Economy

Nighttime light intensity exposes failure of autocratic regimes

From the Fraser Institute

When people have more economic freedom, they are allowed to make more of their own economic decisions, free of constraints imposed by others. During the 1960s and 1970s, despite the relative economic success of most western democracies, most of the rest of the world rejected strong pro-market policies, with the notable exception of Hong Kong. Milton Friedman said Hong Kong offered “an almost laboratory experiment in what happens when government is limited to its proper functions and leaves people free to pursue their own objectives.” Hong Kong’s success served as the primary example of the uplifting potential of economic freedom.

However, without a quantifiable measure of economic freedom, it was difficult to generalize these claims. This led to the conception and production of the Economic Freedom of the World (EFW) index by the Fraser Institute. Armed with a measure of economic freedom, researchers could test the claim that economic freedom leads to prosperity.

Since its inception, the multiple editions of the dataset routinely confirmed that economically freer countries have higher income levels, enjoy faster economic growth, are more resilient to shocks, and produce great reductions in poverty and income gains all along the income ladder.

But in fact, in a recent article published by the European Journal of Political Economy and co-authored with Macy Scheck and Sean Patrick Alvarez, I offer evidence that the EFW report often underestimates the potency of economic freedom.

Why? Because the economic statistics produced in countries ruled by autocrats are not believable.

In autocratic regimes, rulers must bolster their legitimacy to prevent coups or uprisings, so they produce statistics that exaggerate their country’s performance. And since neither the opposition nor independent authorities are allowed to challenge these claims, autocrats can get away with lying about the size of their economies.

Autocrats also repress economic freedom (along with other freedoms), so any estimation of the effects of economic freedom on economic development will likely be exaggerated due to the lies of dictators.

How can we correct these lies? It’s not as if the autocrats would let us check their books. But fortunately, we don’t have to. We simply need a measure of economic activity that correlates with economic development and cannot be manipulated. Namely, nighttime light intensity, as measured by satellites orbiting the Earth.

Satellites provide accurate and unbiased information, which dictators cannot manipulate. Nighttime light is artificial (manmade) and its level should depict (all else being equal) levels of development. It’s why one can often see images of North and South Korea at night where the former is in utter darkness and the latter sparkles like a Christmas tree.

By examining the relationship between light intensity and economic development as measured by GDP in democracies—where data is generally reliable—one can estimate the extent of inaccuracies in the economic data reported by dictatorships and then create corrected data.

In our article, based on satellite data, we found that in more than 110 countries (including dictatorships), the association between economic freedom and income levels was between 10 per cent and 62 per cent greater than previously estimated. We also found that when using the corrected data, one extra point of economic freedom (on a 10-point scale) generated between 5 per cent and 24 per cent more economic growth from 1992 to 2012.

These results are a powerful answer to those who doubt the value of economic freedom. And they offer a way to see past the lies of dictators.

Economy

The Net-Zero Dream Is Unravelling And The Consequences Are Global

From the Frontier Centre for Public Policy

The grand net-zero vision is fading as financial giants withdraw from global climate alliances

In recent years, governments and Financial institutions worldwide have committed to the goal of “net zero”—cutting greenhouse gas emissions to as close to zero as possible by 2050. One of the most prominent initiatives, the Glasgow Financial Alliance for Net Zero (GFANZ), sought to mobilize trillions of dollars by shifting investment away from fossil fuels and toward green energy projects.

The idea was simple in principle: make climate action a core part of financial decision-making worldwide.

The vision of a net-zero future, once championed as an inevitable path to global prosperity and environmental sustainability, is faltering. What began as an ambitious effort to embed climate goals into the flow of international capital is now encountering hard economic and political realities.

By redefining financial risk to include climate considerations, GFANZ aimed to steer financial institutions toward supporting a large-scale energy transition.

Banks and investors were encouraged to treat climate-related risks—such as the future decline of fossil fuels—as central to their financial strategies.

But the practical challenges of this approach have become increasingly clear.

Many of the green energy projects promoted under the net-zero banner have proven financially precarious without substantial government subsidies. Wind and solar technologies often rely on public funding and incentives to stay competitive. Energy storage and infrastructure upgrades, critical to supporting renewable energy, have also required massive financial support from taxpayers.

At the same time, institutions that initially embraced net-zero commitments are now facing soaring compliance costs, legal uncertainties and growing political resistance, particularly in major economies.

Major banks such as JPMorgan Chase, Citigroup and Goldman Sachs have withdrawn from GFANZ, citing concerns over operational risks and conflicting fuduciary duties. Their departure marks a signifcant blow to the alliance and signals a broader reassessment of climate finance strategies.

For many institutions, the initial hope that governments and markets would align smoothly around net-zero targets has given way to concerns over financial instability and competitive disadvantage. But that optimism has faded.

What once appeared to be a globally co-ordinated movement is fracturing. The early momentum behind net-zero policies was fuelled by optimism that government incentives and public support would ease the transition. But as energy prices climb and affordability concerns grow, public opinion has become noticeably more cautious.

Consumers facing higher heating bills and fuel costs are beginning to question the personal price of aggressive climate action.

Voters are increasingly asking whether these policies are delivering tangible benefits to their daily lives. They see rising costs in transportation, food production and home energy use and are wondering whether the promised green transition is worth the economic strain.

