Business

Taxpayers release Naughty and Nice List

From the Canadian Taxpayers Federation

Author: Franco Terrazzano

CBC President and CEO Catherine Tait tops the Taxpayer Naughty List for announcing hundreds of layoffs weeks before Christmas without cancelling bonuses for executives.

“It takes a special type of Scrooge to lay off hundreds of employees weeks before the holidays and not be willing to give up your own bonus, but that’s exactly what taxpayers heard from CBC big shots,” said Franco Terrazzano, CTF Federal Director. “Meanwhile, Senator Pierre Dalphond delayed and watered-down carbon tax relief for farmers and now Santa’s furious because the bills for his candy cane farm and reindeer barn are through the chimney.”

Prime Minister Justin Trudeau made the Taxpayer Naughty List for removing the carbon tax from furnace oil for three years while leaving 97 per cent of Canadian families out in the cold. Nova Scotia Premier Tim Houston also found himself in Santa’s bad books for taking more money from taxpayers through the sneaky income tax hike known as bracket creep.

Manitoba Premier Wab Kinew made the Taxpayer Nice List for providing taxpayers with Santa-sized fuel and income tax relief. The Parliamentary Budget Officer also made Santa’s good books for improving accountability and transparency in Ottawa.

“‘Tis the season for giving, but Calgary Mayor Jyoti Gondek and Edmonton Mayor Amarjeet Sohi shouldn’t be giving their residents steep tax hikes while they give themselves a raise,” said Kris Sims, Alberta Director of the CTF. “The entire Alberta village of Ryley made Santa’s good books for using recall legislation to boot a big-spending politician.”

The 2023 Taxpayer Naughty and Nice List

The Naughty List (So…. long!)

CBC President & CEO Catherine Tait – For clinging to executive bonuses

It takes a special type of Scrooge to announce hundreds of layoffs weeks before Christmas. Even worse, Tait isn’t willing to end the tens-of-millions of dollars in bonuses the CBC doled out in recent years. ‘Tis the season for giving… but giving out bonuses while firing hundreds of staffers is a sure-fire way to land yourself on Santa’s Naughty List!

Prime Minister Justin Trudeau – For leaving 97 per cent of Canadians out in the cold

All Canadians need a warm home to celebrate during the holiday season. But Trudeau thinks only three per cent of Canadians need carbon tax relief this winter. Trudeau is removing the carbon tax from furnace oil while keeping the tax on for 97 per cent of Canadian families. Santa is stuffing the prime minister’s stocking with lumps of coal this year and Trudeau will be sure to carbon tax those lumps, too.

Senator Pierre Dalphond – For making Santa’s milk and cookies more expensive

The holiday season is a time to enjoy festive feasts with loved ones. But Senator Pierre Dalphond is making the holiday season more expensive by delaying and watering down a bill that would take the carbon tax off all farm fuels. Canadians worry they may have to cut back on the milk and cookies they leave out on Christmas eve. Unfortunately for Senator Dalphond, Santa is not a happy camper, because the bills for his candy cane farm and reindeer barn are going through the chimney.

Mayor of Quebec City Bruno Marchand and Vancouver Mayor Ken Sim – For hiking taxes on pets

It’s one thing to tax the air we breathe, the money we earn or the presents we buy. But taxing our pets … have you no heart, Mr. Grinch? Mayors Marchand and Sim are hiking the taxes families pay to own pets in Quebec City and Vancouver. Rumour has it Santa is launching a campaign to take the tax off his reindeer.

Federal Minister of Industry François-Philippe Champagne – For giving billions of dollars to multinational corporations

There’s only one place you’ll find yourself if you pull a reverse Robin Hood … Santa’s Naughty List! Champagne has been busy taking money from struggling taxpayers and giving billions of dollars to multinational corporations to build electric car battery plants. Champagne should take notes from

Santa and his little helpers. They’ve been building batteries and remote-control hot rods for decades, at no cost to taxpayers!

Mayor of Calgary Jyoti Gondek and Edmonton Mayor Amarjeet Sohi – For hiking taxes and their own pay

‘Tis the season for giving … and mayors Gondek and Sohi sure do love giving. They’re giving their residents steep property tax hikes. And they’re giving themselves pay raises. Calgary City Council and Edmonton city council both took a raise this year. More lumps of coal: both Gondek and Sohi take bigger salaries than the premier of Alberta.

