Business

Solving the Housing Affordability Crisis With This One Cool Trick

As you’ll soon see, local and provincial governments – if they were so inspired – could drop the purchase price on new homes by 20 percent. Before breakfast.

The Audit is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

It’s all about taxes and fees. This post will focus mostly on taxes and fees as they apply to new construction of relatively expensive detached homes. But the basic ideas will apply to all homes – and will also impact rentals.

Here are some estimated numbers to chew on. Scenarios based on varying permutations and combinations will produce different results, but I think this example will be a good illustration.

Let’s say that a developer purchases a single residential plot in Toronto for $1.4 million. In mature midtown neighborhoods, that figure is hardly uncommon. The plan is to build an attractive single family home and then sell it on the retail market.

Here are some estimates of the costs our developer will currently face:

- Construction costs on a 2,000 sq. ft. home (@ $350/sq. ft.): $700,000

- Land transfer taxes on the initial land purchase: $35,000

- Development fees: $100,000

- Permits and zoning/site approvals: $40,000

Total direct development costs would therefore come to $875,000. Of course, that’s besides the $1.4 million purchase price for the land which would bring our new running total to $2,275,000.

We’ll also need to account for the costs of regulatory delays. Waiting for permits, approvals, and environmental assessments can easily add a full year to the project. Since nothing can begin until the developer has legal title to the property, he’ll likely be paying interest for a mortgage representing 80 percent of the purchase price (i.e., $1,120,000). Even assuming a reasonable rate, that’ll add another $60,000 in carrying charges. Which will bring us to $2,335,000.

And don’t forget lawyers and consultants. They also have families to feed! Professional guidance for navigating through the permit and assessment system can easily cost a developer another $25,000.

That’s not an exhaustive list, by the way. To keep things simple, I left out Toronto’s Parkland Dedication Fee which, for residential developments, can range from 5 to 20 percent of the land value. And the Education Development Charges imposed by school boards was also ignored.

So assuming everything goes smoothly – something that’s far from given – that’ll give us a total development cost of $2,360,000. To ensure compensation for the time, work, investments, and considerable risks involved, our developer is unlikely to want to sell the home for less than $2,700,000.

But various governments are still holding their hands out. When the buyers sign an agreement of purchase, they’ll be on the hook for land transfer taxes and – since it’s a new house – HST. Ontario and Toronto will want about four percent ($108,000) for the transfer (even though they both just cashed in on the very same transfer tax for the very same land at the start of the process). And, even taking into account both the federal and Ontario rebates, getting the keys to the front door will require handing over another $327,000 for HST.

Here’s how development fee schedules currently look in Toronto:

And here’s a breakdown of the land transfer taxes assessed against anyone buying land:

In our hypothetical case, those fees would give us a total, all-in purchase price of $3,135,000. How much of that is due to government involvement (including associated legal and interest fees)? Around $695,000.

That’s $695,000 our buyers will pay – over and above the actual costs of land and construction. Or, in other words, a 22 percent markup.

Let’s put this a different way. If the cost of the median home in Canada dropped by 22 percent, then around 1.5 million extra Canadian households could enter the market. Congratulations, you’ve solved the housing affordability crisis. (Although supply problems will still need some serious work.)

Now it’s probably not realistic to expect politicians in places like the Ontario Legislature and Toronto City Council to give up that kind of income. But just lowering their intake by 50 or even 25 percent – and reducing the costs and pain points of acquiring permits – could make a serious difference. Not only would it lower home sale prices, but it would lower the barriers to entry for new home construction.

Just what were all those taxes worth to governments? Let’s begin with the City of Toronto. Their 2023 Financial Report tells us that land transfer taxes generated $944 million, permits and zoning applications delivered $137 million, and development fees accounted for $1.45 billion. Total city revenues in 2023 were $16.325 billion.

We’re told that all that money was spent on:

- Roads and transit systems

- Water and wastewater systems

- Fire and emergency services

- Parks and recreation facilities

- Libraries

Well, we do need those things right? We can’t expect the city to just eliminate fire and emergency services.

Wait. Hang on. I seem to recall being told that revenue from my property tax bill covered those services. Yes! My property tax did fund those things. Not 100 percent of those things, but a lot.

