Business

Trudeau’s Latest Scandal: Billions in Indigenous Procurement Fraud Exposed in Explosive OGGO Committee 145

As Trudeau Dodges Accountability on Foreign Interference, His Government’s Systemic Corruption in Indigenous Procurement is Revealed—Witness: “Billions Stolen by Fake Indigenous Businesses”

This week, Justin Trudeau was grilled during the Hogue Inquiry on foreign interference—a spectacle where, despite all his smoke and bluster, no one was named as traitors. Classic Trudeau: all talk, no action. But while the Prime Minister was busy dodging accountability on the global stage, a new scandal was brewing right under our noses. It’s not just foreign interference, WE Charity, SNC-Lavalin, his Green Slush Fund, or ArriveCAN. Oh no, it’s much worse.

For someone who loves to virtue-signal about reconciliation, Trudeau’s record on actually helping Indigenous communities is crumbling. Yesterday’s Meeting No. 145 of the Standing Committee on Government Operations and Estimates (OGGO) tore apart the Liberal façade of caring about Indigenous rights. The truth? Fraud, corruption, and negligence are running rampant within Trudeau’s government, and it’s Indigenous people who are paying the price.

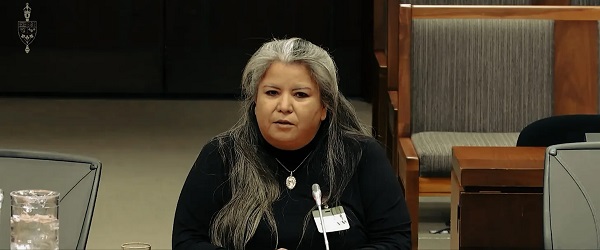

Witnesses from the Ghost Warrior Society and PLATO Testing exposed just how deep the rot goes. Crystal Semaganis, the leader of the Ghost Warrior Society, and Denis Carignan, president of PLATO Testing, laid out in chilling detail how fake Indigenous businesses are stealing billions of dollars meant for real Indigenous communities, all while Trudeau’s government sits back and lets it happen.

So, while Trudeau might want you to think he’s the champion of reconciliation, this committee revealed the real story: Trudeau’s corruption is systemic, and it’s Indigenous people who are being exploited. It’s time we dive into the committee and expose this latest chapter in the Trudeau scandal saga. Buckle up.

Trudeau’s Newest Scandal- Indigenous Procurement

The OGGO committee hearing on Indigenous procurement was supposed to be a moment of reckoning—a chance for the Trudeau government to finally come clean about the rampant fraud within its own ranks. Instead, what we witnessed was a masterclass in Liberal deflection, corruption, and the complete and total betrayal of the Indigenous communities Justin Trudeau pretends to care about.

This wasn’t just another day in Ottawa where Liberals paid lip service to reconciliation. Oh no, this committee meeting exposed the stunning hypocrisy at the heart of the Trudeau government. What the Liberals don’t want you to know is that billions of dollars—yes, billions—have been stolen by fake Indigenous businesses, all under the nose of the Trudeau government. And guess what? They’ve done nothing to stop it.

The star witness, Crystal Semaganis, leader of the Ghost Warrior Society, laid it out for everyone to see. These fraudulent actors—companies and individuals pretending to be Indigenous—have exploited a broken system where no one verifies Indigenous identity. According to Semaganis, billions of dollars in contracts meant to uplift Indigenous communities have been stolen by what she called “corporations posing as Indigenous Nations (CPIN).”

She even gave specific examples: one company alone has raked in $163 million since 1994 by pretending to be Indigenous. That’s right—$163 million. And how did this happen? Because the Trudeau government relies on an honor system for verifying Indigenous identity. You heard that right: an honor system. And because there’s no centralized system to authenticate claims, anyone can say they’re Indigenous, grab a few million in contracts, and laugh all the way to the bank.

Let’s be clear about what’s happening here: real Indigenous people are being robbed by these fraudsters, and the government is standing by, doing nothing. No oversight. No accountability. No legal consequences.

Larry Brock and Garnett Genuis: The Conservatives Fight Back

Thankfully, the Conservative MPs on this committee didn’t let Trudeau’s government get away with this fraud without a fight. Larry Brock (MP for Brantford—Brant) and Garnett Genuis (MP for Sherwood Park—Fort Saskatchewan) came out swinging, and they weren’t about to let the Liberals dodge accountability.

Brock, in particular, delivered a fiery takedown of the Liberal corruption machine. He pointed out that this kind of fraud doesn’t happen in a vacuum. No, this is part of a pattern of corruption that starts at the top—with Justin Trudeau himself. From WE Charity to SNC-Lavalin and now this Indigenous procurement scandal, it’s clear the Trudeau Liberals have made an art form out of covering up fraud and protecting their political cronies.

Brock wasn’t just making vague accusations—he linked it all together. He reminded the committee that, just like with ArriveCAN and WE Charity, the Liberals’ first instinct is always to protect their own. They obstruct, delay, and stall investigations until the truth is buried so deep that Canadians move on. But Brock wasn’t going to let this scandal go the same way. He grilled the witnesses, demanding answers on how these fake Indigenous entities could steal billions while the Trudeau government sat on its hands.

