Housing

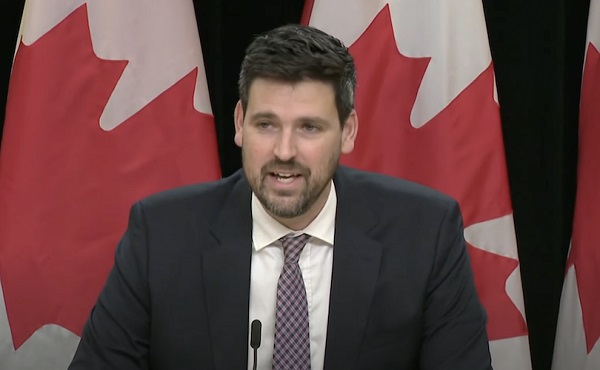

Trudeau loses another cabinet member as Housing Minister Sean Fraser resigns

From LifeSiteNews

Liberal Housing Minister Sean Fraser announced his departure from the Trudeau government on Monday, as Liberals are increasingly leaving Trudeau’s cabinet and calling for his resignation.

Prime Minister Justin Trudeau’s Housing Minister Sean Fraser has quit the Liberal government.

During a December 16 press conference, Liberal Housing Minister Sean Fraser announced his departure from the Trudeau government, as Liberals are increasingly leaving the Liberal cabinet and calling for Trudeau’s resignation.

“I made this decision for myself a few months ago when I was home recovering from surgery that took place in early September,” Fraser told reporters.

“I got a few extra weeks spending time with my kids at home,” he continued. “It felt like I was supposed to be.”

Fraser revealed that he does not plan to seek re-election but “will remain open to different professional opportunities.”

“You are leaving without completing the job,” one reporter yesterday told Fraser, referencing the rising rental costs, homelessness, and high housing prices.

“I am extremely proud of the work we have gotten done,” he responded without expanding on Canada’s housing situation.

Fraser’s resignation comes at the same time as Finance Minister and Deputy Minister Chrystia Freeland announced her departure from the Trudeau cabinet.

“On Friday, you told me you no longer want me to serve as your Finance Minister and offered me another position in the Cabinet,” Freeland wrote in her letter to Trudeau.

“Upon reflection, I have concluded that the only honest and viable path is for me to resign from the Cabinet,” she continued.

In her letter, Freeland appeared to criticize Trudeau’s financial decisions, which she called “costly political gimmicks,” while clarifying that she will stay on as a Liberal MP and plans to run for her Toronto seat in the fall 2025 election.

The resignations come as reports are circulating that suggest Trudeau is considering stepping down as leader.

Additionally, just hours after Freeland’s resignation, leader of the New Democratic Party (NDP) Jagmeet Singh, whose party has been propping up the Liberal minority government, called on the prime minister to resign.

“We are calling for Justin Trudeau’s resignation,” said Singh to reporters in French and later in English.

Singh claimed that should Trudeau not step down voluntarily, he would consider voting non-confidence, saying, “all tools are on the table.”

Leader of the Conservative Party of Canada Pierre Poilievre demanded that Trudeau return to the House of Commons at once so a vote of confidence could be held “tonight.”

Trudeau has seen many ministers resign in recent months as the Liberal Party’s polling continues to trend downward. The most recent polls show a Conservative government under Poilievre would win a supermajority were an election held today.

2025 Federal Election

Homebuilding in Canada stalls despite population explosion

From the Fraser Institute

By Austin Thompson and Steven Globerman

Between 1972 and 2019, Canada’s population increased by 1.8 residents for every new housing unit started compared to 3.9 new residents in 2024. In other words, Canada must now house more than twice as many new residents per new housing unit as it did during the five decades prior to the pandemic

In many parts of Canada, the housing affordability crisis continues with no end in sight. And many Canadians, priced out of the housing market or struggling to afford rent increases, are left wondering how much longer this will continue.

Simply put, too few housing units are being built for the country’s rapidly growing population, which has exploded due to record-high levels of immigration and the federal government’s residency policies.

As noted in a new study published by the Fraser Institute, the country added an all-time high 1.2 million new residents in 2023—more than double the previous record in 2019—and another 951,000 new residents in 2024. Altogether, Canada’s population has grown by about 3 million people since 2022—roughly matching the total population increase during the 1990s.

Meanwhile, homebuilding isn’t keeping up. In 2024, construction started on roughly 245,000 new housing units nationwide—down from a recent peak of 272,000 in 2021. By contrast, in the 1970s construction started on more than 240,000 housing units (on average) per year—when Canada’s population grew by approximately 280,000 people annually.

In fact, between 1972 and 2019, Canada’s population increased by 1.8 residents for every new housing unit started compared to 3.9 new residents in 2024. In other words, Canada must now house more than twice as many new residents per new housing unit as it did during the five decades prior to the pandemic. And of course, housing follows the laws of supply and demand—when a lot more prospective buyers and renters chase a limited supply of new homes, prices increase.

