Fraser Institute

Trudeau and Ford should attach personal fortunes to EV corporate welfare

From the Fraser Institute

By Jason Clemens and Tegan Hill

Last week, with their latest tranche of corporate welfare for the electric vehicle (EV) sector, the Trudeau and Ford governments announced a $5.0 billion subsidy for Honda to help build an EV battery plant and ultimately manufacture EVs in Ontario. Here’s a challenge: if politicians in both governments truly believe these measures are in the public interest, they should tie their personal fortunes with the outcomes of these subsidies (a.k.a. corporate welfare).

One of the major challenges with corporate welfare is the horrendous economic incentives. The politicians and bureaucrats who distribute corporate welfare have no vested financial interest in the outcome of the program. Whether these programs are spectacularly successful (or more likely spectacular failures), the politicians and bureaucrats experience no direct financial gain or loss. Simply put, they’re investing taxpayer money, not their own.

Put differently, the discipline imposed on investors in private markets, such as the risk of losing money or even going out of business, is wholly absent in the government sector. Indeed, the history of corporate welfare in Canada, at both the federal and provincial levels, is rife with abject failures due in large measure to the absence of this investing discipline.

In the last 12 months in Ontario, automakers have been major beneficiaries of corporate welfare. The $5.0 billion for Honda is on top of $13.2 billion to Volkswagen and $15.0 billion to Stellantis. That equates to roughly $979 per taxpayer nationally for federal subsidies and an additional $1,372 for Ontario taxpayers. And these figures do not include the debt interest costs that will be incurred as both governments are borrowing money to finance the subsidies.

And there’s legitimate reason to be skeptical already of the potential success of these largescale industrial interventions by the federal (Liberal) and Ontario (Conservative) governments. EV sales in both Canada and the United States have not grown as expected by governments despite purchase subsidies. Disappointing EV sales have led several auto manufacturers including Toyota and Ford to scale-back their EV production plans.

There are also real concerns about the practical ability of EV manufacturers to secure required materials. Consider the minerals needed for EV batteries. According to a recent study, 388 new mines—including 50 lithium mines, 60 nickel mines and 17 cobalt mines—would be required by 2030 to meet EV adoption commitments by various governments. For perspective, there were a total of 340 metal mines operating across Canada and the U.S. in 2021. The massive task of finding, constructing and developing this level of new mines seems impractical and unattainable, meaning that EV plants being built now will struggle to secure needed inputs. Indeed, depending on the type of mine, it takes anywhere from six to 18 years to develop.

Which brings us back to the Trudeau and Ford governments. Given the economic incentive problems and practical challenges to a large-scale transition to EVs, would members of the Trudeau and Ford governments—including the prime minister and premier—want to attach a portion of their personal pensions to the success of these corporate welfare programs?

More specifically, assume an arrangement whereby those politicians would share the benefits of the program’s success but also share any losses through the value of their pensions. If the programs work as marketed, the politicians would enjoy higher valued pensions. But if the programs disappoint or even fail, their pensions would be reduced or even cancelled. Would these politicians still support billions in corporate handouts if their personal financial wellbeing was tied to the outcomes?

As the funding of private companies to develop the EV sector in Ontario continues with the support of taxpayer subsidies, Ontarians and all Canadians should consider the misalignment of economic incentives underpinning these subsidies and the practical challenges to the success of this industrial intervention.

