Business

Sweet Capones making sweet dreams come true with special training opportunities for employees

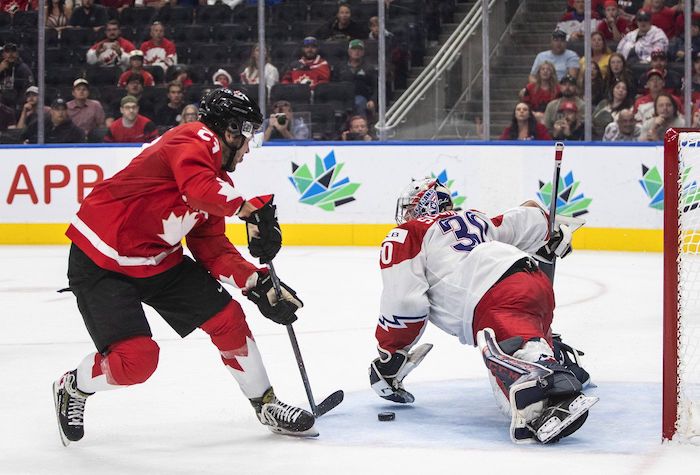

Pictured here is Ciarrea Martin, café manager of Sweet Capone’s Red Deer location. The popular bakery is gearing up to launch training programs to help folks have a better chance of landing employment.

By Mark Weber

Known for their scrumptious cannolis, Sweet Capone’s Italian Bakery and Cannoli Shop is now launching what promises to be life-changing training opportunities.

“I was a paramedic before we started Sweet Capone’s and I absolutely loved my job; I loved helping people,” explained Carina Moran who owns the bakery along with her husband Joel.

They first opened the popular establishment six years ago, having since expanded to Lacombe as well. An injury forced a shift in direction from being a paramedic, and thus the establishment of Sweet Capone’s – which has met with tremendous success.

“I first started selling our family’s cannolis out of our house, but I always felt that the shop needed to stand for something much more – that was always on my heart,” she said. “We’ve always been ‘seeding’ into organizations around us – we’ve been helping local soup kitchens, homeless shelters and women’s shelters by giving donations. It’s a wonderful way to help, but I think the thing we have always had an issue with that it never felt like it was enough,” she said, adding that she has felt how vital it is to support those need help – particularly folks who need a hand in landing employment. “There are people who are constantly looked over – they want to have job skills, and they want others to take a chance on them, but they are often given a pass.”

To date, Carina and Joel have made it a priority to hire those who could use an opportunity to put their gifts and skills to work, but just haven’t been given the chance.

Take Ciarrea, who manages the café in the Red Deer location. A single mom at a young age, she didn’t have managerial experience at first.

“Sweet Capone’s was her very first job. We have believed in her, and we’ve given her opportunity because really – at the end of the day – she did have managerial skills through having to manage a house with two little kids,” noted Carina.

“Now, she’s our manager and we’ve also sent her back to school to take managerial courses. And then one of our delivery drivers is a war veteran – again, he needed someone to take a chance on him.”

Some of Sweet Capone’s bakery workers are immigrants who simply needed an open door to walk through as well. So that has been the approach the couple has consistently taken. But it’s all about to be taken to a new level.

“One of my favourite quotes is from Desmond Tutu – ‘Instead of pulling people out of the water, we need to go upstream and find out why they are falling in in the first place’,” said Carina. “If we give people a chance to develop skills and confidence in themselves; to have someone believe in them and give them an opportunity – I really believe it could help to save them before they got to a place of entering a world where nobody would help them out. They may then start seeking other paths or other things that don’t serve them well.”

To that end, a recent grant to help develop women entrepreneurs is helping Sweet Capone’s to take on a new kind of mission – to be able to provide training to those who need an open door so they can build a better life and a more secure future.

“We are already on the way to making plans about what it would look like to have another location somewhere else, and how can we get that up and running? What organizations are we going to work with to help us with the training competent?”

She also has her eye on those emerging from treatment programs who need someone to offer them a chance when it comes to employment.

Ultimately, Carina points to her Christian faith as being the key inspiration behind delving into this exciting new venture. “I feel like there are so many people in this world who just get passed over, and they just aren’t given a chance.”

She also believes it will take a team to bring this vision ultimately to fruition.

