Opinion

This isn’t the time for “The Great Reset”

From the Facebook page of Red Deer – Lacombe MP Blaine Calkins

Business

Ted Cruz, Jim Jordan Ramp Up Pressure On Google Parent Company To Deal With ‘Censorship’

From the Daily Caller News Foundation

By Andi Shae Napier

Republican Texas Sen. Ted Cruz and Republican Ohio Rep. Jim Jordan are turning their attention to Google over concerns that the tech giant is censoring users and infringing on Americans’ free speech rights.

Google’s parent company Alphabet, which also owns YouTube, appears to be the GOP’s next Big Tech target. Lawmakers seem to be turning their attention to Alphabet after Mark Zuckerberg’s Meta ended its controversial fact-checking program in favor of a Community Notes system similar to the one used by Elon Musk’s X.

Cruz recently informed reporters of his and fellow senators’ plans to protect free speech.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here. Thank you!

“Stopping online censorship is a major priority for the Commerce Committee,” Cruz said, as reported by Politico. “And we are going to utilize every point of leverage we have to protect free speech online.”

Following his meeting with Alphabet CEO Sundar Pichai last month, Cruz told the outlet, “Big Tech censorship was the single most important topic.”

Jordan, Chairman of the House Judiciary Committee, sent subpoenas to Alphabet and other tech giants such as Rumble, TikTok and Apple in February regarding “compliance with foreign censorship laws, regulations, judicial orders, or other government-initiated efforts” with the intent to discover how foreign governments, or the Biden administration, have limited Americans’ access to free speech.

“Throughout the previous Congress, the Committee expressed concern over YouTube’s censorship of conservatives and political speech,” Jordan wrote in a letter to Pichai in March. “To develop effective legislation, such as the possible enactment of new statutory limits on the executive branch’s ability to work with Big Tech to restrict the circulation of content and deplatform users, the Committee must first understand how and to what extent the executive branch coerced and colluded with companies and other intermediaries to censor speech.”

Jordan subpoenaed tech CEOs in 2023 as well, including Satya Nadella of Microsoft, Tim Cook of Apple and Pichai, among others.

Despite the recent action against the tech giant, the battle stretches back to President Donald Trump’s first administration. Cruz began his investigation of Google in 2019 when he questioned Karan Bhatia, the company’s Vice President for Government Affairs & Public Policy at the time, in a Senate Judiciary Committee hearing. Cruz brought forth a presentation suggesting tech companies, including Google, were straying from free speech and leaning towards censorship.

Even during Congress’ recess, pressure on Google continues to mount as a federal court ruled Thursday that Google’s ad-tech unit violates U.S. antitrust laws and creates an illegal monopoly. This marks the second antitrust ruling against the tech giant as a different court ruled in 2024 that Google abused its dominance of the online search market.

2025 Federal Election

PRC-Linked Disinformation Claims Conservatives Threaten Chinese Diaspora Interests, Take Aim at PM Carney’s Debate Remark

As polls tighten in Canada’s pivotal federal election, a Chinese-language website has published multiple editorials suggesting that a Pierre Poilievre government could threaten Chinese Canadian interests with so-called “anti-China” policy clauses—claiming it could bring “inconvenience to the lives of Chinese people, such as restrictions on the use of social media, reductions in return air tickets, etc.”

During the 2021 federal election, then-Conservative leader Erin O’Toole and MP Kenny Chiu were widely attacked with similar arguments across Chinese-language news and social media. CSIS reporting from 2022, cited exclusively by The Bureau, warned that Chinese-language media in Canada is effectively controlled by Beijing and weaponized during election periods to spread Chinese Communist Party-aligned narratives.

One of the new articles also criticizes Prime Minister Mark Carney’s debate remark that Beijing poses the greatest threat to Canada’s national security—a comment that prompted the Chinese-language editorial to question whether Carney’s statement was “a gimmick to attract attention.”

The articles, published Thursday and Friday by 51.ca, have raised deep concern among some community members. One longtime Chinese Canadian journalist, who requested anonymity due to fear of retaliation, told The Bureau they were alarmed by the messaging and suspected the coverage was driven by election-interference motives.

One of the pieces claimed that “the Conservative Party has written anti-China clauses into the party platform,” referencing a prior story that quickly circulated on Chinese-language social media and triggered fearful discussion.

Citing WeChat commentary on the same article, the journalist pointed specifically to a politically connected figure previously associated with CSIS investigations into election interference networks in the Greater Toronto Area—allegedly tied to clandestine funding channels linked to the Chinese Consulate in Toronto.

Sharing a WeChat forum screen-picture, the diaspora journalist noted:

“The writer said, according to the Conservative’s campaign platform, China’s definition is ‘enemy.’ So what is the impact on Chinese Canadians’ daily life? Facing more discrimination? Fewer flights going back to China? How about using social media? If there is a war, what will happen to Chinese Canadians—like Japanese people were sent to the concentration camps or deported?”

