Canadian Energy Centre

Proposed emissions cap threatens critical Canada-U.S. energy trade

From the Canadian Energy Centre

The vast majority of Canadian oil exports to the United States are processed in Midwest states. Above, the Cushing Terminal near Cushing, Oklahoma is Enbridge’s largest tank farm and the most significant trading hub for North American crude.

Canada and the United States share something that doesn’t exist anywhere else. A vast, interconnected energy network that today produces more oil and gas than any other region – including the Middle East, according to analysis by S&P Global.

It’s a blanket of energy security researchers called “a powerful card to play” in increasingly unstable times.

But, according to two leaders in governance and energy policy, that relationship is at risk.

Analysis has shown that the federal proposal to cap emissions in Canada’s oil and gas sector would result in reduced production. That likely means less energy available to Canada’s largest customer, the United States.

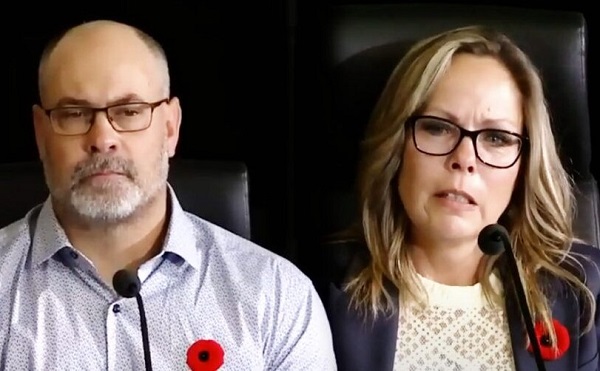

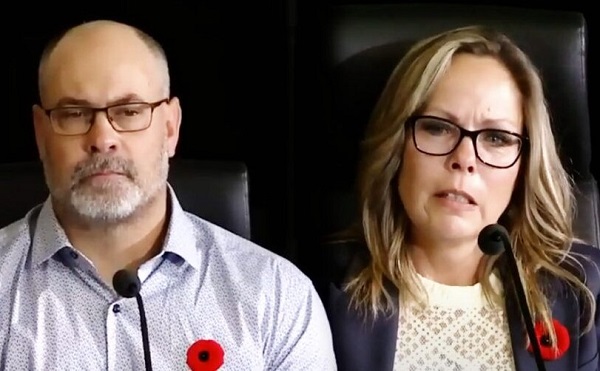

Jamie Tronnes, executive director of the Center for North American Prosperity and Security, is a former Canadian political staffer born in northern Alberta now living in Washington, D.C.

Heather Exner-Pirot is a prominent energy policy analyst and senior fellow with the Ottawa-based Macdonald-Laurier Institute.

Here’s what they shared with CEC.

CEC: The U.S. is one of the world’s largest oil and gas producers. Why does it need imports from Canada?

HEP: It’s because all oil is not the same. The United States developed its refinery industry before the shale revolution, when they were importing heavier crudes. Canada has that heavier crude. They are now exporting some of their sweet light oil and importing Canadian crude because that’s what their refinery mix requires.

What’s interesting is that we have never exported more Canadian crude to the United States than we are right now. Even as they have become the world’s largest oil producer, they’ve never needed Canadian oil more than today.

They also import a ton of natural gas from us. They have become the world’s biggest gas producer and the world’s biggest gas exporter, but part of that, and having their LNG capacity being able to so quickly surpass Qatar and Australia, is because some of the production is being backfilled by Canada.

CEC: Will the incoming new administration (either Democrat or Republican) impact the Canada-U.S. energy relationship?

JT: I don’t see a big change happening in such a way as it did when the Biden administration came in with the axing of the Keystone XL pipeline. Now that Russia has invaded Ukraine, the global energy market has changed radically.

On the Republican side, Trump often repeats the phrase “drill, baby drill.” The issue is that the U.S. is already drilling about as much as demand allows.

I don’t think a Harris government would move quickly to limit oil and gas production without having a strategic alternative in place. It simply would make her look very weak, and she has explicitly said that she would not ban fracking.

In the post-COVID world, I believe that the Democrat side of the aisle is coming to the view that it was a geopolitical mistake in terms of securing North American energy dominance to cut the Keystone XL pipeline.

The reality is that being able to export refined Canadian feedstock is key to keeping the U.S. as an energy superpower.

The U.S. government continues to offer and subsidize tax credits for investment in carbon capture technology. Even though Trump has said that he would end all of those carbon capture credits and subsidies, it still would not stop the U.S. from importing Canadian oil and gas.

That’s only going to grow as things like AI continue to create more demand for energy. A huge amount of the United States electrical energy grid is powered still by natural gas, and that’s going to take decades to change.

CEC: Would a reduction in Canadian production from the federal government’s proposed oil and gas emissions cap impact the United States?

