Business

Justin Trudeau’s legacy—record-high spending and massive debt

From the Fraser Institute

By Jake Fuss and Grady Munro

On Monday, after weeks of turmoil and speculation, Prime Minister Justin Trudeau told Canadians he’ll resign after the Liberal Party choses a new leader. There will be much talk about Trudeau’s legacy, but the modern Trudeau era was distinguished—among other things—by unprecedented levels of government spending.

The numbers don’t lie.

For example, from 2018 to 2023 Justin Trudeau recorded the six-highest levels of spending (on a per-person basis, after adjusting for inflation) in Canadian history, even after excluding emergency spending during the pandemic. For context, that means the Trudeau government spent more per person during those six years than the federal government spent during the Great Depression, both world wars and the height of the Global Financial Crisis in 2008-09.

Unsurprisingly, the Trudeau government was unable to balance the budget during his nine years in power. After first being elected in 2015, Trudeau promised to balance the budget by 2019—then ran nine consecutive deficits including an astonishing $61.9 billion deficit for the 2023/24 fiscal year, the largest deficit of any year outside of COVID.

The result? Historically high levels of government debt compared to previous prime ministers. From 2020 to 2023, the government racked up the four highest years of total federal debt per person (inflation-adjusted) in Canadian history. Compared to 2014/15 (the last full year under Prime Minister Harper), federal debt per person had increased by $14,127 (as of 2023/24).

While a portion of this debt accumulation took place during the pandemic, a sizable chunk of federal COVID-related spending was wasteful. And federal debt increased significantly before, during and after the pandemic. In short, you can’t blame COVID for the Trudeau government’s wild spending and borrowing spree.

This fiscal record, marked by record-high levels, defines Prime Minister Trudeau’s fiscal legacy, which will burden Canadians for years to come. Spending-driven deficits and debt accumulation impose costs on Canadians—largely in the form of higher debt interest costs, which will hit $53.7 billion in 2024/25 or $1,301 per person. That’s more than all revenue collected via the federal GST.

And because government borrowing pushes the responsibility of paying for today’s spending into the future, today’s debt burden will fall disproportionately on younger generations of Canadians who will face higher taxes to finance today’s borrowing. And a growing tax burden (due to debt accumulation) can hurt future economic performance and the country’s ability to compete with other jurisdictions worldwide for business investment and high-skilled workers.

Under Trudeau, Canada has had an abysmal investment record. From 2014 to 2022 (the latest year of available data), inflation-adjusted total business investment (in plants, machinery, equipment and new technologies but excluding residential construction) in Canada declined by $34 billion. During the same period, after adjusting for inflation, business investment declined by $3,748 per worker—from $20,264 per worker in 2014 to $16,515 per worker in 2022. Due in part to Canada’s collapsing business investment, incomes and living standards have stagnated in recent years.

At the same time, Trudeau raised taxes on top-earners who help drive job-creation and prosperity across the income spectrum, and increased the tax burden on middle-class Canadians. Indeed, 86 per cent of middle-income Canadian families pay more in taxes than they did in 2015.

After approximately a decade in office, Prime Minister Justin Trudeau is stepping down. In his wake, he leaves behind a record of unprecedented spending, a mountain of debt, and higher taxes. It’s no wonder many Canadians are looking for change.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

2025 Federal Election

ASK YOURSELF! – Can Canada Endure, or Afford the Economic Stagnation of Carney’s Costly Climate Vision?

From Energy Now

By Tammy Nemeth and Ron Wallace

Carney’s Costly Climate Vision Risks Another “Lost Liberal Decade”

A carbon border tax isn’t the simple offset it’s made out to be—it’s a complex regulatory quagmire poised to reshape Canada’s economy and trade. In its final days, the Trudeau government made commitments to mandate climate disclosures, preserve carbon taxes (both consumer and industrial) and advance a Carbon Border Adjustment Mechanism (CBAM). Newly minted Prime Minister Mark Carney, the godfather of climate finance, has embraced and pledged to accelerate these commitments, particularly the CBAM. Marketed as a strategic shift to bolster trade with the European Union (EU) and reduce reliance on the U.S., a CBAM appears straightforward: pay a domestic carbon price, or face an EU import fee. But the reality is far more extensive and invasive. Beyond the carbon tariffs, it demands rigorous emissions accounting, third-party verification and a crushing compliance burden.

Although it has been little debated, Carney’s proposed climate plan would transform and further undermine Canadian businesses and the economy. Contrary to Carney’s remarks in mid-March, the only jurisdiction that has implemented a CBAM is the EU, with implementation not set until 2026. Meanwhile, the UK plans to implement a CBAM for 1 January 2027. In spite of Carney’s assertion that such a mechanism will be needed for trade with emerging Asian markets, the only Asian country that has released a possible plan for a CBAM is Taiwan. Thus, a Canadian CBAM would only align Canada with the EU and possibly the UK – assuming that those policies are implemented in face of the Trump Administrations’ turbulent tariff policies.

