CBDC Central Bank Digital Currency

Senator Ted Cruz introduces bill to ban CBDCs to prevent US from becoming ‘surveillance state’

From LifeSiteNews

Heritage Action for America warned that ‘anti-CBDC legislation is necessary to safeguard Americans’ financial privacy in the face of potential surveillance, control, and political intimidation.’

U.S. Sen. Ted Cruz introduced the CBDC Anti-Surveillance State Act to prohibit the Federal Reserve from issuing a central bank digital currency (CBDC) that Republican sponsors of the bill believe could turn the nation into a “surveillance state” by handing over control of personal finances to federal government agencies.

While digital currency offers some attractive features, it also would grant the federal government unlimited opportunity to weaponize the technology against citizens, allowing it to both spy on the spending habits of everyday Americans and block access to the money in their personal bank accounts.

U.S. House Majority Whip Tom Emmer of Minnesota described the threat of a U.S. CBDC last fall:

Unlike decentralized cryptocurrencies, like Bitcoin, a CBDC is a digital form of sovereign currency that is designed and issued by a government and transacts on a digital ledger that is controlled by that government. In short, a CBDC is government-controlled programmable money that, if not designed to emulate cash, could give the federal government the ability to surveil Americans’ transactions and choke out politically unpopular activity.

A government-issued CBDC is nothing more than a CCP-style surveillance tool that would be used to undermine the American way of life.

“While Americans across the country are being punished for thinking, speaking, and voting the ‘wrong’ way, the last thing we need is the government surveilling personal finances,” explained a statement from Heritage Action for America concerning the new legislation. “Anti-CBDC legislation is necessary to safeguard Americans’ financial privacy in the face of potential surveillance, control, and political intimidation.”

“CBDCs present major privacy concerns for everyday Americans, including granting the government the ability to collect intimate personal details on U.S. citizens, and potentially track and freeze funds for any reason,” the Blockchain Association noted.

Sen. Cruz, chief sponsor of the bill, said, “The Biden administration salivates at the thought of infringing on our freedom and intruding on the privacy of citizens to surveil their personal spending habits, which is why Congress must clarify that the Federal Reserve has no authority to implement a CBDC.”

“Big government has no business spying on Americans to control their personal finances and track their transactions,” said Republican U.S. Sen. Rick Scott of Florida, a co-sponsor of the bill. “It is a massive overreach.”

In early 2022, the Biden administration urged the Fed to investigate the creation of a CBDC.

“Over 100 countries are exploring or piloting Central Bank Digital Currencies (CBDCs),” said Biden, warning that the U.S. “must play a leading role in international engagement and global governance of digital assets consistent with democratic values and U.S. global competitiveness.”

But many Republicans see this as nothing more than a means to turn America into a totalitarian state.

Pushback against a U.S. CBDC has become an integral part of the messaging of 2024’s presidential hopefuls.

Last month, former President Donald Trump pledged to ban a CBDC if re-elected to the White House.

“As your president, I will never allow the creation of a Central Bank Digital Currency,” Trump told a crowd during a campaign event in New Hampshire.

“Such a currency would give a federal government — our federal government — absolute control over your money,” Trump said. “They could take your money, and you wouldn’t even know it was gone.”

“This would be a dangerous threat to freedom, and I will stop it from coming to America,” he vowed.

Even Robert F. Kennedy Jr., a former Democrat now running as an Independent presidential candidate, has warned that CBCDs are “a calamity for human rights and for civil rights” while similarly promising to halt progress by the Fed from creating a CBDC.

Eleven countries have already fully implemented CBDCs, including China, where digital currency is tied to a person’s “social credit score.”

The CCP (Chinese Communist Party) uses its extensive network of digital cameras —estimated to be over one billion — combined with facial-recognition capabilities to monitor the daily movements and actions of its citizens. That along with other information collecting capabilities used in conjunction with government-controlled digital currency allows the CCP to punish those who transgress desired social norms.

While Democrats in Congress have sought to pass legislation authorizing the Fed to institute a CBDC, Republicans have similarly made sought to preempt such a move.

