Business

Trudeau collecting two pensions worth $8.4 million

The Canadian Taxpayers Federation is calling on all party leaders to commit to ending the second pension for prime ministers.

“Taxpayers can’t afford to pay for all of the perks in Ottawa and the government should start saving money by ending the prime minister’s second taxpayer-funded pension,” said Franco Terrazzano, CTF Federal Director. “Prime ministers already take a salary nearly six times more than the average Canadian and they already get a lucrative MP pension, so taxpayers shouldn’t be on the hook for a second pension for prime ministers.”

Trudeau will collect two taxpayer-funded pensions in retirement. Combined, those pensions total $8.4 million, according to CTF estimates.

First, there’s the MP pension.

The payouts for Trudeau’s MP pension will begin at $141,000 per year when he turns 55 years old. It will total an estimated $6.5 million should he live to the age of 90.

Then there’s the prime minister’s pension.

“A prime minister who holds the Office of the Prime Minister for at least four years is entitled to receive a special retirement allowance in addition to their members of Parliament pension benefit,” according to the government of Canada.

The payouts for Trudeau’s prime minister pension will begin at $73,000 per year when he turns 67 years old. It will total an estimated $1.9 million should he live to the age of 90.

Add the $6.5-million MP pension to the $1.9-million prime minister’s pension and Trudeau will collect a total of about $8.4 million.

The prime minister’s current annual salary is $406,200.

Trudeau’s pension payouts would be even higher if not for reforms implemented in 2012, which increased the retirement age, cut benefits and saw MPs increase their own contributions. Prior to the reforms, MPs contributed just $1 for every $24 of taxpayer and federal monies invested in their pensions.

Former prime minister Stephen Harper forfeited an estimated $1 million to $2 million in additional payouts by implementing the reforms. Nevertheless, the CTF estimates Harper’s lifetime pensions will total about $7 million.

“A prime minister already takes millions through their first pension, they shouldn’t be billing taxpayers more for their second pension,” Terrazzano said. “Taxpayers need to see leadership at the top and all party leaders should commit to ending the second pension for future prime ministers.”

Education

Schools should focus on falling math and reading grades—not environmental activism

From the Fraser Institute

In 2019 Toronto District School Board (TDSB) trustees passed a “climate emergency” resolution and promised to develop a climate action plan. Not only does the TDSB now have an entire department in their central office focused on this goal, but it also publishes an annual climate action report.

Imagine you were to ask a random group of Canadian parents to describe the primary mission of schools. Most parents would say something along the lines of ensuring that all students learn basic academic skills such as reading, writing and mathematics.

Fewer parents are likely to say that schools should focus on reducing their environmental footprints, push students to engage in environmental activism, or lobby for Canada to meet the 2016 Paris Agreement’s emission-reduction targets.

And yet, plenty of school boards across Canada are doing exactly that. For example, the Seven Oaks School Division in Winnipeg is currently conducting a comprehensive audit of its environmental footprint and intends to develop a climate action plan to reduce its footprint. Not only does Seven Oaks have a senior administrator assigned to this responsibility, but each of its 28 schools has a designated climate action leader.

Other school boards have gone even further. In 2019 Toronto District School Board (TDSB) trustees passed a “climate emergency” resolution and promised to develop a climate action plan. Not only does the TDSB now have an entire department in their central office focused on this goal, but it also publishes an annual climate action report. The most recent report is 58 pages long and covers everything from promoting electric school buses to encouraging schools to gain EcoSchools certification.

Not to be outdone, the Vancouver School District (VSD) recently published its Environmental Sustainability Plan, which highlights the many green initiatives in its schools. This plan states that the VSD should be the “greenest, most sustainable school district in North America.”

Some trustees want to go even further. Earlier this year, the British Columbia School Trustees Association released its Climate Action Working Group report that calls on all B.C. school districts to “prioritize climate change mitigation and adopt sustainable, impactful strategies.” It also says that taking climate action must be a “core part” of school board governance in every one of these districts.

Apparently, many trustees and school board administrators think that engaging in climate action is more important than providing students with a solid academic education. This is an unfortunate example of misplaced priorities.

There’s an old saying that when everything is a priority, nothing is a priority. Organizations have finite resources and can only do a limited number of things. When schools focus on carbon footprint audits, climate action plans and EcoSchools certification, they invariably spend less time on the nuts and bolts of academic instruction.

This might be less of a concern if the academic basics were already understood by students. But they aren’t. According to the most recent data from the Programme for International Student Assessment (PISA), the math skills of Ontario students declined by the equivalent of nearly two grade levels over the last 20 years while reading skills went down by about half a grade level. The downward trajectory was even sharper in B.C., with a more than two grade level decline in math skills and a full grade level decline in reading skills.

If any school board wants to declare an emergency, it should declare an academic emergency and then take concrete steps to rectify it. The core mandate of school boards must be the education of their students.

For starters, school boards should promote instructional methods that improve student academic achievement. This includes using phonics to teach reading, requiring all students to memorize basic math facts such as the times table, and encouraging teachers to immerse students in a knowledge-rich learning environment.

