National

Tax and MP pay hikes one month away

From the Canadian Taxpayers Federation

Author: Franco Terrazzano

The Canadian Taxpayers Federation is calling on the federal government to scrap its plan to increase the carbon tax and alcohol taxes while also hiking salaries for members of Parliament on April 1.

“In one month, the feds will make like more expensive with another round of tax hikes,” said Franco Terrazzano, CTF Federal Director. “Canadians are still struggling to afford basic necessities, so Prime Minister Justin Trudeau should be providing relief, not hiking taxes.”

The federal carbon tax will increase to 17 cents per litre of gasoline, 21 cents per litre of diesel and 15 cents per cubic metre of natural gas on April 1. The carbon tax will cost the average family up to $911 a year even after the rebates, according to the Parliamentary Budget Officer.

First passed in the 2017 federal budget, the alcohol escalator tax automatically increases excise taxes on beer, wine and spirits every year by the rate of inflation. Alcohol taxes will increase by 4.7 per cent on April 1. The automatic tax hike is undemocratic as MPs won’t vote on it. The federal government capped the increase at two per cent last year.

MPs also take pay raises each year on April 1. The CTF estimates this year’s pay raise will range from an extra $8,100 for a backbench MP to an extra $16,200 for the prime minister, based on contract data published by the government of Canada.

“The very same day MPs take more money out of Canadians’ pockets they’ll be stuffing more into their own and that’s wrong,” Terrazzano said. “MPs don’t deserve raises when they make life more expensive with tax hikes.”

2025 Federal Election

The status quo in Canadian politics isn’t sustainable for national unity

From Energy Now

William Lacey

The Willful Blindness of the East

That’s it. I’m officially a separatist…sort of. Really, I’m just completely tired of Ontario and Quebec. After 10 years of frozen economic output, a runaway immigration program, and a debt profile that went hyperbolic, Eastern Canada appears to have decided that another four years of the same old, same old is a good path forward.

In short, they think that the clown car that led this country, after just swapping out the driver (who happened to be one of the people who was supplying the directions), is a good idea.

Having been born and raised in Alberta, I feel that there is a significant amount of the battered spouse syndrome that is alive and well in the province, with people saying “I know the rest of the country love me. They’re just having a bad day.” No matter how many times I ask “what’s in this great union for Alberta” I get the same kitschy feedback. Be grateful for Canada and its social programs and “free” medical system (they are broken), Canada in the Great War (umm…that was 107+ years ago), great moments in sports, tidewater access (umm….that’s a quiet threat), etc. When it comes to one tangible answer, I just get silence. But the reality is that the East is perfectly happy to look down their noses, take the money, and then say “you are not one of us; you lack provenance!” Now some of you may say that is bullshit and that Albertans are an ungrateful bunch. But being someone who has lived in both the East and West, and worked with people who come from all walks, I know firsthand the bias exists.

Alberta, and the West, have made outsized contributions to confederation, much of that through the system that we call equalization. The idea behind this system was so that all parts of Canada get equal treatment through the taxation system, taking funds generated by “have” provinces and redistributing those funds to “have not” provinces, making sure that all are afforded the basics that Canadians have taken to be their definition of Canada. This is essentially done by looking at the fiscal capacity of each province, based on the average national tax rate, and then “balance” the books based on this average capacity. And that’s fine. But in the world I live in, when one group reaches out and helps the other, there is an acknowledgement of the effort, not a “va te faire foutre!” like comes out of Quebec. There is a certain irony from the chart below that it looks like Quebec is giving the finger to the rest of the country.

The reality is that the East views it as beneath them to say thank you for such a contribution. Moreover, many go out of their way to vilify the work that is done and to demean those who do it. So you wonder why the frustration mounts? The fact of the matter is that I believe that the Conservative movement has been codified out East as a fringe movement, only to be voted for when the Liberals need a brief time out.

Do I think separation is a real possibility? Not really. There are numerous challenges, some of which are more difficult than others. The largest one is probably related to indigenous matters, but they too likely suffer from a version of battered spouse syndrome. There is an underlying tenet that the Federal Government cares for them, but based on what I have seen, that is a unique “standard of care” that is being applied. I actually believe that better outcome for the indigenous people could be achieved under a new relationship, assuming both sides were open minded.

Now before you say “you are on the fringe, you don’t represent the masses”, I can tell you that I know a lot of people who are leaders in their professions within this province, whether that is health, law, business, etc. that all echo these feelings. The frustration is palpable, it is real and it is broader than you think.

So, with this I finally raise my hand and make the call that “I’m tired of the relationship I am in.” This pains and saddens me deeply, as I am someone who has worn the maple leaf with great pride and who has been happy to pronounce “I am Canadian.” I think it’s time to reconsider who I view as my partner.

2025 Federal Election

RCMP memo warns of Chinese interference on Canadian university campuses to affect election

From LifeSiteNews

The Royal Canadian Mounted Police singled out China as the only nation of interest, noting that the ‘threat posed by the People’s Republic and its powerful security and intelligence apparatus’ remains a ‘concern.’

An internal briefing note from Canada’s top police force warned that agents of the Communist Chinese Party (CCP) are targeting Canadian universities to intimidate them and in some instances challenge them on their “political positions.”

The December 3, 2024, memo titled On-Campus Foreign Interference from the Royal Canadian Mounted Police (RCMP) did not mention specific universities by name but noted that foreign interference was sophisticated and came solely from China.

