Business

Tariff-driven increase of U.S. manufacturing investment would face dearth of workers

From the Fraser Institute

Since 2015, the number of American manufacturing jobs has actually risen modestly. However, as a share of total U.S. employment, manufacturing has dropped from 30 per cent in the 1970s to around 8 per cent in 2024.

Donald Trump has long been convinced that the United States must revitalize its manufacturing sector, having—unwisely, in his view—allowed other countries to sell all manner of foreign-produced manufactured goods in the giant American market. As president, he’s moved quickly to shift the U.S. away from its previous embrace of liberal trade and open markets as cornerstones of its approach to international economic policy —wielding tariffs as his key policy instrument. Since taking office barely two months ago, President Trump has implemented a series of tariff hikes aimed at China and foreign producers of steel and aluminum—important categories of traded manufactured goods—and threatened to impose steep tariffs on most U.S. imports from Canada, Mexico and the European Union. In addition, he’s pledged to levy separate tariffs on imports of automobiles, semi-conductors, lumber, and pharmaceuticals, among other manufactured goods.

In the third week of March, the White House issued a flurry of news releases touting the administration’s commitment to “position the U.S. as a global superpower in manufacturing” and listing substantial new investments planned by multinational enterprises involved in manufacturing. Some of these appear to contemplate relocating manufacturing production in other jurisdictions to the U.S., while others promise new “greenfield” investments in a variety of manufacturing industries.

President Trump’s intense focus on manufacturing is shared by a large slice of America’s political class, spanning both of the main political parties. Yet American manufacturing has hardly withered away in the last few decades. The value of U.S. manufacturing “output” has continued to climb, reaching almost $3 trillion last year (equal to 10 per cent of total GDP). The U.S. still accounts for 15 per cent of global manufacturing production, measured in value-added terms. In fact, among the 10 largest manufacturing countries, it ranks second in manufacturing value-added on a per-capita basis. True, China has become the world’s biggest manufacturing country, representing about 30 per cent of global output. And the heavy reliance of Western economies on China in some segments of manufacturing does give rise to legitimate national security concerns. But the bulk of international trade in manufactured products does not involve goods or technologies that are particularly critical to national security, even if President Trump claims otherwise. Moreover, in the case of the U.S., a majority of two-way trade in manufacturing still takes place with other advanced Western economies (and Mexico).

In the U.S. political arena, much of the debate over manufacturing centres on jobs. And there’s no doubt that employment in the sector has fallen markedly over time, particularly from the early 1990s to the mid-2010s (see table below). Since 2015, the number of American manufacturing jobs has actually risen modestly. However, as a share of total U.S. employment, manufacturing has dropped from 30 per cent in the 1970s to around 8 per cent in 2024.

| U.S. Manufacturing Employment, Select Years (000)* | |

|---|---|

| 1990 | 17,395 |

| 2005 | 14,189 |

| 2010 | 14,444 |

| 2015 | 12,333 |

| 2022 | 12,889 |

| 2024 | 12,760 |

| *December for each year shown. Source: U.S. Bureau of Labor Statistics | |

Economists who have studied the trend conclude that the main factors behind the decline of manufacturing employment include continuous automation, significant gains in productivity across much of the sector, and shifts in aggregate demand and consumption away from goods and toward services. Trade policy has also played a part, notably China’s entry into the World Trade Organization (WTO) in 2001 and the subsequent dramatic expansion of its role in global manufacturing supply chains.

Contrary to what President Trump suggests, manufacturing’s shrinking place in the overall economy is not a uniquely American phenomenon. As Harvard economist Robert Lawrence recently observed “the employment share of manufacturing is declining in mature economies regardless of their overall industrial policy approaches. The trend is apparent both in economies that have adopted free-market policies… and in those with interventionist policies… All of the evidence points to deep and powerful forces that drive the long-term decline in manufacturing’s share of jobs and GDP as countries become richer.”

This brings us back to the president’s seeming determination to rapidly ramp up manufacturing investment and production as a core element of his “America First” program. An important issue overlooked by the administration is where to find the workers to staff a resurgent U.S. manufacturing sector. For while manufacturing has become a notably “capital-intensive” part of the U.S. economy, workers are still needed. And today, it’s hard to see where they will be found. This is especially true given the Trump administration’s well-advertised skepticism about the benefits of immigration.

According to the U.S. Bureau of Labor Statistics, the current unemployment rate across America’s manufacturing industries collectively stands at a record low 2.9 per cent, well below the economy-wide rate of 4.5 per cent. In a recent survey by the National Association of Manufacturers, almost 70 per cent of American manufacturers cited the inability to attract and retain qualified employees as the number one barrier to business growth. A cursory look at the leading industry trade journals confirms that skill and talent shortages remain persistent in many parts of U.S. manufacturing—and that shortages are destined to get worse amid the expected significant jump in manufacturing investment being sought by the Trump administration.

As often seems to be the case with Trump’s stated policy objectives, the math surrounding his manufacturing agenda doesn’t add up. Manufacturing in America is in far better shape than the president acknowledges. And a tariff-driven avalanche of manufacturing investment—should one occur—will soon find the sector reeling from an unprecedented human resource crisis.