School boards should also crack down on student violence and enforce strict behaviour codes. Instead of kicking police officers out of schools for ideological reasons, school boards should establish productive partnerships with the police. No significant learning will take place in a school where students and teachers are unsafe.

Obviously, there’s nothing wrong with school boards ensuring that their buildings are energy efficient or teachers encouraging students to take care of the environment. The problem arises when trustees, administrators and teachers lose sight of their primary mission. In the end, schools should focus on academics, not environmental activism.

2025 Federal Election

Conservative MP Leslyn Lewis warns Canadian voters of Liberal plan to penalize religious charities

From LifeSiteNews

A Liberal government plan for pro-life and religious groups to be stripped of their tax charity status is an ‘assault’ on people’s faith, MP Leslyn Lewis said.

Canadian Conservative pro-life MP Leslyn Lewis said a plan supported by Mark Carney’s Liberal government that calls for pro-life and religious groups to be stripped of their tax charity status should be an election issue as it’s an “assault” on people’s faith.

“The Liberal plan to revoke the charitable status of religious organizations is an assault on people of faith across Canada,” Lewis wrote on X last week.

Lewis linked her post to an opinion piece published in the Niagara Independent by Lee Harding with the headline “Canada’s sleeper election issue: the loss of charitable status for religious organizations.”

Harding observed that the “potential loss of charitable status for religious charities might be the biggest sleeper issue in the federal election.”

“The Liberal government proposed the change and only Conservatives opposed,” Harding said.

Lewis noted that 40 percent of the 85,600 charities in Canada are religious organizations.

“These are organizations that feed the hungry, support the elderly, rally around people in crisis, provide addiction recovery services – and this is just the tip of the iceberg,” she wrote.

“It is quite honestly disgusting that the Liberals would try to sneak in this unconscionable attack in a Finance Committee report, just before Parliament prorogued.”

She noted how a recent Cardus study shows that if these charities lose their tax status “Canadians would lose $16.5B in services.”

Canadians will head to the polls on April 28. Harding noted how “One needn’t be religious to see the harm in such uncharitable changes to Canada’s charitable sector.”

“Fortunately, Canadians can vote down this misguided attack on religious charities. Whether they do so is up to them.”

Last month, the Conservative Party of Canada launched a petition blasting a recent finance committee recommendation supported by Carney that calls for pro-life and religious groups to have their charity tax status revoked.

The Finance Committee’s pre-budget report proposal released in December 2024 by the all-party Finance Committee suggested that legislation is needed to strip pro-life pregnancy centers and religious groups of their charitable status.

The legislation would amend the Income Tax Act and Income Tax. Section 429 of the proposed legislation recommends the government “no longer provide charitable status to anti-abortion organizations.”

All federal parties except for the Conservatives under Pierre Poilievre support the finance report’s recommendation.

Canada’s Catholic bishops have blasted the report’s recommendations and have urged the Liberal federal government to not proceed with any legislation that would target pro-life groups of religious organizations’ charity tax status.

The good news is that in light of former Prime Minister Justin Trudeau’s shutting of Parliament in order to step down from office, already planned legislation to strip pro-life pregnancy centers of charity status is on pause, at least for now.

Despite the reality that Poilievre is also pro-abortion, the former Trudeau now Carney Liberal government has in recent months ramped up his abortion rhetoric on social media in a seeming bid to rally its base, consistently boasting about his government’s desire to make killing a child in the womb easier than ever. Trudeau also repeatedly bragged about his pro-abortion record in the House of Commons.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPPE Videos, CCP Letters Reveal Pandemic Coordination with Liberal Riding Boss and Former JCCC Leader—While Carney Denies Significant Meeting In Campaign

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNo Matter The Winner – My Canada Is Gone

-

Alberta1 day ago

Alberta1 day agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoASK YOURSELF! – Can Canada Endure, or Afford the Economic Stagnation of Carney’s Costly Climate Vision?

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

Alberta2 days ago

Alberta2 days agoProvince to expand services provided by Alberta Sheriffs: New policing option for municipalities

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoInside Buttongate: How the Liberal Swamp Tried to Smear the Conservative Movement — and Got Exposed

-

Dr. Robert Malone22 hours ago

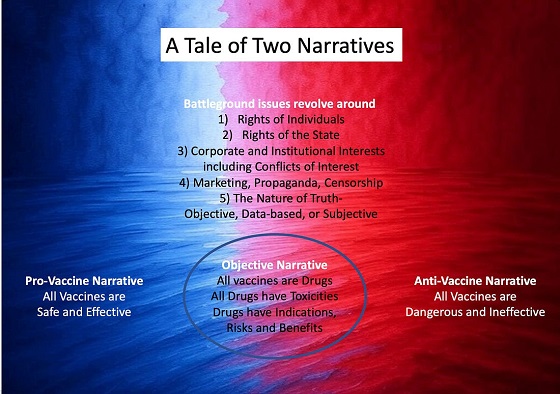

Dr. Robert Malone22 hours agoThe West Texas Measles Outbreak as a Societal and Political Mirror