Business

It’s time for an honest conversation about the costs of new federal programs

From the Fraser Institute

By Jake Fuss and Grady Munro

The Trudeau government will table its next budget on April 16, and with the government’s push on the initial steps of national pharmacare, it’s important to remember there’s a cost Canadians must pay for new and expanded government services.

In March, the Trudeau government and the NDP reached an agreement to introduce the first steps of a national pharmacare program that will initially cover diabetes drugs and contraceptives, but may eventually grow to cover far more. This marks the third major national social program introduced by the Trudeau government in recent years, accompanying the $10-a-day daycare and national dental care programs promised in Budget 2022.

These policies represent an approach by the federal government to expand its role in the funding and provision of social services—an approach which has support among Canadians. Polling data from 2022, which sought to understand Canadian views on new spending programs, revealed the majority of respondents supported $10-a-day daycare (69 per cent), pharmacare (79 per cent) and dental care (72 per cent)—when there were no costs attached.

The Trudeau government has chosen to fund these new programs primarily using debt. Through planned deficits and rising debt interest costs for the foreseeable future, Ottawa is shifting much of the burden of paying for today’s services onto future generations of Canadians. Put differently, the new services are not free, and must ultimately be paid for through higher taxes in the future because debt comes with costs.

It’s therefore informative to look at what happens to the popularity of these programs when the true costs are communicated to Canadians. Polling data clearly shows these new programs lose considerable support when linked to a direct cost in the form of an increase in the federal goods and services tax (GST). Indeed, support for government-funded pharmacare, dental care and daycare plummeted to well below 50 per cent of respondents if the services are paid for by increased taxes.

This is the key difference between Canada and countries such as Sweden or Denmark, which are often used as examples of countries that maintain expansive social services and income supports. These countries have gone much further than Canada regarding government provision of services, but have paid for it through corresponding tax increases applied to individuals and families today rather than through borrowed money. Moreover, the tax burden falls primarily on the middle class, which utilizes these services the most, as opposed to concentrating tax hikes on top income earners.

For example, Swedes earning more than US$62,000 per year face the country’s top marginal personal income tax rate of 52.3 per cent. In comparison, although Canada’s top marginal rate (53.5 per cent) is roughly the same level as Sweden’s, it doesn’t kick in until earnings of nearly US$177,000. Moreover, both Sweden and Denmark maintain a national sales tax rate of 25 per cent, while Canadians face sales taxes ranging from 5 per cent to 15 per cent (depending on the province). Simply put, the Nordic countries fund expansive government through high taxes on their citizens.

To put the cost of national dental care, day care and the first steps of pharmacare in context, an increase in the GST to 6 per cent from its current 5 per cent would be insufficient to pay for an estimated annual cost of at least $13 billion on these programs.

In recent years, the Trudeau government has introduced substantial social services without the corresponding tax increases required to pay for them. But increased federal spending will require higher taxes for families either today or in the future, and Canadians must remember this when deciding if they truly want these new programs.

Authors:

Business

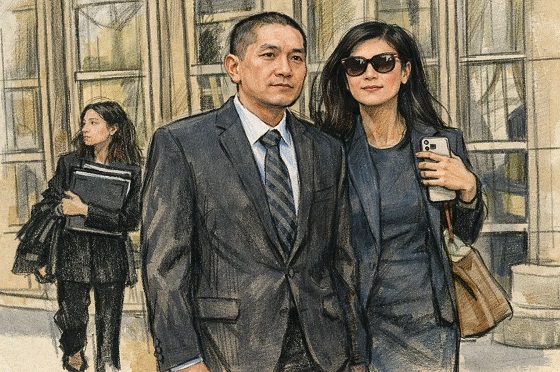

Deadlocked Jury Zeroes In on Alleged US$40 Million PPE Fraud in Linda Sun PRC Influence Case

A jury of New Yorkers will return to court Monday, heading into their second week of deliberations in a landmark foreign-agent and corruption trial that reaches into two governors’ offices, struggling to decide whether former state official Linda Sun secretly served Beijing’s interests while she and her husband built a small business and luxury-property empire cashing in on pandemic-era contracts as other Americans were locked down.

On Thursday — the fourth day of deliberations — the jury sent federal Judge Brian Cogan a blunt note saying they were deadlocked on the sprawling case, in which the federal government has asked jurors to accept its account of a complex web of family and Chinese-community financial transactions through which Sun and her husband allegedly secured many millions of dollars in Chinese business deals channeled through “United Front” proxies aligned with Beijing.

The defense, by contrast, argues that Sun and her husband were simply successful through legitimate, culturally familiar transactions, not any covert scheme directed by a foreign state.

“We deeply feel that no progress can be made to change any jurors’ judgment on all counts,” the panel wrote Thursday. “There are fundamental differences on the evidence and the interpretation of the law. We cannot come to a unanimous decision.”

Cogan reportedly responded with a standard “Allen charge” — an instruction often used in deadlock situations, urging jurors to keep an open mind and continue deliberating. Because a juror had to be replaced due to travel commitments, the reconstituted panel will need to restart deliberations from square one on Monday.

