Business

Taxpayers Federation urging Ontario to join Alberta’s carbon tax court fight

From the Canadian Taxpayers Federation

By Jay Goldberg

The Canadian Taxpayers Federation is calling on Ontario Premier Doug Ford to join the Alberta government and constitutionally challenge against the federal carbon tax.

“Ford has rightly opposed the federal carbon tax for years, but now he has a new chance to beat it in court,” said Jay Goldberg, CTF Ontario Director. “Last time the carbon tax fight went to the Supreme Court, the federal government argued it needed a national carbon tax to deal with a national problem. But then it undercut its own argument for a national carbon tax by making an exception for furnace oil, which clearly favours Atlantic Canada.

“Trudeau torpedoed his own constitutional argument for imposing a carbon tax so it’s time to challenge it in court again.”

Today, the Alberta government announced it has filed an application at the federal court challenging the constitutionality of the carbon tax in the wake of the federal government’s heating oil carbon tax exemption.

Last year, the federal government announced it is removing the carbon tax from heating oil for three years, but did not exempt other forms of home heating energy.

The carve-out disproportionately helps Atlantic Canadians. Only two per cent of Ontario households use furnace oil to heat their homes.

The average Ontario home uses 2,497 cubic metres of natural gas per year. That means removing the current federal carbon tax would save the average home about $381 this year.

“When Trudeau announced his heating oil carve out, he admitted the carbon tax makes life more expensive, he admitted the carbon tax is all about politics and he left the vast majority of Canadians out in the cold,” Goldberg said. “Ford needs to take this new opportunity to join other provinces and fight the carbon tax in court.”

A recent Leger poll commissioned by the CTF shows 60 per cent of Ontarians want the federal government to remove the carbon tax from all heating fuels.

Smith right to fight carbon tax in court

The Canadian Taxpayers Federation applauds Alberta Premier Danielle Smith for launching a renewed constitutional challenge against the federal carbon tax.

“The carbon tax is making the necessities of life in Alberta more expensive and that’s why Smith is right to take Prime Minister Justin Trudeau’s carbon tax back to court,” said Franco Terrazzano, CTF Federal Director. “Last time the carbon tax fight went to the Supreme Court, the federal government argued it needed a national carbon tax to deal with a national problem. But then it undercut its own argument for a national carbon tax by making an exception for furnace oil, which clearly favours Atlantic Canada.

“Trudeau torpedoed his own constitutional argument for imposing a carbon tax so it’s time to challenge it in court again.”

Today, the Alberta government announced it has filed an application at the federal court challenging the constitutionality of the carbon tax in the wake of the federal government’s home heating oil exemption.

Writing in the National Post, the CTF called on all premiers to launch a new legal challenge against the federal carbon tax.

Last year, the federal government announced it is removing the carbon tax from furnace oil for three years, but did not exempt other forms of home heating energy. Less than one per cent of Alberta households use heating oil.

The average Alberta home uses about 2,935 cubic metres of natural gas per year, according to Statistics Canada. That means scrapping the current federal carbon tax would save the average Alberta home about $440 this year.

“Taxpayers are taking it on the chin every time we pay our heating bills and Trudeau is torpedoing constitutional accountability with his unequal application of the carbon tax,” Terrazzano said. “When Trudeau announced his heating oil carve out, he admitted the carbon tax makes life more expensive, he admitted the carbon tax is all about politics and he left the vast majority of Canadians out in the cold.”

A recent Leger poll commissioned by the CTF shows 70 per cent of Albertans want the federal government to remove the carbon tax from all heating fuels.

Business

China, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

Sam Cooper

Sam Cooper

The U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) has identified $1.4 billion in fentanyl-linked suspicious transactions, naming China, Mexico, Canada, and India as key foreign touchpoints in the global production and laundering network. The analysis, based on 1,246 Bank Secrecy Act filings submitted in 2024, tracks financial activity spanning chemical purchases, trafficking logistics, and international money laundering operations.