Garnett Genuis: “This government has a pattern of shutting down committees and avoiding accountability whenever it gets uncomfortable. They don’t want the truth, they want the scandal buried!”

Garnett Genuis, meanwhile, delivered the knockout punch. He didn’t mince words when he accused the Trudeau government of deliberately choosing not to act. Genuis pointed out that this fraud has been happening for years, and yet the government has refused to implement any kind of legal framework to stop it. Why? Because they benefit from the status quo. The fake Indigenous businesses walking away with billions in contracts? Many of them have deep connections within the Liberal Party. It’s not just negligence—it’s complicity.

The Liberal Stall: A Pattern of Dodging Accountability

But what did the Liberal MPs do in response to these explosive revelations? Did they express outrage? Did they vow to put an end to this fraud? Of course not. Instead, they did what Liberals always do when caught in a scandal: stall and deflect.

Sameer Zuberi, Jenica Atwin, and Majid Jowhari spent their time filibustering, offering vague platitudes about “improving the process” and “working together” to help Indigenous communities. Zuberi, the MP for Pierrefonds—Dollard, tried to steer the conversation toward how the government could improve future Indigenous business opportunities, conveniently sidestepping the massive fraud happening right now under his government’s watch.

Atwin, MP for Fredericton, delivered a particularly pathetic performance, rambling about reconciliation without once addressing the real issue of billions being stolen. And Majid Jowhari MP for Richmond Hill? Well, he focused on processes and frameworks, pretending the fraud revelations weren’t even the central issue.

These Liberals weren’t interested in getting to the bottom of this scandal. They were only interested in running out the clock, hoping the committee would end before anyone could connect the dots between this fraud and Trudeau’s corruption.

Final Thoughts

Let’s stop pretending that Justin Trudeau and his Liberals are going to do anything about this. They won’t. They’ve been caught red-handed, allowing billions to be stolen from Indigenous communities by fraudulent actors, and their only response has been to stall, deflect, and cover up. That’s their playbook. But we can’t let them get away with it.

It’s time for the opposition to step up—to do what this government refuses to do. The Conservatives, like Larry Brock and Garnett Genuis, need to pull the rug off this scandal and shine a light on the rot that’s taken hold of Indigenous procurement. We can’t let this cancer of corruption continue to fester under the surface while Trudeau and his cronies pat themselves on the back for their so-called reconciliation.

This isn’t just about fraud—it’s about honor and patriotism. We owe it to the Indigenous communities of this country to fight for them when their government won’t. We owe it to every hardworking taxpayer who sees their dollars funneled into fraudulent schemes, enriching those who know how to game the system. This is a battle for the soul of Canada, and it’s a battle that the opposition must take head-on.

If we believe in truth, if we believe in justice, then we can’t stop until every fake Indigenous business, every fraudulent actor, and every Liberal enabler is exposed. The cancer must be cut out. Canada deserves better. Our Indigenous people deserve better. And it’s time to hold this government to account, once and for all.

The opposition has a duty to tear down the curtain and show Canadians what’s really going on behind Trudeau’s façade of virtue-signaling. This isn’t just about politics—it’s about the future of our country, and the integrity of our government.

It’s time to act. Pull the rug off, expose the cancer, and take our country back.

Please subscribe to The Opposition with Dan Knight .

Business

Major tax changes in 2026: Report

The Canadian Taxpayers Federation released its annual New Year’s Tax Changes report today to highlight the major tax changes in 2026.

“There’s some good news and bad news for taxpayers in 2026,” said Franco Terrazzano, CTF Federal Director. “The federal government cut income taxes, but it’s hiking payroll taxes. The government cancelled the consumer carbon tax, but it’s hammering Canadian businesses with a higher industrial carbon tax.”

Payroll taxes: The federal government is raising the maximum mandatory Canada Pension Plan and Employment Insurance contributions in 2026. These payroll tax increases will cost a worker up to an additional $262 next year.

For workers making $85,000 or more, federal payroll taxes (CPP and EI tax) will cost $5,770 in 2026. Their employers will also be forced to pay $6,219.

Income tax: The federal government cut the lowest income tax rate from 15 to 14 per cent. This will save the average taxpayer $190 in 2026, according to the Parliamentary Budget Officer.

Carbon taxes: The government cancelled its consumer carbon tax effective April 1, 2025. However, the government still charges carbon taxes through its industrial carbon tax and a hidden carbon tax embedded in fuel regulations.

The industrial carbon tax will increase to $110 per tonne in 2026. While the government hasn’t provided further details on how much the industrial carbon tax will cost Canadians, 70 per cent of Canadians believe businesses pass on most or some of the cost of the tax to consumers, according to a Leger poll.

Alcohol taxes: Federal alcohol taxes are expected to increase by two per cent on April 1, 2026. This alcohol tax hike will cost taxpayers about $41 million in 2026-27, according to industry estimates.

