Business

Ottawa’s “Net Zero” emission-reduction plan will cost Canadian workers $8,000 annually by 2050

From the Fraser Institute

Ross McKitrick

Canada’s Path to Net Zero by 2050: Darkness at the End of the Tunnel

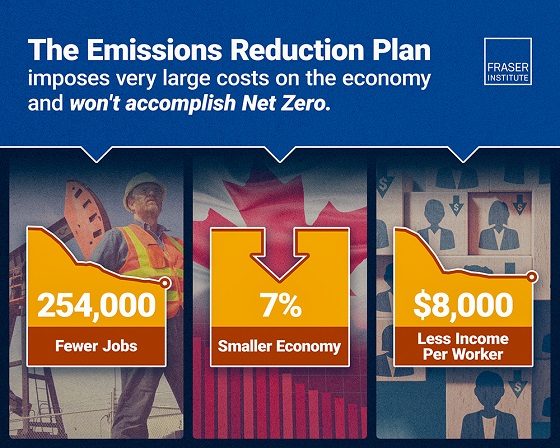

The federal government’s plan to achieve “net zero” greenhouse gas emissions will result in 254,000 fewer jobs and cost workers $8,000 in lower wages by 2050, all while failing to meet the government’s own emission-reduction target, finds a new study published today by the Fraser Institute, an independent, nonpartisan Canadian public policy think-tank.

“Ottawa’s emission-reduction plan will significantly hurt Canada’s economy and cost workers money and jobs, but it won’t achieve the target they’ve set because it is infeasible,” said Ross McKitrick, senior fellow at the Fraser Institute and author of Canada’s Path to Net Zero by 2050: Darkness at the End of the Tunnel.

The government’s Net Zero by 2050 emission-reduction plan includes: the federal carbon tax, clean fuel standards, and various other GHG-related regulations, such as energy efficiency requirements for buildings, fertilizer restrictions on farms, and electric vehicle mandates.

By 2050, these policies will have imposed significant costs on the Canadian economy and on workers.

For example:

• Canada’s economy will be 6.2 per cent smaller in 2050 than it would have been without these policies.

• Workers will make $8,000 less annually.

• And there will be 254,000 fewer jobs.

The study also shows that even a carbon tax of $1,200 per tonne (about $2.70 per litre of gas) would not get emissions to zero. Crucially, the study finds that the economically harmful policies can’t achieve net-zero emissions by 2050 and will only reduce GHG emissions by an estimated 70 per cent of the government’s target.

“Despite political rhetoric, Ottawa’s emission-reduction policies will impose enormous costs without even meeting the government’s target,” McKitrick said.

“Especially as the US moves aggressively to unleash its energy sector, Canadian policymakers need to rethink the damage these policies will inflict on Canadians and change course.”

- The Government of Canada has committed to going beyond the Paris target of reducing greenhouse gas (GHG) emissions to 40 percent below 2005 levels as of 2030 and now intends to achieve net zero carbon dioxide (CO2) emissions as of 2050. This study provides an outlook through 2050 of Canada’s path to net zero by answering two questions: will the Government of Canada’s current Emission Reduction Plan (ERP) get us to net zero by 2050, and if not, is it feasible for any policy to get us there?

- First, a simulation of the ERP extended to 2050 results in emissions falling by approximately 70 percent relative to where they would be otherwise, but still falling short of net zero. Moreover, the economic costs are significant: real GDP declines by seven percent, income per worker drops by six percent, 250,000 jobs are lost, and the annual cost per worker exceeds $8,000.

- Second, the study explores whether a sharply rising carbon tax alone could achieve net zero. At $400 per tonne, emissions decrease by 68 percent, but tripling the carbon tax to $1,200 per tonne achieves only an additional 6 percent reduction. At this level, the economic impacts are severe: GDP would shrink by 18 percent, and incomes per worker would fall by 17 percent, compared with the baseline scenario.

- The conclusion is clear: Without transformative abatement technologies, Canada is unlikely to reach net zero by 2050. Even the most efficient policies impose unsustainable costs, making them unlikely to gain public support.

Ross McKitrick

Business

Musk Slashes DOGE Savings Forecast By 85%

From the Daily Caller News Foundation

By Thomas English

Elon Musk announced Thursday that the Department of Government Efficiency (DOGE) is now targeting $150 billion in federal savings for fiscal year 2026 — dramatically scaling back earlier claims of slashing as much as $2 trillion.