This moment of reckoning offers a crucial lesson: while environmental goals remain important, they must be pursued in balance with economic realities and the need for reliable energy supplies. A durable transition requires market-based solutions, technological innovation and policies that respect the complex needs of modern economies.

Climate progress will not succeed if it comes at the expense of basic affordability and economic stability.

Rather than abandoning climate objectives altogether, many countries and industries are recalibrating, moving away from rigid frameworks in favour of more pragmatic, adaptable strategies. Flexibility is becoming essential as governments seek to maintain public support while still advancing long term environmental goals.

The unwinding of GFANZ underscores the risks of over-centralized approaches to climate policy. Ambitious global visions must be grounded in reality, or they risk becoming liabilities rather than solutions. Co-ordinated international action remains important, but it must leave room for local realities and diverse economic circumstances.

As the world adjusts course, Canada and other energy-producing nations face a clear choice: continue down an economically restrictive path or embrace a balanced strategy that safeguards both prosperity and environmental stewardship. For countries like Canada, where natural resources remain a cornerstone of the economy, the stakes could not be higher.

The collapse of the net-zero consensus is not an end to climate action, but it is a wake-up call. The future will belong to those who learn from this moment and pursue practical, sustainable paths forward. A balanced approach that integrates environmental responsibility with economic pragmatism offers the best hope for lasting progress.

Marco Navarro-Genie is the vice president of research at the Frontier Centre for Public Policy. With Barry Cooper, he is coauthor of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

Alberta

CPP another example of Albertans’ outsized contribution to Canada

From the Fraser Institute

By Tegan Hill

Amid the economic uncertainty fuelled by Trump’s trade war, its perhaps more important than ever to understand Alberta’s crucial role in the federation and its outsized contribution to programs such as the Canada Pension Plan (CPP).

From 1981 to 2022, Albertan’s net contribution to the CPP—meaning the amount Albertans paid into the program over and above what retirees in Alberta received in CPP payments—was $53.6 billion. In 2022 (the latest year of available data), Albertans’ net contribution to the CPP was $3.0 billion.

During that same period (1981 to 2022), British Columbia was the only other province where residents paid more into the CPP than retirees received in benefits—and Alberta’s contribution was six times greater than B.C.’s contribution. Put differently, residents in seven out of the nine provinces that participate in the CPP (Quebec has its own plan) receive more back in benefits than they contribute to the program.

Albertans pay an outsized contribution to federal and national programs, including the CPP because of the province’s relatively high rates of employment, higher average incomes and younger population (i.e. more workers pay into the CPP and less retirees take from it).

Put simply, Albertan workers have been helping fund the retirement of Canadians from coast to coast for decades, and without Alberta, the CPP would look much different.

How different?

If Alberta withdrew from the CPP and established its own standalone provincial pension plan, Alberta workers would receive the same retirement benefits but at a lower cost (i.e. lower CPP contribution rate deducted from our paycheques) than other Canadians, while the contribution rate—essentially the CPP tax rate—to fund the program would likely need to increase for the rest of the country to maintain the same benefits.

And given current demographic projections, immigration patterns and Alberta’s long history of leading the provinces in economic growth, Albertan workers will likely continue to pay more into the CPP than Albertan retirees get back from it.

Therefore, considering Alberta’s crucial role in national programs, the next federal government—whoever that may be—should undo and prevent policies that negatively impact the province and Albertans ability to contribute to Canada. Think of Bill C-69 (which imposes complex, uncertain and onerous review requirements on major energy projects), Bill C-48 (which bans large oil tankers off B.C.’s northern coast and limits access to Asian markets), an arbitrary cap on oil and gas emissions, numerous other “net-zero” targets, and so on.

Canada faces serious economic challenges, including a trade war with the United States. In times like this, it’s important to remember Alberta’s crucial role in the federation and the outsized contributions of Alberta workers to the wellbeing of Canadians across the country.

-

Alberta1 day ago

Alberta1 day agoProvince to expand services provided by Alberta Sheriffs: New policing option for municipalities

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoIs HNIC Ready For The Winnipeg Jets To Be Canada’s Heroes?

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

Alberta1 day ago

Alberta1 day agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoNo Matter The Winner – My Canada Is Gone

-

Health1 day ago

Health1 day agoHorrific and Deadly Effects of Antidepressants

-

2025 Federal Election1 day ago

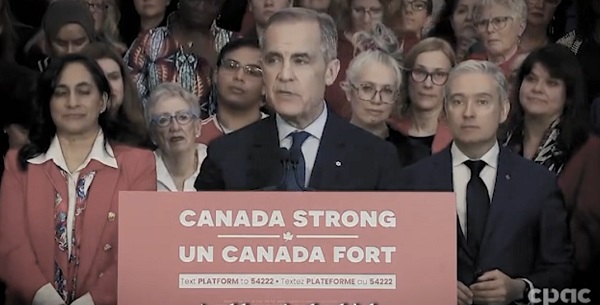

2025 Federal Election1 day agoCampaign 2025 : The Liberal Costed Platform – Taxpayer Funded Fiction

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoA Perfect Storm of Corruption, Foreign Interference, and National Security Failures