Alberta

Oil and gas in the global economy through 2050

From the Canadian Energy Centre

The world will continue to rely on oil and gas for decades to come, according to the International Energy Agency

Recent global conflicts, which have been partly responsible for a global spike in energy prices, have cast their shadow on energy markets around the world. Added to this uncertainty is the ongoing debate among policymakers and public institutions in various jurisdictions about the role of traditional forms of energy in the global economy.

One widely quoted study influencing the debate is the International Energy Agency’s (IEA) World Energy Outlook, the most recent edition of which, World Energy Outlook 2023 (or WEO 2023), was released recently (IEA 2023).

In this CEC Fact Sheet, we examine projections for oil and natural gas production, demand, and investment drawn from the World Energy Outlook 2023 Extended Dataset, using the IEA’s modelled scenario STEPS, or the Stated Policies Scenario. The Extended Dataset provides more detailed data at the global, regional, and country level than that found in the main report.

The IEA’s World Energy Outlook and the various scenarios

Every year the IEA releases its annual energy outlook. The report looks at recent energy supply and demand, and projects the investment outlook for oil and gas over the next three decades. The World Energy Outlook makes use of a scenario approach to examine future energy trends. WEO 2023 models three scenarios: the Net Zero Emissions by 2050 Scenario (NZE), the Announced Pledges Scenario (APS), and the Stated Policies Scenario (STEPS).

STEPS appears to be the most plausible scenario because it is based on the world’s current trajectory, rather than the other scenarios set out in the WEO 2023, including the APS and the NZE. According to the IEA:

The Stated Policies Scenario is based on current policy settings and also considers the implications of industrial policies that support clean energy supply chains as well as measures related to energy and climate. (2023, p. 79; emphasis by author)

and

STEPS looks in detail at what [governments] are actually doing to reach their targets and objectives across the energy economy. Outcomes in the STEPS reflect a detailed sector-by-sector review of the policies and measures that are actually in place or that have been announced; aspirational energy or climate targets are not automatically assumed to be met. (2023, p. 92)

Key results

The key results of STEPS, drawn from the IEA’s Extended Dataset, indicate that the oil and gas industry is not going into decline over the next decade—neither worldwide generally, nor in Canada specifically. In fact, the demand for oil and gas in emerging and developing economies under STEPS will remain robust through 2050.

Oil and natural gas production projections under STEPS

World oil production is projected to increase from 94.8 million barrels per day (mb/d) in 2022 to 97.2 mb/d in 2035, before falling slightly to 94.5 mb/d in 2050 (see Figure 1).

Source: IEA (2023b)

Canadian overall crude oil production is projected to increase from 5.8 mb/d in 2022 to 6.5 mb/d in 2035, before falling to 5.6 mb/d in 2050 (see Figure 2).

Source: IEA (2023b)

Canadian oil sands production is expected to increase from 3.6 mb/d in 2022 to 3.8 mb/d in 2035, and maintain the same production level till 2050 (see Figure 3).

Source: IEA (2023b)

World natural gas production is anticipated to increase from 4,138 billion cubic metres (bcm) in 2022 to 4,173 bcm in 2050 (see Figure 4).

Source: IEA (2023b)

Canadian natural gas production is projected to decrease from 204 bcm in 2022 to 194 bcm in 2050 (see Figure 5).

Source: IEA (2023b)

Oil demand under STEPS

World demand for oil is projected to increase from 96.5 mb/d in 2022 to 97.4 mb/d by 2050 (see Tables 1A and 1B). Demand in Africa for oil is expected to increase from 4.0 mb/d in 2022 to 7.7 mb/d in 2050. Demand for oil in the Asia-Pacific is projected to increase from 32.9 mb/d in 2022 to 35.1 mb/d in 2050. Demand for oil from emerging and developing economies is anticipated to increase from 47.9 mb/d in 2022 to 59.3 mb/d in 2050.

Source: IEA (2023b)

Source: IEA (2023b)

Natural gas demand under STEPS

World demand for natural gas is expected to increase from 4,159 billion cubic metres (bcm) in 2022 to 4,179 bcm in 2050 (see Figures 6 and 7). Demand in Africa for natural gas is projected to increase from 170 bcm in 2020 to 277 bcm in 2050. Demand in the Asia-Pacific for natural gas is anticipated to increase from 900 bcm in 2020 to 1,119 bcm in 2050.

Source: IEA (2023b)

Source: IEA (2023b)

Cumulative oil and gas investment expected to be over $21 trillion

Taking into account projected global demand, between 2023 and 2050 the cumulative global oil and gas investment (upstream, midstream, and downstream) under STEPS is expected to reach nearly U.S.$21.1 trillion (in $2022). Global oil investment alone is expected to be over U.S.$13.1 trillion and natural gas investment is predicted to be over $8.0 trillion (see Figure 8).

