CBDC Central Bank Digital Currency

Klaus Schwab pushes ‘fourth industrial revolution’ at WEF’s ‘Summer Davos’ opening

Chinese Premier Li Qiang (R) shakes hands with founder and executive chairman of the World Economic Forum, Klaus Schwab

From LifeSiteNews

At the WEF’s 2024 ‘Meeting of the New Champions’ in Dalian, China, Klaus Schwab praised China’s economic policies and urged ‘all stakeholders’ to ‘use technologies of the fourth industrial revolution in a wise manner.’

World Economic Forum (WEF) founder Klaus Schwab kicks off the Annual Meeting of the New Champions, aka “Summer Davos,” in Dalian, China, saying that economic growth and a more peaceful future will come from embracing innovation and forcing collaboration.

Speaking at the opening plenary alongside the president of Poland, Andrzej Duda, the prime minister of Vietnam, Pham Minh Chinh, and People’s Republic of China Premier Li Qiang, Schwab regurgitated parts of his speech from last year’s meeting, praising China for its economic policies while congratulating everyone participating in the event for representing “the most outstanding talents from business, government, academia, and civil society.”

In his very brief opening statement, the unelected globalist founder of the WEF said that the participants must “force collaboration” in order to drive economic growth and create a more resilient future.

“To drive future economic growth we must embrace innovation and force the collaboration across sectors, regions, nations, and cultures to create a more peaceful, inclusive, sustainable, and resilient future,” said Schwab.

“At this critical juncture the active participation of all stakeholders is essential to ensure a sustainable development path,” he added.

“To drive future economic growth we must embrace innovation and force the collaboration across sectors, regions, nations, and cultures to create a more peaceful, inclusive, sustainable, and resilient future” Klaus Schwab at the WEF #AMNC24 Summer Davos pic.twitter.com/puctx7Bg5m

— Tim Hinchliffe (@TimHinchliffe) June 25, 2024

Schwab also mentioned that technologies coming out of the so-called fourth industrial revolution would make the world a better place.

“We are witnessing rapid technological advances with many opportunities, and with artificial intelligence, rapidly transforming our production and our lives,” he said, adding, “Breakthroughs from the fourth industrial revolution provide new opportunities for global prosperity and growth.”

"Risks & opportunities co-exist.. Breakthroughs from the fourth industrial revolution provide new opportunities for global prosperity and growth" Klaus Schwab at the WEF #AMNC24 Summer Davos pic.twitter.com/jTcTMLaV9L

— Tim Hinchliffe (@TimHinchliffe) June 25, 2024

The WEF Annual Meeting of the New Champions runs from June 25-27 under the theme “Next Frontiers for Growth.”

At the end of the plenary and after the president, the premier, and the prime minister had all praised their countries’ achievements and ambitions, Schwab returned to the topic of the fourth industrial revolution while revisiting this year’s theme, saying that were “limits to growth.”

"The theme of this annual meeting is 'Next Frontiers For Growth,' but actually what we have seen in the presentations there are now Limits to Growth, provided we use technologies of the fourth industrial revolution in a wise manner" Klaus Schwab at the WEF #AMNC24 Summer Davos pic.twitter.com/SJDT5rLgIO

— Tim Hinchliffe (@TimHinchliffe) June 25, 2024

“Limits to growth” is a nod to the Club of Rome book of the same name published in 1972, and Schwab says that these limits can be overcome by using technologies of the fourth industrial revolution wisely, by taking care of nature, by seeing the green economy as a “great opportunity for humankind,” by exploiting the capabilities of the attendees, and by formulating collaborations between governments and businesses.

The WEF strives to be the “leading global institution for public-private collaboration,” which is the fusion of corporation and state, or corporatism.

Opening Plenary #AMNC24 with Li Qiang, @AndrzejDuda, Pham Minh Chinh (@VNGovtPortal), Klaus Schwab https://t.co/JCTBlo4V8C

— World Economic Forum (@wef) June 25, 2024

At the opening of last year’s Annual Meeting of the New Champions, Schwab praised Premier Li for “opening-up China’s capital market, attracting foreign investment, and innovation, and creating new urban areas to address land scarcity.”

He also thanked China for its “over 40 years of friendly and extensive partnership” with the WEF.

"Premier Li took his office this March at China's National People's Congress at a critical moment when China adopted new COVID control measures and started to boost economic development, social dynamism, and international cooperation": Klaus Schwab #AMNC23 #WEF pic.twitter.com/cWHGl5QNJs

— Tim Hinchliffe (@TimHinchliffe) June 27, 2023

During another session last year, Cornell University professor Eswar Prasad said that “we are at the cusp of physical currency essentially disappearing,” and that programmable Central Bank Digital Currencies (CBDCs) could take us to either a better or much darker place where governments could program CBDCs with expiry dates and to restrict undesirable purchases.

