Business

There’s a big upside to resolving issues with unhappy customers

Unhappy customers are practically inevitable; mistakes happen, communications break down- we’re human after all! But a lot of good can come from this situation.

Studies suggest as many as 90% of unhappy customers don’t ever complain, they simply don’t return. So if dealing with a disappointed customer, listen, empathize and work towards a quick resolution. Consumers who have their problems fixed efficiently are likely to tell up to six people about the experience!

And if you are an unhappy customer? Before taking to social media, contact the business, be clear & specific about your issue and give them a chance to make it right and keep your business! These small things help create a marketplace where buyers and sellers trust each other. And remember, you can use your local BBB to find a list of trustworthy businesses before you buy!

Click here for more information about the Better Business Bureau.

Automotive

Auto giant shuts down foreign plants as Trump moves to protect U.S. industry

MxM News

MxM News

Quick Hit:

Stellantis is pausing vehicle production at two North American facilities—one in Canada and another in Mexico—following President Donald Trump’s announcement of 25% tariffs on foreign-made cars. The move marks one of the first corporate responses to the administration’s push to bring back American manufacturing.

Key Details:

-

In an email to workers Thursday, Stellantis North America chief Antonio Filosa directly tied the production pause to the new tariffs, writing that the company is “continuing to assess the medium- and long-term effects” but is “temporarily pausing production” at select assembly plants outside the U.S.

-

Production at the Windsor Assembly Plant in Ontario will be paused for two weeks, while the Toluca Assembly Plant in Mexico will be offline for the entire month of April.

-

These plants produce the Chrysler Pacifica minivan, the new Dodge Charger Daytona EV, the Jeep Compass SUV, and the Jeep Wagoneer S EV.

Diving Deeper:

On Wednesday afternoon in the White House Rose Garden, President Trump announced sweeping new tariffs aimed at revitalizing America’s auto manufacturing industry. The 25% tariffs on all imported cars are part of a broader “reciprocal tariffs” strategy, which Trump described as ending decades of globalist trade policies that hollowed out U.S. industry.

Just a day later, Stellantis became the first major automaker to act on the new policy, halting production at two of its international plants. According to an internal email obtained by CNBC, Stellantis North American COO Antonio Filosa said the company is “taking immediate actions” to respond to the tariff policy while continuing to evaluate the broader impact.

“These actions will impact some employees at several of our U.S. powertrain and stamping facilities that support those operations,” Filosa wrote.

The Windsor, Ontario plant, which builds the Chrysler Pacifica and the newly introduced Dodge Charger Daytona EV, will shut down for two weeks. The Toluca facility in Mexico, responsible for the Jeep Compass and Jeep Wagoneer S EV, will suspend operations for the entire month of April.

The move comes as Stellantis continues to face scrutiny for its reliance on low-wage labor in foreign markets. As reported by Breitbart News, the company has spent years shifting production and engineering jobs to countries like Brazil, India, Morocco, and Mexico—often at the expense of American workers. Last year alone, Stellantis cut around 400 U.S.-based engineering positions while ramping up operations overseas.

Meanwhile, General Motors appears to be responding differently. According to Reuters, GM told employees in a webcast Thursday that it will increase production of light-duty trucks at its Fort Wayne, Indiana plant—where it builds the Chevrolet Silverado and GMC Sierra. These models are also assembled in Mexico and Canada, but GM’s decision suggests a shift in production to the U.S. could be underway in light of the tariffs.

As Trump’s trade reset takes effect, more automakers are expected to recalibrate their production strategies—potentially signaling a long-awaited shift away from offshoring and toward rebuilding American industry.

Business

‘Time To Make The Patient Better’: JD Vance Says ‘Big Transition’ Coming To American Economic Policy

JD Vance on “Rob Schmitt Tonight” discussing tariff results

From the Daily Caller News Foundation

By Hailey Gomez

Vice President JD Vance said Thursday on Newsmax that he believes Americans will “reap the benefits” of the economy as the Trump administration makes a “big transition” on tariffs.

