Energy

There is nothing green about the ‘green’ agenda

Quick Hit:

RealClearEnergy contributor Steve Milloy argues that the environmental left has been disingenuous about the true costs of so-called green energy. He exposes the environmental and human toll of electric vehicles, solar, and wind power, calling the movement’s claims “Orwellian.”

Key Details:

-

Milloy criticizes Energy Secretary Jennifer Granholm for claiming President Trump is helping China by cutting subsidies for the green economy.

-

He highlights the use of child labor and environmental destruction in mining for electric vehicle (EV) components like lithium and nickel.

-

He challenges the credibility of climate activists, pointing out decades of failed predictions and misleading rhetoric.

Diving Deeper:

Now that Democrats no longer control the federal government, Steve Milloy argues that climate activists are scrambling to rebrand their agenda to appeal to conservatives. In a recent op-ed for RealClearEnergy, Milloy calls out Energy Secretary Jennifer Granholm for claiming that Trump’s rollback of green energy subsidies is a win for Communist China. Milloy translates this as frustration from the left over the end of “the flow of billions of taxpayers’ dollars to subsidize electric vehicles that nobody wants and only the well-off can afford.”

According to Milloy, the so-called green agenda is anything but environmentally friendly. “If the climate movement was truly sincere and intellectually honest in its desire to stop actions contributing to global environmental degradation, it would stand fast against solar panels and electric vehicles,” he writes. He details the horrific conditions in the Democratic Republic of Congo, where children mine cobalt for lithium-ion batteries with their bare hands, breathing in toxic dust while contaminating their own water supply. Meanwhile, he says, activists remain “blithely unaware or unconcerned in the comfort of their own homes.”

The mining of nickel, another key EV battery component, also devastates the environment. Milloy describes Indonesia’s nickel refining operations, where thick brown smog chokes the air, and chemicals leach into groundwater. “Whatever else climate activists may try to tell us, there is nothing green going on here,” he asserts.

In Brazil, an aluminum refinery linked to Ford’s now-canceled all-electric F-150 Lightning has been accused of poisoning local communities with toxic chemicals. Milloy highlights a lawsuit alleging that heavy metal contamination has caused cancer, birth defects, and neurological disorders. Meanwhile, a separate Brazilian EV factory was recently shut down due to “slavery”-like working conditions. “How is that a green virtue?” Milloy asks.

The environmental destruction doesn’t stop with EVs. “Solar energy, long the prize pig of the climate crowd, isn’t green either,” Milloy writes, citing studies showing that clearing forests for solar farms actually increases carbon emissions. Wind power, he notes, is no better, with massive wind farms killing wildlife and disrupting ecosystems both on land and offshore.

Milloy argues that the climate movement has long relied on fear-mongering and deception. “In 1970, they assured us that human activity would cause an ice age by the 21st century,” he recalls. Predictions of global famine, acid rain catastrophes, and rising sea levels have all failed to materialize. He points to Al Gore’s 2008 claim that the North Pole would be ice-free within five years and UK Prime Minister Gordon Brown’s 2009 declaration that the world had “fewer than 50 days to save our planet from catastrophe.” “Spoiler alert: We’re still here and thriving,” Milloy quips.

Ultimately, he says, there is no such thing as “clean” or “dirty” energy—only trade-offs and solutions. With energy costs already high, Milloy argues that reliable fossil fuels remain essential. “Word sophistry from our friends on the left won’t change that,” he concludes.

Energy

Canada’s future prosperity runs through the northwest coast

From Resource Works

A strategic gateway to the world

Tucked into the north coast of B.C. is the deepest natural harbour in North America and the port with the shortest travel times to Asia.

With growing capacity for exports including agricultural products, lumber, plastic pellets, propane and butane, it’s no wonder the Port of Prince Rupert often comes up as a potential new global gateway for oil from Alberta, said CEO Shaun Stevenson.

Thanks to its location and natural advantages, the port can efficiently move a wide range of commodities, he said.

That could include oil, if not for the federal tanker ban in northern B.C.’s coastal waters.

“Notwithstanding the moratorium that was put in place, when you look at the attributes of the Port of Prince Rupert, there’s arguably no safer place in Canada to do it,” Stevenson said.