Nova Scotia Premier Tim Houston – For his bracket creep income tax hike

Nothing makes Santa more upset than bracket creep. It’s a sneaky backdoor tax grab that allows politicians to use inflation to raise income taxes. Nova Scotia Premier Tim Houston is using bracket creep to gouge taxpayers. And for that, Houston finds himself on Santa’s Naughty List this year.

University of Manitoba’s former law dean Jonathan Black-Branch – For racking up half-a-million in expenses

Black-Branch’s term was cut short after an internal investigation found he expensed upwards of $500,000 in public funds, including for personal dinners and drinks. Now that’s a lot of cookies and eggnog! There’s only one way for Black-Branch to get off the Naughty List: pay the money back.

The Nice List (So… short!)

Manitoba Premier Wab Kinew – For the gift of tax relief

Kinew is giving Manitobans Santa-sized fuel and income tax relief in the New Year. He committed

to suspending the province’s fuel tax and providing significant income tax relief. And kudos to the previous Manitoba government who didn’t forget about the Tiny Tims. Thanks to the last budget, taxpayers earning less than $15,000 won’t pay any provincial income taxes.

Liberal MP Ken McDonald – For getting his constituents carbon tax relief

It takes a lot of courage to stand up for your convictions and constituents, and vote against your party leader. McDonald did just that when he voted to “repeal all carbon taxes.” Because of his advocacy, the feds took the carbon tax off furnace oil for three years. Santa just wishes Liberal MPs in other parts of Canada had McDonald’s courage and were willing to stick up for their constituents too.

Parliamentary Budget Officer Yves Giroux – For the gift of government accountability and transparency

Taxpayers always deserve the gift of transparency and accountability in Ottawa. And the PBO delivered it in droves in 2023. From showing the full cost of Trudeau’s two carbon taxes, to fact-checking Ottawa’s deficit numbers and analyzing tax plans, the PBO has been holding politicians accountable all year.

Alberta’s Village of Ryley – For recalling a big-spending mayor

Ryley is the first municipality in Canada to recall a city hall politician, former mayor Nik Lee. During Lee’s tenure, the village’s spending almost doubled from $1.7 million to $3 million in 2022. Lee also spent more than $5,000 on meetings without approval. When Lee refused to resign from council, residents of Ryley took matters into their own hands, launched a recall campaign and booted Lee. For their civic engagement and holding a big-spending politician accountable, all residents of Ryley land themselves on Santa’s Nice List this year!

Business

Ted Cruz, Jim Jordan Ramp Up Pressure On Google Parent Company To Deal With ‘Censorship’

From the Daily Caller News Foundation

By Andi Shae Napier

Republican Texas Sen. Ted Cruz and Republican Ohio Rep. Jim Jordan are turning their attention to Google over concerns that the tech giant is censoring users and infringing on Americans’ free speech rights.

Google’s parent company Alphabet, which also owns YouTube, appears to be the GOP’s next Big Tech target. Lawmakers seem to be turning their attention to Alphabet after Mark Zuckerberg’s Meta ended its controversial fact-checking program in favor of a Community Notes system similar to the one used by Elon Musk’s X.

Cruz recently informed reporters of his and fellow senators’ plans to protect free speech.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here. Thank you!

“Stopping online censorship is a major priority for the Commerce Committee,” Cruz said, as reported by Politico. “And we are going to utilize every point of leverage we have to protect free speech online.”

Following his meeting with Alphabet CEO Sundar Pichai last month, Cruz told the outlet, “Big Tech censorship was the single most important topic.”

Jordan, Chairman of the House Judiciary Committee, sent subpoenas to Alphabet and other tech giants such as Rumble, TikTok and Apple in February regarding “compliance with foreign censorship laws, regulations, judicial orders, or other government-initiated efforts” with the intent to discover how foreign governments, or the Biden administration, have limited Americans’ access to free speech.

“Throughout the previous Congress, the Committee expressed concern over YouTube’s censorship of conservatives and political speech,” Jordan wrote in a letter to Pichai in March. “To develop effective legislation, such as the possible enactment of new statutory limits on the executive branch’s ability to work with Big Tech to restrict the circulation of content and deplatform users, the Committee must first understand how and to what extent the executive branch coerced and colluded with companies and other intermediaries to censor speech.”

