Business

Trudeau’s Alternative Universe: Claiming the Carbon Tax is Not Inflationary Defies Belief

From EnergyNow.ca

By Jim Warren

Back in March 2019, the average price for a pound of lean ground beef at five major chain grocery outlets in Regina was $4.71. In September 2024 lean ground at the five big chain outlets averaged $7.90 — a 68% increase over the past five years… these price increases are a far cry from the official statistic for accumulated inflation of 21% over the same period.

Kudos to the Canadian Trucking Alliance (CTA). They have provided us with some valuable insight into the inflationary effects of Canada’s carbon tax.

This past August, the CTA published a brief to the federal government which among other things called for a moratorium on the carbon tax for diesel fuel.

In commenting on the brief, CTA president Stephen Laskowski said, “The carbon tax on diesel fuel is currently having zero impact on the environment and is only serving to needlessly drive up costs for every good purchased by Canadian families and businesses. The carbon tax needs to be repealed from diesel fuel until viable propulsion alternatives are available for the industry and the Canadian supply chain to choose from.”

The CTA estimates that as of 2024 the carbon tax on diesel adds an extra cost for long-haul truck operators of $15,000 to $20,000 or around 6% of per truck in annual operating costs. The brief to government claims a small trucking business with five trucks, “is seeing between $75,000 and $100,000 in extra costs due to the carbon tax.”

Obviously, truckers striving to remain solvent will be doing their utmost to pass carbon tax costs on to their customers. If the cost of the tax can’t be recouped by some trucking companies, we can bet there will be fewer of them operating over the coming years. As Laskowksi said, the carbon tax increased the cost of virtually every product transported by truck—which means pretty well every physical good consumers purchase.

In light of the political beating the Liberals have been taking over the carbon tax, the Trudeau government has taken a tiny feeble step toward relieving the pressure on businesses. In October 2024 federal finance minister Chrystia Freeland announced the government’s intention to provide carbon tax rebates to businesses with fewer than 500 employees. That means many of Canada’s trucking companies will be eligible to recoup some of the carbon tax they have been paying since fiscal 2019-2020. Freeland says the cheques will be in the mail this December.

It sounds okay until you look at the fine print.

The payments will not reflect the amount of fuel a business uses or how much carbon tax it has paid over the past five years. The rebates will be based on the number of people a company employs and will be paid only in provinces where the federal fuel charge applies. An accounting business with 10 employees will receive the same carbon tax rebate as a small trucking business with 10 employees. A CBC news report pulled the following example from Freeland’s press release, “A business in Ontario with 10 employees can expect to receive $4,010…”

Freeland boasted, “These are real, significant sums of money. They’re going to make a big difference to Canadian small business.”

Freeland’s statement is patently false when it comes to trucking companies.

Let’s say that the 10 employee business is a long-haul trucking company based in Ontario. After paying the carbon tax on five or more trucks for five years, the business would receive a paltry $4,010 rebate. That light dusting of sugar won’t make the carbon tax any more palatable to the trucking industry. According to the CTA’s estimates, if the 10 employee long-haul trucking firm had just five trucks the carbon tax will have cost it approximately $400,000 in operating costs over the past five years.

Carbon tax costs are not the only inflation related frustration affecting Canadians. The way the federal government and its friends in the media describe inflation presents people with a warped view of what is happening to the cost of living. Media reports on inflation rarely reflect the lived experience of people trying to pay the mortgage, feed their families and drive to work.

Governments, and their media apologists, in both Canada and the US have been taking victory laps over the past year because the rate of inflation has decreased. It’s as though people have nothing to worry about because the cost of living this year isn’t increasing as fast as it was last year. Changes in the inflation rate may be important for statistical purposes but they don’t reflect reality for people who have been coping with increases in inflation over several years. Most people measure the difficulties caused by inflation by comparing how much more things cost today than they did three to five years ago. The figure regular civilians, as opposed to statisticians, use to assess increases in the cost of living is accumulated inflation. However, we still need to be cautious about the accumulated inflation rate that we get when using government data.

If we calculate the rate of accumulated inflation based on official annualized inflation rates from 2019 up to the midpoint of 2024. The accumulated increase over that five year period is around 21%. And, it is true that this number better reflects people’s perception of inflation than a statistical comparison indicating the rate of inflation fell from 3.9 % in 2023 to 2.61% by the mid-point of 2024. The problem is the 21% number still does not accurately reflect increases in the cost of many necessary goods and services that are impacting households. This is why according to political polls voters in Canada and the US aren’t buying government propaganda when it comes to inflation.

