Alberta

Premier Kenney addresses Alberta’s COVID-19 economic crisis

From the Province of Alberta

Additional financial support for Albertans and employers

More relief is on the way for Albertans and Alberta employers.

The government has made three significant decisions that will give Albertans and Alberta employers additional supports as they deal with the impacts of the COVID-19 crisis.

“Our priority is to keep our province strong while we get through these difficult times together. We’re doing everything we can to support Albertans and Alberta employers through this crisis. That’s why we’re focused on creating tangible savings for households and freeing up necessary cash for businesses to help them through these unprecedented times.”

Education property tax freeze

During a pandemic, Alberta households should not need to worry about paying additional property taxes.

- The government will immediately cancel the decision made in Budget 2020 and will freeze education property taxes at last year’s level.

- Reversing the 3.4 per cent population and inflation adjustment will save Alberta households and businesses about $87 million in 2020-21, which means $55 million for households and $32 million for employers.

- The government expects that Albertans and Alberta businesses will fully realize these savings and that municipal property tax levels will not be increased as a result of the lower provincial education property tax levels.

Education property tax deferral for business

When Alberta businesses are operating, they employ Albertans who can support themselves, their families and help keep the economy running. Effective immediately, the government will defer education property tax for businesses for six months.

- In the next six months, $458 million in cash will remain with employers to help them pay employees and continue operations.

- The government expects municipalities to set education property tax rates as they normally would, but defer collection. Deferred amounts will be repaid in future tax years.

- The government encourages commercial landlords to pass on these savings to their tenants through reduced or deferred payments. This will help employers continue to manage their debts, pay their employees and stay in business.

- Businesses capable of paying their taxes in full are strongly encouraged to do so. This will assist the province in being able to support Albertans through this pandemic.

“Eliminating the scheduled adjustment of education property taxes and deferring collection of non-residential property taxes will result in savings to Albertans and improved business cash flow. This measure will help Alberta households and businesses during this time – we want to keep Albertans working while we get through these difficult times together.”

WCB premiums deferral for private sector businesses and support for small and medium businesses

Private sector employers can save money on their WCB premium payments at a time when they need it most. These actions ensure the sustainability of the workers’ compensation system and that injured workers continue to receive the benefits and supports they need to return to work.

- Private sector employers will have immediate financial relief by deferring WCB premiums until early 2021, effectively for one year.

- Employers who have already paid their WCB premium payment for 2020 are eligible for a rebate or credit.

- For small and medium businesses, the government will cover 50 per cent of the premium when it is due.

- Large employers will also receive a break by having their 2020 WCB premium payments deferred until 2021, at which time their premiums will be due.

- Paying 50 per cent of small and medium private sector WCB premiums for 2020 will cost government approximately $350 million.

Additional measures to help families, students and employers

Previously announced measure taken by the province to protect Albertans and assist businesses include:

- The collection of corporate income tax balances and instalment payments is deferred until Aug. 31, 2020. This gives Alberta businesses access to about $1.5 billion in funds to help them cope with the COVID-19 crisis.

- $50 million to support emergency isolation for working adult Albertans who must self-isolate, including persons who are the sole caregiver for a dependent who must self-isolate, and who will not have another source of pay or compensation while they are self-isolated. It is distributed in one payment instalment to bridge the gap until the federal emergency payments begin in April.

- Utility payment deferral for residential, farm, and small commercial customers to defer bill payments for the next 90 days and ensure no one is cut off from electricity and natural gas services during this time of crisis.

- A six-month, interest-free moratorium on Alberta student loan payments for all individuals who are in the process of repaying these loans.

COVID-19 a ‘devastating blow’ to mountain towns that rely on tourism

Alberta

Alberta bill would protect freedom of expression for doctors, nurses, other professionals

From LifeSiteNews

‘Peterson’s law,’ named for Canadian psychologist Jordan Peterson, was introduced by Alberta Premier Danielle Smith.

Alberta’s Conservative government introduced a new law that will set “clear expectations” for professional regulatory bodies to respect freedom of speech on social media and online for doctors, nurses, engineers, and other professionals.

The new law, named “Peterson’s law” after Canadian psychologist Jordan Peterson, who was canceled by his regulatory body, was introduced Thursday by Alberta Premier Danielle Smith.

“Professionals should never fear losing their license or career because of a social media post, an interview, or a personal opinion expressed on their own time,” Smith said in a press release sent to media and LifeSiteNews.

“Alberta’s government is restoring fairness and neutrality so regulators focus on competence and ethics, not policing beliefs. Every Albertan has the right to speak freely without ideological enforcement or intimidation, and this legislation makes that protection real.”

The law, known as Bill 13, the Regulated Professions Neutrality Act, will “set clear expectations for professional regulatory bodies to ensure professionals’ right to free expression is protected.”

According to the government, the new law will “Limit professional regulatory bodies from disciplining professionals for expressive off-duty conduct, except in specific circumstances such as threats of physical violence or a criminal conviction.”

It will also restrict mandatory training “unrelated to competence or ethics, such as diversity, equity, and inclusion training.”

Bill 13, once it becomes law, which is all but guaranteed as Smith’s United Conservative Party (UCP) holds a majority, will also “create principles of neutrality that prohibit professional regulatory bodies from assigning value, blame or different treatment to individuals based on personally held views or political beliefs.”