Jordan subpoenaed tech CEOs in 2023 as well, including Satya Nadella of Microsoft, Tim Cook of Apple and Pichai, among others.

Despite the recent action against the tech giant, the battle stretches back to President Donald Trump’s first administration. Cruz began his investigation of Google in 2019 when he questioned Karan Bhatia, the company’s Vice President for Government Affairs & Public Policy at the time, in a Senate Judiciary Committee hearing. Cruz brought forth a presentation suggesting tech companies, including Google, were straying from free speech and leaning towards censorship.

Even during Congress’ recess, pressure on Google continues to mount as a federal court ruled Thursday that Google’s ad-tech unit violates U.S. antitrust laws and creates an illegal monopoly. This marks the second antitrust ruling against the tech giant as a different court ruled in 2024 that Google abused its dominance of the online search market.

Business

China, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

Sam Cooper

Sam Cooper

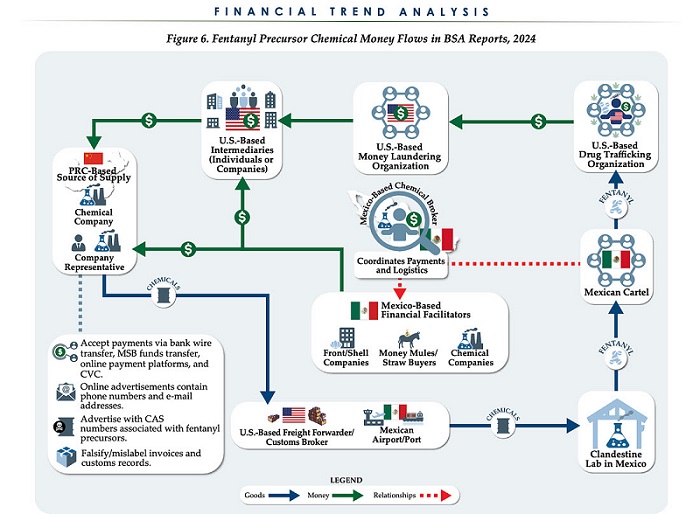

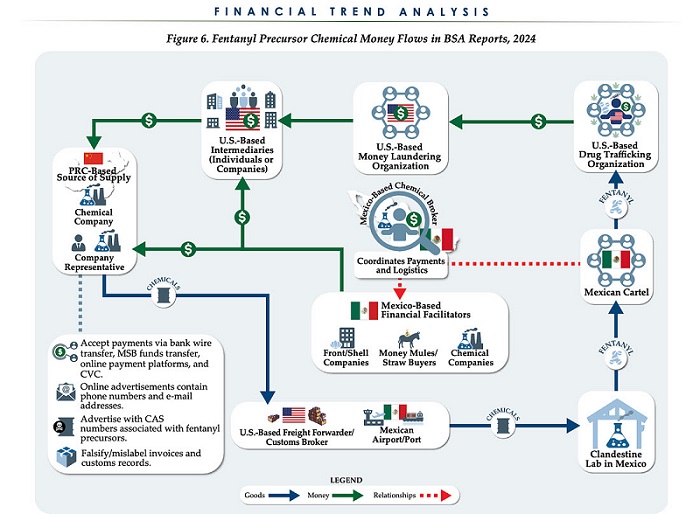

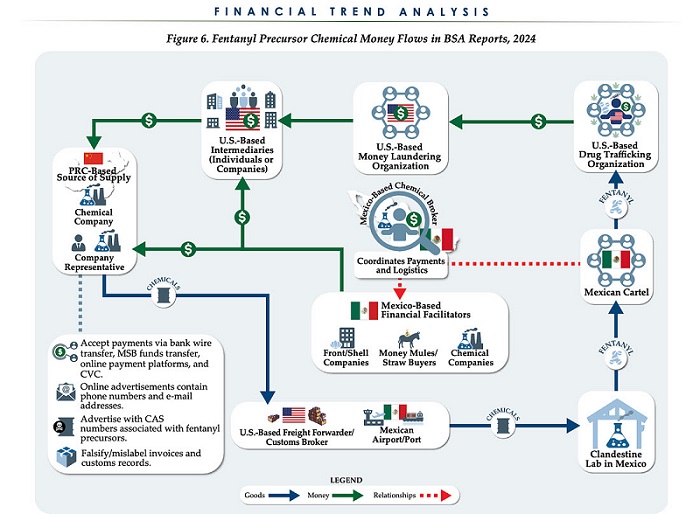

The U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) has identified $1.4 billion in fentanyl-linked suspicious transactions, naming China, Mexico, Canada, and India as key foreign touchpoints in the global production and laundering network. The analysis, based on 1,246 Bank Secrecy Act filings submitted in 2024, tracks financial activity spanning chemical purchases, trafficking logistics, and international money laundering operations.

The data reveals that Mexico and the People’s Republic of China were the two most frequently named foreign jurisdictions in financial intelligence gathered by FinCEN. Most of the flagged transactions originated in U.S. cities, the report notes, due to the “domestic nature” of Bank Secrecy Act data collection. Among foreign jurisdictions, Mexico, China, Hong Kong, and Canada were cited most often in fentanyl-related financial activity.

The FinCEN report points to Mexico as the epicenter of illicit fentanyl production, with Mexican cartels importing precursor chemicals from China and laundering proceeds through complex financial routes involving U.S., Canadian, and Hong Kong-based actors.

The findings also align with testimony from U.S. and Canadian law enforcement veterans who have told The Bureau that Chinese state-linked actors sit atop a decentralized but industrialized global fentanyl economy—supplying precursors, pill presses, and financing tools that rely on trade-based money laundering and professional money brokers operating across North America.

“Filers also identified PRC-based subjects in reported money laundering activity, including suspected trade-based money laundering schemes that leveraged the Chinese export sector,” the report says.

