Alberta

Premier Danielle Smith’s first budget adds health and education spending and forecasts a $2.4 billion surplus

Budget 2023 forecasts a surplus of $2.4 billion in 2023-24 and reflects the government decisions to invest in Alberta’s future and provide security for Alberta families and communities.

“Fiscal responsibility matters. It’s been key to achieving our strong fiscal standing and will be essential for sustainable program delivery in the future. In Budget 2023, we continue our commitment to paying down debt all while continuing to position our economy for growth and invest in the top priorities of Albertans.”

Growing jobs and the economy

Budget 2023 advances the province’s already successful Alberta at Work initiative, investing a further $176 million in 2025-26 to help Albertans build their skills and find jobs, and assisting employers in their search for workers in existing and emerging sectors.

A $111-million increase over three years will add seats to expand enrolment in areas with the highest student demand, including non-trade construction, energy, technology and business. Alberta’s government is committed to removing barriers in order to attract highliy skilled professionals and job-creating entrepreneurs to Alberta.

Investments in aviation and aerospace, agri-food manufacturing and $24.5 million this fiscal year to the Alberta Technology and Innovation Strategy will enhance emerging and innovative technologies, drive economic diversification and attract even more venture capital investments to build on successive record-breaking years. A $54-million per year increase in funding for the Alberta Petrochemicals Incentive Program starting in 2025-26 will support Air Products’ clean hydrogen facility – and continue to make Alberta a global leader in petrochemical production, bring long-term investments and create thousands of construction jobs.

Transforming health care to meet Albertans’ needs

Alberta’s government is setting a new record for spending in health care this year by committing an additional $965 million in operating expense in 2023-24 for the Ministry of Health to continue to build a stronger health-care system for Albertans. This funding will ensure the government can take the urgent action needed to improve ambulance response times, decrease emergency room wait times, reduce wait times for surgeries and attract more front-line health workers to deliver the care patients expect and deserve.

Budget 2023 includes $158 million this year to attract, recruit and train more doctors and nurses to work across the province, with a focus on family physicians for rural areas. Alberta’s primary health-care system is being strengthened and modernized with a record $2 billion over three years. Another $196 million over three years will strengthen emergency medical services and $3.1 billion over three years will modernize and expand health facilities across Alberta, including the Red Deer Regional Hospital and expanding capacity for operating rooms in 15 communities to complete more of the surgeries Albertans are waiting for. An additional $529 million in capital maintenance and renewal funding will be used to keep facilities operational and a further $732 million in self-financed investment will add to health infrastructure.

Supporting Albertans, students and families

With $2.3 billion in affordability measures in 2023-24, $1.5 billion in 2024-25 and another $1.8 billion in 2025-26, Alberta’s government is keeping more money in the pockets of Albertans and continues to provide a helping hand to those in need. New relief measures will save post-secondary students about $18 million each year with lower interest rates for student loans. Adoptive families will have access to more subsidies and tax breaks to make adoption more feasible. Workers in the social services sector will see their wages increased by 10 per cent, so they can continue to provide compassionate services to people with complex needs, those experiencing homelessness or family violence. Albertans will also receive a larger tax credit when they donate to their favourite charities to lend a helping hand.

An increase of $1.8 billion for education will help Alberta’s young people succeed and thrive in smaller classes. This increase will support the hiring of up to 3,000 education staff, including teachers, educational assistants, bus drivers and school support staff to give students the focused time and attention they need to succeed in their studies.

The government is also investing $59.3 million in 2023-24 to create thousands more licensed child-care spaces as part of opening a total of 68,700 new spaces by the end of March 2023, increasing access and choice so parents can go to school, work and participate in the economy. Affordability grants to child-care operators and subsidies for parents will further lower the cost of child care, with the Alberta federal-provincial child-care agreement already reducing fees by an average of 50 per cent in 2022 for young children.

Keeping Albertans and communities safe

All Albertans, families and children have the right to safety and security in their homes, at school, at work and in their communities, no matter where they live.

Budget 2023 keeps communities safe by increasing collaboration between first responders and community partners and increasing access for vulnerable populations to recovery-oriented mental health and addiction supports and services.

- $12.5 million in 2023-24 will support the expansion of therapeutic living units within provincial correctional facilities to help inmates access recovery-oriented treatment and recovery programs. This is a joint investment between Mental Health and Addiction and Public Safety and Emergency Services.

- $65 million over the next three years will strengthen First Nations policing to address the unique needs of their communities and members. This will secure new policing positions and the creation of another First Nations police service in addition to the Lakeshore Regional Police Service, the Blood Tribe Police Service and Tsuut’ina Nation Police Service.

- $20 million over three years is committed to combat human trafficking and ensure necessary resources are provided to survivors and victims.

The province will review options for delivering policing services with the objective of improving the safety and security of Albertans and their property.