“I think that speaks to the need to build trust and confidence that it can be done safely, with protection of environmental risks. You can’t talk about the economic opportunity before you address safety and environmental protection.”

Safe transit at Prince Rupert

About a 16-hour drive from Vancouver, the Port of Prince Rupert’s terminals are one to two sailing days closer to Asia than other West Coast ports.

The entrance to the inner harbour is wider than the length of three Canadian football fields.

The water is 35 metres deep — about the height of a 10-storey building — compared to 22 metres at Los Angeles and 16 metres at Seattle.

Shipmasters spend two hours navigating into the port with local pilot guides, compared to four hours at Vancouver and eight at Seattle.

“We’ve got wide open, very simple shipping lanes. It’s not moving through complex navigational channels into the site,” Stevenson said.

A port on the rise

The Prince Rupert Port Authority says it has entered a new era of expansion, strengthening Canada’s economic security.

The port estimates it anchors about $60 billion of Canada’s annual global trade today. Even without adding oil exports, Stevenson said that figure could grow to $100 billion.

“We need better access to the huge and growing Asian market,” said Heather Exner-Pirot, director of energy, natural resources and environment at the Macdonald-Laurier Institute.

“Prince Rupert seems purpose-built for that.”

Roughly $3 billion in new infrastructure is already taking shape, including the $750 million rail-to-container CANXPORT transloading complex for bulk commodities like specialty agricultural products, lumber and plastic pellets.

Canadian propane goes global

A centrepiece of new development is the $1.35-billion Ridley Energy Export Facility — the port’s third propane terminal since 2019.

“Prince Rupert is already emerging as a globally significant gateway for propane exports to Asia,” Exner-Pirot said.

Thanks to shipments from Prince Rupert, Canadian propane – primarily from Alberta – has gone global, no longer confined to U.S. markets.

More than 45 per cent of Canada’s propane exports now reach destinations outside the United States, according to the Canada Energy Regulator.

“Twenty-five per cent of Japan’s propane imports come through Prince Rupert, and just shy of 15 per cent of Korea’s imports. It’s created a lift on every barrel produced in Western Canada,” Stevenson said.

“When we look at natural gas liquids, propane and butane, we think there’s an opportunity for Canada via Prince Rupert becoming the trading benchmark for the Asia-Pacific region.”

That would give Canadian production an enduring competitive advantage when serving key markets in Asia, he said.

Deep connection to Alberta

The Port of Prince Rupert has been a key export hub for Alberta commodities for more than four decades.

Through the Alberta Heritage Savings Trust Fund, the province invested $134 million — roughly half the total cost — to build the Prince Rupert Grain Terminal, which opened in 1985.

The largest grain terminal on the West Coast, it primarily handles wheat, barley, and canola from the prairies.

Today, the connection to Alberta remains strong.

In 2022, $3.8 billion worth of Alberta exports — mainly propane, agricultural products and wood pulp — were shipped through the Port of Prince Rupert, according to the province’s Ministry of Transportation and Economic Corridors.

In 2024, Alberta awarded a $250,000 grant to the Prince Rupert Port Authority to lead discussions on expanding transportation links with the province’s Industrial Heartland region near Edmonton.

Handling some of the world’s biggest vessels

The Port of Prince Rupert could safely handle oil tankers, including Very Large Crude Carriers (VLCCs), Stevenson said.

“We would have the capacity both in water depth and access and egress to the port that could handle Aframax, Suezmax and even VLCCs,” he said.

“We don’t have terminal capacity to handle oil at this point, but there’s certainly terminal capacities within the port complex that could be either expanded or diversified in their capability.”

Market access lessons from TMX

Like propane, Canada’s oil exports have gained traction in Asia, thanks to the expanded Trans Mountain pipeline and the Westridge Marine Terminal near Vancouver — about 1,600 kilometres south of Prince Rupert, where there is no oil tanker ban.

The Trans Mountain expansion project included the largest expansion of ocean oil spill response in Canadian history, doubling capacity of the West Coast Marine Response Corporation.

The Canada Energy Regulator (CER) reports that Canadian oil exports to Asia more than tripled after the expanded pipeline and terminal went into service in May 2024.

