Business

Ottawa’s emissions cap another headache for consumers and business

From Resource Works

Ottawa’s emissions cap for oil and gas aims to cut emissions but risks raising costs for consumers and disrupting industry stability.

Ottawa has brought down a new emissions cap for the oil and gas industry, with a mandate to reduce emissions by 35 percent from 2019 levels by 2030 to support the federal government’s climate targets. While the federal government is celebrating the cap as a big step towards a more sustainable future, it is going to make life harder for consumers and businesses alike.

This cap is coming in at a time when the oil sector is finally gaining greater stability due to the expanded Trans Mountain pipeline (TMX), and the mandate would undermine that progress and press greater costs upon households and industries that are already adjusting to high inflation and uncertainty in world markets.

Now that TMX is operational, Canada’s oil producers have grown their access to international markets, most importantly in Asia and the West Coast of the United States. Much-needed price stability now exists for Western Canadian Select (WCS), cutting the discount against the U.S. West Texas Intermediate benchmark, enabling Canadian oil to compete more effectively.

Newfound stability means that Canadian consumers and businesses have benefited from slightly lower prices, and that industry has grown less dependent on a more limited domestic demand. However, Ottawa’s emissions cap does threaten this new balance, and the sector now has to deal with compliance costs that could be passed down to consumers.

In order to meet the cap’s targets, Canadian oil producers must heavily invest in carbon capture and storage (CCS) technologies, which is costly but essential. Major CCS projects include Shell’s Quest and the Alberta Carbon Trunk Line, both of which are already operational.

The Pathways Alliance is a coalition of six major oil sands companies and is preparing to invest in one of the world’s largest networks for carbon storage. These efforts are crucial for reducing emissions, despite requiring vast amounts of capital.

Those in the industry are worrying that the emissions cap will push resources away from production and, instead, towards compliance, adding costs that will be borne by fuel prices and other consumer products.

Ottawa has portrayed the cap as an essential measure for meeting the federal government’s climate goals, with Environment Minister Jonathan Wilkinson labeling it “technically achievable.” Nonetheless, industry players argue that the timeline does not align with the practicalities of scaling CCS and other strategies aimed at decarbonizing.

Strathcona Resources executive chairman Adam Waterous pointed out the “stroke-of-the-pen” risk, in which shifting political landscapes imperil ongoing investments in carbon capture. Numerous oil producers feel that without certainty in carbon price stability, Ottawa’s cap will result in an unstable business environment that will push investment away from production.

Business leaders do not share the federal government’s optimism about the cap and see it as a one-sided approach that fails to reckon with market realities. The Pathways Alliance, which includes companies like Suncor Energy and Canadian Natural Resources, has been frustrated in its multiple attempts to get federal support to fund its $16.5-billion CCS project.

Rather than imposing these new limits, energy industry advocates argue that the government should provide targeted incentives like “carbon contracts for difference” (CCfDs), which help to stabilize carbon credit prices and reduce financial risk among investors. These measures would enable the energy sector to decarbonize without putting a greater burden on consumers.

The cap’s timing also raises concerns about the Canada-U.S. relationship. Canada has traditionally been a stable supplier of energy and helps to bolster U.S. energy security. However, as the U.S. increases its reliance on Canadian oil, the cap could disrupt this trade relationship. Lowered production levels would leave the economies of both the U.S. and Canada vulnerable, potentially disrupting energy prices and supply stability.

For households across Canada, the emissions cap could mean further financial strain. The higher costs of compliance passed to oil producers will mean higher prices at the pump and more expensive heating costs at a time when Canadian consumers are already struggling financially.

Businesses will also face increasing operating costs, which will be passed down to consumers via more expensive goods and services. Furthermore, higher costs and reduced production will erode Canada’s competitive advantage in the global energy market, slowing economic growth and risking job losses in the energy sector.

So, while Ottawa can laud its emissions cap as a necessary action on the climate, the implications for consumers and businesses are tremendous. Working with industry to find pragmatic, collaborative solutions is how Ottawa can avoid creating more financial burdens for Canadians.

Business

US Supreme Court may end ‘emergency’ tariffs, but that won’t stop the President

From the Fraser Institute

By Scott Lincicome

The U.S. Supreme Court will soon decide the fate of the global tariffs President Donald J. Trump has imposed under the International Emergency Powers Act (IEEPA). A court decision invalidating the tariffs is widely expected—hovering around 75 per cent on various betting markets—and would be welcome news for American importers, the United States economy and the rule of law. Even without IEEPA, however, other U.S. laws all but ensure that much higher tariffs will remain the norm. Realizing that protection will just take a little longer and, perhaps, be a little more predictable.