Committing to responsible fiscal management

Budget 2023 secures Alberta’s future by staying true to responsible fiscal management and spending hard-earned tax dollars wisely to support Albertans today and tomorrow.

A new fiscal framework would require all future Alberta governments to balance their annual budgets, with certain exceptions, and use any surpluses to first pay down debt and save for the future before investing in one-time initiatives.

Taxpayer-supported debt is being reduced by $14.8 billion between 2021-22 and 2023-24, and the Alberta Heritage Savings Trust Fund is growing by $5.7 billion between 2021-22 and 2025-26. This will bring taxpayer-supported debt to $78.3 billion at the end of 2023-24, and saves Albertans estimated $260 million in this fiscal year and $551 million in 2023-24.

Mandating balanced budgets and tying operating expense increases to population growth and inflation would help control spending to prevent what could be temporarily high resource revenue being used to increase spending in an unsustainable way. Spending decisions instead would be focused on not only meeting the needs and priorities of Albertans but also on continuing to drive change, innovation and improvement of vital services and programs.

Revenue

- In 2023-24, total revenue is estimated to be $70.7 billion, which is $5.4 billion lower than the forecast for 2022-23. Commodity prices are expected to soften due to fears of a looming global recession, while investment income is expected to recover well after dropping in 2022-23.

- Revenue is expected to remain above $70 billion in following years. The revenue forecast for 2024-25 is $71.7 billion and for 2025-26 is $72.6 billion.

- In 2023-24, corporate income tax revenue is estimated at $5.9 billion, down 7.8 per cent from 2022-23, largely due to declining commodity prices.

- Non-renewable resource revenue is estimated to be $18.4 billion in 2023-24, down from the highest-ever resource revenue of $27.5 billion forecast in 2022-23.

Expense

- Total expense in 2023-24 is $68.3 billion, which is $2.6 billion more than the forecast for 2022-23.

- Total expense is expected to be $69.7 billion in 2024-25 and $71.2 billion in 2025-26.

Surplus

- A surplus of $2.4 billion is forecast for 2023-24 compared with $10.4 billion in 2022-23.

- Surpluses of $2 billion and $1.4 billion are forecast for 2024-25 and 2025-26, respectively.

Economic outlook

- In 2022, real gross domestic product (GDP) rose by an estimated 4.8 per cent, which is lower than the budget forecast of 5.4 per cent. The softer growth reflects the impact of higher interest rates and prices on consumer spending and residential investment. Even so, real GDP fully recovered from the COVID-19 downturn and surpassed the 2014 peak in 2022.

- In 2023, real GDP is expected to grow by 2.8 per cent, up slightly from the 2.7 per cent growth forecast at mid-year.

Energy and economic assumptions, 2023-24

- West Texas Intermediate oil (USD/bbl) $79.00

- Western Canadian Select @ Hardisty (CND/bbl) $78.00

- Light-heavy differential (USD/bbl) $19.50

- Natural gas (CND/GJ) $4.10

- Convention crude production (000s barrels/day) 497

- Raw bitumen production (000s barrels/day) 3,345

- Canadian dollar exchange rate (USD/CDN) $76.20

- Interest rate (10-year Canada bonds, per cent) 3.60

Budget 2023 secures Alberta’s bright future by transforming the health-care system to meet people’s needs, supporting Albertans with the high cost of living, keeping our communities safe and driving the economy with more jobs, quality education and continued diversification.

Alberta

Red Deer Justice Centre Grand Opening: Building access to justice for Albertans

The new Red Deer Justice Centre will help Albertans resolve their legal matters faster.

Albertans deserve to have access to a fair, accessible and transparent justice system. Modernizing Alberta’s courthouse infrastructure will help make sure Alberta’s justice system runs efficiently and meets the needs of the province’s growing population.

Alberta’s government has invested $191 million to build the new Red Deer Justice Centre, increasing the number of courtrooms from eight to 12, allowing more cases to be heard at one time.

“Modern, accessible courthouses and streamlined services not only strengthen our justice

system – they build safer, stronger communities across the province. Investing in the new Red Deer Justice Centre is vital to helping our justice system operate more efficiently, and will give people in Red Deer and across central Alberta better access to justice.”

Government of Alberta and Judiciary representatives with special guests at the Red Deer Justice Centre plaque unveiling event April 22, 2025.

On March 3, all court services in Red Deer began operating out of the new justice centre. The new justice centre has 12 courtrooms fully built and equipped with video-conference equipment to allow witnesses to attend remotely if they cannot travel, and vulnerable witnesses to testify from outside the courtroom.

The new justice centre also has spaces for people taking alternative approaches to the traditional courtroom trial process, with the three new suites for judicial dispute resolution services, a specific suite for other dispute resolution services, such as family mediation and civil mediation, and a new Indigenous courtroom with dedicated venting for smudging purposes.