The data reveals that Mexico and the People’s Republic of China were the two most frequently named foreign jurisdictions in financial intelligence gathered by FinCEN. Most of the flagged transactions originated in U.S. cities, the report notes, due to the “domestic nature” of Bank Secrecy Act data collection. Among foreign jurisdictions, Mexico, China, Hong Kong, and Canada were cited most often in fentanyl-related financial activity.

The FinCEN report points to Mexico as the epicenter of illicit fentanyl production, with Mexican cartels importing precursor chemicals from China and laundering proceeds through complex financial routes involving U.S., Canadian, and Hong Kong-based actors.

The findings also align with testimony from U.S. and Canadian law enforcement veterans who have told The Bureau that Chinese state-linked actors sit atop a decentralized but industrialized global fentanyl economy—supplying precursors, pill presses, and financing tools that rely on trade-based money laundering and professional money brokers operating across North America.

“Filers also identified PRC-based subjects in reported money laundering activity, including suspected trade-based money laundering schemes that leveraged the Chinese export sector,” the report says.

A point emphasized by Canadian and U.S. experts—including former U.S. State Department investigator Dr. David Asher—that professional Chinese money laundering networks operating in North America are significantly commanded by Chinese Communist Party–linked Triad bosses based in Ontario and British Columbia—is not explored in detail in this particular FinCEN report.¹

Chinese chemical manufacturers—primarily based in Guangdong, Zhejiang, and Hebei provinces—were repeatedly cited for selling fentanyl precursors via wire transfers and money service businesses. These sales were often facilitated through e-commerce platforms, suggesting that China’s global retail footprint conceals a lethal underground market—one that ultimately fuels a North American public health crisis. In many cases, the logistics were sophisticated: some Chinese companies even offered delivery guarantees and customs clearance for precursor shipments, raising red flags for enforcement officials.

While China’s industrial base dominates the global fentanyl supply chain, Mexican cartels are the next most prominent state-like actors in the ecosystem—but the report emphasizes that Canada and India are rising contributors.

“Subjects in other foreign countries—including Canada, the Dominican Republic, and India—highlight the presence of alternative suppliers of precursor chemicals and fentanyl,” the report says.

“Canada-based subjects were primarily identified by Bank Secrecy Act filers due to their suspected involvement in drug trafficking organizations allegedly sourcing fentanyl and other drugs from traditional drug source countries, such as Mexico,” it explains, adding that banking intelligence “identified activity indicative of Canada-based individuals and companies purchasing precursor chemicals and laboratory equipment that may be related to the synthesis of fentanyl in Canada. Canada-based subjects were primarily reported with addresses in the provinces of British Columbia and Ontario.”

FinCEN also flagged activity from Hong Kong-based shell companies—often subsidiaries or intermediaries for Chinese chemical exporters. These entities were used to obscure the PRC’s role in transactions and to move funds through U.S.-linked bank corridors.

Breaking down the fascinating and deadly world of Chinese underground banking used to move fentanyl profits from American cities back to producers, the report explains how Chinese nationals in North America are quietly enlisted to move large volumes of cash across borders—without ever triggering traditional wire transfers.

These networks, formally known as Chinese Money Laundering Organizations (CMLOs), operate within a global underground banking system that uses “mirror transfers.” In this system, a Chinese citizen with renminbi in China pays a local broker, while the U.S. dollar equivalent is handed over—often in cash—to a recipient in cities like Los Angeles or New York who may have no connection to the original Chinese depositor aside from their role in the laundering network. The renminbi, meanwhile, is used inside China to purchase goods such as electronics, which are then exported to Mexico and delivered to cartel-linked recipients.

FinCEN reports that US-based money couriers—often Chinese visa holders—were observed depositing large amounts of cash into bank accounts linked to everyday storefront businesses, including nail salons and restaurants. Some of the cash was then used to purchase cashier’s checks, a common method used to obscure the origin and destination of the funds. To banks, the activity might initially appear consistent with a legitimate business. However, modern AI-powered transaction monitoring systems are increasingly capable of flagging unusual patterns—such as small businesses conducting large or repetitive transfers that appear disproportionate to their stated operations.

