Business

Judge blocks Musk’s Department of Government Efficiency from accessing Treasury records

From LifeSiteNews

The emergency ruling comes as 15 Soros-installed AGs seek to block Elon Musk and the Department of Government Efficiency (DOGE) from access to information that would reveal how activist groups in blue states have been funded by the U.S. government.

In a stunning and sweeping emergency injunction that has even stunned the people who demanded it, a Manhattan-based district judge has just removed Secretary of Treasury Scott Bessent from his authority over the Treasury Department; blocked any political appointee from accessing records within the Treasury Department; blocked any “special appointee” of President Trump from records within Treasury; and demanded that all information previously extracted be destroyed.

The emergency injunction, signed by District Judge Paul Engelmayer in Manhattan, was determined without any input from the Trump administration and applies until Friday, February 14, 2025, when U.S. District Judge Jeannette A. Vargas will hear the full arguments of the lawsuit.

The emergency ruling comes as a result of 15 (Soros-installed) attorneys general from New Jersey, New York, Arizona, California, Colorado, Connecticut, Delaware, Illinois, Maine, Maryland, Minnesota, Nevada, Rhode Island, and Vermont all filing suit in New York seeking to block Elon Musk and the Department of Government Efficiency (DOGE) from access to information that would reveal how activist groups in their states have been funded by the U.S. government.

READ: Judge blocks Trump plan that would put thousands of USAID staff on paid leave

From Reuters:

The lawsuit said Musk and his team could disrupt federal funding for health clinics, preschools, climate initiatives, and other programs, and that Republican President Donald Trump could use the information to further his political agenda.

DOGE’s access to the system also ‘poses huge cybersecurity risks that put vast amounts of funding for the States and their residents in peril,’ the state attorneys general said. They sought a temporary restraining order blocking DOGE’s access.

The judge, an appointee of Democratic former President Barack Obama, said the states’ claims were ‘particularly strong’ and warranted him acting on their request for emergency relief pending a further hearing before another judge on February 14.

‘That is both because of the risk that the new policy presents of the disclosure of sensitive and confidential information and the heightened risk that the systems in question will be more vulnerable than before to hacking,’ Engelmayer wrote.

New York Attorney General Letitia James, a Democrat whose office is leading the case, welcomed the ruling, saying nobody was above the law and that Americans across the country had been horrified by the DOGE team’s unfettered access to their data.

‘We knew the Trump administration’s choice to give this access to unauthorized individuals was illegal, and this morning, a federal court agreed,’ James said in a statement.

‘Now, Americans can trust that Musk – the world’s richest man – and his friends will not have free rein over their personal information while our lawsuit proceeds.’

Engelmayer’s order bars access from being granted to Treasury Department payment and data systems by political appointees, special government employees and government employees detailed from an agency outside the Treasury Department.

The judge also directed that anyone prohibited under his order from accessing those systems to immediately destroy anything they copied or downloaded.

The order by the judge is transparent judicial activism; it will almost certainly be overturned and nullified by later rulings. However, it creates blocks and slows down the goal of DOGE and the objective of the Trump administration.

On what basis do states think they can sue the federal government to stop the federal government from auditing federal spending? How can a judge block the executive branch from executing the functions of the executive branch? This lawfare activism is ridiculous.

Within the ruling:

… restrained from granting access to any Treasury Department payment record, payment systems, or any other data systems maintained by the Treasury Department containing personally identifiable information and/or confidential financial information of payees, other than to civil servants with a need for access to perform their job duties within the Bureau of Fiscal Services who have passed all background checks and security clearances and taken all information security training called for in federal statutes and Treasury Department regulations… [Emphasis added.]

So the unelected bureaucracy is in charge and not the secretary of the Treasury?

Reprinted with permission from Conservative Treehouse.

2025 Federal Election

MEI-Ipsos poll: 56 per cent of Canadians support increasing access to non-governmental healthcare providers

-

Most believe private providers can deliver services faster than government-run hospitals

-

77 per cent of Canadians say their provincial healthcare system is too bureaucratic

Canadians are increasingly in favour of breaking the government monopoly over health care by opening the door to independent providers and cross-border treatments, an MEI-Ipsos poll has revealed.

“Canadians from coast to coast are signalling they want to see more involvement from independent health providers in our health system,” explains Emmanuelle B. Faubert, economist at the MEI. “They understand that universal access doesn’t mean government-run, and that consistent failures to deliver timely care in government hospitals are a feature of the current system.”

Support for independent health care is on the rise, with 56 per cent of respondents in favour of allowing patients to access services provided by independent health entrepreneurs. Only 25 per cent oppose this.

In Quebec, support is especially strong, with 68 per cent endorsing this change.

Favourable views of accessing care through a mixed system are widespread, with three quarters of respondents stating that private entrepreneurs can deliver healthcare services faster than hospitals managed by the government. This is up four percentage points from last year.

Countries like Sweden and France combine universal coverage with independent providers and deliver faster, more accessible care. When informed about how these health systems run, nearly two in three Canadians favour adopting such models.

