Alberta

Qatar, Norway and ‘The Trouble with Canada’

From the Canadian Energy Centre Ltd.

By David Yager

Resource developers in Canada face unique geographical, jurisdictional, regulatory and political obstacles

That Germany has given up on Canada to supply liquefied natural gas (LNG) and instead signed a massive multi-year LNG purchase agreement with Qatar has left many angry and disappointed.

Investment manager and perennial oil bull Eric Nuttall recently visited Qatar and Saudi Arabia and wrote an opinion piece for the Financial Post titled, “Canada could be as green and wealthy as Qatar and Saudi Arabia if government wakes up – Instead of vilifying the oil and gas sectors, Canada should champion them.”

Nuttall described how Saudi Arabia and Qatar are investing their enormous energy wealth to make life better for their citizens. This includes decarbonizing future domestic energy supplies and making large investments in infrastructure.

Nuttall concludes, “Why is it that Qatar, a country that embraced its LNG industry, has nearly three times the number of doctors per capita than Canada? We can do it all: increase our oil and natural gas production, at the highest environmental standards anywhere in the world, thereby allowing us to help meet the world’s needs while benefiting from its revenue and allowing for critical incremental investments in our national infrastructure…This could have been us.”

The country most often mentioned that Albertans should emulate is Norway.

Alberta’s Heritage Savings and Trust Fund has been stuck below $20 billion since it was created by Premier Peter Lougheed in 1976.

Norway’s Sovereign Wealth Fund, which started 20 years later in 1996, now sits at US$1.2 trillion.

How many times have you been told that if Alberta’s politicians weren’t so incompetent, our province would have a much larger nest egg after 47 years?

After all, Canada and Alberta have gobs of natural gas and oil, just like Qatar and Norway.

Regrettably, that’s all we have in common.

That Qatar and Norway’s massive hydrocarbon assets are offshore is a massive advantage that producers in the Western Canada Sedimentary Basin will never enjoy. All pipelines are submerged. There are no surface access problems on private property, no municipal property taxes or surface rights payments, and there are no issues with First Nations regarding land claims, treaty rights and constitutional guarantees.

Being on tidewater is a huge advantage when it comes to market access, greatly reducing operating and transportation costs.

But it’s more complicated than that, and has been for a long time. In 1990, Olympic athlete and businessman William G. Gairdner wrote a book titled, “The Trouble with Canada – A Citizen Speaks Out.” It takes Gairdner 450 pages to explain how one of the most unique places in the world in terms of resource wealth and personal and economic opportunity was fading fast.

That was 33 years ago. Nothing has improved.

As I wrote in my own book about the early days of settlement and development, citizens expected little from their governments and got less.

Today politics increasingly involves which party will give the most voters the most money.

The book’s inside front cover reads how Gairdner was concerned that Canada was already “caught between two irreconcilable styles of government, a ‘top down’ collectivism and a ‘bottoms-up individualism;’ he shows how Canadian society has been corrupted by a dangerous love affair with the former.”

Everything from the constitution to official bilingualism to public health care were identified as the symptoms of a country heading in the wrong direction.

But Canadian “civil society” often regards these as accomplishments.

The constitution enshrines a federal structure that ignores representation by population in the Senate thus leaving the underpopulated regions vulnerable to the political desires of central Canada. This prohibited Alberta’s closest access to tidewater for oil through Bill C48.

Official bilingualism and French cultural protection has morphed into Quebec intentionally blocking Atlantic tidewater access for western Canadian oil and gas.

In the same country!

Another election will soon be fought in Alberta over sustaining a mediocre public health care system that continues to slide in international rankings of cost and accessibility.

What’s remarkable about comparing Canada to Norway or Qatar for missed hydrocarbon export opportunities is how many are convinced that the Canadian way of doing things is equal, if not superior, to that of other countries.

But neither Norway or Qatar have the geographical, jurisdictional, regulatory and political obstacles that impair resource development in Canada.

Norway has over 1,000 years of history shared by a relatively homogenous population with similar views on many issues. Norway has a clear sense of its national identity.

