News

Overview of recent Red Deer RCMP arrests include stolen vehicles

Red Deer, Alberta – Recent arrests by Red Deer RCMP include locating and arresting a number of suspects in stolen vehicles, many of whom attempted to flee police before being arrested. A number of those arrests occurred as RCMP monitored areas and prolific property offenders identified through the Red Deer RCMP’s Pinpoint policing strategies. Other arrests were thanks to citizens reporting suspicious activity.

October 11

Shortly before 5:30 am on October 11, RCMP located a suspect walking in the Johnstone neighbourhood who fled when he saw police. Police located him shortly afterward and confirmed that he was wanted on 10 outstanding warrants out of Red Deer and Edmonton. A new court date has not yet been set for 30 year old Jeremy Sanderson-Hayward regarding those outstanding warrants.

October 10

At 5:30 pm on October 10, RCMP worked with Lacombe Police Service in locating two men driving a stolen SUV in south Red Deer. When the vehicle refused to stop for RCMP, more police officers laid a tire deflation device, which punctured several tires. The SUV continued south onto Spruce Drive, where the occupants abandoned it and attempted to flee police on foot. Both suspects were arrested in the Mountview neighbourhood. One suspect assaulted a police officer in his attempt to escape custody, used stolen identification in an attempt to conceal his identity from police, and was found to be in possession of a small amount of what appeared to be crystal meth. The police officer was not injured during the arrest. The SUV had been reported stolen out of Red Deer on October 9.

A 32 year old man and a 39 year old man face charges; their names cannot be released at this time as those charges have not yet been sworn before the courts.

October 9

Shortly before 5:30 pm on October 9, RCMP responded to a report of a suspicious vehicle driving in an industrial area in north Red Deer. Police located the truck and confirmed that it was stolen; the blue Ford F250 truck refused to stop for police, who did not pursue due to public safety concerns. The truck was observed speeding, driving over a median and through a ditch as it fled police. RCMP located the truck abandoned in the GH Dawe Centre parking lot and arrested the suspect after he fled on foot and attempted to hide in an alley at Hamilton Drive. At the time of his arrest, the suspect was found to be in possession of a small amount of what is believed to be ecstasy. The truck had been reported stolen out of Airdrie on October 8.

34 year old Shane William Brown was wanted on three outstanding warrants at the time of his arrest. In addition to those charges, he now faces the following charges:

· CDSA 4(1) – Possession of Schedule I substance (MDMA/ Ecstasy)

· Criminal Code 249(1)(a) – Dangerous operation of motor vehicle

· Criminal Code 249.1(1) – Operate motor vehicle while being pursued by police

· Criminal Code 355(a) – Possession of stolen property over $5,000

· Criminal Code 733.1(1) – Fail to comply with probation order X 3

· TSA 94(2) – Drive motor vehicle while license suspended

· TSA 52(1)(a) – Operate motor vehicle without registration

· TSA 54(1)(a) – Drive uninsured motor vehicle

Brown is scheduled to appear in court in Red Deer on October 11 at 9:30 am.

October 9

At approximately 5 pm on October 9, RCMP located a stolen truck as it drove in north Red Deer. The white Ford truck refused to stop for police, who did not pursue it for public safety reasons but moved to intercept it as it drove through the Normandeau neighbourhood and back to Gaetz Avenue, where its occupants abandoned the truck in a parking lot and attempted to flee police on foot. The female driver and the male passenger were arrested without incident. He was wanted on several outstanding warrants out of neighbouring areas, and she was found to be in possession of break-in instruments and stolen identification.

31 year old Lacey Ann Crabbe faces the following charges:

· Criminal Code 355(a) – Possession of stolen property over $5,000 X 2

· Criminal Code 249(1)(a) – Dangerous operation of motor vehicle

· Criminal Code 249.1(1) – Operate motor vehicle while being pursued by police

· Criminal Code 88(1) – Possession of weapon for dangerous purpose

· Criminal Code 351(b) – Possession of break-in instruments

· Criminal Code 145(3) – Fail to comply with conditions X 3

· Criminal Code 733.1(1) – Fail to comply with probation X 3

Crabbe is scheduled to appear in court in Red Deer on October 11 at 9:30 am.