Between 2023 and 2050, total oil and gas investment in North America (Canada, the U.S., and Mexico) is expected to be nearly U.S.$5.6 trillion, split between oil at over $3.8 trillion and gas at nearly $1.8 trillion (see Figure 8). Oil and gas investment in the Asia Pacific, over the same period, is estimated at nearly $3.3 trillion, split between oil at over $1.4 trillion and gas at over $1.9 trillion.

Source: IEA (2023b)

Conclusion

The sector-by-sector measures that governments worldwide have put in place and the specific policy initiatives that support clean energy policy, i.e., the Stated Policies Scenario (STEPS), both show oil and gas continuing to play a major role in the global economy through 2050. Key data points on production and demand drawn from the IEA’s WEO 2023 Extended Dataset confirm this trend.

Positioning Canada as a secure and reliable oil and gas supplier can and must be part of the medium- to long-term solution to meeting the oil and gas demands of the U.S., Europe, Asia and other regions as part of a concerted move supporting energy security.

The need for stable energy, which is something that oil and natural gas provide, is critical to a global economy whose population is set to grow by another 2 billion people by 2050. Along with the increasing population comes rising incomes, and with them comes a heightened demand for oil and natural gas, particularly in many emerging and developing economies in Africa, the Asia-Pacific, and Latin America, where countries are seeing urbanization and industrialization grow rapidly.

References (as of February 11, 2024)

International Energy Agency (IEA), 2023(a), World Energy Outlook 2023 <http://tinyurl.com/4nv9xyfj>; International Energy Agency (IEA), 2023(b), World Energy Outlook 2023 Extended Dataset <http://tinyurl.com/3222553b>.

Alberta

So Alberta, what’s next?

Albertans, not Ottawa, should shape Alberta’s future. The Alberta Next Panel is hitting the road to engage directly with Albertans and chart a path forward for the province.

Albertans are frustrated after 10 years of punitive policies, enacted by the federal government, attacking Alberta’s economy and targeting its core industries.

Chaired by Premier Danielle Smith, the Alberta Next panel will bring together a broad mix of leaders, experts, and community voices to gather input, discuss solutions, and provide feedback to government on how Alberta can better protect its interests, defend its economy, and assert its place in Confederation.

The panel will consult across the province over the summer and early fall to ensure that those living, working, doing business and raising families are the ones to drive Alberta’s future forward. The work will include identifying solutions advanced by Albertans on how to make Alberta stronger and more sovereign within a united Canada that respects and empowers the province to achieve its full potential. It will also include making recommendations to the government on potential referendum questions for Albertans to vote on in 2026.

It will consider and hear from Albertans on the risks and benefits of ideas like a establishing an Alberta Pension Plan, using an Alberta Provincial Police Service rather than the RCMP for community policing, whether Albertans should consider pursuing constitutional changes, which (if any) changes to federal transfer payments and equalization Albertans should demand of the federal government, potential immigration reform that would give the provincial government more oversight into who comes to the province, and changes to how Alberta collects personal income tax. Albertans will also have the opportunity to put forward their own ideas for discussion.

“This isn’t just about talk. It’s about action. The Alberta Next Panel is giving everyday Albertans a direct say in the direction of our province. It’s time to stand up to Ottawa’s overreach and make sure decisions about Alberta’s future are made here, by the people who live and work here.”

“Right now, there is a need to restore fairness and functionality in the country. Years of problematic policy and decisions from Ottawa have hurt Albertan and Canadian prosperity. I am honoured to be asked by Premier Smith to participate in the Alberta Next Panel. This panel is about listening to Albertans on how we build a stronger Alberta within a united Canada, to which I, and the Business Council of Alberta, are firmly committed.”

Chaired by Premier Danielle Smith, the panel includes 13 additional members, including elected officials, academics, business leaders and community advocates:

- Honourable Rebecca Schulz, Minister of Environment and Protected Areas of Alberta

- Brandon Lunty, MLA for Leduc-Beaumont

- Glenn van Dijken, MLA for Athabasca-Barrhead-Westlock

- Tara Sawyer, MLA-elect for Olds-Didsbury-Three Hills

- Bruce McDonald, former justice, Court of Appeal of Alberta

- Trevor Tombe, director of fiscal and economic policy, the University of Calgary School of Public Policy

- Adam Legge, president, Business Council of Alberta

- Andrew Judson, vice chairman (prairies), Fraser Institute

- Sumita Anand, vice president, Above and Beyond Care Services

- Melody Garner-Skiba, business and agricultural advocate

- Grant Fagerheim, president and CEO, Whitecap Resources Inc.