"You could have a potentially […] darker world where the government decides that [CBDC] can be used to purchase some things, but not other things that it deems less desirable like say ammunition, or drugs, or pornography, or something of the sort": Eswar Prasad, WEF #AMNC23 pic.twitter.com/KkWgaEWAR5

— Tim Hinchliffe (@TimHinchliffe) June 28, 2023

Last month the WEF announced that Schwab will be transitioning from his role as the executive chairman of the forum to become chairman of the board of trustees, which consists of some of the most powerful people on the planet.

Starting next year, the forum’s executive responsibilities will be run by a president and managing board.

The current WEF president is former Norwegian MP Børge Brende. He is also the chair of the managing board.

If Brende keeps his position as president, then he may be the new face and voice of the organization, which has been pivoting “from a convening platform to the leading global institution for public-private collaboration” for almost a decade.

However, executive decisions will not be placed on a single individual but will include a managing board as well.

Reprinted with permission from The Sociable.

Carbon Tax

Mark Carney has history of supporting CBDCs, endorsed Freedom Convoy crackdown

From LifeSiteNews

Carney also said last week that he is willing to use all government powers, including “emergency powers,” to enforce his energy plan if elected prime minister.

World Economic Forum-linked Liberal Party leadership frontrunner Mark Carney has a history of supporting central bank digital currencies, and in 2022 supported “choking off the money” donated to the Freedom Convoy.

In his 2021 book Value(s), Carney said that the “future of money” is a “central bank stablecoin, known as a central bank digital currency or CBDC.”

He noted in his book that such a currency would be similar to current cryptocurrencies such as Bitcoin, but without the private nature afforded to it by its decentralization.

“It is simply untenable in democracies that the core of the monetary system could be based on forms of electronic private money whose creators control large blocks of the currency, like Bitcoin,” he wrote. “Cryptocurrencies are not the future of money.”

Carney noted that a CBDC, if “properly designed,” could serve “all the functions to which private cryptocurrencies and stablecoins aspire while addressing the fundamental legal and governance issues that will, in time, undermine those alternatives.”

Expanding on his worldview in relation to CBDCs, Carney suggested that “fear” can be taken advantage of to shape the future of money.

“With fear on the march, people were willing to surrender to Hobbes’ ‘Leviathan’ such basic rights as the freedom to leave their homes,” he wrote. “And so it is with money. People will support the delegation to independent central banks of the tough decisions that are necessary to maintain the value of money provided the authorities deliver monetary and financial stability.”

Some Canadians are alarmed by the prospect of CBDCs, a fear that only worsened after the Liberals under Prime Minister Justin Trudeau froze hundreds of bank accounts it deemed were importantly linked to the 2022 Freedom Convoy.

During the Freedom Convoy, Carney wrote in an op-ed for the Globe and Mail, “Those who are still helping to extend this occupation must be identified and punished to the full force of the law,” adding that “Drawing the line means choking off the money that financed this occupation.”

Carney is a former head of the Bank of Canada and Bank of England. His ties to globalist groups have led to Conservative Party leader Pierre Poilievre calling him the World Economic Forum’s “golden boy.”

In addition to his comments on CBDCs, Carney has a history of promoting anti-life and anti-family agendas, including abortion and LGBT-related efforts. He has also previously endorsed the carbon tax and even criticized Trudeau when the tax was exempted from home heating oil to reduce costs for some Canadians.

Carney also said last week that he is willing to use all government powers, including “emergency powers,” to enforce his energy plan if elected prime minister.

The Liberal Party of Canada will choose its next leader, who will automatically become prime minister, on March 9, after Prime Minister Justin Trudeau announced that he plans to step down as Liberal Party leader once a new leader has been chosen.

In contrast to Carney, Poilievre has promised that if he is elected prime minister, he would stop any implementation of a “digital currency” or a compulsory “digital ID” system.

When it comes to a digital Canadian dollar, the Bank of Canada found that Canadians are very wary of a government-backed digital currency, concluding that a “significant number” of citizens would resist the implementation of such a system.

Business

Black Rock latest to leave Net Zero Alliance

From The Center Square

By

US House committee investigating 60 companies over ESG policies

Blackrock Inc. is the latest to announce it has left a United Nations-backed Net-Zero Banking Alliance (NZBA), among several within one month and not soon after Donald Trump was elected president. It did so as it and roughly 60 companies are being investigated by Congress for allegedly colluding as a “woke ESG cartel” to “impose radical environmental, social, and governance goals on American companies.”

Last month, Goldman Sachs was the first to withdraw from the alliance, followed by Wells Fargo, The Center Square reported. Citigroup, Bank of America, Morgan Stanley and JPMorgan next announced their departure.

According to the “bank-led and UN-convened” alliance, global banks joined, pledging to align their lending, investment and capital markets activities with a net-zero greenhouse gas emissions target by 2050.

Major U.S. banks began leaving the alliance after President-elect Donald Trump vowed to increase domestic oil and natural gas production and pledged to go after “woke” companies.

