment is entirely paralyzed—and will continue to be frozen for the foreseeable future. That is exactly the opposite of what Trump intended.”

It doesn’t help that Canada is in the midst of a federal election, and that the government is therefore “otherwise occupied.” Once Canadian voters have spoken, the government elected on April 28 must deal with a deteriorating economy, navigate through the tariff fog and determine how to reset economic and security relations with our principal ally and commercial partner in the turbulent era of Trump 2.0.

2025 Federal Election

Does Canada Need a DOGE?

From the Fraser Institute

By Philip Cross

The legions of Canadians wanting to see government spending shrink probably look enviously at how Elon Musk’s Department of Government Efficiency (DOGE) is slashing some government programs in the United States, even if DOGE’s non-surgical chainsaw approach is controversial, to say the least.

Some problems are common to cutting any government’s spending. Ironclad job security for union employees with seniority means cuts are skewed disproportionately to junior staff still on probation, with the regrettable side effect of denying an injection of fresh blood into a sclerotic workforce. Cutting employees and not programs makes it easier for higher staffing to resume: as documented by Carleton University Professor Ian Lee in How Ottawa Spends, even prolonged bouts of austerity do not derail government spending from long-term trend of higher growth. Across the board cuts do not allow for the surgical removal of redundant or inefficient programs and poor performing employees.

Canada has some unique problems with federal government spending. Savoie documents how 41 per cent of federal civil servants are located in Ottawa, versus 16 per cent in Washington and 19 per cent in London, despite Canada having the most decentralized federation in the G7. The concentration in Ottawa partly reflects the exceptional influence exerted by central agencies on all departments. As well, University of Cambridge Professor Dennis Grube found Canada’s civil service was the most resistant to public scrutiny and the most risk adverse in a comparative study of public servants in the U.S., the United Kingdom, Australia, New Zealand and Canada.

Canada’s federal employees are among the most expensive anywhere. The average civil servant costs taxpayers $146,500 a year including all salary, benefits and costs such as computers and training. Multiplying this average cost by 366,316 federal employees yields a total labour bill of $53.7 billion, not including other spending such as $17.8 billion on consultants. All the recent increase in the ranks of the civil service happened in Justin Trudeau’s tenure, expanding 38.5 per cent after Stephen Harper had cut them 9 per cent between 2010 and 2015 in his determination to balance the budget.

While the cost of government employees has risen sharply, the services they provide to the public are dwindling as government spending increasingly is devoted to managing its unwieldy and bloated bureaucracy. As Savoie observes, unions like to paint civil servants as providing essential services such as food inspectors and rescue workers, when in reality most are involved in a vast web of “policy, coordination, liaison, and performance evaluation units.” The fastest growing occupations in the federal government are in administrative services and program administration, whose share of jobs rose from 25.1 per cent in 2010 to 31.9 per cent in 2023 according to the latest report from the Treasury Board.

A chronic problem is the fierce defense offered by public service unions in “protecting non-performers and insulating the public sector from effective outside scrutiny” as Savoie wrote. The refusal to acknowledge and root out non-performers depresses the morale of the average civil servant who’s unfairly tarred with the reputation of a minority. It also motivates the across-the-board chainsaw approach of DOGE, which critics then decry as not discriminating between good and bad employees. The latter could easily be targeted by senior managers, who know exactly who the non-performers are but cannot be bothered with the years of documentation and bureaucratic headaches needed to get rid of them. The cost of poor performers is substantial; if even 10 per cent of the civil service was eliminated as redundant non-performers, the government would save $5.4 billion a year. Potential savings are likely well over $10 billion.

The federal government potentially has enormous leverage in negotiating civil service pay and getting rid of non-performers, because it can unilaterally change the federal pension plan without negotiating with public-sector unions. The federal pension plan is so generous that it’s referred to as the “golden handcuffs” that tie employees to their jobs irrespective of their pay or working conditions. To protect their lucrative pensions, unions inevitably would be willing to make concessions that substantially lower the burden on Canada’s taxpayers and still improve morale within the civil service.

-

COVID-192 days ago

COVID-192 days agoMassive new study links COVID jabs to higher risk of myocarditis, stroke, artery disease

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoConservative Party urges investigation into Carney plan to spend $1 billion on heat pumps

-

2025 Federal Election2 days ago

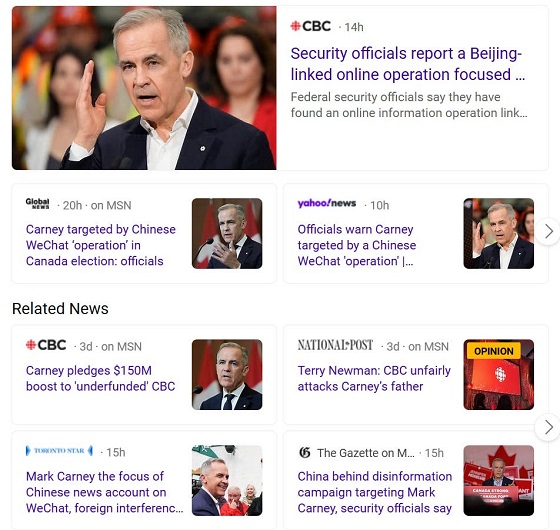

2025 Federal Election2 days agoCommunist China helped boost Mark Carney’s image on social media, election watchdog reports

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFifty Shades of Mark Carney

-

Health1 day ago

Health1 day agoExpert Medical Record Reviews Of The Two Girls In Texas Who Purportedly Died of Measles

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCorporate Media Isn’t Reporting on Foreign Interference—It’s Covering for It

-

COVID-192 days ago

COVID-192 days agoBiden Admin concealed report on earliest COVID cases from 2019

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoMark Carney To Ban Free Speech if Elected