In a Dec. 22, 2025 article, influential Japanese newspaper Asahi Shimbun laid out why Japan is placing growing strategic weight on liquefied natural gas exports from Western Canada – and why the start of full-scale operations at LNG Canada marks a significant shift in Japan’s energy-security calculus.

The article, written by staff writer Shiki Iwasawa, approaches Canadian LNG not as a climate story or an industrial milestone, but as a response to the vulnerabilities Japan has experienced since Russia’s invasion of Ukraine upended global gas markets.

1. Shorter distance and faster delivery

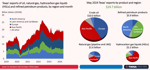

The most immediate advantage identified is geography. LNG shipped from British Columbia’s Pacific coast reaches Japan in about 10 days, roughly half the time required for cargoes originating in the Middle East or the U.S. Southeast, which can take 16 to 30 days.

For Japan – the world’s largest LNG importer – shorter voyages mean lower transportation costs, tighter inventory management, and reduced exposure to disruptions while cargoes are at sea.

2. Avoidance of global maritime choke points

Just as important, Canadian LNG avoids the world’s most precarious shipping bottlenecks.

The Asahi report emphasizes that shipments from B.C. do not pass through either:

- the Strait of Hormuz, increasingly volatile amid Middle East conflict, or

- the Panama Canal, where climate-driven water shortages have already led to passage restrictions.

Japanese officials explicitly frame these routes as strategic liabilities. As one senior government official responsible for energy security told the newspaper: “We, the government, have high hopes. It means a lot not having to go through the choke points.”

From Japan’s perspective, Canada’s Pacific-facing terminals offer a rare combination of proximity and route resilience.

3. Political reliability and allied status

The article contrasts Canada sharply with Russia, once a significant LNG supplier to Japan through the Sakhalin-2 project.

Before the Ukraine war, Russia accounted for about 10 per cent of Japan’s LNG imports. When Japan joined international sanctions, Moscow responded by restructuring the project’s ownership – a move that underscored how energy supplies can be weaponized.

A government source reflected on that experience bluntly: “We had thought it would be OK if we diversified procurement sources, but we were at risk of power outages even if only 10 percent (of LNG) didn’t reach Japan.”

Canada, by contrast, is described as a friendly and politically stable nation, free from sanctions risk and viewed as a long-term, rules-based partner.

4. Scale, certainty, and investment momentum

The Asahi article devotes considerable attention to the fundamentals of LNG Canada itself.

Key features highlighted include:

- approximately $14 billion in total development costs,

- 14 million tonnes per year of production capacity,

- two liquefaction trains already operating,

- natural gas sourced from inland Canada and transported via a 670-kilometre pipeline to the coast,

- and the successful shipment of first cargoes in mid-2025.

Mitsubishi Corp., which holds a 15 per cent stake, has rights to market 2.1 million tonnes annually to Japan and other Asian buyers. Mitsubishi expects the project to generate tens of billions of yen in annual profits starting in the fiscal year beginning April 2026.

At a Nov. 4 news conference, Mitsubishi president Katsuya Nakanishi said the company is actively considering additional investment to expand capacity, with internal sources indicating output could eventually double.

5. LNG’s continuing role in Japan’s energy system

The article situates Canadian LNG within Japan’s broader energy strategy. Under Japan’s Economic Security Promotion Law, LNG is designated a “specified critical product.” The government maintains dedicated funds to secure supply during emergencies.

While nuclear power remains central to long-term planning, officials acknowledge LNG’s indispensable role. A senior economy ministry official told Asahi: “Nuclear power is the key player in the spotlight, but thermal power (mainly fueled by LNG) is the key player behind the scenes.”

Japan’s latest Basic Energy Plan projects LNG imports rising to 74 million tonnes by 2040, roughly 10 per cent higher than today, underscoring why secure, politically insulated suppliers matter.

What Japan’s view tells Canada

In a recent Canada-Japan leaders’ meeting on the sidelines of APEC, Prime Minister Mark Carney and Prime Minister Sanae Takaichi discussed expanding economic ties, with energy cooperation specifically highlighted around the LNG Canada project as a key element of their bilateral relationship. While Takaichi didn’t make a detailed public statement about Canadian LNG itself, the joint statement underscored Japan’s interest in stable and diversified LNG supplies—of which Canadian exports are a part of the broader Indo-Pacific energy security context.

What emerges from Asahi Shimbun’s reporting is a pragmatic assessment shaped by recent shocks. Japan values Canadian LNG because it is closer, less exposed to conflict-prone routes, backed by a stable political system, and already delivering cargoes at scale.

For Canadian readers, the message is unambiguous: Western Canadian LNG is not being embraced because of rhetoric or aspiration, but because it aligns with the operational, geopolitical, and economic priorities of one of the world’s most energy-dependent nations.