Business

The Mortgage Maelstrom: Navigating the Impending Financial Tempest in Canada

From The Opposition with Dan Knight substack

As renewal rates surge and interest rates soar, Canadian households stand on the precipice of a fiscal fallout that could redefine the nation’s economic landscape

As we wade through the current economic climate, it’s becoming increasingly clear that a storm is brewing on the Canadian horizon, one that could sweep away the financial stability of countless households. The heart of this looming tempest? The mortgage market—specifically, the shock awaiting about 60% of mortgage holders in the next three years as their terms come up for renewal.

RBC has crunched the numbers and the forecast is grim. More than $186 billion in mortgages is set to renew in 2024 alone, and if today’s interest rates hold, homeowners could see their payments leap by a staggering 32%. And that’s just the beginning. The following year, $315 billion worth of mortgages are on the renewal chopping block, many of which are variable-rate mortgages, potentially pushing the payment shock to 33%.

What’s the root cause? It’s the interest rates—sitting at a 5% benchmark, the highest we’ve seen since the turn of the millennium. If there’s no significant decrease, we’re looking at a tidal wave of credit losses come 2025. And let’s not forget the elephant in the room: those with variable-rate mortgages could face a payment shock as high as 84% by 2026 if the rates stay put.

Here’s the scoop, folks. Bank of Canada Governor Tiff Macklem laid out a cold hard truth: fiscal and monetary policy are at loggerheads. While the central bank is straining every sinew to wrestle down inflation with rate hikes, the federal and provincial governments are lighting the fuse with their spending, fueling the very inflation the Bank of Canada is trying to stamp out.

In the red corner, we’ve got the Bank of Canada, gloves on, ready to slug inflation down to its target by 2025. In the blue corner, Trudeau’s government, doling out dollars like there’s no tomorrow. What does this mean for John and Jane Doe on Main Street? As their mortgage renewals roll in, they’re staring down the barrel of a 32% to a mind-boggling 84% payment shock.

Folks, let’s cut to the chase. This economic quagmire we’re sinking into? It’s got Trudeau’s fingerprints all over it. The fabric of Canadian society is getting shredded not by accident, but by a government playing fast and loose with fiscal policy. The Bank of Canada is scrambling to counteract with rate hikes, but Trudeau’s Liberals seem hell-bent on doling out dollars like candy on Halloween, inflaming inflation and leaving families to foot the bill.

As for Trudeau, he’s steering the ship with a blindfold on, and the polls? They’re reading like an obituary for the Liberals’ prospects. Come the next federal election, if these mortgage hikes hit as hard as predicted, Trudeau’s so-called economic strategy could be the very thing that buries his political future. We’re not just talking about a swing in the voting booths; we’re talking about a full-scale revolt from a populace that’s had enough of being ignored in the face of an economic abyss.

As Canadians navigate the turbulent waters of an economy where the dream of homeownership slips through their fingers and the basic necessity of putting food on the table becomes a herculean task, the political pageantry of promised dental plans rings hollow. When the ballots are drawn, the echo of dissatisfaction will thunder across the voting booths. Yes, my dear readers, as the national mood simmers with the desire for change, there’s a palpable sense that a political reckoning looms on the horizon — a red wedding in the electoral sense, where the old guard may be unseated in a dramatic upheaval.

Subscribe to The Opposition with Dan Knight.

For the full experience, upgrade your subscription.

Dan Knight

Business

Trump considers $5K bonus for moms to increase birthrate

MxM News

MxM News

Quick Hit:

President Trump voiced support Tuesday for a $5,000 cash bonus for new mothers, as his administration weighs policies to counter the country’s declining birthrate. The idea is part of a broader push to promote family growth and revive the American family structure.

Key Details:

- Trump said a reported “baby bonus” plan “sounds like a good idea to me” during an Oval Office interview.

- Proposals under consideration include a $5,000 birth bonus, prioritizing Fulbright scholarships for parents, and fertility education programs.

- U.S. birthrates hit a 44-year low in 2023, with fewer than 3.6 million babies born.

Diving Deeper:

President Donald Trump signaled his support Tuesday for offering financial incentives to new mothers, including a potential $5,000 cash bonus for each child born, as part of an effort to reverse America’s falling birthrate. “Sounds like a good idea to me,” Trump told The New York Post in response to reports his administration is exploring such measures.

The discussions highlight growing concern among Trump administration officials and allies about the long-term implications of declining fertility and family formation in the United States. According to the report, administration aides have been consulting with pro-family advocates and policy experts to brainstorm solutions aimed at encouraging larger families.

Among the proposals: a $5,000 direct payment to new mothers, allocating 30% of all Fulbright scholarships to married applicants or those with children, and launching federally supported fertility education programs for women. One such program would educate women on their ovulation cycles to help them better understand their reproductive health and increase their chances of conceiving.