- Dr. Akin Osakuade, physician and section chief, Didsbury Hospital

- Dr. Benny Xu, community health expert

- Michael Binnion, president, Questerre Energy

Albertans have a choice: let Ottawa continue calling the shots—or come together to chart our own course. What’s next? You decide.

Key facts:

- Town hall dates and sites, along with other opportunities to participate in this engagement, are available online at Alberta.ca/Next. Exact locations will be posted in the weeks ahead of the event, and Albertans will be asked to RSVP online.

- The panel’s recommendations will be submitted to government by Dec. 31, 2025.

- It is anticipated that the panel will add additional members in the coming weeks.

Related information

Related news

]

]

Alberta

Alberta poll shows strong resistance to pornographic material in school libraries

From LifeSiteNews

A government survey revealed strong public support, particularly among parents, for restricting or banning sexually explicit books.

Albertans are largely opposed to their children viewing pornography in school libraries, according to government polling.

In a June 20 press release, the Government of Alberta announced that their public engagement survey, launched after the discovery of sexually explicit books in school libraries, found that Albertans strongly support removing or limiting such content.

“Parents, educators and Albertans in general want action to ensure children don’t have access to age-inappropriate materials in school libraries,” Demetrios Nicolaides, Minister of Education and Childcare, said.

“We will use this valuable input to guide the creation of a province-wide standard to ensure the policy reflects the priorities and values of Albertans,” he continued.

READ: Support for traditional family values surges in Alberta

The survey, conducted between May 28 to June 6, received nearly 80,000 responses, revealing a widespread interest in the issue.

While 61 percent of respondents said that they had never previously been concerned about children viewing sexually explicit content in libraries, most were opposed to young children viewing it. 34 percent said children should never be able to access sexually explicit content in school libraries, while 23 percent believed it should be restricted to those aged 15 and up.

Similarly, 44 percent of parents of school-aged children were supportive of government regulations to control content in school libraries. Additionally, 62 percent of respondents either agreed or strongly agreed that “parents and guardians should play a role in reporting or challenging the availability of materials with sexually explicit content in school libraries.”

READ: Alberta Conservatives seeking to ban sexually graphic books from school libraries

The polling results come after the Conservative Alberta government under Premier Danielle Smith announced that they are going ahead with plans to eventually ban books with sexually explicit as well as pornographic material, many of which contain LGBT and even pedophilic content, from all school libraries, on May 27.

At the time, Nicolaides revealed that it was “extremely concerning” to discover that sexually explicit books were available in school libraries.

The books in question, found at multiple school locations, are Gender Queer, a graphic novel by Maia Kobabe; Flamer, a graphic novel by Mike Curato; Blankets, a graphic novel by Craig Thompson; and Fun Home, a graphic novel by Alison Bechdel.

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoWhat Connor Should Say To Oilers: It’s Not You. It’s Me.

-

Business1 day ago

Business1 day agoThe Passage of Bill C-5 Leaves the Conventional Energy Sector With as Many Questions as Answers

-

Business1 day ago

Business1 day agoFederal fiscal anchor gives appearance of prudence, fails to back it up

-

Business1 day ago

Business1 day agoCanada should already be an economic superpower. Why is Canada not doing better?

-

Alberta1 day ago

Alberta1 day agoAlberta poll shows strong resistance to pornographic material in school libraries

-

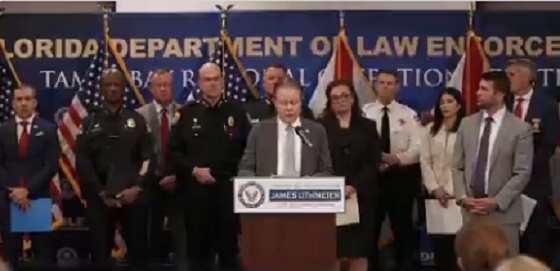

Crime1 day ago

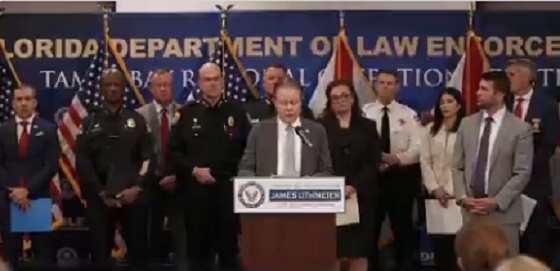

Crime1 day agoFlorida rescues 60 missing kids in nation’s largest-ever operation

-

Banks1 day ago

Banks1 day agoScrapping net-zero commitments step in right direction for Canadian Pension Plan

-

Business6 hours ago

Business6 hours agoWhile China Hacks Canada, B.C. Sends Them a Billion-Dollar Ship Building Contract