39 year old Johnathon Patrick Durocher faces the following charges:

· Criminal Code 355(a) – Possession of stolen property over $5,000

· Criminal Code 145(3) – Fail to comply with conditions X 2

· Criminal Code 145(5.1) – Fail to comply with conditions of an undertaking

Durocher is scheduled to appear in court in Red Deer on October 12 at 9:30 am.

October 7

Shortly after 1:30 pm on October 7, RCMP responded to a report of a disturbance at a residence in the Riverside Meadows neighbourhood. On arrival, they located a male suspect in possession of a machete and arrested him after a brief foot chase. RCMP determined that the victim and the suspect were known to each other and that there was no danger to the public during this incident.

21 year old Solomon Courtoreille faces the following charges:

· Criminal Code 88(1) – Possession of weapon for dangerous purpose

· Criminal Code 129(a) – Resist/ obstruct peace officer

· Criminal Code 145(3) – Fail to comply with conditions X 2

Courtoreille made his first court appearance in Red Deer on October 10; he is scheduled to appear again on October 12 at 9:30 am.

October 6

Shortly before 9:30 pm on October 6, RCMP were called to a break and enter in progress as a suspect attempted to break down the door of an apartment unit at a building in the West Park neighbourhood. On arrival, RCMP determined that the suspect had smashed the glass at the building entry door to gain access, and then attempted to break into an apartment while its residents were inside. The suspect and the victims were not known to each other, and the suspect was taken into custody at the scene.

35 year old Jordan Charles Allen faces the following charges:

· Criminal Code 348(1)(a) – Break and enter

· Criminal Code 145(3) – Fail to comply with conditions

· Criminal Code 733.1(1) – Breach of probation

Allen made his first court appearance in Red Deer on October 10; he is scheduled to appear again on October 17 at 9:30 am.

October 5

Shortly before 10:30 am on October 5, RCMP responded to a report of a suspicious vehicle in a parking lot in the Highland Green neighbourhood. On arrival, RCMP located a suspect who was wanted on outstanding warrants, and seized a club and hydromorphone during his arrest.

A 32 year old man faces new charges in addition to his outstanding warrants; his name cannot be released at this time as those charges have not yet been sworn before the courts.

September 29

Shortly before 1:30 pm, Red Deer RCMP Traffic unit was doing a speed campaign in the area of 59 Avenue and 63 Street when a grey Chevrolet truck refused to stop and fled. RCMP determined the vehicle was stolen and tracked it to C & E Trail just north of Highway 11A, where the occupants abandoned it and attempted to flee police on foot. Police Dog Services attended and tracked the suspects to a bushed area where they were attempting to hide. The truck had been reported stolen out of Red Deer on September 4.

A 22 year old man and a 20 year old woman each face charges; their names cannot be released at this time as those charges have not yet been sworn before the courts.

Follow us on Twitter: @RCMPAlberta Like us on Facebook: RCMPinAlberta

International

UK Supreme Court rules ‘woman’ means biological female

Susan Smith (L) and Marion Calder, directors of ‘For Women Scotland’ cheer as they leave the Supreme Court on April 16, 2025, in London, England after winning their appeal in defense of biological reality

From LifeSiteNews

By Michael Haynes, Snr. Vatican Correspondent

The ruling, in which the court rejected transgender legal status, comes as a victory for campaigners who have urged the recognition of biological reality and common sense in the law.

The U.K. Supreme Court has issued a ruling stating that “woman” in law refers to a biological female, and that transgender “women” are not female in the eyes of the law.

In a unanimous verdict, the Supreme Court of the United Kingdom ruled today that legally transgender “women” are not women, since a woman is legally defined by “biological sex.”