On the Mexican side, nearly one-third of reports named subjects located in Sinaloa and Jalisco, regions long controlled by the Sinaloa Cartel and Cartel Jalisco Nueva Generación. Individuals in these states were often cited as recipients of wire transfers from U.S.-based senders suspected of repatriating drug proceeds. Others were flagged as originators of payments to Chinese chemical suppliers, raising alarms about front companies and brokers operating under false pretenses.

The report outlines multiple cases where Mexican chemical brokers used generic payment descriptions such as “goods” or “services” to mask wire transfers to China. Some of these transactions passed through U.S.-based intermediaries, including firms owned by Chinese nationals. These shell companies were often registered in unrelated sectors—like marketing, construction, or hardware—and exhibited red flags such as long dormancy followed by sudden spikes in large transactions.

Within the United States, California, Florida, and New York were most commonly identified in fentanyl-related financial filings. These locations serve as key hubs for distribution and as collection points for laundering proceeds. Cash deposits and peer-to-peer payment platforms were the most cited methods for fentanyl-linked transactions, appearing in 54 percent and 51 percent of filings, respectively.

A significant number of flagged transactions included slang terms and emojis—such as “blues,” “ills,” or blue dots—in memo fields. Structured cash deposits were commonly made across multiple branches or ATMs, often linked to otherwise legitimate businesses such as restaurants, salons, and trucking firms.

FinCEN also tracked a growing number of trade-based laundering schemes, in which proceeds from fentanyl sales were used to buy electronics and vaping devices. In one case, U.S.-based companies owned by Chinese nationals made outbound payments to Chinese manufacturers, using funds pooled from retail accounts and shell companies. These goods were then shipped to Mexico, closing the laundering loop.

Another key laundering method involved cryptocurrency. Nearly 10 percent of all fentanyl-related reports involved virtual currency, with Bitcoin the most commonly cited, followed by Ethereum and Litecoin. FinCEN flagged twenty darknet marketplaces as suspected hubs for fentanyl distribution and cited failures by some digital asset platforms to catch red-flag activity.

Overall, FinCEN warns that fentanyl-linked funds continue to enter the U.S. financial system through loosely regulated or poorly monitored channels, even as law enforcement ramps up enforcement. The Drug Enforcement Administration reported seizures of over 55 million counterfeit fentanyl pills in 2024 alone.

The broader pattern is unmistakable: precursor chemicals flow from China, manufacturing occurs in Mexico, Canada plays an increasing role in chemical acquisition and potential synthesis, and drugs and proceeds flood into the United States, supported by global financial tools and trade structures. The same infrastructure that enables lawful commerce is being manipulated to sustain the deadliest synthetic drug crisis in modern history.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

2025 Federal Election

Canada drops retaliatory tariffs on automakers, pauses other tariffs

MxM News

MxM News

Quick Hit:

Canada has announced it will roll back retaliatory tariffs on automakers and pause several other tariff measures aimed at the United States. The move, unveiled by Finance Minister François-Philippe Champagne, is designed to give Canadian manufacturers breathing room to adjust their supply chains and reduce reliance on American imports.

Key Details:

- Canada will suspend 25% tariffs on U.S. vehicles for automakers that maintain production, employment, and investment in Canada.

- A broader six-month pause on tariffs for other U.S. imports is intended to help Canadian sectors transition to domestic sourcing.

- A new loan facility will support large Canadian companies that were financially stable before the tariffs but are now struggling.

Diving Deeper:

Ottawa is shifting its approach to the escalating trade war with Washington, softening its economic blows in a calculated effort to stabilize domestic manufacturing. On Tuesday, Finance Minister François-Philippe Champagne outlined a new set of trade policies that provide conditional relief from retaliatory tariffs that have been in place since March. Automakers, the hardest-hit sector, will now be eligible to import U.S. vehicles duty-free—provided they continue to meet criteria that include ongoing production and investment in Canada.

