From the Fraser Institute By Ross McKitrick Canadian federal politicians are floundering in their responses to Donald Trump’s tariff and annexation threats. Unfortunately, they’re stuck in a...

From the Fraser Institute By Steven Globerman To state the obvious, president-elect Donald Trump’s threat to impose an across-the-board 25 per cent tariff on Canadian exports to...

From the Fraser Institute By Elmira Aliakbari and Jason Clemens As Donald Trump, who will be sworn in as president on Monday, threatens to impose tariffs...

From the Fraser Institute By Ben Eisen In the days following Prime Minister Justin Trudeau’s resignation as leader of the Liberal Party, there has been much...

From the Fraser Institute By Kenneth P. Green Canada has a regulation problem. Our economy is over-regulated and the regulatory load is growing. To reverse this trend, we...

From the Fraser Institute By Tegan Hill After recently meeting with president-elect Donald Trump, Premier Danielle Smith warned that Trump’s tariffs could include oil. That’s just one more...

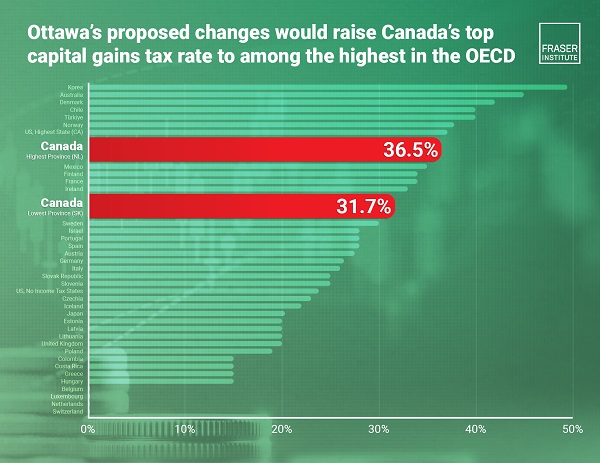

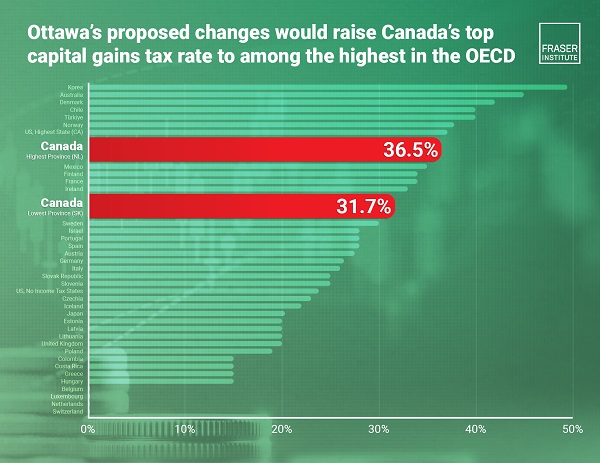

From the Fraser Institute By Jake Fuss and Grady Munro Ottawa’s proposed increase to the effective capital gains tax rate will result in Canada having among...

From the Fraser Institute By Tegan Hill and Jake Fuss This fiscal year (2024/25), the federal government and eight out of 10 provinces project a budget deficit, meaning...

From the Fraser Institute By Jake Fuss and Grady Munro On Monday outside Rideau Cottage in Ottawa, after Prime Minister Justin Trudeau told Canadians he plans...

From the Fraser Institute By Tegan Hill In a recent CBC interview, Premier Danielle Smith said she would “love to be able to accelerate our tax cut,” referring...