As my Cato Institute colleague Clark Packard and I wrote last year, the Constitution grants Congress the power to impose tariffs, but the legislative branch during the 20th century delegated much of that authority to the president under the assumption that he would be the least likely to abuse it. Thus, U.S. trade law is today littered with provisions granting the president broad powers to impose tariffs for various reasons. No IEEPA needed.

This includes laws that Trump has already invoked. Today, for example, we have “Section 301” tariffs of up to 25 per cent on around half of all Chinese imports, due to alleged “unfair trade” practices by Beijing. We also have global “Section 232” tariffs of up to 50 per cent on imports of steel and aluminum, automotive goods, heavy-duty trucks, copper and wood products—each imposed on the grounds that these goods threaten U.S. national security. The Trump administration also has created a process whereby “derivative” products made from goods subject to Section 232 tariffs will be covered by those same tariffs. Several other Section 232 investigations—on semiconductors, pharmaceuticals, critical minerals, commercial aircraft, and more—were also initiated earlier this year, setting the stage for more U.S. tariffs in the weeks ahead.

Trump administration officials admit that they’ve been studying these and other laws as fallback options if the Supreme Court invalidates the IEEPA tariffs. Their toolkit reportedly includes completing the actions above, initiating new investigations under Section 301 (targeting specific countries) and Section 232 (targeting certain products), and imposing tariffs under other laws that have not yet been invoked. Most notably, there’s strong administration interest in Section 122 of the Trade Act of 1974, which empowers the president to address “large and serious” balance-of-payments deficits via global tariffs of up to 15 per cent for no more than 150 days (after which Congress must act to continue the tariffs). The administration might also consider Section 338 of the Tariff Act of 1930—a short and ambiguous law that authorizes the president to impose tariffs of up to 50 per cent on imports from countries that have “discriminated” against U.S. commerce—but this is riskier because the law may have been superseded by Section 301.

We should expect the administration to move quickly to use these measures to reverse engineer Trump’s global tariff regime under IEEPA. The main difference would be in how he does so. IEEPA was essentially a tariff switch in the Oval Office that could be flipped on and off instantly, creating massive uncertainty for businesses, foreign governments and the U.S. economy. The alternative authorities, by contrast, all have substantive and procedural guardrails that limit their size and scope, or, at the very least, give American and foreign companies time to prepare for forthcoming tariffs (or lobby against them).

Section 301, for example, requires an investigation of a foreign country’s trade and economic policies—cases that typically take nine months and involve public hearings and formal findings. Section 232 requires an investigation into and a report on whether imports threaten national security—actions that also typically take months. Section 122 has fewer procedures, but its limited duration and 15 per cent cap make it far less dangerous than IEEPA, under which Trump has repeatedly threatened tariffs of 100 per cent or more.

Of course, “procedural guardrails” is a relative term for an administration that has already stretched Section 232’s “national security” rationale to cover bathroom vanities. The courts also have largely rubber-stamped the administration’s previous moves under Section 232 and Section 301—a big reason why we should expect the Trump administration’s tariff “Plan B” to feature them.

Thus, a court ruling against the IEEPA tariffs would be an important victory for constitutional governance and would eliminate the most destabilizing element of Trump’s tariff regime. But until the U.S. Congress reclaims some of its constitutional authority over U.S. trade policy, high and costly tariffs will remain.

Business

Canada is failing dismally at our climate goals. We’re also ruining our economy.

From the Fraser Institute

By Annika Segelhorst and Elmira Aliakbari

Short-term climate pledges simply chase deadlines, not results

The annual meeting of the United Nations Conference of the Parties, or COP, which is dedicated to implementing international action on climate change, is now underway in Brazil. Like other signatories to the Paris Agreement, Canada is required to provide a progress update on our pledge to reduce greenhouse gas (GHG) emissions by 40 to 45 per cent below 2005 levels by 2030. After decades of massive government spending and heavy-handed regulations aimed at decarbonizing our economy, we’re far from achieving that goal. It’s time for Canada to move past arbitrary short-term goals and deadlines, and instead focus on more effective ways to support climate objectives.

Since signing the Paris Agreement in 2015, the federal government has introduced dozens of measures intended to reduce Canada’s carbon emissions, including more than $150 billion in “green economy” spending, the national carbon tax, the arbitrary cap on emissions imposed exclusively on the oil and gas sector, stronger energy efficiency requirements for buildings and automobiles, electric vehicle mandates, and stricter methane regulations for the oil and gas industry.

Recent estimates show that achieving the federal government’s target will impose significant costs on Canadians, including 164,000 job losses and a reduction in economic output of 6.2 per cent by 2030 (compared to a scenario where we don’t have these measures in place). For Canadian workers, this means losing $6,700 (each, on average) annually by 2030.