The poll also finds that 73 per cent of Canadians support allowing patients to receive treatment abroad with provincial coverage, which could help reduce long wait times at home.

Common in the European Union, this “cross-border directive” enabled 450,000 patients to access elective surgeries in 2022, with costs reimbursed as if they had been treated in their home country.

There’s a growing consensus that provincial healthcare systems are overly bureaucratic, with the strongest agreement in Alberta, B.C., and Quebec. The proportion of Canadians holding this view has risen by 16 percentage points since 2020.

Nor do Canadians see more spending as being a solution: over half say the current pace of healthcare spending in their province is unsustainable.

“Governments shouldn’t keep doubling down on what isn’t working. Instead, they should look at what works abroad,” says Ms. Faubert. “Canadians have made it clear they want to shift gears; now it’s up to policymakers to show they’re listening.”

A sample of 1,164 Canadians aged 18 and older was polled between March 24th and March 28th, 2025. The margin of error is ±3.3 percentage points, 19 times out of 20.

The results of the MEI-Ipsos poll are available here.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

2025 Federal Election

POLL: Canadians say industrial carbon tax makes life more expensive

The Canadian Taxpayers Federation released Leger polling showing 70 per cent of Canadians believe businesses pass on most or some of the cost of the industrial carbon tax to consumers. Meanwhile, just nine per cent believe businesses pay most of the cost.

“The poll shows Canadians understand that a carbon tax on business is a carbon tax on Canadians that makes life more expensive,” said Franco Terrazzano, CTF Federal Director. “Only nine per cent of Canadians believe Liberal Leader Mark Carney’s claim that businesses will pay most of the cost of his carbon tax.

“Canadians have a simple question for Carney: How much will your carbon tax cost?”

The federal government currently imposes an industrial carbon tax on oil and gas, steel and fertilizer businesses, among others.

Carney said he would “improve and tighten” the industrial carbon tax and extend the “framework to 2035.” Carney also said that by “changing the carbon tax … We are making the large companies pay for everybody.”

The Leger poll asked Canadians who they think ultimately pays the industrial carbon tax. Results of the poll show:

- 44 per cent say most of the cost is passed on to consumers

- 26 per cent say some of the cost is passed on to consumers

- 9 per cent say businesses pay most of the cost

- 21 per cent don’t know

Among those decided on the issue, 89 per cent of Canadians say businesses pass on most or some of the cost to consumers.

“Carbon taxes on refineries make gas more expensive, carbon taxes on utilities make home heating more expensive and carbon taxes on fertilizer plants increase costs for farmers and that makes groceries more expensive,” Terrazzano said. “A carbon tax on business will push our entrepreneurs to cut production in Canada and increase production south of the border and that means higher prices and fewer jobs for Canadians.”

-

Alberta2 days ago

Alberta2 days agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoInside Buttongate: How the Liberal Swamp Tried to Smear the Conservative Movement — and Got Exposed

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoIs HNIC Ready For The Winnipeg Jets To Be Canada’s Heroes?

-

Dr. Robert Malone1 day ago

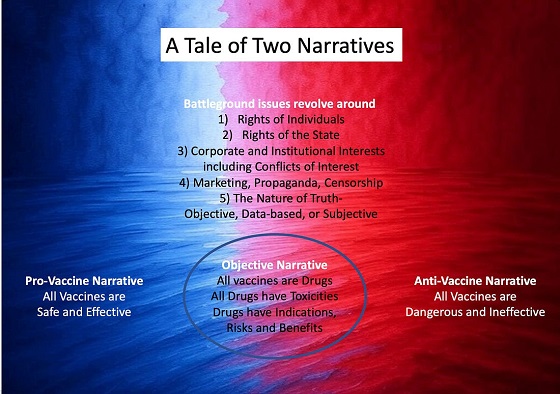

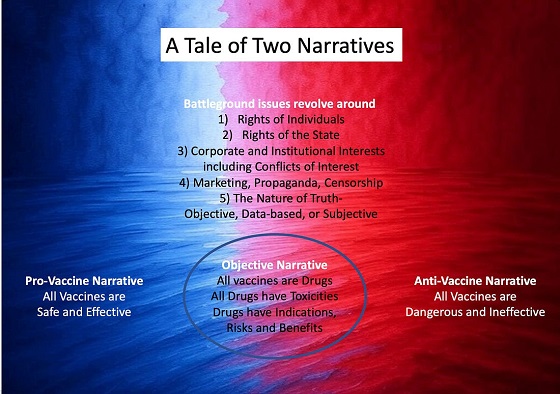

Dr. Robert Malone1 day agoThe West Texas Measles Outbreak as a Societal and Political Mirror

-

COVID-191 day ago

COVID-191 day agoCOVID virus, vaccines are driving explosion in cancer, billionaire scientist tells Tucker Carlson

-

Health1 day ago

Health1 day agoHorrific and Deadly Effects of Antidepressants

-

illegal immigration1 day ago

illegal immigration1 day agoDespite court rulings, the Trump Administration shows no interest in helping Abrego Garcia return to the U.S.