As a country, Canada has only 156 years in its current form and is comprised of Indigenous people and newcomers from all over the world who are still getting to know each other.

In the endless pursuit of politeness, today’s Canada recognizes multiple nations within its borders.

Norway and Qatar only have one.

While relatively new as a country, Qatar is ruled by a “semi-constitutional” monarchy where the major decisions about economic development are made by a handful of people.

Canada has three layers of elected governments – federal, provincial and municipal – that have turned jurisdictional disputes, excessive regulation, and transferring more of everything to the public sector into an industry.

Regrettably, saying that Canada should be more like Norway or Qatar without understanding why it can’t be deflects attention away from our challenges and solutions.

David Yager is an oilfield service executive, oil and gas writer, and energy policy analyst. He is author of From Miracle to Menace – Alberta, A Carbon Story.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

Alberta

Province to expand services provided by Alberta Sheriffs: New policing option for municipalities

Expanding municipal police service options |

Proposed amendments would help ensure Alberta’s evolving public safety needs are met while also giving municipalities more options for local policing.

As first announced with the introduction of the Public Safety Statutes Amendment Act, 2024, Alberta’s government is considering creating a new independent agency police service to assume the police-like duties currently performed by Alberta Sheriffs. If passed, Bill 49 would lay additional groundwork for the new police service.

Proposed amendments to the Police Act recognize the unique challenges faced by different communities and seek to empower local governments to adopt strategies that effectively respond to their specific safety concerns, enhancing overall public safety across the province.

If passed, Bill 49 would specify that the new agency would be a Crown corporation with an independent board of directors to oversee its day-to-day operations. The new agency would be operationally independent from the government, consistent with all police services in Alberta. Unlike the Alberta Sheriffs, officers in the new police service would be directly employed by the police service rather than by the government.

“With this bill, we are taking the necessary steps to address the unique public safety concerns in communities across Alberta. As we work towards creating an independent agency police service, we are providing an essential component of Alberta’s police framework for years to come. Our aim is for the new agency is to ensure that Albertans are safe in their communities and receive the best possible service when they need it most.”

Additional amendments would allow municipalities to select the new agency as their local police service once it becomes fully operational and the necessary standards, capacity and frameworks are in place. Alberta’s government is committed to ensuring the new agency works collaboratively with all police services to meet the province’s evolving public safety needs and improve law enforcement response times, particularly in rural communities. While the RCMP would remain the official provincial police service, municipalities would have a new option for their local policing needs.

Once established, the agency would strengthen Alberta’s existing policing model and complement the province’s current police services, which include the RCMP, Indigenous police services and municipal police. It would help fill gaps and ensure law enforcement resources are deployed efficiently across the province.

Related information

-

Alberta1 day ago

Alberta1 day agoProvince to expand services provided by Alberta Sheriffs: New policing option for municipalities

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoIs HNIC Ready For The Winnipeg Jets To Be Canada’s Heroes?

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoNo Matter The Winner – My Canada Is Gone

-

Alberta1 day ago

Alberta1 day agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

Health1 day ago

Health1 day agoHorrific and Deadly Effects of Antidepressants

-

2025 Federal Election1 day ago

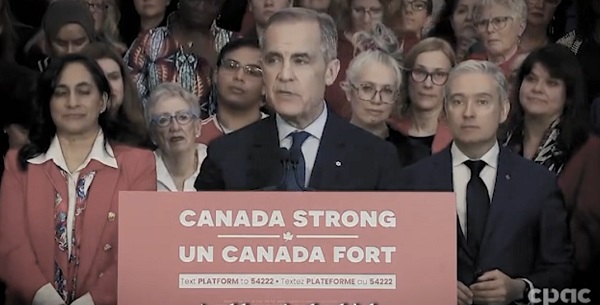

2025 Federal Election1 day agoCampaign 2025 : The Liberal Costed Platform – Taxpayer Funded Fiction

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoA Perfect Storm of Corruption, Foreign Interference, and National Security Failures