“We are very excited about this new courthouse for central Alberta. Investing in the places where people seek justice shows respect for the rights of all Albertans. The Red Deer Justice Centre fills a significant infrastructure need for this rapidly growing part of the province. It is also an important symbol of the rule of law, meaning that none of us are above the law, and there is an independent judiciary to decide disputes. This is essential for a healthy functioning democracy.”

“Public safety and access to justice go hand in hand. With this investment in the new Red Deer Justice Centre, Alberta’s government is ensuring that communities are safer, legal matters are resolved more efficiently and all Albertans get the support they need.”

“This state-of-the-art facility will serve the people of Red Deer and surrounding communities for generations. Our team at Infrastructure is incredibly proud of the work done to plan, design and build this project. I want to thank everyone, at all levels, who helped make this project a reality.”

Budget 2025 is meeting the challenge faced by Alberta with continued investments in education and health, lower taxes for families and a focus on the economy.

Quick facts

- The new Red Deer Justice Centre is 312,000 sq ft (29,000 m2). (The old courthouse is 98,780 sq ft (9,177 m2)).

- The approved project funding for the Red Deer Justice Centre is about $191 million.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

-

Business2 days ago

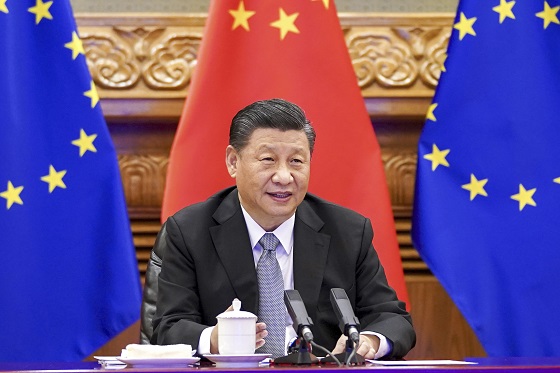

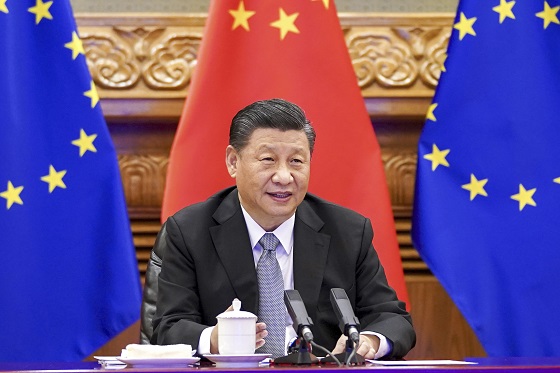

Business2 days agoTrump: China’s tariffs to “come down substantially” after negotiations with Xi

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPolice Associations Endorse Conservatives. Poilievre Will Shut Down Tent Cities

-

Business2 days ago

Business2 days agoTrump considers $5K bonus for moms to increase birthrate

-

Business1 day ago

Business1 day agoChinese firm unveils palm-based biometric ID payments, sparking fresh privacy concerns

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCanada’s press tries to turn the gender debate into a non-issue, pretend it’s not happening

-

COVID-192 days ago

COVID-192 days agoRFK Jr. Launches Long-Awaited Offensive Against COVID-19 mRNA Shots

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNext federal government should end corporate welfare for forced EV transition

-

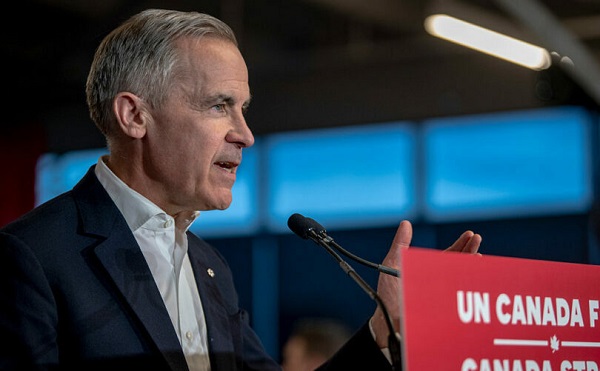

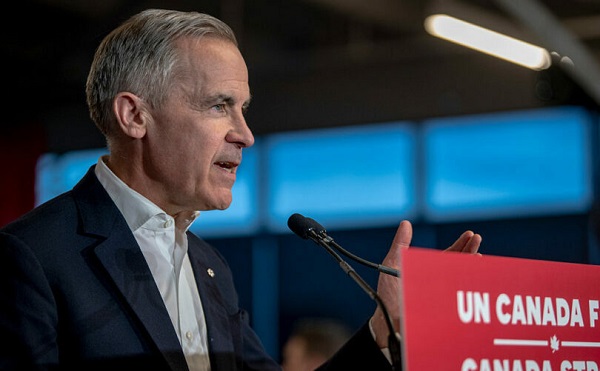

2025 Federal Election18 hours ago

2025 Federal Election18 hours agoCarney’s Hidden Climate Finance Agenda