This key insight should guide the policy responses from all levels of government.

For example, the next federal government—whoever that may be—should avoid policies that merely fuel housing demand such as home savings accounts. And provincial governments (including in Ontario and British Columbia) should scrap any policies that discourage new housing supply such as rent controls, which reduce incentives to build rental housing. At the municipal level, governments across the country should ensure that permit approval timelines and building fees do not discourage builders from breaking ground. Increasing housing supply is, however, only part of the solution. The next federal government should craft immigration and residency policies so population growth doesn’t overwhelm available housing supply, driving up costs for Canadians.

It’s hard to predict how long Canada’s housing affordability crisis will last. But without more homebuilding, slower population growth, or both, there’s little reason to expect affordability woes to subside anytime soon.

2025 Federal Election

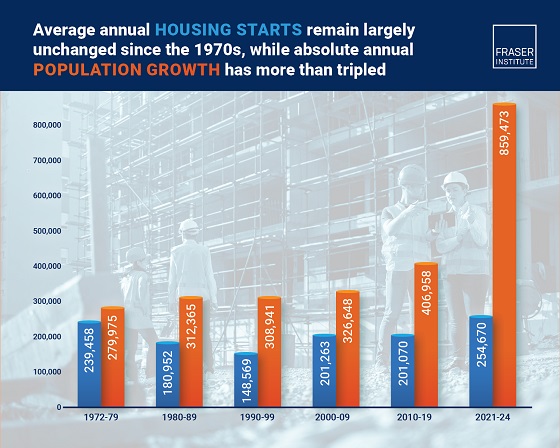

Housing starts unchanged since 1970s, while Canadian population growth has more than tripled

From the Fraser Institute

By: Austin Thompson and Steven Globerman

The annual number of new homes being built in Canada in recent years is virtually the same as it was in the 1970s, despite annual population growth

now being three times higher, finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think tank.

“Despite unprecedented levels of immigration-driven population growth following the COVID-19 pandemic, Canada has failed to ramp up homebuilding sufficiently to meet housing demand,” said Steven Globerman, Fraser Institute senior fellow and co-author of The Crisis in Housing Affordability: Population Growth and Housing Starts 1972–2024.

Between 2021 and 2024, Canada’s population grew by an average of 859,473 people per year, while only 254,670 new housing units were started annually. From 1972 to 1979, a similar number of new housing units were built—239,458—despite the population only growing by 279,975 people a year.

As a result, more new residents are competing for each new home than in the past, which is driving up housing costs.

“The evidence is clear—population growth has been outpacing housing construction for decades, with predictable results,” Globerman said.

“Unless there is a substantial acceleration in homebuilding, a slowdown in population growth, or both, Canada’s housing affordability crisis is unlikely to improve.”

The Crisis in Housing Affordability: Population Growth and Housing Starts 1972–2024

- Canada experienced unprecedented population growth following the COVID-19 pandemic without a commensurately large increase in new homebuilding.

- The imbalance between population growth and new housing construction is reflected in a significant gap between housing demand and supply, which is driving up housing costs.

- Canada’s population grew by a record 1.23 million new residents in 2023 almost entirely due to immigration. That growth was more than double the pre-pandemic record set in 2019.

- Population growth slowed to 951,517 in 2024, still well above any year before 2023.

- Nationally, construction began on about 245,367 new housing units in 2024, down from a recent high of 271,198 starts in 2021—Canada’s annual number of housing starts peaked at 273,203 in 1976.

- Canada’s annual number of housing starts regularly exceeded 200,000 in past decades, when absolute population growth was much lower.

- In 2023, Canada added 5.1 new residents for every housing unit started, which was the highest ratio over the study’s timeframe and well above the average rate of 1.9 residents for every unit started observed over the study period (1972–2024).

- This ratio improved modestly in 2024, with 3.9 new residents added per housing start. However, the ratio remains far higher than at any point prior to the COVID-19 pandemic.

- These national trends are broadly mirrored across all 10 provinces, where annual population growth relative to housing starts is, to varying degrees, elevated when compared to long-run averages.

- Without an acceleration in homebuilding, a slowdown in population growth, or both, Canada’s housing affordability crisis will likely persist.

Austin Thompson

-

Business2 days ago

Business2 days agoChinese firm unveils palm-based biometric ID payments, sparking fresh privacy concerns

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoConservatives promise to ban firing of Canadian federal workers based on COVID jab status

-

Business1 day ago

Business1 day agoIs Government Inflation Reporting Accurate?

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCarney’s Hidden Climate Finance Agenda

-

Environment2 days ago

Environment2 days agoExperiments to dim sunlight will soon be approved by UK government: report

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoStudy links B.C.’s drug policies to more overdoses, but researchers urge caution

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoIs free speech over in the UK? Government censorship reaches frightening new levels

-

International2 days ago

International2 days agoPope Francis Got Canadian History Wrong