A point emphasized by Canadian and U.S. experts—including former U.S. State Department investigator Dr. David Asher—that professional Chinese money laundering networks operating in North America are significantly commanded by Chinese Communist Party–linked Triad bosses based in Ontario and British Columbia—is not explored in detail in this particular FinCEN report.¹

Chinese chemical manufacturers—primarily based in Guangdong, Zhejiang, and Hebei provinces—were repeatedly cited for selling fentanyl precursors via wire transfers and money service businesses. These sales were often facilitated through e-commerce platforms, suggesting that China’s global retail footprint conceals a lethal underground market—one that ultimately fuels a North American public health crisis. In many cases, the logistics were sophisticated: some Chinese companies even offered delivery guarantees and customs clearance for precursor shipments, raising red flags for enforcement officials.

While China’s industrial base dominates the global fentanyl supply chain, Mexican cartels are the next most prominent state-like actors in the ecosystem—but the report emphasizes that Canada and India are rising contributors.

“Subjects in other foreign countries—including Canada, the Dominican Republic, and India—highlight the presence of alternative suppliers of precursor chemicals and fentanyl,” the report says.

“Canada-based subjects were primarily identified by Bank Secrecy Act filers due to their suspected involvement in drug trafficking organizations allegedly sourcing fentanyl and other drugs from traditional drug source countries, such as Mexico,” it explains, adding that banking intelligence “identified activity indicative of Canada-based individuals and companies purchasing precursor chemicals and laboratory equipment that may be related to the synthesis of fentanyl in Canada. Canada-based subjects were primarily reported with addresses in the provinces of British Columbia and Ontario.”

FinCEN also flagged activity from Hong Kong-based shell companies—often subsidiaries or intermediaries for Chinese chemical exporters. These entities were used to obscure the PRC’s role in transactions and to move funds through U.S.-linked bank corridors.

Breaking down the fascinating and deadly world of Chinese underground banking used to move fentanyl profits from American cities back to producers, the report explains how Chinese nationals in North America are quietly enlisted to move large volumes of cash across borders—without ever triggering traditional wire transfers.

These networks, formally known as Chinese Money Laundering Organizations (CMLOs), operate within a global underground banking system that uses “mirror transfers.” In this system, a Chinese citizen with renminbi in China pays a local broker, while the U.S. dollar equivalent is handed over—often in cash—to a recipient in cities like Los Angeles or New York who may have no connection to the original Chinese depositor aside from their role in the laundering network. The renminbi, meanwhile, is used inside China to purchase goods such as electronics, which are then exported to Mexico and delivered to cartel-linked recipients.