Musk initially projected DOGE would deliver $2 trillion in savings by targeting government waste, fraud and abuse. That figure was halved to $1 trillion earlier this year, but Musk walked it back again at Thursday’s Cabinet meeting, saying the revised $150 billion projection will “result in better services for the American people” and ensure federal spending “in a way that is sensible and fair and good.”

“I’m excited to announce we anticipate saving in FY ’26 from a reduction of waste and fraud a reduction of $150 billion dollars,” Musk said. “And some of it is just absurd, like, people getting unemployment insurance who haven’t been born yet. I mean, I think anyone can appreciate — I mean, come on, that’s just crazy.”

The announcement marks the latest in a string of revised projections from Musk, who has become the face of President Donald Trump’s aggressive federal efficiency agenda.

“Your people are fantastic,” the president responded. “In fact, hopefully they’ll stay around for the long haul. We’d like to keep as many as we can. They’re great — smart, sharp, finding things that nobody would have thought of.”

Musk originally floated the $2 trillion figure during campaign appearances last fall.

“I think we could do at least $2 trillion,” Musk said at the Madison Square Garden campaign rally in November. “At the end of the day, you’re being taxed — all government spending is taxation … Your money is being wasted, and the Department of Government Efficiency is going to fix that.”

By January, he softened expectations to a “really quite achievable” $1 trillion target before downsizing that figure again this week.

“Our goal is to reduce the deficit by a trillion dollars,” Musk told Fox News’ Bret Baier “Looked at in total federal spending, to drop the federal spending from $7 trillion to $6 trillion by eliminating waste, fraud and abuse … Which seems really quite achievable.”

DOGE’s website, which tracks cost-saving initiatives and contract cancellations, currently calculates total federal savings at $150 billion.

2025 Federal Election

Taxpayers urge federal party leaders to drop home sale reporting to CRA

Party leaders must clarify position on home equity tax

The Canadian Taxpayers Federation is calling on all party leaders to prove they’re against home equity taxes by pledging to immediately remove the Canada Revenue Agency reporting requirement on the sale of primary residences.

“Canadians rely on the sale of their homes to pay for their golden years,” said Carson Binda, CTF B.C. Director. “After the government spent hundreds of thousands of dollars flirting with home taxes, taxpayers need party leaders to prove they won’t tax our homes by removing the CRA reporting requirement.”

Right now, the profit you make from selling your home is exempt from the capital gains tax. However, in 2016, the federal government mandated that Canadians report the sale of their homes to the CRA, even though it’s tax exempt.

The Canada Mortgage and Housing Corporation also spent at least $450,000 to study and influence public opinion in favour of home equity taxes. The report recommended a home equity tax targeting the “housing wealth windfalls gained by many homeowners while they sleep and watch TV.”

“A home equity tax would hurt seniors saving for their golden years and make homes more expensive for younger generations,” Binda said. “If the federal government isn’t planning on imposing a home equity tax, then Canadians shouldn’t be forced to report the sale of their home to the CRA.”

-

Business2 days ago

Business2 days agoStocks soar after Trump suspends tariffs

-

COVID-192 days ago

COVID-192 days agoBiden Admin concealed report on earliest COVID cases from 2019

-

Business2 days ago

Business2 days agoScott Bessent Says Trump’s Goal Was Always To Get Trading Partners To Table After Major Pause Announcement

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoResearchers Link China’s Intelligence and Elite Influence Arms to B.C. Government, Liberal Party, and Trudeau-Appointed Senator

-

Business1 day ago

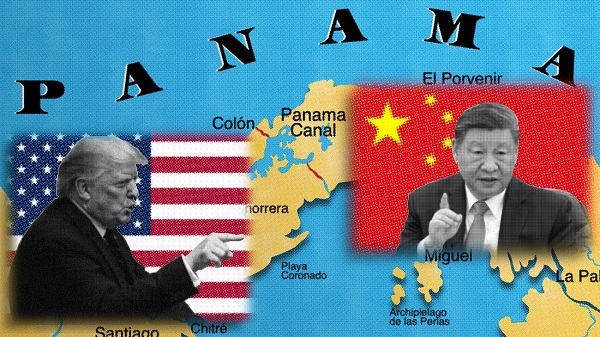

Business1 day agoTimeline: Panama Canal Politics, Policy, and Tensions

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP memo warns of Chinese interference on Canadian university campuses to affect election

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoThe status quo in Canadian politics isn’t sustainable for national unity

-

COVID-191 day ago

COVID-191 day agoFauci, top COVID officials have criminal referral requests filed against them in 7 states