As a result, the price for Canadian oil has gone up.

The gap between Western Canadian Select (WCS) and West Texas Intermediate (WTI) has narrowed to about $12 per barrel this year, compared to $19 per barrel in 2023, according to GLJ Petroleum Consultants.

Each additional dollar earned per barrel adds about $280 million in annual government royalties and tax revenues, according to economist Peter Tertzakian.

The road ahead

There are likely several potential sites for a new West Coast oil terminal, Stevenson said.

“A pipeline is going to find its way to tidewater based upon the safest and most efficient route,” he said.

“The terminal part is relatively straightforward, whether it’s in Prince Rupert or somewhere else.”

Under Canada’s Marine Act, the Port of Prince Rupert’s mandate is to enable trade, Stevenson said.

“If Canada’s trade objectives include moving oil off the West Coast, we’re here to enable it, presuming that the project has a mandate,” he said.

“If we see the basis of a project like this, we would ensure that it’s done to the best possible standard.”

This article originally appeared in Canadian Energy Centre

Resource Works News

Business

The world is no longer buying a transition to “something else” without defining what that is

From Resource Works

Even Bill Gates has shifted his stance, acknowledging that renewables alone can’t sustain a modern energy system — a reality still driving decisions in Canada.

You know the world has shifted when the New York Times, long a pulpit for hydrocarbon shame, starts publishing passages like this:

“Changes in policy matter, but the shift is also guided by the practical lessons that companies, governments and societies have learned about the difficulties in shifting from a world that runs on fossil fuels to something else.”

For years, the Times and much of the English-language press clung to a comfortable catechism: 100 per cent renewables were just around the corner, the end of hydrocarbons was preordained, and anyone who pointed to physics or economics was treated as some combination of backward, compromised or dangerous. But now the evidence has grown too big to ignore.

Across Europe, the retreat to energy realism is unmistakable. TotalEnergies is spending €5.1 billion on gas-fired plants in Britain, Italy, France, Ireland and the Netherlands because wind and solar can’t meet demand on their own. Shell is walking away from marquee offshore wind projects because the economics do not work. Italy and Greece are fast-tracking new gas development after years of prohibitions. Europe is rediscovering what modern economies require: firm, dispatchable power and secure domestic supply.

Meanwhile, Canada continues to tell itself a different story — and British Columbia most of all.

A new Fraser Institute study from Jock Finlayson and Karen Graham uses Statistics Canada’s own environmental goods and services and clean-tech accounts to quantify what Canada’s “clean economy” actually is, not what political speeches claim it could be.

The numbers are clear:

- The clean economy is 3.0–3.6 per cent of GDP.

- It accounts for about 2 per cent of employment.

- It has grown, but not faster than the economy overall.

- And its two largest components are hydroelectricity and waste management — mature legacy sectors, not shiny new clean-tech champions.

Despite $158 billion in federal “green” spending since 2014, Canada’s clean economy has not become the unstoppable engine of prosperity that policymakers have promised. Finlayson and Graham’s analysis casts serious doubt on the explosive-growth scenarios embraced by many politicians and commentators.

What’s striking is how mainstream this realism has become. Even Bill Gates, whose philanthropic footprint helped popularize much of the early clean-tech optimism, now says bluntly that the world had “no chance” of hitting its climate targets on the backs of renewables alone. His message is simple: the system is too big, the physics too hard, and the intermittency problem too unforgiving. Wind and solar will grow, but without firm power — nuclear, natural gas with carbon management, next-generation grid technologies — the transition collapses under its own weight. When the world’s most influential climate philanthropist says the story we’ve been sold isn’t technically possible, it should give policymakers pause.

And this is where the British Columbia story becomes astonishing.

It would be one thing if the result was dramatic reductions in emissions. The provincial government remains locked into the CleanBC architecture despite a record of consistently missed targets.

Since the staunchest defenders of CleanBC are not much bothered by the lack of meaningful GHG reductions, a reasonable person is left wondering whether there is some other motivation. Meanwhile, Victoria’s own numbers a couple of years ago projected an annual GDP hit of courtesy CleanBC of roughly $11 billion.