The Dow Jones Industrial Average dropped 1,679.39 points on Thursday, just a day after President Donald Trump announced reciprocal tariffs against nations charging imports from the U.S. On “Rob Schmitt Tonight,” Schmitt asked Vance about the stock market hit, asking how the White House felt about the “Liberation Day” move.

“We’re feeling good. Look, I frankly thought in some ways it could be worse in the markets, because this is a big transition. You saw what the President said earlier today. It’s like a patient who was very sick,” Vance said. “We did the operation, and now it’s time to make the patient better. That’s exactly what we’re doing. We have to remember that for 40 years, we’ve been doing this for 40 years.”

“American economic policy has rewarded people who ship jobs overseas. It’s taxed our workers. It’s made our supply chains more brittle, and it’s made our country less prosperous, less free and less secure,” Vance added.

Vance recalled that one of his children had been sick and needed antibiotics that were not made in the United States. The Vice President called it a “ridiculous thing” that some medicines invented in the country are no longer manufactured domestically.

“That’s fundamentally what this is about. The national security of manufacturing and making the things that we need, from steel to pharmaceuticals, antibiotics, and so forth, but also the good jobs that come along when you have economic policies that reward investing in America, rather than investing in foreign countries,” Vance said.

WATCH:

With a baseline 10% tariff placed on an estimated 60 countries, higher tariffs were applied to nations like China and Israel. For example, China, which has a 67% tariff on U.S. goods, will now face a 34% tariff from the U.S., while Israel, which has a 33% tariff, will face a 17% U.S. tariff.

“One bad day in the stock market, compared to what President Trump said earlier today, and I think he’s right about this. We’re going to have a booming stock market for a long time because we’re reinvesting in the United States of America. More importantly than that, of course, the people in Wall Street have done well,” Vance said.

“We want them to do well. But we care the most about American workers and about American small businesses, and they’re the ones who are really going to benefit from these policies,” Vance said.

The number of factories in the U.S., Vance said, has declined, adding that “millions of workers” have lost their jobs.

“My town [Middletown, Ohio], where you had 10,000 great American steel workers, and my town was one of the lucky ones, now probably has 1,500 steel workers in that factory because you had economic policies that rewarded shipping our jobs to China instead of investing in American workers,” Vance said. “President Trump ran on changing it. He promised he would change it, and now he has. I think Americans are going to reap the benefits.”

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoMORE OF THE SAME: Mark Carney Admits He Will Not Repeal the Liberal’s Bill C-69 – The ‘No Pipelines’ Bill

-

2025 Federal Election2 days ago

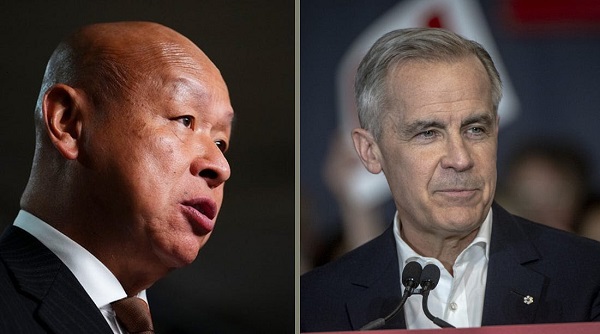

2025 Federal Election2 days ago‘Coordinated and Alarming’: Allegations of Chinese Voter Suppression in 2021 Race That Flipped Toronto Riding to Liberals and Paul Chiang

-

Alberta2 days ago

Alberta2 days agoBig win for Alberta and Canada: Statement from Premier Smith

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoThree cheers for Poilievre’s alcohol tax cut

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoDon’t let the Liberals fool you on electric cars

-

2025 Federal Election2 days ago

2025 Federal Election2 days ago‘I’m Cautiously Optimistic’: Doug Ford Strongly Recommends Canada ‘Not To Retaliate’ Against Trump’s Tariffs

-

Alberta2 days ago

Alberta2 days agoEnergy sector will fuel Alberta economy and Canada’s exports for many years to come

-

Catherine Herridge1 day ago

Catherine Herridge1 day agoFBI imposed Hunter Biden laptop ‘gag order’ after employee accidentally confirmed authenticity: report