Alberta

Potential investment manager for an Alberta pension plan—here are the facts

From the Fraser Institute

As discussions around Alberta’s potential withdrawal from the Canada Pension Plan (CPP) continue, commentators have bombarded Albertans (and Canadians more generally) with sometimes misleading rhetoric, which can undermine the public’s understanding of this key issue. Albertans—and Canadians broadly—need facts to make well-informed decisions.

One key issue has been the potential investment manager for an Alberta pension plan. Specifically, commentators have implied that by leaving the CPP, Albertans retirement funds would no longer be managed by the Canada Pension Plan Investment Board (CPPIB) but rather by the Alberta Investment Management Corporation (AIMCo), which manages several public funds and pensions in the province.

This is not necessarily the case. The province has the option to retain the CPPIB as its investment manager, contract with AIMCo, create a new provider, or contract with the private sector. Put simply, an independent Albertan pension plan has options other than contracting with AIMCo.

But for argument’s sake, let’s assume AIMCo was chosen as the investment manager for an Alberta pension plan. There’s quite a bit of confusion regarding AIMCo that should be clarified. Perhaps most commonly, critics of AIMCo emphasize that the CPPIB has averaged 10 per cent annual returns over the past decade, higher than AIMCo’s 7.2 per cent.

While true, the CPPIB rate of return is distinct from the rate of return earned by contributors to the CPP. Put differently, an individual’s rate of return is not the same as the fund’s rate of return because of the way the CPP was originally designed. Some of the commentary written on this issue has implied that the lower rates of return at AIMCo would influence the benefits received by Alberta retirees. In fact, the retirement benefits Canadians receive from the CPP, and from a comparable Alberta pension plan, are based on several unrelated factors including how many years they’ve worked, their annual contributions and the age they retire. This is key since the CPP and a potential Alberta pension plan are largely based on current workers paying for current retirees, or what’s known as a pay-as-you-go system. Estimates suggest Canadian workers born in 1993 or later can expect a real rate of return of just 2.5 per cent from the CPP.

Given the pay-as-you-go nature of the plan, the key for the CPP, and one assumes for an independent Alberta pension plan, is that the fund earns a rate of return that allows for sustainable payments to retirees over time. The current required rate of return for the CPPIB is 6.0 per cent, which both it and AIMCo exceed.

Moreover, AIMCo, unlike the CPPIB, is constrained by the investment policies of each individual pension fund that it manages. Indeed, unlike the CPPIB, AIMCo is responsible for managing the funds of numerous pension plans, each with their own investment objectives, risk tolerances and asset mixes AIMCo must follow.

For instance, the Management Employees Pension Plan, one of AIMCo’s largest pension funds, requires that 20 per cent to 45 per cent of the market value of the plan’s assets be invested in “inflation sensitive” investments, which include real estate, renewable resources and other assets that may have lower returns compared to alternatives such as investments in private equity. These constraints can limit AIMCo’s overall rate of return, while the CPPIB, unencumbered by the investment policies of other pension funds, has the flexibility to invest according to its core objective, which is to maximize returns adjusted for risk. Put differently, Albertans could grant AIMCo the same flexibility—it all depends on the investment policy implemented if an Alberta pension plan were created.

Finally, opponents also argue that the CPPIB fund’s size (more than $575 billion) makes it superior to any potential provincial fund. Yet the evidence suggests that despite its size, the CPP is not a low-cost pension plan. In fact, according to an analysis by Philip Cross, former chief analyst at Statistics Canada, the CPP’s cost at 1.07 per cent of assets was higher than the other analyzed pension plans, which ranged from 0.34 per cent to 1.02 per cent. And the CPP’s costs have skyrocketed from $4 million in 2000 to 4.4. billion annually, largely due to an increase in staff and compensation. For perspective, the CPPIB had only five employees in 2000; by 2020 it employed nearly 2,000 people. And critically, these changes have not increased the fund’s net returns.

Ultimately, it will be up to Albertans to decide if they want to opt out of the CPP for an Alberta pension plan, but to make that decision, they must be armed with facts. That includes clarifying some misunderstanding on two potential investment managers—CPPIB and AIMCo.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

Alberta

Province to expand services provided by Alberta Sheriffs: New policing option for municipalities

Expanding municipal police service options |

Proposed amendments would help ensure Alberta’s evolving public safety needs are met while also giving municipalities more options for local policing.

As first announced with the introduction of the Public Safety Statutes Amendment Act, 2024, Alberta’s government is considering creating a new independent agency police service to assume the police-like duties currently performed by Alberta Sheriffs. If passed, Bill 49 would lay additional groundwork for the new police service.

Proposed amendments to the Police Act recognize the unique challenges faced by different communities and seek to empower local governments to adopt strategies that effectively respond to their specific safety concerns, enhancing overall public safety across the province.