HEP: Yes, and we should be raising the alarm bells. The federal government has said it is a cap on emissions, not a cap on production, but all the analysis that Alberta and the oil and gas sector have done is that it will create somewhere between 1 million and 2 million barrels of production being shut in.

Well, 95 per cent of our exports are to the United States. If we are shutting in 1 million barrels or 2 million barrels, that all comes out of their end just when their shale oil is expected to plateau and decline.

A cap would also tap down natural gas production and LNG capacity. If you’re Japan or South Korea and you’re looking to secure 20 years of supply, the cap creates a lot of uncertainty with that Canadian supply. There’s zero uncertainty with Qatar’s supply. If you’re Japanese, these are not pleasant conversations. This is not giving you confidence. And if you don’t have confidence in LNG, you’re going to burn coal.

In a perfect world, Canada would supply LNG to Asia, the United States would supply it to Europe, and we’d be a pretty energy-independent Western alliance.

I wish we would be honest that we need a different way to reduce emissions that does not take away from production, because that capacity is a big part of what we offer our allies right now.

JT: It threatens the security of North America in a big way because the energy dominance of the United States is tied to Canada. Especially with what’s going on in Russia and other countries, it behooves us as Canadians and me as an American to remember that security is not freely granted.

We have to make sure that we are thinking more holistically when we think of things like emissions cap legislation that’s going to have knock-on effects and may even increase emissions. If you’re trying to replace that feedstock, it’s got to come from somewhere.

Alberta

Alberta’s number of inactive wells trending downward

Aspenleaf Energy vice-president of wells Ron Weber at a clean-up site near Edmonton.

From the Canadian Energy Centre

Aspenleaf Energy brings new life to historic Alberta oil field while cleaning up the past

In Alberta’s oil patch, some companies are going beyond their obligations to clean up inactive wells.

Aspenleaf Energy operates in the historic Leduc oil field, where drilling and production peaked in the 1950s.

In the last seven years, the privately-held company has spent more than $40 million on abandonment and reclamation, which it reports is significantly more than the minimum required by the Alberta Energy Regulator (AER).

CEO Bryan Gould sees reclaiming the legacy assets as like paying down a debt.

“To me, it’s not a giant bill for us to pay to accelerate the closure and it builds our reputation with the community, which then paves the way for investment and community support for the things we need to do,” he said.

“It just makes business sense to us.”

Aspenleaf, which says it has decommissioned two-thirds of its inactive wells in the Leduc area, isn’t alone in going beyond the requirements.

Producers in Alberta exceeded the AER’s minimum closure spend in both years of available data since the program was introduced in 2022.

That year, the industry-wide closure spend requirement was set at $422 million, but producers spent more than $696 million, according to the AER.

In 2023, companies spent nearly $770 million against a requirement of $700 million.

Alberta’s number of inactive wells is trending downward. The AER’s most recent report shows about 76,000 inactive wells in the province, down from roughly 92,000 in 2021.

In the Leduc field, new development techniques will make future cleanup easier and less costly, Gould said.

That’s because horizontal drilling allows several wells, each up to seven kilometres long, to originate from the same surface site.

“Historically, Leduc would have been developed with many, many sites with single vertical wells,” Gould said.

“This is why the remediation going back is so cumbersome. If you looked at it today, all that would have been centralized in one pad.

“Going forward, the environmental footprint is dramatically reduced compared to what it was.”

During and immediately after a well abandonment for Aspenleaf Energy near Edmonton. Photos for the Canadian Energy Centre

Gould said horizontal drilling and hydraulic fracturing give the field better economics, extending the life of a mature asset.

“We can drill more wells, we can recover more oil and we can pay higher royalties and higher taxes to the province,” he said.

Aspenleaf has also drilled about 3,700 test holes to assess how much soil needs cleanup. The company plans a pilot project to demonstrate a method that would reduce the amount of digging and landfilling of old underground materials while ensuring the land is productive and viable for use.

Crew at work on a well abandonment for Aspenleaf Energy near Edmonton. Photo for the Canadian Energy Centre

“We did a lot of sampling, and for the most part what we can show is what was buried in the ground by previous operators historically has not moved anywhere over 70 years and has had no impact to waterways and topography with lush forestry and productive agriculture thriving directly above and adjacent to those sampled areas,” he said.

At current rates of about 15,000 barrels per day, Aspenleaf sees a long runway of future production for the next decade or longer.

Revitalizing the historic field while cleaning up legacy assets is key to the company’s strategy.

“We believe we can extract more of the resource, which belongs to the people of Alberta,” Gould said.

“We make money for our investors, and the people of the province are much further ahead.”

Alberta

Canada’s heavy oil finds new fans as global demand rises

From the Canadian Energy Centre

By Will Gibson

“The refining industry wants heavy oil. We are actually in a shortage of heavy oil globally right now, and you can see that in the prices”

Once priced at a steep discount to its lighter, sweeter counterparts, Canadian oil has earned growing admiration—and market share—among new customers in Asia.