But here is the part that would make any objective analyst blink: when I recently flagged my interest in presenting my research to the CleanBC review panel, I discovered that the “reviewers” were, in fact, two of the key architects of the very program being reviewed. They were effectively asked to judge their own work.

You can imagine what they told us.

What I saw in that room was not an evidence-driven assessment of performance. It was a high-handed, fact-light defence of an ideological commitment. When we presented data showing that doctrinaire renewables-only thinking was failing both the economy and the environment, the reception was dismissive and incurious. It was the opposite of what a serious policy review looks like.

Meanwhile our hydro-based electricity system is facing historic challenges: long term droughts, soaring demand, unanswered questions about how growth will be powered especially in the crucial Northwest BC region, and continuing insistence that providers of reliable and relatively clean natural gas are to be frustrated at every turn.

Elsewhere, the price of change increasingly includes being able to explain how you were going to accomplish the things that you promise.

And yes — in some places it will take time for the tide of energy unreality to recede. But that doesn’t mean we shouldn’t be improving our systems, reducing emissions, and investing in technologies that genuinely work. It simply means we must stop pretending politics can overrule physics.

Europe has learned this lesson the hard way. Global energy companies are reorganizing around a 50-50 world of firm natural gas and renewables — the model many experts have been signalling for years. Even the New York Times now describes this shift with a note of astonishment.

British Columbia, meanwhile, remains committed to its own storyline even as the ground shifts beneath it. This isn’t about who wins the argument — it’s about government staying locked on its most basic duty: safeguarding the incomes and stability of the families who depend on a functioning energy system.

Resource Works News

-

Bruce Dowbiggin3 hours ago

Bruce Dowbiggin3 hours agoWayne Gretzky’s Terrible, Awful Week.. And Soccer/ Football.

-

espionage6 hours ago

espionage6 hours agoWestern Campuses Help Build China’s Digital Dragnet With U.S. Tax Funds, Study Warns

-

Agriculture2 hours ago

Agriculture2 hours agoCanada’s air quality among the best in the world

-

Business4 hours ago

Business4 hours agoCanada invests $34 million in Chinese drones now considered to be ‘high security risks’

-

Economy5 hours ago

Economy5 hours agoAffordable housing out of reach everywhere in Canada

-

Business2 days ago

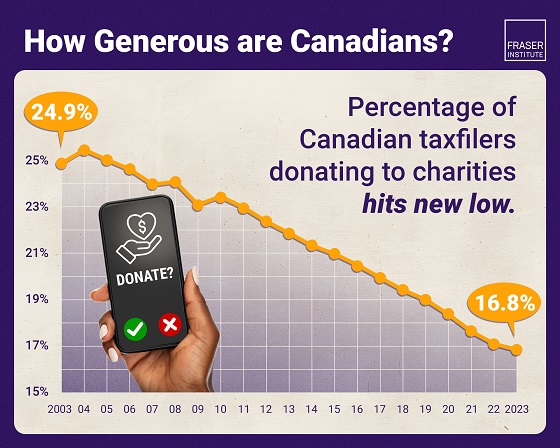

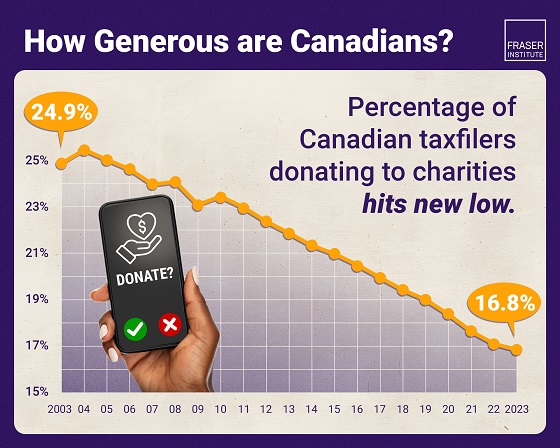

Business2 days agoAlbertans give most on average but Canadian generosity hits lowest point in 20 years

-

Fraser Institute1 day ago

Fraser Institute1 day agoClaims about ‘unmarked graves’ don’t withstand scrutiny

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoCarney Hears A Who: Here Comes The Grinch