FinCEN reports that US-based money couriers—often Chinese visa holders—were observed depositing large amounts of cash into bank accounts linked to everyday storefront businesses, including nail salons and restaurants. Some of the cash was then used to purchase cashier’s checks, a common method used to obscure the origin and destination of the funds. To banks, the activity might initially appear consistent with a legitimate business. However, modern AI-powered transaction monitoring systems are increasingly capable of flagging unusual patterns—such as small businesses conducting large or repetitive transfers that appear disproportionate to their stated operations.

On the Mexican side, nearly one-third of reports named subjects located in Sinaloa and Jalisco, regions long controlled by the Sinaloa Cartel and Cartel Jalisco Nueva Generación. Individuals in these states were often cited as recipients of wire transfers from U.S.-based senders suspected of repatriating drug proceeds. Others were flagged as originators of payments to Chinese chemical suppliers, raising alarms about front companies and brokers operating under false pretenses.

The report outlines multiple cases where Mexican chemical brokers used generic payment descriptions such as “goods” or “services” to mask wire transfers to China. Some of these transactions passed through U.S.-based intermediaries, including firms owned by Chinese nationals. These shell companies were often registered in unrelated sectors—like marketing, construction, or hardware—and exhibited red flags such as long dormancy followed by sudden spikes in large transactions.

Within the United States, California, Florida, and New York were most commonly identified in fentanyl-related financial filings. These locations serve as key hubs for distribution and as collection points for laundering proceeds. Cash deposits and peer-to-peer payment platforms were the most cited methods for fentanyl-linked transactions, appearing in 54 percent and 51 percent of filings, respectively.

A significant number of flagged transactions included slang terms and emojis—such as “blues,” “ills,” or blue dots—in memo fields. Structured cash deposits were commonly made across multiple branches or ATMs, often linked to otherwise legitimate businesses such as restaurants, salons, and trucking firms.

FinCEN also tracked a growing number of trade-based laundering schemes, in which proceeds from fentanyl sales were used to buy electronics and vaping devices. In one case, U.S.-based companies owned by Chinese nationals made outbound payments to Chinese manufacturers, using funds pooled from retail accounts and shell companies. These goods were then shipped to Mexico, closing the laundering loop.

Another key laundering method involved cryptocurrency. Nearly 10 percent of all fentanyl-related reports involved virtual currency, with Bitcoin the most commonly cited, followed by Ethereum and Litecoin. FinCEN flagged twenty darknet marketplaces as suspected hubs for fentanyl distribution and cited failures by some digital asset platforms to catch red-flag activity.

Overall, FinCEN warns that fentanyl-linked funds continue to enter the U.S. financial system through loosely regulated or poorly monitored channels, even as law enforcement ramps up enforcement. The Drug Enforcement Administration reported seizures of over 55 million counterfeit fentanyl pills in 2024 alone.

The broader pattern is unmistakable: precursor chemicals flow from China, manufacturing occurs in Mexico, Canada plays an increasing role in chemical acquisition and potential synthesis, and drugs and proceeds flood into the United States, supported by global financial tools and trade structures. The same infrastructure that enables lawful commerce is being manipulated to sustain the deadliest synthetic drug crisis in modern history.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

-

COVID-192 days ago

COVID-192 days agoCanadian student denied religious exemption for COVID jab takes tech school to court

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNeil Young + Carney / Freedom Bros

-

International2 days ago

International2 days agoUK Supreme Court rules ‘woman’ means biological female

-

Business1 day ago

Business1 day agoChina, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoTucker Carlson Interviews Maxime Bernier: Trump’s Tariffs, Mass Immigration, and the Oncoming Canadian Revolution

-

espionage1 day ago

espionage1 day agoEx-NYPD Cop Jailed in Beijing’s Transnational Repatriation Plot, Canada Remains Soft Target

-

Business2 days ago

Business2 days agoDOGE Is Ending The ‘Eternal Life’ Of Government

-

Health2 days ago

Health2 days agoWHO member states agree on draft of ‘pandemic treaty’ that could be adopted in May