Authors:

Business

Clean energy transition price tag over $150 billion and climbing, with very little to show for it

From the Fraser Institute

By Jake Fuss, Julio Mejía, Elmira Aliakbari, Karen Graham and Jock Finlayson

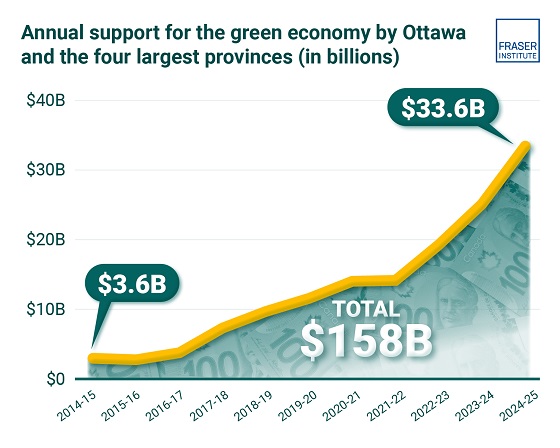

Ottawa and the four biggest provinces have spent (or foregone revenues) of at least $158 billion to create at most 68,000 “clean” jobs since 2014

Despite the hype of a “clean” economic transition, governments in Ottawa and in the four largest provinces have spent or foregone revenues of more than $150 billion (inflation-adjusted) on low-carbon initiatives since 2014/15, but have only created, at best, 68,000 clean jobs, according to two new studies published by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Governments, activists and special interest groups have been making a lot of claims about the opportunities of a clean economic transition, but after a decade of policy interventions and more than $150 billion in taxpayers’ money, the results are

extremely underwhelming,” said Elmira Aliakbari, director of natural resource studies and co-author of The Fiscal Cost of Canada’s Low-Carbon Economy.

The study finds that since 2014/15, the federal government and provincial governments in the country’s four largest provinces (Ontario, Quebec, Alberta and British Columbia) combined have spent and foregone revenues of $158 billion (inflation adjusted to 2024 dollars) trying to create clean jobs, as defined by Statistics Canada’s Environmental and Clean Technology Products Economic Account.

Importantly, that cost estimate is conservative since it does not account for an exhaustive list of direct government spending and it does not measure the costs from Canada’s other six provinces, municipalities, regulatory costs and other economic

costs because of the low-carbon spending and tax credits.

A second study, Sizing Canada’s Clean Economy, finds that there was very little change over the 2014 to 2023 period in terms of the share of the total economy represented by the clean economy. For instance, in 2014, the clean economy represented 3.1 per cent of GDP compared to 3.6 per cent in 2023.

“The evidence is clear—the much-hyped clean economic transition has failed to fundamentally transform Canada’s $3.3 trillion economy,” said study co-author and Fraser Institute senior fellow Jock Finlayson.

State of the Green Economy

- The Fiscal Cost of Canada’s Low-Carbon Economy documents spending initiatives by the federal government and the governments of Ontario, British Columbia, Alberta, and Quebec since 2014 to promote the low-carbon economy, as well as how much revenue they have foregone through offering tax credits.

- Overall, the combined cost of spending and tax credits supporting a low-carbon economy by the federal government and the four provincial governments is estimated at $143.6 billion from 2014–15 to 2024–25, in nominal terms. When adjusted for inflation, the total reaches $158 billion in 2024 dollars.

- These estimates are based on very conservative assumptions, and they do not cover every program area or government-controlled expenditure related to the low-carbon economy and/or reducing greenhouse gas emissions.

- Sizing Canada’s Green Economy assesses the composition, growth, share of Gross Domestic Product (GDP) output, and employment of Canada’s “clean economy” from 2014 to 2023.

- Canada’s various environmental and clean technology industries collectively have accounted for between 3.07% and 3.62% of all-industry GDP over the 10-year period from 2014 to 2023. While it has grown, the sector as a whole has not been expanding at a pace that meaningfully exceeds the growth of the overall Canadian economy, despite significant policy attention and mounting public subsidies.

- The clean economy represents a respectable and relatively stable share of Canada’s $3.3 trillion economy. However, it remains a small part of Canada’s broader industrial mix, it is not a major source of export earnings, and it is not about to supplant the many other industries that underpin the country’s prosperity and dominate its international exports.

Alberta

Petition threatens independent school funding in Alberta

From the Fraser Institute

Recently, amid the backdrop of a teacher strike, an Alberta high school teacher began collecting signatures for a petition to end government funding of independent schools in the province. If she gets enough people to sign—10 per cent of the number of Albertans who voted in the last provincial election—Elections Alberta will consider launching a referendum about the issue.

