Alberta

Police warning to families: Too much detail in obituaries can lead to identity fraud

As part of Fraud Prevention Month, the Edmonton Police Service is warning families to be cautious about how much information they include in obituaries.

In one recent example, city police are investigating identity fraud involving one suspect who has allegedly used obituary information to commit more than 110 instances of fraud since July 2018.

Police say information such as a birth date or details about an employer may be all a criminal needs to steal your family member’s identity.

Suspects in these types of frauds use information provided in public obituaries to contact former employers, utility providers and other sources. Through social engineering (such as deception and manipulation techniques), they are able to gain further personal details about the deceased and use this information to commit identity fraud.

Police are encouraging families to take the following proactive steps when a loved one passes away:

- When posting an obituary, do not use the day and month of birth of the deceased. Try not to include information on employment history or home address.

- If acting as an executor for an estate:

- Alert credit bureaus at the earliest opportunity, so a flag can be placed on the deceased’s profile.

- Alert Canada Revenue Agency (CRA) and Service Canada, so a flag can be placed on the deceased’s social insurance number and CRA account.

- Inform the financial institutions used by the deceased, as well as utility providers, including cell phone provider.

- Monitor bank and utility account activity until they are closed.

In 2018, there were three additional investigations related to information being taken from obituaries. The deceased’s identities were fraudulently used in the following ways:

- A condo was fraudulently rented using the deceased’s name. The suite was then abandoned, and the rent left unpaid.

- The deceased’s identity was used to sell a vehicle, open a telephone account and obtain a rental vehicle.

- The deceased’s vehicle, containing a wallet with a driver’s license, Alberta health card, SIN card, debit card, and two cell phones, was stolen.

The individuals responsible were identified and charged with various fraud and identity theft related charges.

Obituary information is also used to commit other scams/frauds:

- Grandparent scam – the fraudster contacts the surviving spouse and uses the name of one of the grandchildren listed in the obituary, as well as personal information they find on the grandchild’s social media sites or through internet searches.

- Employment scam – through social engineering, the fraudster obtains the deceased’s personal information and uses it to acquire employment under the deceased’s name, thereby directing the income tax owed to the identity of the deceased.

- Income/benefits fraud – the deceased’s identity is used to apply for senior’s benefits and pensions through the federal government or to redirect pensions or benefits the deceased was receiving to someone else.

- Bank fraud – bank accounts, lines of credit and credit cards are opened in the deceased’s name.

Anyone with any information about this or any other crime is asked to contact the EPS at 780-423-4567 or #377 from a mobile phone. Anonymous information can also be submitted to Crime Stoppers at 1-800-222-8477 or online at www.p3tips.com/250.

Alberta

Big win for Alberta and Canada: Statement from Premier Smith

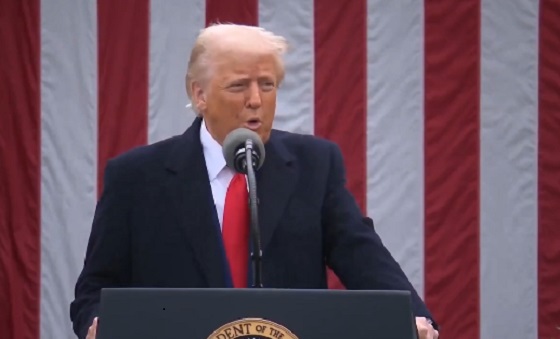

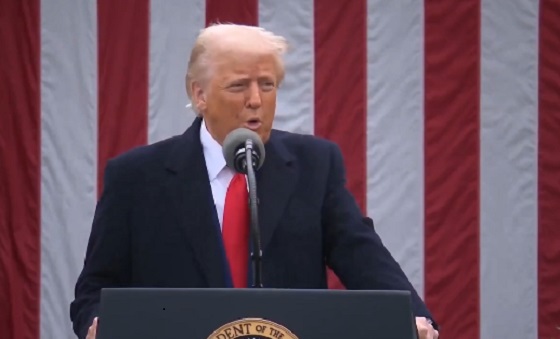

Premier Danielle Smith issued the following statement on the April 2, 2025 U.S. tariff announcement:

“Today was an important win for Canada and Alberta, as it appears the United States has decided to uphold the majority of the free trade agreement (CUSMA) between our two nations. It also appears this will continue to be the case until after the Canadian federal election has concluded and the newly elected Canadian government is able to renegotiate CUSMA with the U.S. administration.

“This is precisely what I have been advocating for from the U.S. administration for months.

“It means that the majority of goods sold into the United States from Canada will have no tariffs applied to them, including zero per cent tariffs on energy, minerals, agricultural products, uranium, seafood, potash and host of other Canadian goods.