Specifically, Toronto property tax revenues cover 65 percent of the municipal costs for roads and transit systems, 85 percent of fire and emergency services, 75 percent of parks and recreation facilities, and 95 percent of library costs (even though very few people use public libraries any more).

Granted, property tax revenue covered only five percent of water and wastewater systems, but that’s because another 40 percent came from user fees (i.e., utility bills).

So revenues from land transfer taxes, developer fees, and permitting aren’t an insignificant portion of City income, but they’re hardly the linchpin propping the whole thing up either. City Council could respond to losing that income by increasing property taxes. Or – and I’m just throwing around random ideas here – they could reduce their spending.

Now what about the province? I couldn’t get a good sense of how much of their HST revenue comes specifically from new home sales, but Ontario’s 2023–24 consolidated financial statements tell us that provincial land transfer taxes brought in $3.538 billion. That would be around 1.7% of total government revenues. Again, a bit more than a rounding error.

Politics is about finding balances through trade offs. Sure, maintaining program spending while minimizing deficits is an ongoing and real challenge for governments. On the other hand, they all say they’re concerned about the housing crisis. Foregoing just one to five percent of revenues should, given the political payoffs and bragging rights that could follow, probably be an easy pill to swallow.

A few weeks ago I reached out to the City of Toronto Housing Secretariat and the Province of Ontario’s Municipal Affairs and Housing for their thoughts. I received no response.

The Audit is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Business

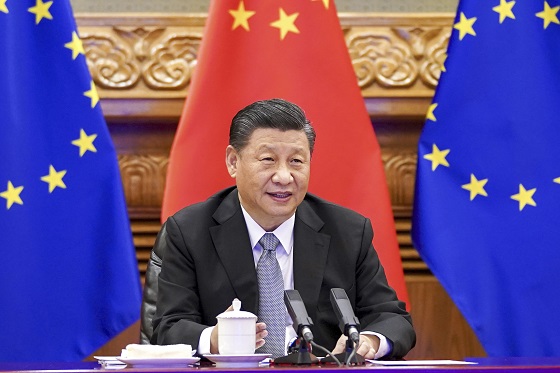

Chinese firm unveils palm-based biometric ID payments, sparking fresh privacy concerns

By Ken Macon

Alipay’s biometric PL1 scanner uses vein and palm-print data for processing payments, raising security concerns over the storage and use of permanent biometric data.

Alipay, the financial arm of Alibaba, has introduced a new palm-based biometric terminal, dubbed the PL1, which enables individuals to make purchases simply by presenting their hand – no phone, card, or PIN required. Positioned as a faster, touch-free alternative for payment, this system reflects a growing industry shift toward frictionless biometric transactions.

At the core of the PL1 is a dual-mode recognition system that combines surface palm print detection with internal vein mapping. This multi-layered authentication relies on deeply unique biological signatures that are significantly harder to replicate than more common methods like fingerprints or facial scans. Alipay reports that the device maintains a false acceptance rate of less than one in a million, suggesting a substantial improvement in resisting identity spoofing.

Enrollment is designed to be quick: users hover their palm over the sensor and link their account through a QR code. Once registered, purchases are completed in around two seconds without physical interaction. During early trials in Hangzhou, this system reportedly accelerated checkout lines and contributed to more hygienic point-of-sale environments.

The PL1 arrives at a time of rapid expansion in the biometric payments sector. Forecasts estimate that more than 3 billion people will use biometrics for transactions by 2026, with total payments surpassing $5 trillion. Major players are already onboard: Amazon has integrated palm authentication across U.S. retail and healthcare facilities, while JP Morgan is gearing up for a national deployment in the same year.

Alipay envisions the PL1’s use extending well beyond checkout counters. It is exploring applications in public transit, controlled access facilities, and healthcare check-ins, reflecting a broader trend toward embedding biometric systems in daily infrastructure. However, while domestic deployment benefits from favorable policy conditions, international expansion may be constrained by differing legal standards, particularly in jurisdictions that enforce stringent rules on biometric data usage and consent.