With the first phase of the EU’s CBAM, exporters of cement, iron and steel, aluminum, fertiliser, electricity and hydrogen must have paid a domestic carbon tax or the EU will charge more for those imports. But it’s much more than that. Even if exporting companies have a domestic carbon tax, they will still have to monitor, account for, and verify their CO2 emissions to certify the price they have paid domestically in order to trade with the EU. The purported goal is to reduce so-called “carbon leakage” which makes imports from emission-intensive sectors more costly in favour of products with fewer emissions. Hence, the EU’s CBAM is effectively a CO2 emissions importation tariff equivalent to what would be paid by companies if the products were produced under the EU’s carbon pricing rules under their Emissions Trading System (ETS).

While that may sound simple enough, in practice the EU’s CBAM represents a significant expansion of government involvement with a new layer of bureaucracy. The EU system will require corporate emissions accounting of the direct and indirect emissions of production processes to calculate the embedded emissions. This type of emissions accounting is a central component of climate disclosures like those released by the Canadian Sustainability Standards Board.

Hence, the CBAM isn’t just a tariff: It’s a system for continuous emissions monitoring and verification. Unlike traditional tariffs tied to product value, the CBAM requires companies exporting to the EU to track embedded emissions and submit verified data to secure an EU-accredited verification. Piling complexity atop cost, importers must then file a CBAM declaration, reviewed and certified by an EU regulatory body, before obtaining an import certificate.

This system offers little discernible benefit for the environment. The CBAM ignores broader environmental regulatory efforts, fixating solely on taxation of embedded emissions. For Canadian exporters, Carney’s plan would impose an expensive, intricate web of compliance monitoring, verification and fees accompanied by uncertain administrative penalties.

Hence, any serious pivot to the EU to offset trade restrictions in the U.S. will require a transformation of Canada’s economy, one with a questionable return on investment. Carney’s plan to diversify and accelerate trade with the EU, whose economies are increasingly shackled with burdensome climate-related policies, ignores the potential of successful trade negotiations with the U.S., India or emerging Asian countries. The U.S., our largest and most significant trading partner, has abandoned the Paris Climate Agreement, ceased defence of its climate-disclosure rule and will undoubtedly be seeking fewer, not more, climate-related tariffs. Meanwhile, despite rulings from the Supreme Court of Canada, Carney has doubled down on his support for the Trudeau governments’ Impact Assessment Act (Bill C-69) and confirmed intentions to proceed with an emissions cap on oil and gas production. Carney’s continuance of the Trudeau governments’ regulatory agenda combined with new, proposed trade policies will take Canada in directions not conducive to future economic growth or to furthering trade agreements with the U.S.

Canadians need to carefully consider whether or not Canada can endure, or afford, Carney’s costly climate vision that risks another “lost Liberal decade” of economic stagnation?

Tammy Nemeth is a U.K.-based strategic energy analyst.

Ron Wallace is an executive fellow of the Canadian Global Affairs Institute and the Canada West Foundation.

-

COVID-192 days ago

COVID-192 days agoMassive new study links COVID jabs to higher risk of myocarditis, stroke, artery disease

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoConservative Party urges investigation into Carney plan to spend $1 billion on heat pumps

-

2025 Federal Election1 day ago

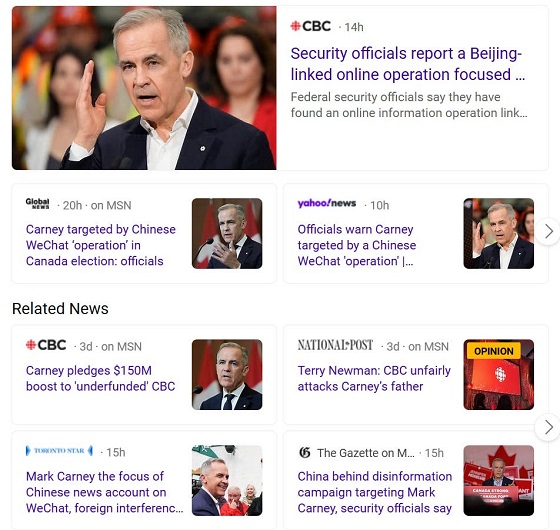

2025 Federal Election1 day agoCommunist China helped boost Mark Carney’s image on social media, election watchdog reports

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFifty Shades of Mark Carney

-

Alberta2 days ago

Alberta2 days agoAlberta’s embrace of activity-based funding is great news for patients

-

Health1 day ago

Health1 day agoExpert Medical Record Reviews Of The Two Girls In Texas Who Purportedly Died of Measles

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCorporate Media Isn’t Reporting on Foreign Interference—It’s Covering for It

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoI don’t believe these polls!