Yet even with all these costly measures, Canada will only achieve 57 per cent of its goal for emissions reductions. Several studies have already confirmed that Canada, despite massive green spending and heavy-handed regulations to decarbonize the economy over the past decade, remains off track to meet its 2030 emission reduction target.

And even if Canada somehow met its costly and stringent emission reduction target, the impact on the Earth’s climate would be minimal. Canada accounts for less than 2 per cent of global emissions, and that share is projected to fall as developing countries consume increasing quantities of energy to support rising living standards. In 2025, according to the International Energy Agency (IEA), emerging and developing economies are driving 80 per cent of the growth in global energy demand. Further, IEA projects that fossil fuels will remain foundational to the global energy mix for decades, especially in developing economies. This means that even if Canada were to aggressively pursue short-term emission reductions and all the economic costs it would imposes on Canadians, the overall climate results would be negligible.

Rather than focusing on arbitrary deadline-contingent pledges to reduce Canadian emissions, we should shift our focus to think about how we can lower global GHG emissions. A recent study showed that doubling Canada’s production of liquefied natural gas and exporting to Asia to displace an equivalent amount of coal could lower global GHG emissions by about 1.7 per cent or about 630 million tonnes of GHG emissions. For reference, that’s the equivalent to nearly 90 per cent of Canada’s annual GHG emissions. This type of approach reflects Canada’s existing strength as an energy producer and would address the fastest-growing sources of emissions, namely developing countries.

As the 2030 deadline grows closer, even top climate advocates are starting to emphasize a more pragmatic approach to climate action. In a recent memo, Bill Gates warned that unfounded climate pessimism “is causing much of the climate community to focus too much on near-term emissions goals, and it’s diverting resources from the most effective things we should be doing to improve life in a warming world.” Even within the federal ministry of Environment and Climate Change, the tone is shifting. Despite the 2030 emissions goal having been a hallmark of Canadian climate policy in recent years, in a recent interview, Minister Julie Dabrusin declined to affirm that the 2030 targets remain feasible.

Instead of scrambling to satisfy short-term national emissions limits, governments in Canada should prioritize strategies that will reduce global emissions where they’re growing the fastest.

Elmira Aliakbari

-

Alberta2 days ago

Alberta2 days agoAlberta to protect three pro-family laws by invoking notwithstanding clause

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoLawsuit Claims Google Secretly Used Gemini AI to Scan Private Gmail and Chat Data

-

Health1 day ago

Health1 day agoCDC’s Autism Reversal: Inside the Collapse of a 25‑Year Public Health Narrative

-

Business2 days ago

Business2 days agoCanada is failing dismally at our climate goals. We’re also ruining our economy.

-

Crime2 days ago

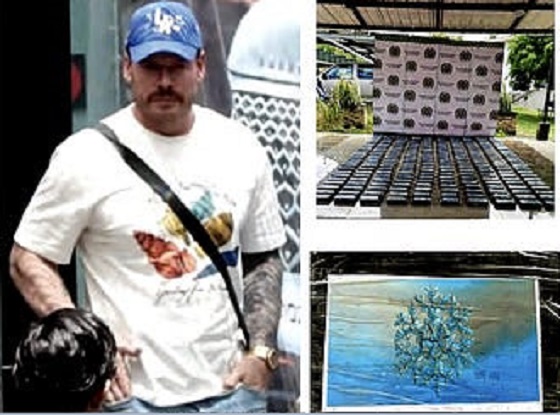

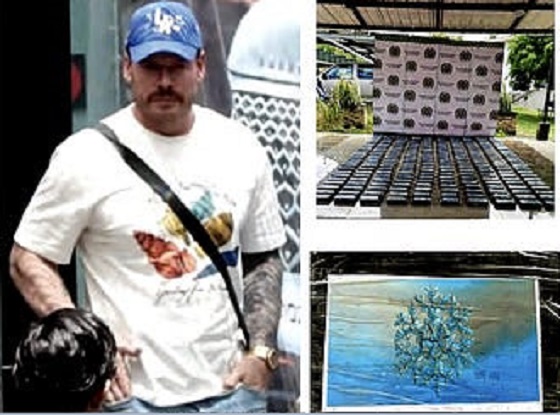

Crime2 days ago‘Modern-Day Escobar’: U.S. Says Former Canadian Olympian Ran Cocaine Pipeline with Cartel Protection and a Corrupt Toronto Lawyer

-

Crime1 day ago

Crime1 day agoCocaine, Manhunts, and Murder: Canadian Cartel Kingpin Prosecuted In US

-

Health1 day ago

Health1 day agoBREAKING: CDC quietly rewrites its vaccine–autism guidance

-

Alberta19 hours ago

Alberta19 hours agoPremier Smith explains how private clinics will be introduced in Alberta