Fraser Institute

Policymakers in Ottawa and Edmonton maintain broken health-care system

From the Fraser Institute

What’s preventing these reforms? In a word, Ottawa.

To say Albertans, and indeed all Canadians, are getting poor value for their health-care dollars is a gross understatement. In reality, Canada remains among the highest spenders on health care in the developed world, in exchange for one of the least accessible universal health-care systems. And while Canadians are increasingly open to meaningful reform, policymakers largely cling to their stale approach of more money, platitudes and little actual change.

In 2021 (the latest year of available data), among high-income universal health-care countries, Canada spent the highest share of its economy on health care (after adjusting for age differences between countries). For that world-class level of spending, Canada ranked 28th in the availability of physicians, 23rd in hospital beds, 25th in MRI scanners and 26th in CT scanners. And we ranked dead last on wait times for specialist care and non-emergency surgeries.

This abysmal performance has been consistent since at least the early 2000s with Canada regularly posting top-ranked spending alongside bottom-ranked performance in access to health-care.

On a provincial basis, Albertans are no better off. Alberta’s health-care system ranks as one of the most expensive in Canada on a per-person basis (after adjusting for population age and sex) while wait times in Alberta were 21 per cent longer than the national average in 2023.

And what are governments doing about our failing health-care system? Not much it seems, other than yet another multi-billion-dollar federal spending commitment (from the Trudeau government) and some bureaucratic shuffling (by the Smith government) paired with grandiose statements of how this will finally solve the health-care crisis.

But people aren’t buying it anymore. Canadians increasingly understand that more money for an already expensive and failing system is not the answer, and are increasingly open to reforms based on higher-performing universal health-care countries where the public system relies more on private firms and entrepreneurs to deliver publicly-funded services. Indeed, according to one recent poll, more than six in 10 Canadians agree that Canada should emulate other countries that allow private management of public hospitals, and more than half of those polled would like increased access to care provided by entrepreneurs.

What’s preventing these reforms?

In a word, Ottawa. The large and expanding federal cash transfers so often applauded by premiers actually prevent provinces from innovating and experimenting with more successful health-care policies. Why? Because to receive federal transfers, provinces must abide by the terms and conditions of the Canada Health Act (CHA), which prescribes often vaguely defined federal preferences for health policy and explicitly disallows certain reforms such as cost-sharing (where patients pay fees for some services, with protections for low-income people).

That threat of financial penalty discourages the provinces from following the examples of countries that provide more timely universal access to quality care such as Germany, Switzerland, Australia and the Netherlands. These countries follow the same blueprint, which includes patient cost-sharing for physician and hospital services (again, with protections for vulnerable populations including low-income individuals), private competition in the delivery of universally accessible services with money following patients to hospitals and surgical clinics, and allowing private purchases of care. Yet if Alberta adopted this blueprint, which has served patients in these other countries so well, it would risk losing billions in health-care transfers from Ottawa.

Finally, provinces have seemingly forgot the lesson from Saskatchewan’s surgical initiative, which ran between 2010 and 2014. That initiative, which included contracting out publicly financed surgeries to private clinics, reduced wait lists in Saskatchewan from among the highest in the country to among the shortest. And when the initiative ended, wait times began to grow again.

The simple reality of health care in every province including Alberta is that the government system is failing despite a world-class price tag. The solutions to this problem are known and increasingly desired by Canadians. Ottawa just needs to get out of the way and allow the provinces to genuinely reform the way we finance and deliver universal health care.

Author:

2025 Federal Election

Housing starts unchanged since 1970s, while Canadian population growth has more than tripled

From the Fraser Institute

By: Austin Thompson and Steven Globerman

The annual number of new homes being built in Canada in recent years is virtually the same as it was in the 1970s, despite annual population growth

now being three times higher, finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think tank.

“Despite unprecedented levels of immigration-driven population growth following the COVID-19 pandemic, Canada has failed to ramp up homebuilding sufficiently to meet housing demand,” said Steven Globerman, Fraser Institute senior fellow and co-author of The Crisis in Housing Affordability: Population Growth and Housing Starts 1972–2024.

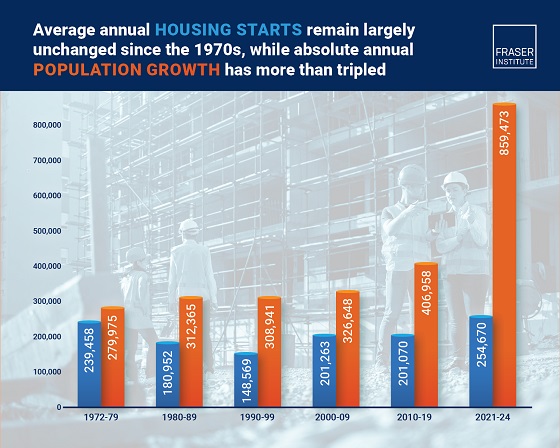

Between 2021 and 2024, Canada’s population grew by an average of 859,473 people per year, while only 254,670 new housing units were started annually. From 1972 to 1979, a similar number of new housing units were built—239,458—despite the population only growing by 279,975 people a year.

As a result, more new residents are competing for each new home than in the past, which is driving up housing costs.

“The evidence is clear—population growth has been outpacing housing construction for decades, with predictable results,” Globerman said.

“Unless there is a substantial acceleration in homebuilding, a slowdown in population growth, or both, Canada’s housing affordability crisis is unlikely to improve.”

The Crisis in Housing Affordability: Population Growth and Housing Starts 1972–2024

- Canada experienced unprecedented population growth following the COVID-19 pandemic without a commensurately large increase in new homebuilding.

