Alberta

OPINION: Marlin Schmidt on water allocation in the Bow River Basin

Marlin Schmidt, MLA for Edmonton-Gold Bar, Environment and Parks Critic for Alberta’s Official NDP Opposition

The wise allocation of water in Alberta is essential to the sustainable development of an economy that works for all Albertans while preserving our precious natural heritage.

In 2007, Alberta recognized that limits for water allocation in the Bow River basin had been exceeded. No more new allocations of water have been allowed and Albertans have carefully managed the water resources in the basin since then. Fortress Mountain Holdings’ recent application to haul away and sell more than half of the 98 million litres a year it currently has the license to use threatens the careful management of water in the Bow River basin.

The original operators of Fortress Mountain were granted a license in 1968 to use 98 million litres of water per year from a tributary to Galatea Creek to prepare food and provide drinking water to skiers at the resort. The current owners claim that more than half of that allocation is not needed for those purposes and now want permission from Alberta Environment and Parks to haul 50 million litres of water per year away and sell it to the highest bidder. Allowing current license holders to subsidize their business operations with the sale of the unused portions of their licenses moves Alberta further away from the goal of sustainable development and would put the future of our river ecosystems at great risk.

Much has changed in the Bow River basin since 1968 – the demands on the river ecosystem have increased significantly with the twin pressures of population growth and climate change. Re-allocating 50 million litres of water would increase that pressure in a very ecologically sensitive area. It would also set a dangerous precedent for future allocations of water resources. If this application is approved, there’s nothing that will prevent future water license holders from selling their unused water allocations, and while the license holders may profit, our watersheds will pay the price.

Additionally, we must remember that this water allocation would be given priority over all other allocations granted after 1968 under Alberta’s “first-in-time first-in-right water” allocation system. This means that Fortress Mountain would receive priority for this use over a whole host of other users during times of extreme water shortage. Is selling bottled water really a higher priority for the people in the Bow River basin ahead of so many agricultural and municipal water uses? Most Albertans who have talked to me about this issue don’t think so.

Revenues from the sale of the water would apparently fund the goals that the owners have for the development of the resort, including environmentally sound development, living wages for staff, charitable and community activities, as well as reclamation of the site. I support those stated goals, but it should be the skiers who use the resort who pay for those activities. The other Bow River water users and the ecosystem should not be asked to pay for others’ enjoyment of a ski facility.

Alberta Environment and Parks must live up to its mandate of supporting sustainable development now and for future generations. Rejecting Fortress Mountain Holding’s water application would be a step in the right direction.

Marlin Schmidt

Environment & Parks Critic

Alberta’s Official NDP Opposition

Alberta

From Underdog to Top Broodmare

WATCH From Underdog to Top Broodmare (video)

Executive Producers Jeff Robillard (Horse Racing Alberta) and Mike Little (Shinelight Entertainment)

What began as an underdog story became a legacy of excellence. Crackers Hot Shot didn’t just race — she paved the way for future generations, and in doing so became one of the most influential producers the province has known.

The extraordinary journey of Crackers Hot Shot — once overlooked, now revered — stands as one of Alberta’s finest success stories in harness racing and breeding.

Born in humble circumstances and initially considered rough around the edges, Crackers Hot Shot overcame long odds to carve out a career that would forever impact the province’s racing industry. From a “wild, unhandled filly” to Alberta’s “Horse of the Year” in 2013, to producing foals who carry her spirit and fortitude into future generations.

Her influence ripples through Alberta’s racing and breeding landscape: from how young stock are prepared, to the aspirations of local breeders who now look to “the mare that did it” as proof that world-class talent can emerge from Alberta’s paddocks.

“Crackers Hot Shot, she had a tough start. She wasn’t much to look at when we first got her” — Rod Starkewski

“Crackers Hot Shot was left on her own – Carl Archibald heard us talking, he said ‘I’ll go get her – I live by there’. I think it took him 3 days to dig her out of the snow. She was completely wild – then we just started working on her. She really needed some humans to work with her – and get to know that people are not scary.” — Jackie Starkewski

“Crackers Hot Shot would be one of the top broodmares in Albeta percentage wise if nothing else. Her foals hit the track – they’re looking for the winners circle every time.” — Connie Kolthammer

Visit thehorses.com to learn more about Alberta’s Horse Racing industry.

Alberta

Gondek’s exit as mayor marks a turning point for Calgary

This article supplied by Troy Media.

The mayor’s controversial term is over, but a divided conservative base may struggle to take the city in a new direction

Calgary’s mayoral election went to a recount. Independent candidate Jeromy Farkas won with 91,112 votes (26.1 per cent). Communities First candidate Sonya Sharp was a very close second with 90,496 votes (26 per cent) and controversial incumbent mayor Jyoti Gondek finished third with 71,502 votes (20.5 per cent).

Gondek’s embarrassing tenure as mayor is finally over.

Gondek’s list of political and economic failures in just a single four-year term could easily fill a few book chapters—and most likely will at some point. She declared a climate emergency on her first day as Calgary’s mayor that virtually no one in the city asked for. She supported a four per cent tax increase during the COVID-19 pandemic, when many individuals and families were struggling to make ends meet. She snubbed the Dec. 2023 menorah lighting during Hanukkah because speakers were going to voice support for Israel a mere two months after the country was attacked by the bloodthirsty terrorist organization Hamas. The

Calgary Party even accused her last month of spending over $112,000 in taxpayers’ money for an “image makeover and brand redevelopment” that could have benefited her re-election campaign.

How did Gondek get elected mayor of Calgary with 176,344 votes in 2021, which is over 45 per cent of the electorate?