The economy, and by extension, the high cost of living was a major issue in the recent US federal election campaign. The Democrats did not do themselves any favours claiming Bidenomics had wrestled inflation to the ground simply because it wasn’t increasing as fast as it was a year ago. A large number of voters in the US embraced former US president Lyndon Johnson’s maxim, “Don’t piss on my leg and tell me it’s raining.”

But wait, it gets worse. The basket of goods and services the Canadian government uses to calculate the cost of living index and the inflation rate fails to identify high increases in the prices for specific household essentials including many grocery staples. Similarly, official calculations for statistically weighted national average consumption of various products used to calculate the Consumer Price Index are skewed in favour of big urban centres. Montreal, Toronto and Vancouver are over represented. There is no way that the average annual consumption of gasoline for a household in downtown Montreal comes anywhere close to the amount used in most of Canada where public transit is scarce and distances are great. The result is the official accumulated inflation rate fails to show what many people are experiencing in most regions of the country.

Here is a good example of how published statistics don’t reflect the inflation shock that consumers experience at the grocery store. Back in March 2019, the average price for a pound of lean ground beef at five major chain grocery outlets in Regina was $4.71. In September 2024 lean ground at the five big chain outlets averaged $7.90 — a 68% increase over the past five years. The price of rib eye steak increased by even more. Rib eyes averaged $14.91 per pound at the five stores in Regina in March 2019. This September, the average price for rib eye steak was $29.40 – a 97% increase over five years. Obviously, these price increases are a far cry from the official statistic for accumulated inflation of 21% over the same period. (FYI: the data presented here was derived from Beef Business magazine published by the Saskatchewan Stock Growers Association. Each bimonthly edition of Beef Business features a retail beef price check)

Assuming we can find similar rates of accumulated inflation for other staples like dairy products and fresh vegetables it’s no wonder smart shoppers have been incensed over what’s going on with grocery prices and the cost of living (not to mention price increases for fuel, rents house prices and mortgage interest). Consumers have discovered today’s prices of $6.50 for a four litre jug of milk and $7.00 for a pound of butter aren’t going to be reduced simply because the rate of inflation has decreased form 3.69% to 2.61% over the past year. Using history as our guide, with the exception of rare periods of deflation such as the depression of the 1930s, it is unlikely we’ll see the price increases of the past few years come down other than for sales or loss leader strategies. And, while a 72 cent dollar might boost sales for some of our exports, it will add more than 25% to the cost of imported fruit and vegetables this winter,

Furthermore, the impacts of inflation are being more severely felt by Canadians today than they would have been a decade ago. This is because our per capita national income (using GDP as a proxy for national income) has been shrinking since 2014. That was the year oil prices fell into an eight year depression and the last full year before Justin Trudeau became Prime minister.

According to a 2024 Fraser Institute Bulletin authored by Alex Whelan, Milagros Placios and Lawrence Shembri, “Canadians have been getting poorer relative to residents of other countries in the OECD [a club of mostly rich countries]. From 2002 to 2014, Canadian income growth, as measured by GDP per capita, roughly kept pace with the rest of the OECD. From 2014 to 2022, however, Canada’s position declined sharply, ranking third lowest among 30 countries for average growth over the period.”

Canada’s per capita GDP/national income for 2024 is projected to be $54,866.05. According Whelan, Placios and Shembri, that is lower than per capita national income in the US, UK, New Zealand and Austrailia.

Only one US state, Mississippi, the poorest state in the union, has a per capita GDP/national income less than Canada’s. Mississippi’s total is $53,061. Other states considered poor by US standards such as Alabama and Arkansas have higher per capita GDPs than Canada. On average, Canadians have increasingly less money with which to buy more expensive goods and services.

The challenges Canadians have faced as a result of the high cost of living have coincided with the eight plus years that Justin Trudeau has been prime minister. The decline in per capita national income also occurred under Trudeau’s watch—in conjunction with Liberal policies designed to stifle growth in Canada’s petroleum and natural gas industries. What did the Trudeau Liberals think would happen to growth in per capita national income after they handcuffed our single most important export industry?

In the final analysis it’s a tossup. Do we have an inflation problem or is inflation just a symptom of our Trudeau problem?

2025 Federal Election

The “Hardhat Vote” Has Embraced Pierre Poilievre

David Krayden

David Krayden

Blue collar and unionized workers are supporting Pierre Poilievre and the CPC

When President Richard Nixon won a landslide in his 1972 reelection, he did so by broadening his own personal popularity and the appeal of the Republican Party to blue collar and unionized workers. It was called the hardhat vote and many working people embraced Nixon because he seemed to be talking the same language as they were. Nixon talked about law and order and getting tough on crime; safer streets and harsher penalties for serious crime. Although unionized workers had traditionally voted for the Democratic Party and seen the Republicans as the party of the wealthy, by 1972 the Democrats had moved far to the left on social issues and were completely out of touch with average Americans who saw Democratic presidential nominee Sen. George McGovern as being soft on crime and approving of the anarchy on the streets.