“To see Ciaerra grow and also surprise herself with what she is capable of when all she needed was the opportunity – it’s 100 per cent her – she shows up every day and she just gives it her all,” explained Carina. “Watching her grow in a safe environment has been very, very cool.”

At the end of the day, Carina emphasizes that this initiative is all about others.

“I’m a girl of faith, and God has put this on my heart,” she explained. “I’m just obeying Him – I’m just doing what He told me to do. That’s it. It’s always been on my heart – He has had this on my heart since day one.”

She has also been inspired by her own kids – who launched the Caring Cookie Company a few years back. “They raised money for the homeless shelter, but what it also did for my husband and I is it showed us how easy it is to get caught up as a business owner in the world of profit,” she explained. “The boys brought it back down to what matters. Sometimes, you stop seeing the human side of things, and our kids really showed us that. We really started to think about what we’re doing with our lives – what are we doing with this business?”

It really boils down to taking a step of faith.

“You have to step out with that intention first of all – and the rest will follow.”

As mentioned, Ciarrea started with Sweet Capone’s nearly four years ago. “Essentially, I had never had a job before coming here,” she explained. “I really wanted to work, so I was looking for a job everywhere.”

Ciarrea explained to Carina how much she loved the bakery and told her how much she would like to work at Sweet Capone’s.

It wasn’t long before she got a call about a position that had opened.

“It was a couple of shifts a week, and I said yes! Anything – just to be at the store,” she recalled.

Over time, she learned the day-to-day routines at the bakery and has never looked back.

Like Carina, her Christian faith inspires her in virtually everything she does. And her sense of gratitude is unmistakable. “They were just very willing, (and welcomed) us with open arms,” Ciarrea added, reflecting on those early days.

“Every time I have had any type of struggle, complication or an area that I’ve needed work in, they’ve always taken me under their wing.”

“There are things that I need to work on as well, and Carina isn’t afraid to tell me that,” she said. “It’s incredible for me because I love to grow and learn. It’s been incredible to work alongside them both, and to see how they do things. They are an amazing team!”

She’s thrilled with the news about the expanded training programs. With aspirations of one day owning her own eatery, Ciarrea is indeed grateful for the experience and the wisdom that the Morans have poured into her life. And ultimately, she certainly agrees that it’s also about giving someone an opportunity. It’s often at that point that their true potential has the chance to flourish.

“It’s about having that understanding that maybe just looking at a piece of paper isn’t a complete description or definition of a person,” she explained. “I also know that from the beginning, we have stood for helping to raise people up – whether it be in their personal lives or work lives.”

Business

Large-scale energy investments remain a pipe dream

I view the recent announcements by the Government of Canada as window dressing, and not addressing the fundamental issue which is that projects are drowning in bureaucratic red tape and regulatory overburden. We don’t need them picking winners and losers, a fool’s errand in my opinion, but rather make it easier to do business within Canada and stop the hemorrhaging of Foreign Direct Investment from this country.

Thanks for reading William’s Substack!

Subscribe for free to receive new posts and support my work.

Changes are afoot—reportedly, carve-outs and tweaks to federal regulations that would help attract investment in a new oil pipeline from Alberta. But any private proponent to come out of this deal will presumably be handpicked to advance through the narrow Bill C-5 window, aided by one-off fixes and exemptions.

That approach can only move us so far. It doesn’t address the underlying problem.

Anyone in the investment world will tell you a patchwork of adjustments is nowhere near enough to unlock the large-scale energy investment this country needs. And from that investor’s perspective, the horizon stretches far beyond a single political cycle. Even if this government promises clarity today in the much-anticipated memorandum of understanding (MOU), who knows whether it will be around by the time any major proposal actually moves forward.

With all of the talk of “nation-building” projects, I have often been asked what my thoughts are about what we must see from the federal government.

The energy sector is the file the feds have to get right. It is by far the largest component of Canadian exports, with oil accounting for $147 billion in 2024 (20 percent of all exports), and energy as a whole accounting for $227 billion of exports (30 percent of all exports).

Furthermore, we are home to some of the largest resource reserves in the world, including oil (third-largest in proven reserves) and natural gas (ninth-largest). Canada needs to wholeheartedly embrace that. Natural resource exceptionalism is exactly what Canada is, and we should be proud of it.

One of the most important factors that drives investment is commodity prices. But that is set by market forces.