The memo stated that as Canada’s academic institutions rely on “open, creative and collaborative environments” to foster independent debate, some “foreign intelligence services and government officials including the People’s Republic of China can exploit this culture of openness to monitor and coerce students, faculty and other university officials.”

“On university campuses foreign states may seek to exert undue influence, covertly and through proxies, by harassing dissidents and suppressing academic freedoms and free speech that are not aligned with their political interests,” the RCMP noted in the memo.

The memo noted that foreign agents’ influence in “public debate at academic institutions” may lead to them sponsoring “specific events to shape discussion rather than engage in free debate and dialogue.”

“They may also directly or indirectly attempt to disrupt public events or other on-campus activities they perceive as challenging their political positions and spread disinformation, undermining confidence in academic discourse and expertise,” the memo observed.

Notably, the memo singled out China, and thus the CCP, as the only nation of interest, noting that the “threat posed by the People’s Republic and its powerful security and intelligence apparatus including malign activities targeting our democratic institutions, communities and economic prosperity” remains a “concern.”

Some of the activities that foreign agents engaged included the recruitment of CCP sympathizers and “in some instances,” noted the memo, saw students be “pressured to participate in activities that are covertly organized by a foreign power.”

“Universities can also be used as venues for ‘talent spotting’ and intelligence collection in specific circumstances,” the memo stated.

The final report from the Foreign Interference Commission concluded that operatives from China may have had a hand in helping to elect a handful of MPs in both the 2019 and 2021 Canadian federal elections. It also concluded that China was the primary foreign interference threat to Canada.

According to hearings from a 2021 House of Commons Special Committee on Canada-China Relations, there were numerous documented incidents of CCP intimidation.

For example, a Tibetan Canadian, Chemi Lhamo, testified she got death threats after she ran for student council president at the University of Toronto’s Scarborough campus.

“There were comments saying the bullet that would go through me was made in China,” she said, noting that “Community members of the allied nations who are subjected to the Chinese Communist Party’s colonial violence are not alien to these tactics. We have witnessed China’s interference and influence not just in our university campuses but also in our communities.”

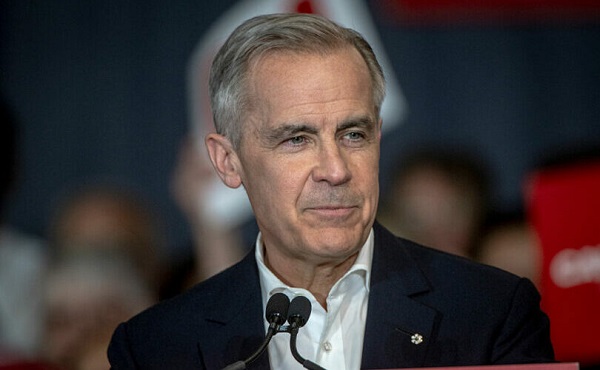

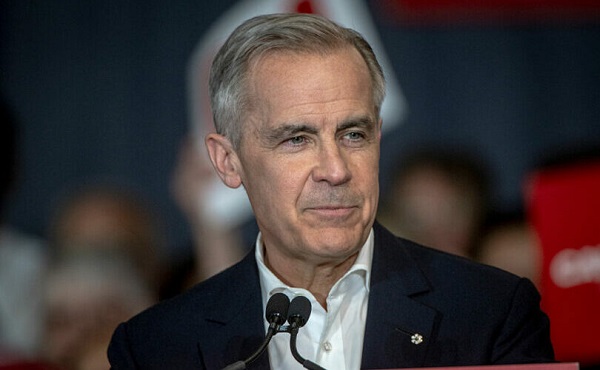

Earlier this week, LifeSiteNews reported that Canada’s Security and Intelligence Threats to Elections Task Force (SITE) confirmed the CCP government was behind an online “operation” on WeChat to paint Prime Minister Mark Carney in a positive light.

Canadians will head to the polls in a general election on April 28.

LifeSiteNews reported last week that the Liberal Party under Carney, has thus far seen no less than three MP candidates drop out of the election race over allegations of foreign interference.

LifeSiteNews recently reported how the Conservative Party sounded the alarm by sharing a 2016 video of Carney saying the Communist Chinese regime’s “perspective” on things is “one of its many strengths.”

As reported by LifeSiteNews, a new exposé by investigative journalist Sam Cooper claims there is compelling evidence that Carney and former Prime Minister Justin Trudeau are strongly influenced by an “elite network” of foreign actors, including those with ties to China and the World Economic Forum.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHarper Endorses Poilievre at Historic Edmonton Rally: “This Crisis Was Made in Canada”

-

conflict2 days ago

conflict2 days agoZelensky Alleges Chinese Nationals Fighting for Russia, Calls for Global Response

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAn In-Depth Campaign Trail “Interview” With Pierre Poilievre

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoMark Carney’s radical left-wing, globalist record proves he is Justin Trudeau 2.0

-

Business2 days ago

Business2 days agoTrump’s tariff plan replaces free trade with balanced trade. Globalists hate that.

-

2025 Federal Election22 hours ago

2025 Federal Election22 hours agoConservative Party urges investigation into Carney plan to spend $1 billion on heat pumps

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoScott Atlas: COVID lockdowns, censorship have left a ‘permanent black mark on America’

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoDon’t double-down on net zero again