It’s precisely the language that Conservative Party of Canada leader Pierre Poilievere is speaking in the 2025 federal election. As support for the New Democratic Party has collapsed throughout the election campaign, don’t think most of it is going to the Liberal Party. Poilievre has been targeting blue collar workers for years with his emphasis on the trades and talking about middle class tax cuts and safe streets. A factory or construction worker is middle class and just want an affordable lifestyle for their families. They don’t have a lot of time for the woke underbelly of the Liberals or the NDP and are increasingly reluctant to support either party because both have appealed to elites.

Listen to Karl Lovett, the president of the Local 773 of the International Brotherhood of Electrical Workers, talk about Carney corruption and why he is supporting Poilievre and the CPC in 2025.

“Mark Carney also failed to pay $5 billion in Canadian taxes by hiding his company’s assets in Bermuda above a bike shop. Hard to believe that information comes from Canada’s NDP, or at least who is left of them, because the irony is, Mark Carney has eaten all those people alive. Even the mayor of Lima has warned Canadians not to vote for Mark Carney, and why for ripping him off the poorest of the poor people in Peru. That’s who he ripped off,” Lovett said.

“Listen, there are countless other outrageous examples proving that Mark Carney doesn’t give a damn about the Canadian working man. And now, as prime minister, which he’s not, Carney is promising to put carbon tax and tariff on the auto industry. It’s another rip-off screen that’s right. We’re getting punched by Trump on one side of the border, and Carney plans to punch us on this side of the border, also pretending it’s all about climate change, and now he’s made millions off the workers’ backs. He wants more than money. He wants more power. He wants all of the power to do whatever he wants to do. Mark Carney cannot be trusted with this power. Mark Carney cannot be trusted to protect workers,” Lovett continued.

The union leader told a cheering crowd that “Mark Carney is in it for himself, and when he loses this election, you can bet Mark Carney is going to leave Canada in a New York minute. But there’s hope, there’s hope, there’s our last hope. His name is Pierre Poilievere – the .only hope for Canadian workers. You see Mark Carney fooled Justin Trudeau. We can’t let him keep fooling us.”

“Local 773, which I represent, knows Pierre Poilievre very well. We can proudly tell you that Pierre has our back. Pierre has been putting Canadian people to work and Canadian workers. First, local 773 began working with Pierre Poilievre, the Conservative Member of Parliament Chris Lewis, some years ago, when it became all too clear that the Liberal Party had zero interest in helping out workers. Upon winning the leadership of the party, Pierre made Local 773 his very first priority, he came to my union hall. Pier made the Local 773 Visitor Training Center, and he met all our workers, and he made a pledge to me; he’s not going to turn his back on us, and I believe him,” Lovett said.

Toronto Sun columnist Joe Warmington agreed with me and you can hear that entire interview, below. “Labor wants to work, and they want to, you know, build things, and they want those good, paying jobs, and that’s what Poilievre has always been about, you know.”

“He wants more power. He wants all of the power to do whatever he wants to do. Mark Carney cannot be trusted with this power. Mark Carney cannot be trusted to protect workers,”

“Again, it’s hard to know, but I always felt … and I still think that Poilievre is going to pull this off because of these reasons that you’ve raised today, I never really bought into and again, I’m just one person’s opinion, and I go on the ground. In the air, the polls are saying, I know there’s this main street poll today, maybe it’ll swing differently. But in the air, it says one thing, and on the ground, it says another thing. And that clip you just showed, that’s the ground, that’s where the workers are, that’s where the families are.”

2025 Federal Election

Poilievre will cancel Mark Carney’s new Liberal packaging law and scrap the Liberal plastic ban!

From Conservative Party Communications

Conservative Leader Pierre Poilievre promised today that a new Conservative government will stop Mark Carney’s proposed Liberal food tax and scrap the existing Liberal plastic ban. Poilievre will:

- Stop proposed new labelling and packaging requirements that will raise the cost of fresh produce by as much as 34% and cost the average Canadian household an additional $400 each year.

- Scrap the Liberal plastics ban, including the ban on straws, grocery bags, food containers and cutlery, and other single-use plastics, letting consumers and businesses choose what works for them.