As reported by LifeSiteNews, Peterson has been embattled with the College of Psychologists of Ontario (CPO) after it mandated he undergo social media “training” to keep his license following posts he made on X, formerly Twitter, criticizing Trudeau and LGBT activists.

He recently noted how the CPO offered him a deal to “be bought,” in which the legal fees owed to them after losing his court challenge could be waived but only if he agreed to quit his job as a psychologist.

Early this year, LifeSiteNews reported that the CPO had selected Peterson’s “re-education coach” for having publicly opposed the LGBT agenda.

The Alberta government directly referenced Peterson’s (who is from Alberta originally) plight with the CPO, noting “the disciplinary proceedings against Dr. Jordan Peterson by the College of Psychologists of Ontario, demonstrate how regulatory bodies can extend their reach into personal expression rather than professional competence.”

“Similar cases involving nurses, engineers and other professionals revealed a growing pattern: individuals facing investigations, penalties or compulsory ideological training for off-duty expressive conduct. These incidents became a catalyst, confirming the need for clear legislative boundaries that protect free expression while preserving professional standards.”

Alberta Minister of Justice and Attorney General Mickey Amery said regarding Bill 13 that the new law makes that protection of professionals “real and holds professional regulatory bodies to a clear standard.”

Last year, Peterson formally announced his departure from Canada in favor of moving to the United States, saying his birth nation has become a “totalitarian hell hole.”

Alberta

‘Weird and wonderful’ wells are boosting oil production in Alberta and Saskatchewan

From the Canadian Energy Centre

Multilateral designs lift more energy with a smaller environmental footprint

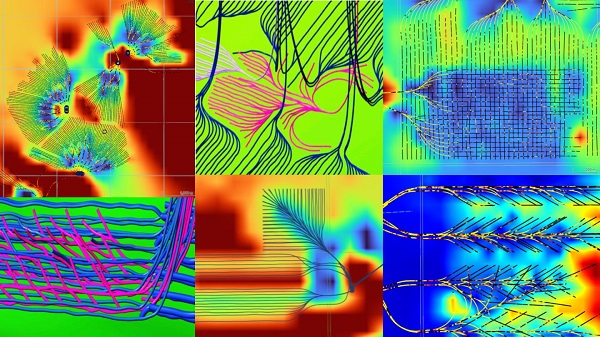

A “weird and wonderful” drilling innovation in Alberta is helping producers tap more oil and gas at lower cost and with less environmental impact.

With names like fishbone, fan, comb-over and stingray, “multilateral” wells turn a single wellbore from the surface into multiple horizontal legs underground.

“They do look spectacular, and they are making quite a bit of money for small companies, so there’s a lot of interest from investors,” said Calin Dragoie, vice-president of geoscience with Calgary-based Chinook Consulting Services.

Dragoie, who has extensively studied the use of multilateral wells, said the technology takes horizontal drilling — which itself revolutionized oil and gas production — to the next level.

“It’s something that was not invented in Canada, but was perfected here. And it’s something that I think in the next few years will be exported as a technology to other parts of the world,” he said.

Dragoie’s research found that in 2015 less than 10 per cent of metres drilled in Western Canada came from multilateral wells. By last year, that share had climbed to nearly 60 per cent.

Royalty incentives in Alberta have accelerated the trend, and Saskatchewan has introduced similar policy.

Multilaterals first emerged alongside horizontal drilling in the late 1990s and early 2000s, Dragoie said. But today’s multilaterals are longer, more complex and more productive.

The main play is in Alberta’s Marten Hills region, where producers are using multilaterals to produce shallow heavy oil.

Today’s average multilateral has about 7.5 horizontal legs from a single surface location, up from four or six just a few years ago, Dragoie said.

One record-setting well in Alberta drilled by Tamarack Valley Energy in 2023 features 11 legs stretching two miles each, for a total subsurface reach of 33 kilometres — the longest well in Canada.

By accessing large volumes of oil and gas from a single surface pad, multilaterals reduce land impact by a factor of five to ten compared to conventional wells, he said.

The designs save money by skipping casing strings and cement in each leg, and production is amplified as a result of increased reservoir contact.

Here are examples of multilateral well design. Images courtesy Chinook Consulting Services.

Parallel

Fishbone

Fan

Waffle

Stingray

Frankenwells

-

COVID-1918 hours ago

COVID-1918 hours agoNew report warns Ottawa’s ‘nudge’ unit erodes democracy and public trust

-

Great Reset2 days ago

Great Reset2 days agoEXCLUSIVE: A Provincial RCMP Veterans’ Association IS TARGETING VETERANS with Euthanasia

-

Daily Caller2 days ago

Daily Caller2 days agoSpreading Sedition? Media Defends Democrats Calling On Soldiers And Officers To Defy Chain Of Command

-

Crime2 days ago

Crime2 days agoHow Global Organized Crime Took Root In Canada

-

Energy2 days ago

Energy2 days agoExpanding Canadian energy production could help lower global emissions

-

Business1 day ago

Business1 day agoThe numbers Canada uses to set policy don’t add up

-

Alberta23 hours ago

Alberta23 hours agoAlberta bill would protect freedom of expression for doctors, nurses, other professionals

-

Business1 day ago

Business1 day agoNew airline compensation rules could threaten regional travel and push up ticket prices