Published April 16, the Supreme Court’s 88-page verdict was handed down on the case of Women Scotland Ltd (Appellant) v. The Scottish Ministers (Respondent). The ruling marks the end of a battle of many years between the Scottish government and women’s right campaigners who sought to oppose the government’s promotion of transgender ideology.

In 2018, the Scottish government issued a decision to allow the definition of “woman” to include men who assume their gender to be female, opening the door to allowing so-called “transgender” individuals to identify as women.

This guidance was challenged by women’s rights campaigners, arguing that a woman should be defined in line with biological sex, and in 2022 the Scottish government was forced to change its definition after the court found that such a move was outside the government’s “legislative competence.”

Given this, the government issued new guidance which sought to cover both aspects: saying that biological women are women, but also that men with a “gender recognition certificate” (GRC) are also considered women. A GRC is given to people who identify as the opposite sex and who have had medical or surgical interventions in an attempt to “reassign” their gender.

Women Scotland Ltd appealed this new guidance. At first it was rejected by inner courts, but upon their taking the matter to the Supreme Court in March last year, the nation’s highest judicial body took up the case.

Today, with the ruling issued against transgender ideology, women’s campaigners are welcoming the news as a win for women’s safety.

“A thing of beauty,” praised Lois McLatchie Miller from the Alliance Defending Freedom legal group.

“They looked at the whole argument, not just who goes in what bathroom and trans women. This is going to change organizations, employers, service providers,” Maya Forstater, chief executive of Sex Matters, told the Telegraph. “Everyone is going to have to pay attention to this, this is from the highest court in the land. It’s saying sex in the Equality Act is biological sex. Self ID is dead.”

“Victory,” commented Charlie Bently-Astor, a prominent campaigner for biological reality against the transgender movement, after she nearly underwent surgical transition herself at a younger age.

“After 15 years of insanity, the U.K. Supreme Court has ruled that men who say they are ‘trans women’ are not women,” wrote leader of the Christian political movement David Kurten.

Leader of the Conservative Party – the opposition to the current Labour government – Kemi Badenoch welcomed the court’s ruling, writing that “saying ‘trans women are women’ was never true in fact and now isn’t true in law, either.”

Others lamented the fact that the debate even was taking place, let alone having gone to the Supreme Court.

“What a parody we live in,” commented Reform Party candidate Joseph Robertson.

Rupert Lowe MP – who has risen to new prominence in recent weeks for his outspoken condemnation of the immigration and rape gang crisis – wrote, “Absolute madness that we’re even debating what a woman is – it’s a biological fact. No amount of woke howling will ever change that.”

However, the Supreme Court did not wish to get pulled into siding with certain arguments, with Lord Hodge of the tribunal stating that “we counsel against reading this judgment as a triumph of one or more groups in our society at the expense of another. It is not.”

The debate has taken center stage in the U.K. in recent years, not least for the role played by the current Labour Prime Minister Keir Starmer. Starmer himself has become notorious throughout the nation for his contradictions and inability to answer the question of what a woman is, having flip-flopped on saying that a woman can have a penis, due to his support for the transgender movement.

At the time of going to press, neither Starmer nor his deputy Angela Rayner issued a statement about the Supreme Court ruling. There has been no statement issued from the Scottish government either, nor from the office of the first minister.

Transgender activists have expectedly condemned the ruling as “a disgusting attack on trans rights.” One leading transgender campaigner individual told Sky News, “I am gutted to see the judgement from the Supreme Court which ends 20 years of understanding that transgender people with a GRC are able to be, for all intents and purposes, legally recognized as our true genders.”

International

Tulsi Gabbard tells Trump she has ‘evidence’ voting machines are ‘vulnerable to hackers’

From LifeSiteNews

By Stephen Kokx

Last month, Trump signed an executive order directing federal election-related funds to be conditioned on states “complying with the integrity measures set forth by Federal law, including the requirement that states use the national mail voter registration form that will now require proof of citizenship.”

Director of National Intelligence Tulsi Gabbard announced during a Cabinet meeting last week at the White House that voting machines across the U.S. are not secure.