- Protect restaurants, grocers, and low-income Canadians from one-size-fits-all packaging rules that disproportionately affect those who can least afford it.

“After the Lost Liberal Decade, many Canadians can barely afford to put food on the table. And now Mark Carney and the Liberals want to make it even harder with a new food packaging law that will raise the price of food–again,” said Poilievre. “A new Conservative government will keep food prices down by scrapping the Liberal plastic ban and stopping Carney’s new Liberal food tax.”

After a decade of out-of-control spending and massive tax increases, families are spending $800 more on food this year than they did in 2024, and food banks had to handle a record two million visits in a single month. In Montreal, 44 percent of CEGEP students are experiencing some form of food insecurity, while places like Hawkesbury, Kingston, Toronto and Mississauga have all declared food insecurity emergencies.

And food prices are still rocketing upwards, surging by 3.2% over the last year, with no end in sight. In the last month alone, food inflation increased by 1.9 percentage points—the largest monthly jump in food prices in decades.

As if this wasn’t bad enough, Liberals have made life even more expensive and inconvenient for Canadians by banning plastics – including everything from straws to bags to food packaging. The current Liberal ban on single-use plastics will cost Canadians $1.3 billion dollars over the next decade.

Now Mark Carney wants to make it worse by adding complicated and costly new food packaging rules that will drive up the price of food even more–in effect, a new Liberal food tax. Plastic food packaging makes up 1/3 of all plastic packaging in Canada. The proposed Liberal food tax will cost the average Canadian household an additional $400 each year, waste half a million tonnes of food, decrease access to imported fruit and produce, and increase food inflation. The Chemistry Industry Association of Canada has also warned that this tax will put up to 60,000 Canadians out of work.

“The Liberals’ ideological crusade against convenience has already driven up food prices and the last thing Canadians need is Mark Carney’s new food tax added directly to your grocery bill,” said Poilievre. “The choice for Canadians is clear, a fourth Liberal term that will make food even more expensive or a new Conservative government that will axe the food tax and bring back straws, grocery bags and other items, to make life more affordable and convenient for Canadians – For a Change.”

-

Business2 days ago

Business2 days agoChina, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

-

espionage2 days ago

espionage2 days agoEx-NYPD Cop Jailed in Beijing’s Transnational Repatriation Plot, Canada Remains Soft Target

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBREAKING from THE BUREAU: Pro-Beijing Group That Pushed Erin O’Toole’s Exit Warns Chinese Canadians to “Vote Carefully”

-

Daily Caller2 days ago

Daily Caller2 days agoTrump Executive Orders ensure ‘Beautiful Clean’ Affordable Coal will continue to bolster US energy grid

-

Daily Caller2 days ago

Daily Caller2 days agoDOJ Releases Dossier Of Deported Maryland Man’s Alleged MS-13 Gang Ties

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAllegations of ethical misconduct by the Prime Minister and Government of Canada during the current federal election campaign

-

Energy2 days ago

Energy2 days agoStraits of Mackinac Tunnel for Line 5 Pipeline to get “accelerated review”: US Army Corps of Engineers

-

Opinion2 days ago

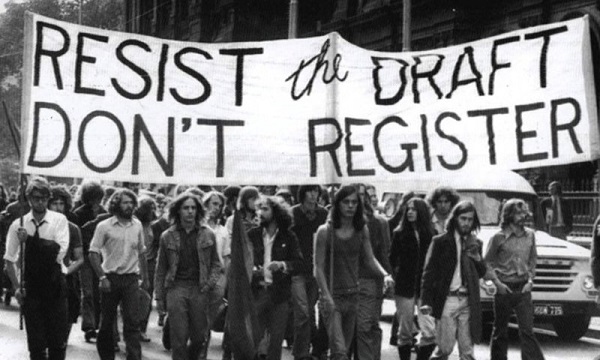

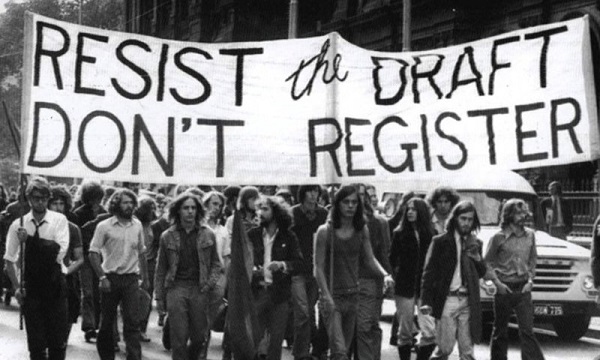

Opinion2 days agoLeft Turn: How Viet Nam War Resisters Changed Canada’s Political Compass