“Calgary may be a historically right-of-centre city,” I wrote in a recent National Post column, “but it’s experienced some unusual voting behaviour when it comes to mayoral elections. Its last three mayors, Dave Bronconnier, Naheed Nenshi and Gondek, have all been Liberal or left-leaning. There have also been an assortment of other Liberal mayors in recent decades like Al Duerr and, before he had a political epiphany, Ralph Klein.”

In fairness, many Canadians used to support the concept of balancing their votes in federal, provincial and municipal politics. I knew of some colleagues, friends and family members, including my father, who used to vote for the federal Liberals and Ontario PCs. There were a couple who supported the federal PCs and Ontario Liberals in several instances. In the case of one of my late

grandfathers, he gave a stray vote for Brian Mulroney’s federal PCs, the NDP and even its predecessor, the Co-operative Commonwealth Federation.

That’s not the case any longer. The more typical voting pattern in modern Canada is one of ideological consistency. Conservatives vote for Conservative candidates, Liberals vote for Liberal candidates, and so forth. There are some rare exceptions in municipal politics, such as the late Toronto mayor Rob Ford’s populistconservative agenda winning over a very Liberal city in 2010. It doesn’t happen very often these days, however.

I’ve always been a proponent of ideological consistency. It’s a more logical way of voting instead of throwing away one vote (so to speak) for some perceived model of political balance. There will always be people who straddle the political fence and vote for different parties and candidates during an election. That’s their right in a democratic society, but it often creates a type of ideological inconsistency that doesn’t benefit voters, parties or the political process in general.

Calgary goes against the grain in municipal politics. The city’s political dynamics are very different today due to migration, immigration and the like. Support for fiscal and social conservatism may still exist in Alberta, but the urban-rural split has become more profound and meaningful than the historic left-right divide. This makes the task of winning Calgary in elections more difficult for today’s provincial and federal Conservatives, as well as right-leaning mayoral candidates.

That’s what we witnessed during the Oct. 20 municipal election. Some Calgary Conservatives believed that Farkas was a more progressive-oriented conservative or centrist with a less fiscally conservative plan and outlook for the city. They viewed Sharp, the leader of a right-leaning municipal party founded last December, as a small “c” conservative and much closer to their ideology. Conversely, some Calgary Conservatives felt that Farkas, and not Sharp, would be a better Conservative option for mayor because he seemed less ideological in his outlook.

When you put it all together, Conservatives in what used to be one of the most right-leaning cities in a historically right-leaning province couldn’t decide who was the best political option available to replace the left-wing incumbent mayor. Time will tell if they chose wisely.

Fortunately, the razor-thin vote split didn’t save Gondek’s political hide. Maybe ideological consistency will finally win the day in Calgary municipal politics once the recount has ended and the city’s next mayor has been certified.

Michael Taube is a political commentator, Troy Media syndicated columnist and former speechwriter for Prime Minister Stephen Harper. He holds a master’s degree in comparative politics from the London School of Economics, lending academic rigour to his political insights.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

-

Alberta24 hours ago

Alberta24 hours agoFrom Underdog to Top Broodmare

-

Media2 days ago

Media2 days agoCarney speech highlights how easily newsrooms are played by politicians

-

Business1 day ago

Business1 day agoPaying for Trudeau’s EV Gamble: Ottawa Bought Jobs That Disappeared

-

Business1 day ago

Business1 day agoCBC uses tax dollars to hire more bureaucrats, fewer journalists

-

National1 day ago

National1 day agoElection Officials Warn MPs: Canada’s Ballot System Is Being Exploited

-

Economy21 hours ago

Economy21 hours agoIn his own words: Stunning Climate Change pivot from Bill Gates. Poverty and disease should be top concern.

-

Addictions23 hours ago

Addictions23 hours agoThe Shaky Science Behind Harm Reduction and Pediatric Gender Medicine

-

Business22 hours ago

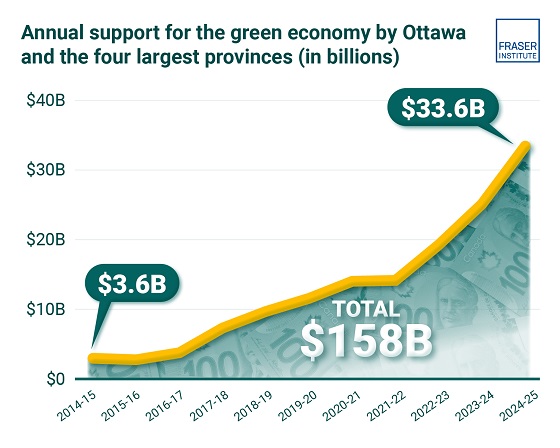

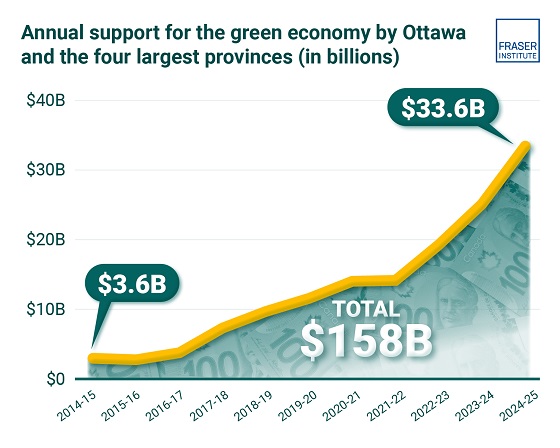

Business22 hours agoClean energy transition price tag over $150 billion and climbing, with very little to show for it