Jock Finlayson

Senior Fellow, Fraser Institut

2025 Federal Election

POLL: Canadians want spending cuts

By Gage Haubrich

By Gage Haubrich

The Canadian Taxpayers Federation released Leger polling showing Canadians want the federal government to cut spending and shrink the size and cost of the bureaucracy.

“The poll shows most Canadians want the federal government to cut spending,” said Gage Haubrich, CTF Prairie Director. “Canadians know they pay too much tax because the government wastes too much money.”

Between 2019 and 2024, federal government spending increased 26 per cent even after accounting for inflation. Leger asked Canadians what they think should happen to federal government spending in the next five years. Results of the poll show:

- 43 per cent say reduce spending

- 20 per cent say increase spending

- 16 per cent say maintain spending

- 20 per cent don’t know

The federal government added 108,000 bureaucrats and increased the cost of the bureaucracy 73 per cent since 2016. Leger asked Canadians what they think should happen to the size and cost of the federal bureaucracy. Results of the poll show:

- 53 per cent say reduce

- 24 per cent say maintain

- 4 per cent say increase

- 19 per cent don’t know

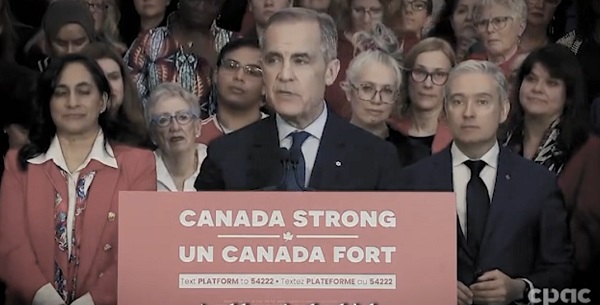

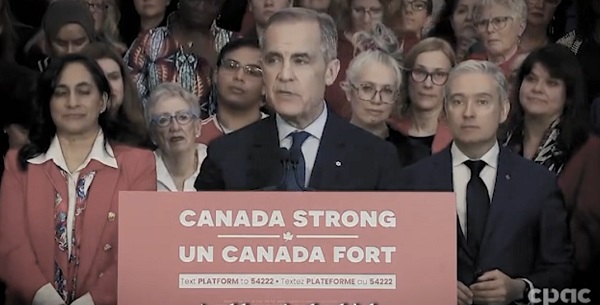

Liberal Leader Mark Carney promised to “balance the operating budget in three years.” Leger asked Canadians if they believed Carney’s promise to balance the budget. Results of the poll show:

- 58 per cent are skeptical

- 32 per cent are confident

- 10 per cent don’t know

“Any politician that wants to fix the budget and cut taxes will need to shrink the size and cost of Ottawa’s bloated bureaucracy,” Haubrich said. “The polls show Canadians want to put the federal government on a diet and they won’t trust promises about balancing the budget unless politicians present credible plans.”

2025 Federal Election

Carney’s budget means more debt than Trudeau’s

The Canadian Taxpayers Federation is criticizing Liberal Party Leader Mark Carney’s budget plan for adding another $225 billion to the debt.

“Carney plans to borrow even more money than the Trudeau government planned to borrow,” said Franco Terrazzano, CTF Federal Director. “Carney claims he’s not like Trudeau and when it comes to the debt, here’s the truth: Carney’s plan is billions of dollars worse than Trudeau’s plan.”

Today, Carney released the Liberal Party’s “fiscal and costing plan.” Carney’s plan projects the debt to increase consistently.

Here is the breakdown of Carney’s annual budget deficits:

- 2025-26: $62 billion

- 2026-27: $60 billion

- 2027-28: $55 billion

- 2028-29: $48 billion

Over the next four years, Carney plans to add an extra $225 billion to the debt. For comparison, the Trudeau government planned on increasing the debt by $131 billion over those years, according to the most recent Fall Economic Statement.

Carney’s additional debt means he will waste an extra $5.6 billion on debt interest charges over the next four years. Debt interest charges already cost taxpayers $54 billion every year – more than $1 billion every week.

“Carney’s debt binge means he will waste $1 billion more every year on debt interest charges,” Terrazzano said. “Carney’s plan isn’t credible and it’s even more irresponsible than the Trudeau plan.

“After years of runaway spending Canadians need a government that will cut spending and stop wasting so much money on debt interest charges.”

-

Alberta2 days ago

Alberta2 days agoProvince to expand services provided by Alberta Sheriffs: New policing option for municipalities

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoIs HNIC Ready For The Winnipeg Jets To Be Canada’s Heroes?

-

Alberta2 days ago

Alberta2 days agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNo Matter The Winner – My Canada Is Gone

-

Health2 days ago

Health2 days agoHorrific and Deadly Effects of Antidepressants

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCampaign 2025 : The Liberal Costed Platform – Taxpayer Funded Fiction

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoA Perfect Storm of Corruption, Foreign Interference, and National Security Failures