They also announced their departure two years after 19 state attorneys general launched an investigation into them for alleged deceptive trade practices connected to ESG.

While the companies haven’t appeared to seem daunted by state investigations, Trump’s reelection appears to be a different matter.

“BlackRock has hung in there as long as it could, but the pressure has become too great, and the reputational and legal risks too high, just before Trump takes office. It won’t be the last financial organization to quit a net zero initiative,” Hortense Bioy, Morningstar Analytics director of sustainable investing research, told Bloomberg News.

Texas Comptroller Glenn Hegar has expressed skepticism about companies claiming to withdraw from ESG commitments, noting there is often doublespeak in announcements, The Center Square reported. This includes statements made by Goldman Sachs, JPMorgan and Blackrock.

Blackrock claims its “participation in NZAMi didn’t impact the way we managed client portfolios. Therefore, our departure doesn’t change the way we develop products and solutions for clients or how we manage their portfolios. … Our commitment to helping our clients achieve their investment goals remains unwavering,” Bloomberg reported.

Last month, the U.S. House Judiciary Committee announced it was investigating more than 60 US-based asset managers’ involvement in the alliance, including BlackRock, Inc., JP Morgan Asset Management, Rockefeller Asset Management, State Street Global Advisors, among others.

The committee also issued a report, “Climate Control: Exposing the Decarbonization Collusion in Environmental, Social, and Governance (ESG) Investing,” saying it found “direct evidence of a ‘climate cartel’ consisting of left-wing activists and major financial institutions that collude to impose radical environmental, social, and governance goals on American companies.”

Under the Trump administration, the committee will continue to investigate if “existing civil and criminal penalties and current antitrust law enforcement efforts are sufficient to deter anticompetitive collusion to promote ESG-related goals in the investment industry.” It also maintains that the companies “must answer for their involvement in prioritizing woke investments over their own fiduciary duties.”

The committee sent letters to dozens of entities in 12 states and the District of Columbia requesting them to provide information by Jan. 10. The majority are located in New York, Massachusetts and California.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre refuses to bash Trump via trick question, says it’s possible to work with him and be ‘firm’

-

COVID-192 days ago

COVID-192 days ago17-year-old died after taking COVID shot, but Ontario judge denies his family’s liability claim

-

Community2 days ago

Community2 days agoSupport local healthcare while winning amazing prizes!

-

Alberta1 day ago

Alberta1 day agoAlberta Institute urging Premier Smith to follow Saskatchewan and drop Industrial Carbon Tax

-

Business2 days ago

Business2 days agoWhile “Team Canada” attacks Trump for election points, Premier Danielle Smith advocates for future trade relations

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFool Me Once: The Cost of Carney–Trudeau Tax Games

-

Addictions1 day ago

Addictions1 day agoShould fentanyl dealers face manslaughter charges for fatal overdoses?

-

Alberta23 hours ago

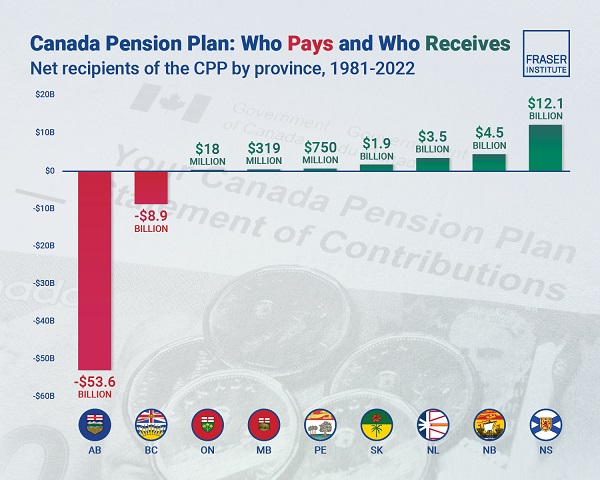

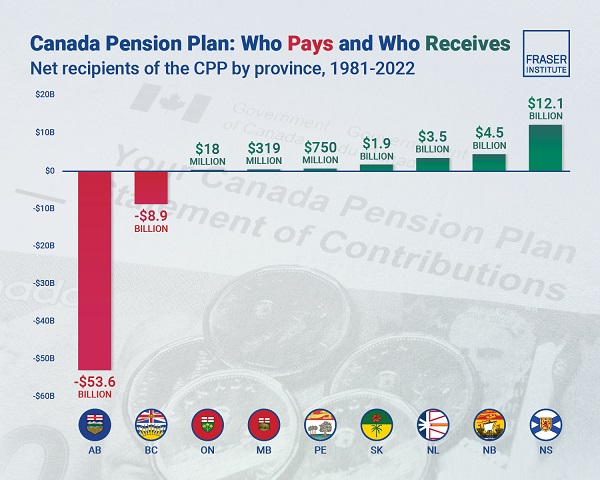

Alberta23 hours agoAlbertans have contributed $53.6 billion to the retirement of Canadians in other provinces