Despite the technological advancements and convenience the PL1 offers, privacy remains a major point of contention. Unlike passwords or cards that can be reset or replaced, biometric data is immutable. If compromised, individuals cannot simply “change” their palm patterns or vein structures. This permanence heightens the stakes of any potential data breach and raises long-term concerns about identity theft and surveillance.

Alipay’s approach, storing encrypted biometric templates locally on devices and restricting data flow within national border, does address certain regulatory demands, especially within China, but the broader implications of biometrics are likely to be a growing privacy and surveillance concern in the coming years.

Business

Trump considers $5K bonus for moms to increase birthrate

MxM News

MxM News

Quick Hit:

President Trump voiced support Tuesday for a $5,000 cash bonus for new mothers, as his administration weighs policies to counter the country’s declining birthrate. The idea is part of a broader push to promote family growth and revive the American family structure.

Key Details:

- Trump said a reported “baby bonus” plan “sounds like a good idea to me” during an Oval Office interview.

- Proposals under consideration include a $5,000 birth bonus, prioritizing Fulbright scholarships for parents, and fertility education programs.

- U.S. birthrates hit a 44-year low in 2023, with fewer than 3.6 million babies born.

Diving Deeper:

President Donald Trump signaled his support Tuesday for offering financial incentives to new mothers, including a potential $5,000 cash bonus for each child born, as part of an effort to reverse America’s falling birthrate. “Sounds like a good idea to me,” Trump told The New York Post in response to reports his administration is exploring such measures.

The discussions highlight growing concern among Trump administration officials and allies about the long-term implications of declining fertility and family formation in the United States. According to the report, administration aides have been consulting with pro-family advocates and policy experts to brainstorm solutions aimed at encouraging larger families.

Among the proposals: a $5,000 direct payment to new mothers, allocating 30% of all Fulbright scholarships to married applicants or those with children, and launching federally supported fertility education programs for women. One such program would educate women on their ovulation cycles to help them better understand their reproductive health and increase their chances of conceiving.

The concern stems from sharp demographic shifts. The number of babies born in the U.S. fell to just under 3.6 million in 2023—down 76,000 from 2022 and the lowest figure since 1979. The average American family now has fewer than two children, a dramatic drop from the once-common “2.5 children” norm.

Though the birthrate briefly rose from 2021 to 2022, that bump appears to have been temporary. Additionally, the age of motherhood is trending older, with fewer teens and young women having children, while more women in their 30s and 40s are giving birth.

White House Press Secretary Karoline Leavitt underscored the administration’s commitment to families, saying, “The President wants America to be a country where all children can safely grow up and achieve the American dream.” Leavitt, herself a mother, added, “I am proud to work for a president who is taking significant action to leave a better country for the next generation.”

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

John Stossel2 days ago

John Stossel2 days agoClimate Change Myths Part 2: Wildfires, Drought, Rising Sea Level, and Coral Reefs

-

Media2 days ago

Media2 days agoCBC retracts false claims about residential schools after accusing Rebel News of ‘misinformation’

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCHINESE ELECTION THREAT WARNING: Conservative Candidate Joe Tay Paused Public Campaign

-

Business2 days ago

Business2 days ago‘Great Reset’ champion Klaus Schwab resigns from WEF

-

Bjorn Lomborg2 days ago

Bjorn Lomborg2 days agoNet zero’s cost-benefit ratio is CRAZY high

-

International2 days ago

International2 days agoPope Francis’ funeral to take place Saturday

-

Business16 hours ago

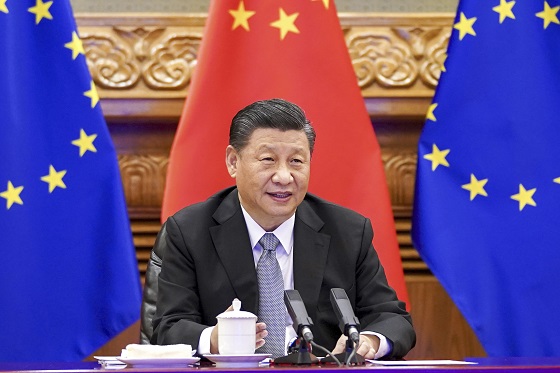

Business16 hours agoTrump: China’s tariffs to “come down substantially” after negotiations with Xi