If passed, Bill 49 would specify that the new agency would be a Crown corporation with an independent board of directors to oversee its day-to-day operations. The new agency would be operationally independent from the government, consistent with all police services in Alberta. Unlike the Alberta Sheriffs, officers in the new police service would be directly employed by the police service rather than by the government.

“With this bill, we are taking the necessary steps to address the unique public safety concerns in communities across Alberta. As we work towards creating an independent agency police service, we are providing an essential component of Alberta’s police framework for years to come. Our aim is for the new agency is to ensure that Albertans are safe in their communities and receive the best possible service when they need it most.”

Additional amendments would allow municipalities to select the new agency as their local police service once it becomes fully operational and the necessary standards, capacity and frameworks are in place. Alberta’s government is committed to ensuring the new agency works collaboratively with all police services to meet the province’s evolving public safety needs and improve law enforcement response times, particularly in rural communities. While the RCMP would remain the official provincial police service, municipalities would have a new option for their local policing needs.

Once established, the agency would strengthen Alberta’s existing policing model and complement the province’s current police services, which include the RCMP, Indigenous police services and municipal police. It would help fill gaps and ensure law enforcement resources are deployed efficiently across the province.

Related information

-

Business1 day ago

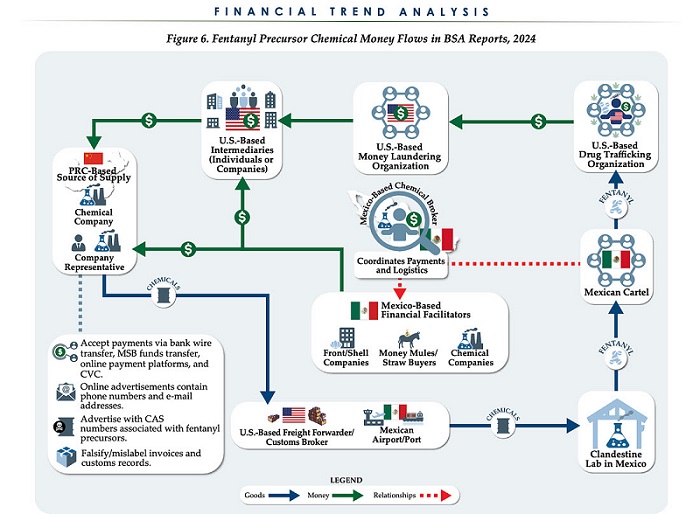

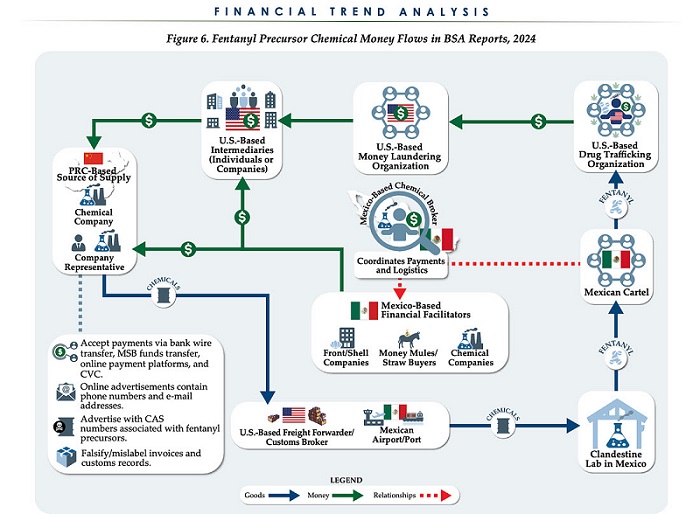

Business1 day agoChina, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoTucker Carlson Interviews Maxime Bernier: Trump’s Tariffs, Mass Immigration, and the Oncoming Canadian Revolution

-

espionage1 day ago

espionage1 day agoEx-NYPD Cop Jailed in Beijing’s Transnational Repatriation Plot, Canada Remains Soft Target

-

Business2 days ago

Business2 days agoDOGE Is Ending The ‘Eternal Life’ Of Government

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCanada drops retaliatory tariffs on automakers, pauses other tariffs

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoBREAKING from THE BUREAU: Pro-Beijing Group That Pushed Erin O’Toole’s Exit Warns Chinese Canadians to “Vote Carefully”

-

Daily Caller1 day ago

Daily Caller1 day agoDOJ Releases Dossier Of Deported Maryland Man’s Alleged MS-13 Gang Ties

-

Daily Caller1 day ago

Daily Caller1 day agoTrump Executive Orders ensure ‘Beautiful Clean’ Affordable Coal will continue to bolster US energy grid