“We have evidence of how these electronic voting systems have been vulnerable to hackers for a very long time, and vulnerable to exploitation to manipulate the results of the votes being cast,” she said about a half hour into the meeting.

Gabbard’s remarks confirm what millions of Americans have long suspected about elections across the U.S.

President Donald Trump himself has maintained skepticism of current voting methods and has called for paper ballots to prevent cheating.

MyPillow CEO Mike Lindell was one of only a few voices to publicly argue that voting machines, like those run by Dominion and Smartmatic which were used during the 2020 presidential election, were compromised. GOP Congresswoman Marjorie Taylor-Greene took to X to praise the businessman after Gabbard made her remarks.

“Mike Lindell along with MANY others vindicated!!” she exclaimed on X. “Another conspiracy theory being proven right! Guess what Democrats already knew this and publicly talked about it in 2019! And then lied and lied and lied!!!”

Last month, Trump signed an executive order directing federal election-related funds to be conditioned on states “complying with the integrity measures set forth by Federal law, including the requirement that states use the national mail voter registration form that will now require proof of citizenship.”

Congress has also taken steps to ensure election integrity by voting on the Safeguard American Voter Eligibility Act (also known as the SAVE Act) last week. Dubbed “controversial” by the media and left-wing groups, the common sense bill would require persons to show proof of citizenship before voting. The House approved the measure 220-208 with four Democrats in support. The bill now heads to the Senate where it will face an uphill battle for the required 60 votes. Republicans currently have a 53 seat majority.

Gabbard told Trump at the meeting that the evidence she found “further drives forward your mandate to bring about paper ballots across the country so that voters can have faith in the integrity of our elections.”

-

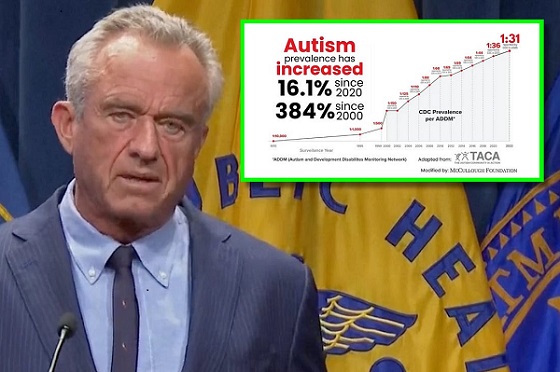

Autism2 days ago

Autism2 days agoRFK Jr. Exposes a Chilling New Autism Reality

-

COVID-192 days ago

COVID-192 days agoCanadian student denied religious exemption for COVID jab takes tech school to court

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNeil Young + Carney / Freedom Bros

-

International2 days ago

International2 days agoUK Supreme Court rules ‘woman’ means biological female

-

2025 Federal Election1 day ago

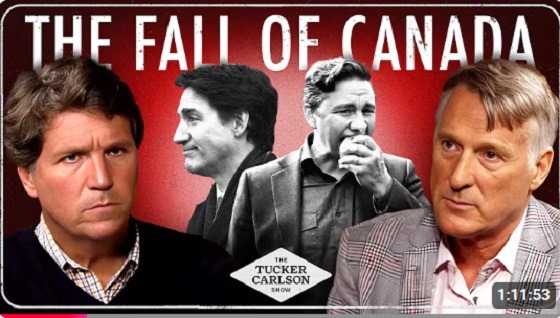

2025 Federal Election1 day agoTucker Carlson Interviews Maxime Bernier: Trump’s Tariffs, Mass Immigration, and the Oncoming Canadian Revolution

-

Health2 days ago

Health2 days agoWHO member states agree on draft of ‘pandemic treaty’ that could be adopted in May

-

Business1 day ago

Business1 day agoDOGE Is Ending The ‘Eternal Life’ Of Government

-

espionage1 day ago

espionage1 day agoEx-NYPD Cop Jailed in Beijing’s Transnational Repatriation Plot, Canada Remains Soft Target