The journalist said the messaging is not only inflammatory, but dangerously manipulative—casting the Conservative Party as a threat to the civil rights and safety of Chinese Canadians, while exploiting historical trauma to provoke fear.

The same 51.ca article—while quoting from the Conservative Party’s platform documents—shifts sharply into misleading commentary. It contrasts the party’s current positions with historical discrimination enacted by the Liberal government of the 1920s.

One of the recent 51.ca articles warns that the Conservative Party’s stance “can easily cause ethnic tensions and even exacerbate anti-China sentiment.”

A second article delivers a similar critique of Conservative policy while also taking aim at Prime Minister Mark Carney, who, in last night’s nationally televised debate, stated:

“I think the biggest security threat to Canada is China.”

That comment, consistent with assessments from Canadian intelligence services and allied Five Eyes partners, was immediately seized upon by 51.ca’s editorial board.

“Carney blurted out that China is Canada’s biggest threat. Is this a deep-rooted idea or a gimmick to attract attention? It is not known yet. But what is certain is that when other party leaders are talking about how to deal with the problems facing Canada itself, Carney is talking about China being the enemy. I really don’t know what’s going on in his mind.”

Both 51.ca articles strategically focus their sharpest criticism on the Conservative Party, portraying its platform as existentially dangerous, while the second treats Carney’s one-line debate comment as a moment of rhetorical overreach.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

-

Business1 day ago

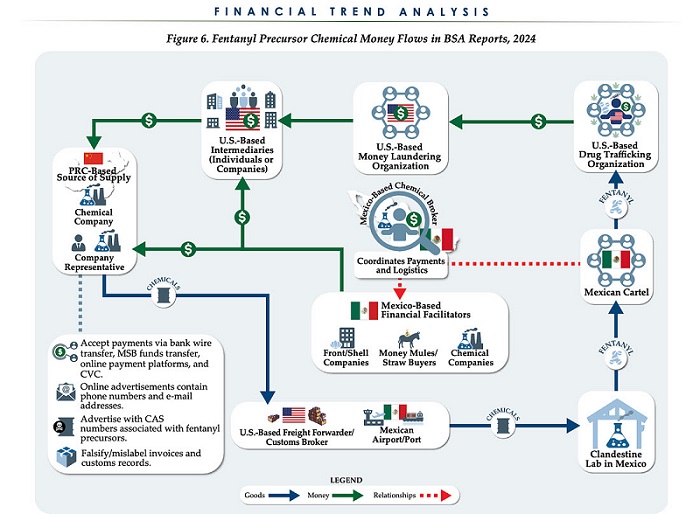

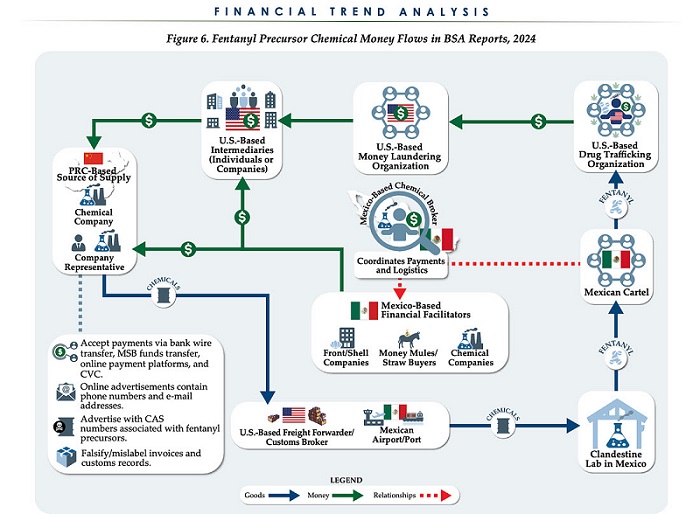

Business1 day agoChina, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoTucker Carlson Interviews Maxime Bernier: Trump’s Tariffs, Mass Immigration, and the Oncoming Canadian Revolution

-

espionage1 day ago

espionage1 day agoEx-NYPD Cop Jailed in Beijing’s Transnational Repatriation Plot, Canada Remains Soft Target

-

Business2 days ago

Business2 days agoDOGE Is Ending The ‘Eternal Life’ Of Government

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoBREAKING from THE BUREAU: Pro-Beijing Group That Pushed Erin O’Toole’s Exit Warns Chinese Canadians to “Vote Carefully”

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCanada drops retaliatory tariffs on automakers, pauses other tariffs

-

Daily Caller1 day ago

Daily Caller1 day agoTrump Executive Orders ensure ‘Beautiful Clean’ Affordable Coal will continue to bolster US energy grid

-

Daily Caller1 day ago

Daily Caller1 day agoDOJ Releases Dossier Of Deported Maryland Man’s Alleged MS-13 Gang Ties