“There is still work to be done, of course. Unfortunately, tariffs previously announced by the United States on Canadian automobiles, steel and aluminum have not been removed. The efforts of premiers and the federal government should therefore shift towards removing or significantly reducing these remaining tariffs as we go forward and ensuring affected workers across Canada are generously supported until the situation is resolved.

“I again call on all involved in our national advocacy efforts to focus on diplomacy and persuasion while avoiding unnecessary escalation. Clearly, this strategy has been the most effective to this point.

“As it appears the worst of this tariff dispute is behind us (though there is still work to be done), it is my sincere hope that we, as Canadians, can abandon the disastrous policies that have made Canada vulnerable to and overly dependent on the United States, fast-track national resource corridors, get out of the way of provincial resource development and turn our country into an independent economic juggernaut and energy superpower.”

Alberta

Energy sector will fuel Alberta economy and Canada’s exports for many years to come

From the Fraser Institute

By any measure, Alberta is an energy powerhouse—within Canada, but also on a global scale. In 2023, it produced 85 per cent of Canada’s oil and three-fifths of the country’s natural gas. Most of Canada’s oil reserves are in Alberta, along with a majority of natural gas reserves. Alberta is the beating heart of the Canadian energy economy. And energy, in turn, accounts for one-quarter of Canada’s international exports.

Consider some key facts about the province’s energy landscape, as noted in the Alberta Energy Regulator’s (AER) 2023 annual report. Oil and natural gas production continued to rise (on a volume basis) in 2023, on the heels of steady increases over the preceding half decade. However, the dollar value of Alberta’s oil and gas production fell in 2023, as the surging prices recorded in 2022 following Russia’s invasion of Ukraine retreated. Capital spending in the province’s energy sector reached $30 billion in 2023, making it the leading driver of private-sector investment. And completion of the Trans Mountain pipeline expansion project has opened new offshore export avenues for Canada’s oil industry and should boost Alberta’s energy production and exports going forward.

In a world striving to address climate change, Alberta’s hydrocarbon-heavy energy sector faces challenges. At some point, the world may start to consume less oil and, later, less natural gas (in absolute terms). But such “peak” consumption hasn’t arrived yet, nor does it appear imminent. While the demand for certain refined petroleum products is trending down in some advanced economies, particularly in Europe, we should take a broader global perspective when assessing energy demand and supply trends.

Looking at the worldwide picture, Goldman Sachs’ 2024 global energy forecast predicts that “oil usage will increase through 2034” thanks to strong demand in emerging markets and growing production of petrochemicals that depend on oil as the principal feedstock. Global demand for natural gas (including LNG) will also continue to increase, particularly since natural gas is the least carbon-intensive fossil fuel and more of it is being traded in the form of liquefied natural gas (LNG).

Against this backdrop, there are reasons to be optimistic about the prospects for Alberta’s energy sector, particularly if the federal government dials back some of the economically destructive energy and climate policies adopted by the last government. According to the AER’s “base case” forecast, overall energy output will expand over the next 10 years. Oilsands output is projected to grow modestly; natural gas production will also rise, in part due to greater demand for Alberta’s upstream gas from LNG operators in British Columbia.

The AER’s forecast also points to a positive trajectory for capital spending across the province’s energy sector. The agency sees annual investment rising from almost $30 billion to $40 billion by 2033. Most of this takes place in the oil and gas industry, but “emerging” energy resources and projects aimed at climate mitigation are expected to represent a bigger slice of energy-related capital spending going forward.

Like many other oil and gas producing jurisdictions, Alberta must navigate the bumpy journey to a lower-carbon future. But the world is set to remain dependent on fossil fuels for decades to come. This suggests the energy sector will continue to underpin not only the Alberta economy but also Canada’s export portfolio for the foreseeable future.

-

2025 Federal Election2 days ago

2025 Federal Election2 days ago‘I’m Cautiously Optimistic’: Doug Ford Strongly Recommends Canada ‘Not To Retaliate’ Against Trump’s Tariffs

-

Alberta2 days ago

Alberta2 days agoBig win for Alberta and Canada: Statement from Premier Smith

-

Catherine Herridge2 days ago

Catherine Herridge2 days agoFBI imposed Hunter Biden laptop ‘gag order’ after employee accidentally confirmed authenticity: report

-

Business2 days ago

Business2 days agoCanada may escape the worst as Trump declares America’s economic independence with Liberation Day tariffs

-

Canadian Energy Centre1 day ago

Canadian Energy Centre1 day agoSaskatchewan Indigenous leaders urging need for access to natural gas

-

Business1 day ago

Business1 day agoB.C. Credit Downgrade Signals Deepening Fiscal Trouble

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoLiberal MP resigns after promoting Chinese government bounty on Conservative rival

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHighly touted policies the Liberal government didn’t actually implement