First passed in the 2017 federal budget, the alcohol escalator tax automatically increases excise taxes on beer, wine and spirits every year without a vote in Parliament. Since being imposed, the alcohol escalator tax has cost taxpayers about $1.6 billion, according to industry estimates.

“Canadians pay too much tax because the government wastes too much money,” Terrazzano said. “Canadians are overtaxed and need serious tax cuts to help make life more affordable and our economy more competitive.

“Prime Minister Mark Carney needs to significantly cut spending, provide major tax relief and scrap all carbon taxes.”

You can read the CTF’s New Year’s Tax Changes report here.

Automotive

Politicians should be honest about environmental pros and cons of electric vehicles

From the Fraser Institute

By Annika Segelhorst and Elmira Aliakbari

According to Steven Guilbeault, former environment minister under Justin Trudeau and former member of Prime Minister Carney’s cabinet, “Switching to an electric vehicle is one of the most impactful things Canadians can do to help fight climate change.”

And the Carney government has only paused Trudeau’s electric vehicle (EV) sales mandate to conduct a “review” of the policy, despite industry pressure to scrap the policy altogether.

So clearly, according to policymakers in Ottawa, EVs are essentially “zero emission” and thus good for environment.

But is that true?

Clearly, EVs have some environmental advantages over traditional gasoline-powered vehicles. Unlike cars with engines that directly burn fossil fuels, EVs do not produce tailpipe emissions of pollutants such as nitrogen dioxide and carbon monoxide, and do not release greenhouse gases (GHGs) such as carbon dioxide. These benefits are real. But when you consider the entire lifecycle of an EV, the picture becomes much more complicated.

Unlike traditional gasoline-powered vehicles, battery-powered EVs and plug-in hybrids generate most of their GHG emissions before the vehicles roll off the assembly line. Compared with conventional gas-powered cars, EVs typically require more fossil fuel energy to manufacture, largely because to produce EVs batteries, producers require a variety of mined materials including cobalt, graphite, lithium, manganese and nickel, which all take lots of energy to extract and process. Once these raw materials are mined, processed and transported across often vast distances to manufacturing sites, they must be assembled into battery packs. Consequently, the manufacturing process of an EV—from the initial mining of materials to final assembly—produces twice the quantity of GHGs (on average) as the manufacturing process for a comparable gas-powered car.

Once an EV is on the road, its carbon footprint depends on how the electricity used to charge its battery is generated. According to a report from the Canada Energy Regulator (the federal agency responsible for overseeing oil, gas and electric utilities), in British Columbia, Manitoba, Quebec and Ontario, electricity is largely produced from low- or even zero-carbon sources such as hydro, so EVs in these provinces have a low level of “indirect” emissions.

However, in other provinces—particularly Alberta, Saskatchewan and Nova Scotia—electricity generation is more heavily reliant on fossil fuels such as coal and natural gas, so EVs produce much higher indirect emissions. And according to research from the University of Toronto, in coal-dependent U.S. states such as West Virginia, an EV can emit about 6 per cent more GHG emissions over its entire lifetime—from initial mining, manufacturing and charging to eventual disposal—than a gas-powered vehicle of the same size. This means that in regions with especially coal-dependent energy grids, EVs could impose more climate costs than benefits. Put simply, for an EV to help meaningfully reduce emissions while on the road, its electricity must come from low-carbon electricity sources—something that does not happen in certain areas of Canada and the United States.

Finally, even after an EV is off the road, it continues to produce emissions, mainly because of the battery. EV batteries contain components that are energy-intensive to extract but also notoriously challenging to recycle. While EV battery recycling technologies are still emerging, approximately 5 per cent of lithium-ion batteries, which are commonly used in EVs, are actually recycled worldwide. This means that most new EVs feature batteries with no recycled components—further weakening the environmental benefit of EVs.

So what’s the final analysis? The technology continues to evolve and therefore the calculations will continue to change. But right now, while electric vehicles clearly help reduce tailpipe emissions, they’re not necessarily “zero emission” vehicles. And after you consider the full lifecycle—manufacturing, charging, scrapping—a more accurate picture of their environmental impact comes into view.

-

COVID-191 day ago

COVID-191 day agoTrump DOJ seeks to quash Pfizer whistleblower’s lawsuit over COVID shots

-

Alberta1 day ago

Alberta1 day agoAlberta introducing three “all-season resort areas” to provide more summer activities in Alberta’s mountain parks

-

Agriculture1 day ago

Agriculture1 day agoGrowing Alberta’s fresh food future

-

International1 day ago

International1 day agoTrump admin wants to help Canadian woman rethink euthanasia, Glenn Beck says

-

Alberta1 day ago

Alberta1 day agoThe case for expanding Canada’s energy exports

-

Business2 days ago

Business2 days agoStorm clouds of uncertainty as BC courts deal another blow to industry and investment

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoOttawa’s New Hate Law Goes Too Far

-

Business1 day ago

Business1 day agoFuelled by federalism—America’s economically freest states come out on top