- The imbalance between population growth and new housing construction is reflected in a significant gap between housing demand and supply, which is driving up housing costs.

- Canada’s population grew by a record 1.23 million new residents in 2023 almost entirely due to immigration. That growth was more than double the pre-pandemic record set in 2019.

- Population growth slowed to 951,517 in 2024, still well above any year before 2023.

- Nationally, construction began on about 245,367 new housing units in 2024, down from a recent high of 271,198 starts in 2021—Canada’s annual number of housing starts peaked at 273,203 in 1976.

- Canada’s annual number of housing starts regularly exceeded 200,000 in past decades, when absolute population growth was much lower.

- In 2023, Canada added 5.1 new residents for every housing unit started, which was the highest ratio over the study’s timeframe and well above the average rate of 1.9 residents for every unit started observed over the study period (1972–2024).

- This ratio improved modestly in 2024, with 3.9 new residents added per housing start. However, the ratio remains far higher than at any point prior to the COVID-19 pandemic.

- These national trends are broadly mirrored across all 10 provinces, where annual population growth relative to housing starts is, to varying degrees, elevated when compared to long-run averages.

- Without an acceleration in homebuilding, a slowdown in population growth, or both, Canada’s housing affordability crisis will likely persist.

Austin Thompson

Education

Schools should focus on falling math and reading grades—not environmental activism

From the Fraser Institute

In 2019 Toronto District School Board (TDSB) trustees passed a “climate emergency” resolution and promised to develop a climate action plan. Not only does the TDSB now have an entire department in their central office focused on this goal, but it also publishes an annual climate action report.

Imagine you were to ask a random group of Canadian parents to describe the primary mission of schools. Most parents would say something along the lines of ensuring that all students learn basic academic skills such as reading, writing and mathematics.

Fewer parents are likely to say that schools should focus on reducing their environmental footprints, push students to engage in environmental activism, or lobby for Canada to meet the 2016 Paris Agreement’s emission-reduction targets.

And yet, plenty of school boards across Canada are doing exactly that. For example, the Seven Oaks School Division in Winnipeg is currently conducting a comprehensive audit of its environmental footprint and intends to develop a climate action plan to reduce its footprint. Not only does Seven Oaks have a senior administrator assigned to this responsibility, but each of its 28 schools has a designated climate action leader.

Other school boards have gone even further. In 2019 Toronto District School Board (TDSB) trustees passed a “climate emergency” resolution and promised to develop a climate action plan. Not only does the TDSB now have an entire department in their central office focused on this goal, but it also publishes an annual climate action report. The most recent report is 58 pages long and covers everything from promoting electric school buses to encouraging schools to gain EcoSchools certification.

Not to be outdone, the Vancouver School District (VSD) recently published its Environmental Sustainability Plan, which highlights the many green initiatives in its schools. This plan states that the VSD should be the “greenest, most sustainable school district in North America.”

Some trustees want to go even further. Earlier this year, the British Columbia School Trustees Association released its Climate Action Working Group report that calls on all B.C. school districts to “prioritize climate change mitigation and adopt sustainable, impactful strategies.” It also says that taking climate action must be a “core part” of school board governance in every one of these districts.

Apparently, many trustees and school board administrators think that engaging in climate action is more important than providing students with a solid academic education. This is an unfortunate example of misplaced priorities.

There’s an old saying that when everything is a priority, nothing is a priority. Organizations have finite resources and can only do a limited number of things. When schools focus on carbon footprint audits, climate action plans and EcoSchools certification, they invariably spend less time on the nuts and bolts of academic instruction.

This might be less of a concern if the academic basics were already understood by students. But they aren’t. According to the most recent data from the Programme for International Student Assessment (PISA), the math skills of Ontario students declined by the equivalent of nearly two grade levels over the last 20 years while reading skills went down by about half a grade level. The downward trajectory was even sharper in B.C., with a more than two grade level decline in math skills and a full grade level decline in reading skills.

If any school board wants to declare an emergency, it should declare an academic emergency and then take concrete steps to rectify it. The core mandate of school boards must be the education of their students.

For starters, school boards should promote instructional methods that improve student academic achievement. This includes using phonics to teach reading, requiring all students to memorize basic math facts such as the times table, and encouraging teachers to immerse students in a knowledge-rich learning environment.

School boards should also crack down on student violence and enforce strict behaviour codes. Instead of kicking police officers out of schools for ideological reasons, school boards should establish productive partnerships with the police. No significant learning will take place in a school where students and teachers are unsafe.

Obviously, there’s nothing wrong with school boards ensuring that their buildings are energy efficient or teachers encouraging students to take care of the environment. The problem arises when trustees, administrators and teachers lose sight of their primary mission. In the end, schools should focus on academics, not environmental activism.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoASK YOURSELF! – Can Canada Endure, or Afford the Economic Stagnation of Carney’s Costly Climate Vision?

-

Alberta2 days ago

Alberta2 days agoProvince to expand services provided by Alberta Sheriffs: New policing option for municipalities

-

Alberta2 days ago

Alberta2 days agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoInside Buttongate: How the Liberal Swamp Tried to Smear the Conservative Movement — and Got Exposed

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoIs HNIC Ready For The Winnipeg Jets To Be Canada’s Heroes?

-

COVID-191 day ago

COVID-191 day agoCOVID virus, vaccines are driving explosion in cancer, billionaire scientist tells Tucker Carlson

-

Dr. Robert Malone1 day ago

Dr. Robert Malone1 day agoThe West Texas Measles Outbreak as a Societal and Political Mirror