Beyond that, I have always said that the two most important things one considers before looking at a project are the rule of law and regulatory certainty.

The Liberal government has been obtuse when it comes to whether it will continue the West Coast tanker ban (Bill C-48) or lift it to make way for a pipeline. But nobody will propose a pipeline without the regulatory and legal certainty that they will not be seriously hindered should they propose to build one.

Meanwhile, the proposed emissions cap is something that sets an incredibly negative tone, a sentiment that is the most influential factor in ensuring funds flow. Finally, the Impact Assessment Act, often referred to as the “no more pipelines bill” (Bill C-69), has started to blur the lines between provincial and federal authority.

All three are supposedly on the table for tweaks or carve-outs. But that may not be enough.

It is interesting that Norway—a country that built its wealth on oil and natural gas—has adopted the mantra that as long as oil is a part of the global economy, it will be the last producer standing. It does so while marrying conventional energy with lower-carbon standards. We should be more like Norway.

Rather than constantly speaking down to the sector, the Canadian government should embrace the wealth that this represents and adopt a similar narrative.

The sector isn’t looking for handouts. Rather, it is looking for certainty, and a government proud of the work that they do and is willing to say so to Canada and the rest of the world. Foreign direct investment outflows have been a huge issue for Canada, and one of the bigger drags on our economy.

Almost all of the major project announcements Prime Minister Mark Carney has made to date have been about existing projects, often decades in the making, which are not really “additive” to the economy and are reflective of the regulatory overburden that industry faces en masse.

I have always said governments are about setting the rules of the game, while it is up to businesses to decide whether they wish to participate or to pick up the ball and look elsewhere.

Capital is mobile and will pursue the best risk-adjusted returns it can find. But the flow of capital from our country proves that Canada is viewed as just too risky for investors.

The government’s job is not to try to pick winners and losers. History has shown that governments are horrible at that. Rather, it should create a risk-appropriate environment with stable and capital-attractive rules in place, and then get out of the way and see where the chips fall.

Link to The Hub article: Large-scale energy investments remain a pipe dream

Formerly the head of institutional equity research at FirstEnergy Capital Corp and ATB Capital Markets. I have been involved in the energy sector in either the sell side or corporately for over 25 years

Thanks for reading William’s Substack!

Subscribe for free to receive new posts and support my work.

Business

I Was Hired To Root Out Bias At NIH. The Nation’s Health Research Agency Is Still Sick

From the Daily Caller News Foundation

By Joe Duarte

Federal agencies like the National Institutes of Health (NIH) continue to fund invalid, ideologically driven “scientific” research that subsidizes leftist activists and harms conservatives and the American people at large. There’s currently no plan to stop.

Conversely, NIH does not fund obvious research topics that would help the American people, because of institutional leftist bias.

While serving as a senior advisor at NIH, I discovered many active grants like these:

“Examining Anti-Racist Healing in Nature to Protect Telomeres of Transitional Age BIPOC for Health Equity” — Take minority teens to parks in a bid to reduce telomere erosion (the shortening of repetitive DNA sequences as we age). $3.8 million in five years and no results published – not surprising, given their absurd premise.

“Ecological Momentary Assessment of Racial/Ethnic Microaggressions and Cannabis Use among Black Adults” – This rests on an invalid leftist ideological concept – “microaggressions.” An example of a “microaggression” is a white person denying he’s racist. They can’t be validly measured since they’re simply defined into existence by Orwellian leftist ideology, with no attempt to discover the alleged aggressor’s motives.

“Influence of Social Media, Social Networks, and Misinformation on Vaccine Acceptance Among Black and Latinx Individuals” — from an activist who said the phrase “The coronavirus is genetically engineered” was “misinformation” and also conducted a bizarre, partisan study based entirely on a Trump tweet about recovering from COVID.

I will be leaving the great Walter Reed Medical Center today at 6:30 P.M. Feeling really good! Don’t be afraid of Covid. Don’t let it dominate your life. We have developed, under the Trump Administration, some really great drugs & knowledge. I feel better than I did 20 years ago!

— Donald J. Trump (@realDonaldTrump) October 5, 2020

The study claimed that people saw COVID as less “serious” after the tweet. I apologize for the flashback to when Democrats demanded everyone feel the exact level of COVID panic and anti-optimism they felt (and share their false beliefs on the efficacy of school closures, masks, and vaccines ). NIH funded this study and gave him another $651,586 in July for his new “misinformation” study, including $200,000 from the Office of the Director.