Last fall, Emmer introduced a bill in the U.S. House with the same name as Cruz’s bill, “CBDC Anti-Surveillance State Act,” to” halt the efforts of unelected bureaucrats in Washington, D.C. from issuing a central bank digital currency (CBDC) that dismantles Americans’ right to financial privacy.”

Co-sponsoring the bill with Cruz are Republican Sens. Bill Hagerty of Tennessee, Scott, Ted Budd of North Carolina, and Mike Braun of Indiana.

Carbon Tax

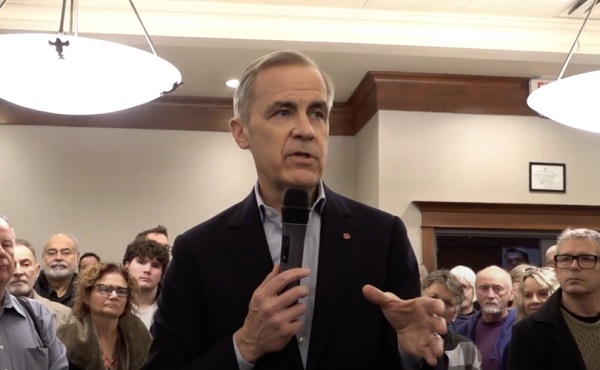

Mark Carney has history of supporting CBDCs, endorsed Freedom Convoy crackdown

From LifeSiteNews

Carney also said last week that he is willing to use all government powers, including “emergency powers,” to enforce his energy plan if elected prime minister.

World Economic Forum-linked Liberal Party leadership frontrunner Mark Carney has a history of supporting central bank digital currencies, and in 2022 supported “choking off the money” donated to the Freedom Convoy.

In his 2021 book Value(s), Carney said that the “future of money” is a “central bank stablecoin, known as a central bank digital currency or CBDC.”

He noted in his book that such a currency would be similar to current cryptocurrencies such as Bitcoin, but without the private nature afforded to it by its decentralization.

“It is simply untenable in democracies that the core of the monetary system could be based on forms of electronic private money whose creators control large blocks of the currency, like Bitcoin,” he wrote. “Cryptocurrencies are not the future of money.”

Carney noted that a CBDC, if “properly designed,” could serve “all the functions to which private cryptocurrencies and stablecoins aspire while addressing the fundamental legal and governance issues that will, in time, undermine those alternatives.”

Expanding on his worldview in relation to CBDCs, Carney suggested that “fear” can be taken advantage of to shape the future of money.

“With fear on the march, people were willing to surrender to Hobbes’ ‘Leviathan’ such basic rights as the freedom to leave their homes,” he wrote. “And so it is with money. People will support the delegation to independent central banks of the tough decisions that are necessary to maintain the value of money provided the authorities deliver monetary and financial stability.”

Some Canadians are alarmed by the prospect of CBDCs, a fear that only worsened after the Liberals under Prime Minister Justin Trudeau froze hundreds of bank accounts it deemed were importantly linked to the 2022 Freedom Convoy.

During the Freedom Convoy, Carney wrote in an op-ed for the Globe and Mail, “Those who are still helping to extend this occupation must be identified and punished to the full force of the law,” adding that “Drawing the line means choking off the money that financed this occupation.”

Carney is a former head of the Bank of Canada and Bank of England. His ties to globalist groups have led to Conservative Party leader Pierre Poilievre calling him the World Economic Forum’s “golden boy.”

In addition to his comments on CBDCs, Carney has a history of promoting anti-life and anti-family agendas, including abortion and LGBT-related efforts. He has also previously endorsed the carbon tax and even criticized Trudeau when the tax was exempted from home heating oil to reduce costs for some Canadians.

Carney also said last week that he is willing to use all government powers, including “emergency powers,” to enforce his energy plan if elected prime minister.

The Liberal Party of Canada will choose its next leader, who will automatically become prime minister, on March 9, after Prime Minister Justin Trudeau announced that he plans to step down as Liberal Party leader once a new leader has been chosen.

In contrast to Carney, Poilievre has promised that if he is elected prime minister, he would stop any implementation of a “digital currency” or a compulsory “digital ID” system.