Canada’s oil exports are primarily “heavy” oil from the Alberta oil sands, compared to oil from more conventional “light” plays like the Permian Basin in the U.S.

One way to think of it is that heavy oil is thick and does not flow easily, while light oil is thin and flows freely, like fudge compared to apple juice.

“The refining industry wants heavy oil. We are actually in a shortage of heavy oil globally right now, and you can see that in the prices,” said Susan Bell, senior vice-president of downstream research with Rystad Energy.

A narrowing price gap

Alberta’s heavy oil producers generally receive a lower price than light oil producers, partly a result of different crude quality but mainly because of the cost of transportation, according to S&P Global.

The “differential” between Western Canadian Select (WCS) and West Texas Intermediate (WTI) blew out to nearly US$50 per barrel in 2018 because of pipeline bottlenecks, forcing Alberta to step in and cut production.

So far this year, the differential has narrowed to as little as US$10 per barrel, averaging around US$12, according to GLJ Petroleum Consultants.

“The differential between WCS and WTI is the narrowest I’ve seen in three decades working in the industry,” Bell said.

Trans Mountain Expansion opens the door to Asia

Oil tanker docked at the Westridge Marine Terminal in Burnaby, B.C. Photo courtesy Trans Mountain Corporation

The price boost is thanks to the Trans Mountain expansion, which opened a new gateway to Asia in May 2024 by nearly tripling the pipeline’s capacity.

This helps fill the supply void left by other major regions that export heavy oil – Venezuela and Mexico – where production is declining or unsteady.

Canadian oil exports outside the United States reached a record 525,000 barrels per day in July 2025, the latest month of data available from the Canada Energy Regulator.

China leads Asian buyers since the expansion went into service, along with Japan, Brunei and Singapore, Bloomberg reports.

Asian refineries see opportunity in heavy oil

“What we are seeing now is a lot of refineries in the Asian market have been exposed long enough to WCS and now are comfortable with taking on regular shipments,” Bell said.

Kevin Birn, chief analyst for Canadian oil markets at S&P Global, said rising demand for heavier crude in Asia comes from refineries expanding capacity to process it and capture more value from lower-cost feedstocks.

“They’ve invested in capital improvements on the front end to convert heavier oils into more valuable refined products,” said Birn, who also heads S&P’s Center of Emissions Excellence.

Refiners in the U.S. Gulf Coast and Midwest made similar investments over the past 40 years to capitalize on supply from Latin America and the oil sands, he said.

While oil sands output has grown, supplies from Latin America have declined.

Mexico’s state oil company, Pemex, reports it produced roughly 1.6 million barrels per day in the second quarter of 2025, a steep drop from 2.3 million in 2015 and 2.6 million in 2010.

Meanwhile, Venezuela’s oil production, which was nearly 2.9 million barrels per day in 2010, was just 965,000 barrels per day this September, according to OPEC.

The case for more Canadian pipelines

Worker at an oil sands SAGD processing facility in northern Alberta. Photo courtesy Strathcona Resources

“The growth in heavy demand, and decline of other sources of heavy supply has contributed to a tighter market for heavy oil and narrower spreads,” Birn said.

Even the International Energy Agency, known for its bearish projections of future oil demand, sees rising global use of extra-heavy oil through 2050.

The chief impediments to Canada building new pipelines to meet the demand are political rather than market-based, said both Bell and Birn.

“There is absolutely a business case for a second pipeline to tidewater,” Bell said.

“The challenge is other hurdles limiting the growth in the industry, including legislation such as the tanker ban or the oil and gas emissions cap.”

A strategic choice for Canada

Because Alberta’s oil sands will continue a steady, reliable and low-cost supply of heavy oil into the future, Birn said policymakers and Canadians have options.

“Canada needs to ask itself whether to continue to expand pipeline capacity south to the United States or to access global markets itself, which would bring more competition for its products.”

-

COVID-192 days ago

COVID-192 days agoFreedom Convoy leader Tamara Lich to appeal her recent conviction

-

Justice2 days ago

Justice2 days agoCarney government lets Supreme Court decision stand despite outrage over child porn ruling

-

espionage1 day ago

espionage1 day agoU.S. Charges Three More Chinese Scholars in Wuhan Bio-Smuggling Case, Citing Pattern of Foreign Exploitation in American Research Labs

-

Business1 day ago

Business1 day agoCarney budget doubles down on Trudeau-era policies

-

Business2 days ago

Business2 days agoCarney’s budget spares tax status of Canadian churches, pro-life groups after backlash

-

Daily Caller2 days ago

Daily Caller2 days agoUN Chief Rages Against Dying Of Climate Alarm Light

-

COVID-191 day ago

COVID-191 day agoCrown still working to put Lich and Barber in jail

-

Business1 day ago

Business1 day agoCarney budget continues misguided ‘Build Canada Homes’ approach