In other words, the critical funding many Alberta families rely on for their children’s educational needs may be in jeopardy.

In Alberta, the provincial government partially funds independent schools and charter schools. The Alberta Teachers’ Association (ATA), whose members are currently on strike, opposes government funding of independent and charter schools.

But kids are not one-size-fits-all, and schools should reflect that reality, particularly in light of today’s increasing classroom complexity where different kids have different needs. Unlike government-run public schools, independent schools and charter schools have the flexibility to innovate and find creative ways to help students thrive.

And things aren’t going very well for all kids or teachers in government-run pubic school classrooms. According to the ATA, 93 per cent of teachers report encountering some form of aggression or violence at school, most often from students. Additionally, 85 per cent of unionized teachers face an increase in cognitive, social/emotional and behavioural issues in their classrooms. In 2020, one-quarter of students in Edmonton’s government-run public schools were just learning English, and immigration to Canada—and Alberta especially—has exploded since then. It’s not easy to teach a classroom of kids where a significant proportion do not speak English, many have learning disabilities or exceptional needs, and a few have severe behavioural problems.

Not surprisingly, demand for independent schools in Alberta is growing because many of these schools are designed for students with special needs, Autism, severe learning disabilities and ADHD. Some independent schools cater to students just learning English while others offer cultural focuses, expanded outdoor time, gifted learning and much more.

Which takes us back to the new petition—yet the latest attempt to defund independent schools in Alberta.

Wealthy families will always have school choice. But if the Alberta government wants low-income and middle-class kids to have the ability to access schools that fit them, too, it’s crucial to maintain—or better yet, increase—its support for independent and charter schools.

Consider a fictional Alberta family: the Millers. Their daughter, Lucy, is struggling at her local government-run public school. Her reading is below grade level and she’s being bullied. It’s affecting her self-esteem, her sleep and her overall wellbeing. The Millers pay their taxes. They don’t take vacations, they rent, and they haven’t upgraded their cars in many years. They can’t afford to pay full tuition for Lucy to attend an independent school that offers the approach to education she needs to succeed. However, because the Alberta government partially funds independent schools—which essentially means a portion of the Miller family’s tax dollars follow Lucy to the school of their choice—they’re able to afford the tuition.

The familiar refrain from opponents is that taxpayers shouldn’t pay for independent school tuition. But in fact, if you’re concerned about taxpayers, you should encourage school choice. If Lucy attends a government-run public school, taxpayers pay 100 per cent of her education costs. But if she attends an independent or charter school, taxpayers only pay a portion of the costs while her parents pay the rest. That’s why research shows that school choice saves tax dollars.

If you’re a parent with a child in a government-run public school in Alberta, you now must deal with another teacher strike. If you have a child in an independent or charter school, however, it’s business as usual. If Albertans are ever asked to vote on whether or not to end government funding for independent schools, they should remember that students are the most important stakeholder in education. And providing parents more choices in education is the solution, not the problem.

-

Business2 days ago

Business2 days agoThe painful return of food inflation exposes Canada’s trade failures

-

Business18 hours ago

Business18 hours agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

Business2 days ago

Business2 days agoCBC uses tax dollars to hire more bureaucrats, fewer journalists

-

National2 days ago

National2 days agoElection Officials Warn MPs: Canada’s Ballot System Is Being Exploited

-

Business2 days ago

Business2 days agoPaying for Trudeau’s EV Gamble: Ottawa Bought Jobs That Disappeared

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoIs Roundball A Square Game? Sports Betting Takes Another Hit

-

Alberta2 days ago

Alberta2 days agoCoutts border officers seize 77 KG of cocaine in commercial truck entering Canada – Street value of $7 Million

-

Alberta1 day ago

Alberta1 day agoPremier Smith sending teachers back to school and setting up classroom complexity task force