I’m a social psychologist who has focused on the harms of ideological bias in academic research. Our sensemaking institutions have been gashed by a cult political ideology that treats its conjectures and abstractions as descriptively true, without argument or even explanation, and enforces conformity with inhumane psychologizing and ostracism. This ideology – which dominates academia and NIH – poses an unprecedented threat to our connection to reality, and thus to science, by vaporizing the distinction between descriptive reality and ideological tenets.

In March, I emailed Jay Bhattacharya, Director of NIH, and pitched him on how I could build an objective framework to eliminate ideological bias in NIH-funded research.

Jay seemed to agree with my analysis. We spoke on the phone, and I started in May as a senior advisor to Jay in the Office of the Director (NIH-OD).

I never heard from Jay again beyond a couple of cursory replies.

For four months, I read tons of grants, passed a lengthy federal background check, started to build the pieces, and contacted Jay about once a week with questions, follow-up, and example grants. Dead air – he was ghosting me.

Jay also bizarrely deleted the last two months’ worth of my messages to him but kept the older ones. I’d sent him a two-page framework summary, asked if I should keep working on it, and also asked if I’d done something wrong, given his persistent lack of response. No response.

In September, the contractors working at NIH-OD, me included, were laid off. No explanation was given.

I have no idea what happened here. It’s been the strangest and most unprofessional experience of my career.

The result is that NIH is still funding ideological, scientifically invalid research and will continue to ignore major topics because of leftist bias. We have a precious opportunity for lasting reform, and that opportunity will be lost without a systematic approach to eliminating ideology in science.

What’s happened so far is that DOGE cut some grants earlier this year, after a search for DEI terms. It was a good first step but caught some false positives and missed most of the ideological research, including many grants premised on “microaggressions,” “systemic racism,” “intersectionality,” and other proprietary, question-begging leftist terms. Leftist academics are already adapting by changing their terminology – this meme is popular on Bluesky:

DOGE didn’t have the right search terms, and a systematic, objective anti-bias framework is necessary to do the job. It’s also more legally resilient and persuasive to reachable insiders — there’s no way to reform a huge bureaucracy without getting buy-in from some insiders (yes, you also have to fire some people). This mission requires empowered people at every funding agency who are thoroughly familiar with leftist ideology, can cleanly define “ideology,” and build robust frameworks to remove it from scientific research.

My framework identifies four areas of bias so far:

- Ideological research

- Rigged research

- Ideological denial of science / suppression of data

- Missing research – research that would happen if not for leftist bias

The missing research at NIH likely hurts the most — e.g. American men commit suicide at unusually high rates, especially white and American Indian men, yet NIH funds no research on this. But they do fund “Hypertension Self-management in Refugees Living in San Diego.”

Similarly, NIH is AWOL on the health benefits of religious observance and prayer, a promising area of research that Muslim countries are taking the lead on. These two gaping holes suggest that NIH is indifferent to the American people and even culturally and ideologically hostile them.

Joe Duarte grew up in small copper-mining towns in Southern Arizona, earned his PhD in social psychology, and focuses on political bias in media and academic research. You can find his work here, find him on X here, and contact him at gravity at protonmail.com.

-

COVID-197 hours ago

COVID-197 hours agoNew report warns Ottawa’s ‘nudge’ unit erodes democracy and public trust

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoBurying Poilievre Is Job One In Carney’s Ottawa

-

Great Reset2 days ago

Great Reset2 days agoEXCLUSIVE: A Provincial RCMP Veterans’ Association IS TARGETING VETERANS with Euthanasia

-

Health2 days ago

Health2 days agoDisabled Canadians petition Parliament to reverse MAiD for non-terminal conditions

-

COVID-192 days ago

COVID-192 days agoCovid Cover-Ups: Excess Deaths, Vaccine Harms, and Coordinated Censorship

-

Daily Caller2 days ago

Daily Caller2 days agoSpreading Sedition? Media Defends Democrats Calling On Soldiers And Officers To Defy Chain Of Command

-

Digital ID2 days ago

Digital ID2 days agoLeslyn Lewis urges fellow MPs to oppose Liberal push for mandatory digital IDs

-

Crime1 day ago

Crime1 day agoHow Global Organized Crime Took Root In Canada