“From day one, the government has reacted with strength and determination to the unjust tariffs imposed by the United States on Canadian goods,” Champagne stated. “We’re giving Canadian companies and entities more time to adjust their supply chains and become less dependent on U.S. suppliers.”

The tariff battle, which escalated in April with Canada slapping a 25% tax on U.S.-imported vehicles, had caused severe anxiety within Canada’s auto industry. John D’Agnolo, president of Unifor Local 200, which represents Ford employees in Windsor, warned the BBC the situation “has created havoc” and could trigger a recession.

Speculation about a possible Honda factory relocation to the U.S. only added to the unrest. But Ontario Premier Doug Ford and federal officials were quick to tamp down the rumors. Honda Canada affirmed its commitment to Canadian operations, saying its Alliston facility “will operate at full capacity for the foreseeable future.”

Prime Minister Mark Carney reinforced the message that the relief isn’t unconditional. “Our counter-tariffs won’t apply if they (automakers) continue to produce, continue to employ, continue to invest in Canada,” he said during a campaign event. “If they don’t, they will get 25% tariffs on what they are importing into Canada.”

Beyond the auto sector, Champagne introduced a six-month tariff reprieve on other U.S. imports, granting time for industries to explore domestic alternatives. He also rolled out a “Large Enterprise Tariff Loan Facility” to support big businesses that were financially sound prior to the tariff regime but have since been strained.

While Canada has shown willingness to ease its retaliatory measures, there’s no indication yet that the U.S. under President Donald Trump will reciprocate. Nevertheless, Ottawa signaled its openness to further steps to protect Canadian businesses and workers, noting that “additional measures will be brought forward, as needed.”

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP Whistleblowers Accuse Members of Mark Carney’s Inner Circle of Security Breaches and Surveillance

-

Also Interesting2 days ago

Also Interesting2 days agoBetFury Review: Is It the Best Crypto Casino?

-

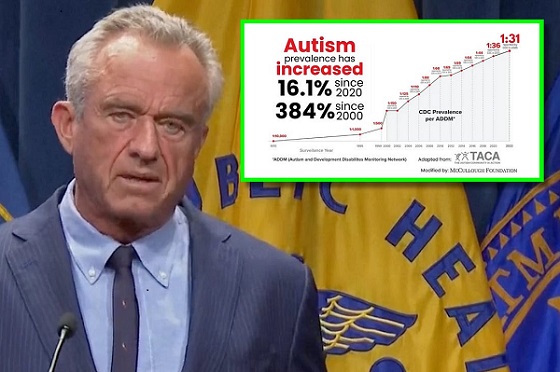

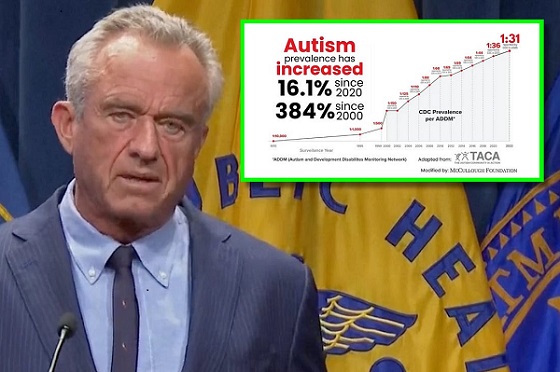

Autism2 days ago

Autism2 days agoRFK Jr. Exposes a Chilling New Autism Reality

-

COVID-192 days ago

COVID-192 days agoCanadian student denied religious exemption for COVID jab takes tech school to court

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBureau Exclusive: Chinese Election Interference Network Tied to Senate Breach Investigation

-

International2 days ago

International2 days agoUK Supreme Court rules ‘woman’ means biological female

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNeil Young + Carney / Freedom Bros

-

Health2 days ago

Health2 days agoWHO member states agree on draft of ‘pandemic treaty’ that could be adopted in May