Alberta

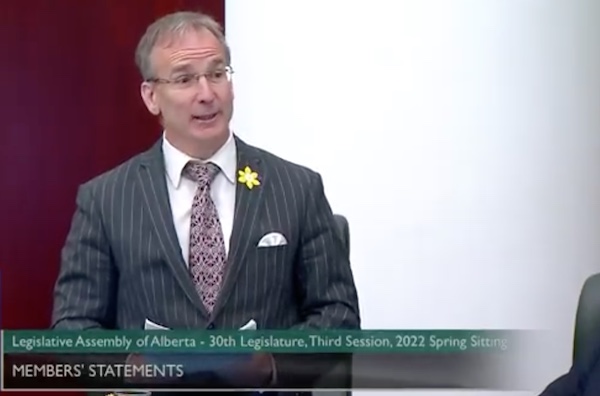

It’s time for the Alberta Sovereignty Act – Red Deer South MLA Jason Stephan

This article submitted by Red Deer South MLA Jason Stephan

THE ALBERTA SOVEREIGNTY ACT IS GOOD FOR ALBERTA

I supported the concept of the Alberta Sovereignty Act before the UCP leadership race. It was developed by the Free Alberta Strategy. I participated in their townhalls supporting their strategies, as did two of the UCP leadership candidates, Danielle Smith and Todd Loewen. Jason Kenney and his cabinet ministers did not.

What is the Alberta Sovereignty Act?

The Sovereignty Act affirms Alberta’s right to refuse and reject Federal Government actions or laws that intrude into provincial areas of jurisdiction or attack the interests of Alberta.

Ottawa recently released a “discussion paper” seeking to limit, or impose additional carbon taxes on, oil and gas development. This is not an isolated incident; this is a pattern of hostile behavior from Ottawa seeking to attack and take advantage of Alberta, holding it back.

Albertans should be aware that this discussion paper is likely a pretext, an excuse to either take more money from Alberta or prevent it from excelling ahead of other provinces.

Albertans should be aware that at any time Ottawa may leverage the Supreme Court of Canada decision permitting carbon taxes, overruling our Court of Appeal describing Ottawa’s carbon taxes as a “constitutional trojan horse”, to impose a targeted windfall or carbon tax on Alberta’s natural resources that discriminates and disproportionately punishes Alberta while sparing Ontario and Quebec from burden or harm.

The Supreme Court of Canada says carbon taxes are a tool that Ottawa has its disposal at any time to punish Alberta, yet under section 92A of the Constitution Act, Alberta has jurisdiction over its natural resources, not Ottawa.

The Alberta Sovereignty Act should be invoked to reject the “discussion paper” and tell Ottawa to leave Alberta and its constitutional jurisdiction alone.

The unfortunate truth is that Ottawa has made itself an unpredictable and hostile variable, a threat to the freedom and prosperity of Alberta businesses and families that should not be underestimated.

Alberta is compelled to protect itself.

Does the Establishment like the Alberta Sovereignty Act? No. Many Eastern politicians and their media pundits do not like the Alberta Sovereignty Act. It challenges the status quo they benefit under.

Their status quo has enabled a pattern of abuse and economic warfare on Alberta, disrespecting its jurisdiction over its resources, creating chaos and injecting commercial uncertainty, chasing away billions in private sector investments and thousands of Alberta jobs.

Albertans are becoming more aware that this is a rigged partnership. Alberta businesses and families give hundreds of millions more to Ottawa than they receive in return, with Ottawa using our money, not to benefit Alberta, but for political gain, primarily in Quebec, the structural welfare recipient under the partnership. Equalization is one of the devices that Ottawa uses for this purpose.

Albertans want change. Alberta held an equalization referendum. Ottawa ignored the result –to them Alberta is means to an end, they want our money. Strongly worded letters from Alberta politicians have accomplished nothing. It is time for less words and more actions.

Boundaries are reasonable and normal.

Boundaries are integral to adult relationships. The Alberta Sovereignty Act seeks to impose boundaries that Ottawa continually disrespects, to discriminate, attack, and force itself into Alberta’s constitutional jurisdictions.

Some of the UCP leadership candidates say the Alberta Sovereignty Act will produce chaos. They are wrong. It is a morally and fiscally bankrupt Ottawa, a trillion dollar plus fiscal train wreck, that is producing chaos. Ottawa is the risk that we can no longer afford, not a law that seeks to do something about it!

The Alberta Sovereignty Act is good for Alberta. Wisely applied it can help protect the Alberta Advantage, as the most attractive Canadian jurisdiction to start and grow a business, to work and raise our families. Alberta is a land of freedom and opportunity for us and our children. We must be vigilant to keep it that way.

The deadline to become a member of the United Conservative Party to vote in this leadership race is this Friday, August 12. We invite all Alberta conservatives to become a member of the party, to vote and have your say on who will be the next leader and Premier of Alberta!

You can buy a membership here, or check if your membership is up-to-date here.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

Alberta

Province to expand services provided by Alberta Sheriffs: New policing option for municipalities

Expanding municipal police service options |

Proposed amendments would help ensure Alberta’s evolving public safety needs are met while also giving municipalities more options for local policing.

As first announced with the introduction of the Public Safety Statutes Amendment Act, 2024, Alberta’s government is considering creating a new independent agency police service to assume the police-like duties currently performed by Alberta Sheriffs. If passed, Bill 49 would lay additional groundwork for the new police service.

Proposed amendments to the Police Act recognize the unique challenges faced by different communities and seek to empower local governments to adopt strategies that effectively respond to their specific safety concerns, enhancing overall public safety across the province.

If passed, Bill 49 would specify that the new agency would be a Crown corporation with an independent board of directors to oversee its day-to-day operations. The new agency would be operationally independent from the government, consistent with all police services in Alberta. Unlike the Alberta Sheriffs, officers in the new police service would be directly employed by the police service rather than by the government.

“With this bill, we are taking the necessary steps to address the unique public safety concerns in communities across Alberta. As we work towards creating an independent agency police service, we are providing an essential component of Alberta’s police framework for years to come. Our aim is for the new agency is to ensure that Albertans are safe in their communities and receive the best possible service when they need it most.”

Additional amendments would allow municipalities to select the new agency as their local police service once it becomes fully operational and the necessary standards, capacity and frameworks are in place. Alberta’s government is committed to ensuring the new agency works collaboratively with all police services to meet the province’s evolving public safety needs and improve law enforcement response times, particularly in rural communities. While the RCMP would remain the official provincial police service, municipalities would have a new option for their local policing needs.

Once established, the agency would strengthen Alberta’s existing policing model and complement the province’s current police services, which include the RCMP, Indigenous police services and municipal police. It would help fill gaps and ensure law enforcement resources are deployed efficiently across the province.

Related information

-

Alberta15 hours ago

Alberta15 hours agoProvince to expand services provided by Alberta Sheriffs: New policing option for municipalities

-

Bruce Dowbiggin10 hours ago

Bruce Dowbiggin10 hours agoIs HNIC Ready For The Winnipeg Jets To Be Canada’s Heroes?

-

2025 Federal Election12 hours ago

2025 Federal Election12 hours agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

2025 Federal Election14 hours ago

2025 Federal Election14 hours agoNo Matter The Winner – My Canada Is Gone

-

Alberta13 hours ago

Alberta13 hours agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

Health11 hours ago

Health11 hours agoHorrific and Deadly Effects of Antidepressants

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoThe “Hardhat Vote” Has Embraced Pierre Poilievre

-

COVID-192 days ago

COVID-192 days agoThe Pandemic Justice Phase Begins as Criminal Investigations Commence