When it comes to a digital Canadian dollar, the Bank of Canada found that Canadians are very wary of a government-backed digital currency, concluding that a “significant number” of citizens would resist the implementation of such a system.

Business

Black Rock latest to leave Net Zero Alliance

From The Center Square

By

US House committee investigating 60 companies over ESG policies

Blackrock Inc. is the latest to announce it has left a United Nations-backed Net-Zero Banking Alliance (NZBA), among several within one month and not soon after Donald Trump was elected president. It did so as it and roughly 60 companies are being investigated by Congress for allegedly colluding as a “woke ESG cartel” to “impose radical environmental, social, and governance goals on American companies.”

Last month, Goldman Sachs was the first to withdraw from the alliance, followed by Wells Fargo, The Center Square reported. Citigroup, Bank of America, Morgan Stanley and JPMorgan next announced their departure.

According to the “bank-led and UN-convened” alliance, global banks joined, pledging to align their lending, investment and capital markets activities with a net-zero greenhouse gas emissions target by 2050.

Major U.S. banks began leaving the alliance after President-elect Donald Trump vowed to increase domestic oil and natural gas production and pledged to go after “woke” companies.

They also announced their departure two years after 19 state attorneys general launched an investigation into them for alleged deceptive trade practices connected to ESG.

While the companies haven’t appeared to seem daunted by state investigations, Trump’s reelection appears to be a different matter.

“BlackRock has hung in there as long as it could, but the pressure has become too great, and the reputational and legal risks too high, just before Trump takes office. It won’t be the last financial organization to quit a net zero initiative,” Hortense Bioy, Morningstar Analytics director of sustainable investing research, told Bloomberg News.

Texas Comptroller Glenn Hegar has expressed skepticism about companies claiming to withdraw from ESG commitments, noting there is often doublespeak in announcements, The Center Square reported. This includes statements made by Goldman Sachs, JPMorgan and Blackrock.

Blackrock claims its “participation in NZAMi didn’t impact the way we managed client portfolios. Therefore, our departure doesn’t change the way we develop products and solutions for clients or how we manage their portfolios. … Our commitment to helping our clients achieve their investment goals remains unwavering,” Bloomberg reported.

Last month, the U.S. House Judiciary Committee announced it was investigating more than 60 US-based asset managers’ involvement in the alliance, including BlackRock, Inc., JP Morgan Asset Management, Rockefeller Asset Management, State Street Global Advisors, among others.

The committee also issued a report, “Climate Control: Exposing the Decarbonization Collusion in Environmental, Social, and Governance (ESG) Investing,” saying it found “direct evidence of a ‘climate cartel’ consisting of left-wing activists and major financial institutions that collude to impose radical environmental, social, and governance goals on American companies.”

Under the Trump administration, the committee will continue to investigate if “existing civil and criminal penalties and current antitrust law enforcement efforts are sufficient to deter anticompetitive collusion to promote ESG-related goals in the investment industry.” It also maintains that the companies “must answer for their involvement in prioritizing woke investments over their own fiduciary duties.”

The committee sent letters to dozens of entities in 12 states and the District of Columbia requesting them to provide information by Jan. 10. The majority are located in New York, Massachusetts and California.

-

Business2 days ago

Business2 days agoStocks soar after Trump suspends tariffs

-

COVID-192 days ago

COVID-192 days agoBiden Admin concealed report on earliest COVID cases from 2019

-

Business2 days ago

Business2 days agoScott Bessent Says Trump’s Goal Was Always To Get Trading Partners To Table After Major Pause Announcement

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoResearchers Link China’s Intelligence and Elite Influence Arms to B.C. Government, Liberal Party, and Trudeau-Appointed Senator

-

Business1 day ago

Business1 day agoTimeline: Panama Canal Politics, Policy, and Tensions

-

COVID-191 day ago

COVID-191 day agoFauci, top COVID officials have criminal referral requests filed against them in 7 states

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP memo warns of Chinese interference on Canadian university campuses to affect election

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoThe status quo in Canadian politics isn’t sustainable for national unity