The concern stems from sharp demographic shifts. The number of babies born in the U.S. fell to just under 3.6 million in 2023—down 76,000 from 2022 and the lowest figure since 1979. The average American family now has fewer than two children, a dramatic drop from the once-common “2.5 children” norm.

Though the birthrate briefly rose from 2021 to 2022, that bump appears to have been temporary. Additionally, the age of motherhood is trending older, with fewer teens and young women having children, while more women in their 30s and 40s are giving birth.

White House Press Secretary Karoline Leavitt underscored the administration’s commitment to families, saying, “The President wants America to be a country where all children can safely grow up and achieve the American dream.” Leavitt, herself a mother, added, “I am proud to work for a president who is taking significant action to leave a better country for the next generation.”

Business

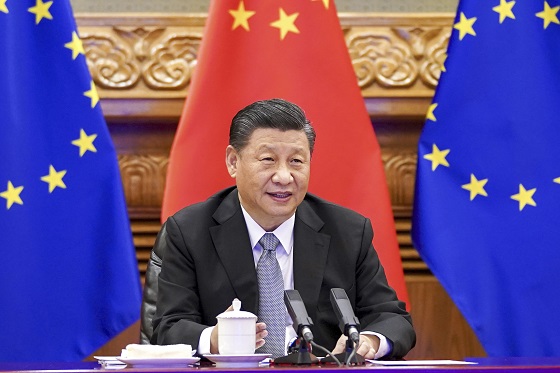

Trump: China’s tariffs to “come down substantially” after negotiations with Xi

MxM News

MxM News

Quick Hit:

President Trump said the 145% tariff rate on Chinese imports will drop significantly once a deal is struck with Chinese President Xi Jinping, expressing confidence that a new agreement is on the horizon.

Key Details:

- Trump said the current 145% tariff rate on China “won’t be anywhere near that high” after negotiations.

- He pointed to his relationship with Xi Jinping as a reason for optimism.

- The White House said it is preparing the groundwork for a deal, and Treasury officials expect a “de-escalation” of the trade war.

Diving Deeper:

President Donald Trump on Tuesday told reporters that the steep tariff rate currently imposed on Chinese imports will come down substantially after his administration finalizes a new trade deal with Chinese President Xi Jinping. While the current level stands at 145%, Trump made clear that number was temporary and would be adjusted following talks with Beijing.

“145 percent is very high. It won’t be that high, it’s not going to be that high … it won’t be anywhere near that high,” Trump said from the Oval Office, signaling a shift once a bilateral agreement is reached. “It will come down substantially, but it won’t be zero.”

The tariff, which Trump previously described as “reciprocal,” was maintained on China even after he delayed similar penalties on other trading partners. Those were cut to 10% and paused for 90 days to allow room for further negotiation.

“We’re going to be very nice. They’re going to be very nice, and we’ll see what happens. But ultimately, they have to make a deal because otherwise they’re not going to be able to deal in the United States,” Trump said, reinforcing his view that the U.S. holds the leverage.

Trump’s remarks come as markets remain wary of ongoing trade tensions, though the White House signaled progress, saying it is “setting the stage for a deal with China.” The president cited his personal rapport with Xi Jinping as a key factor in his confidence that an agreement can be reached.

“China was taking us for a ride, and it’s not going to happen,” Trump said. “They would make billions a year off us and build up their military with our money. That’s over. But we’ll still be good to China, and I think we’ll work together.”

Treasury Secretary Scott Bessent also said Tuesday that he expects a cooling of trade hostilities between the two nations, according to several reports from a private meeting with investors.

As the 90-day pause on other reciprocal tariffs nears its end, Trump emphasized that his team is prepared to finalize deals quickly. “We’ve been in talks with many, many world leaders,” he said, expressing confidence that talks will “go pretty quickly.”

White House Press Secretary Karoline Leavitt added that the administration has received 18 formal proposals from other countries engaged in trade negotiations, another sign that momentum is building behind Trump’s broader push to restructure global trade in favor of American workers and businesses.

(Li Xueren/Xinhua via AP)

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHow Canada’s Mainstream Media Lost the Public Trust

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoReal Homes vs. Modular Shoeboxes: The Housing Battle Between Poilievre and Carney

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCHINESE ELECTION THREAT WARNING: Conservative Candidate Joe Tay Paused Public Campaign

-

Media1 day ago

Media1 day agoCBC retracts false claims about residential schools after accusing Rebel News of ‘misinformation’

-

John Stossel1 day ago

John Stossel1 day agoClimate Change Myths Part 2: Wildfires, Drought, Rising Sea Level, and Coral Reefs

-

COVID-192 days ago

COVID-192 days agoNearly Half of “COVID-19 Deaths” Were Not Due to COVID-19 – Scientific Reports Journal