According to a message the U.S. Justice Department sent to The Bureau on Wednesday, the panel had already asked for transcripts from four witnesses — Sean Carroll, Mary Beth Hefner, Karen Gallacchi and Jenny Low.

Those requests underline just how dense the case is — and how much money was at stake in the pandemic-era PPE deals at the heart of several key counts. Sun and her husband, businessman Chris Hu, face 19 counts in total, including Sun acting as an unregistered foreign agent for the People’s Republic of China; visa-fraud and alien-smuggling charges tied to a 2019 Henan provincial delegation; a multimillion-dollar pandemic PPE kickback scheme; bank-fraud and identity-misuse allegations; and multiple money-laundering and tax-evasion counts.

Carroll and Hefner’s testimony is central to the government’s key procurement-corruption allegation. Prosecutors say Sun used her influence to help steer more than US$40 million in PPE contracts to companies tied to her husband in China, with an expected profit of roughly US$8 million — money they allege was partly kicked back to Sun and Hu and funneled through accounts opened in Sun’s mother’s name and via friends and relatives.

Prosecutors say the clearest money trail in the Sun case runs through New York’s COVID PPE scramble and a pair of Jiangsu-linked emails.

“What was Linda Sun’s reward for taking official action to steer these contracts through the procurement process? Millions of dollars in kickbacks or bribes. It was money that she knew would be coming her way if she pushed these contracts through,” prosecutor Alexander Solomon told jurors in closing.

He argued that in March 2020, as the pandemic hit, a Jiangsu provincial official in Albany emailed state staff, including Sun, with information on four Chinese PPE and medical suppliers — and that the next day Sun forwarded herself a second email that copied the language about two of those vendors but added a new line claiming that “High Hope comes highly recommended by the Jiangsu Department of Commerce.”

A New York State IT specialist testified that this exact phrase appears only once in the state’s entire email system, in Sun’s self-forwarded message. Prosecutors urged jurors to see it as a fabricated email.

They suggest it is one of a number of frauds and forgeries, including claims that Sun repeatedly faked Governor Kathy Hochul’s signature on invitation letters used to bring Chinese provincial officials into the United States as part of plans to build a large education complex in New York.

On the PPE dealings, prosecutors say that during a period when Sun still had broad latitude to vet vendors, she sent procurement official Sean Carroll a proposal for High Hope to supply five million masks.

Prosecutors say she did not disclose that High Hope was tied to family associate Henry Hua or that she had a financial interest in the deal, but did repeat language that the company “came recommended” by Jiangsu authorities — phrasing Carroll testified he understood as an official validation from the Chinese side.

Prosecutors then linked the High Hope contracts that moved through Carroll’s office to alleged downstream cash flows laid out in a Chris Hu spreadsheet: PPE contract money Hu recorded as owed by Jay Chen, marked as wired into an account called “Golden” and then on to “HC Paradise,” the vehicle Hu allegedly used to pay for a Hawaii property.

In the government’s telling, that is how a doctored Jiangsu government “recommendation” for High Hope ultimately turned into New York taxpayer funds helping to buy a Hawaiian condo.

As The Bureau has reported in detail, prosecutor Alexander Solomon used his closing argument to give jurors one of the clearest open-court narratives yet of how the Chinese Communist Party’s United Front allegedly seeks to shape Western politics through diaspora networks — and to argue that Sun sat at the center of such a network in Albany.

Solomon walked the panel through a cast that ran from Sun’s family and business partners in Queens to United Front–linked association bosses in New York, provincial officials in Henan and Guangdong, and senior staff at China’s New York consulate. In his account, Sun — officially feted in Beijing as an “eminent young overseas Chinese” after a 2017 political tour — became a “trusted insider” who quietly repurposed New York State letterhead, access and messaging to serve Beijing’s priorities on Taiwan, Uyghurs and trade, while keeping that relationship hidden from her own colleagues.

Among the most striking elements of the government’s case, as The Bureau reported from Solomon’s summation, were that Sun allegedly forged Hochul’s signature on multiple invitation letters that Chinese officials then used to secure U.S. visas for provincial delegations — promising meetings in Albany that, Solomon said, no one in state government had actually approved — as part of a broader push by Henan Province to anchor a major education complex in the United States.

He then tied that influence narrative to money: millions in lobster-export deals for Chris Hu, allegedly greased by Chinese officials and New York-based United Front intermediaries; coded “apple” cash drop-offs funneled through third-party accounts; and the pandemic PPE contracts.

In Solomon’s formulation, all of that adds up to clandestine agency for Beijing.

He told jurors that while Sun was boasting to Chinese consulate officials that she could treat Hochul “like her puppet,” she was acting “like an agent,” treating PRC officials as her “real bosses,” and seeking and receiving benefits. Sun kept doing so, Solomon said, even after an FBI agent warned her about the Foreign Agents Registration Act and the risks of working too closely with the consulate.

Defense lawyers for Sun and Hu, in their own summations, urged the jury to reject that picture of a couple monetizing their access to senior American politicians in order to enrich themselves through clandestine business dealings facilitated by community leaders secretly working for Beijing’s United Front units. According to the Global Investigations Review summary and other accounts, they argued that prosecutors have overreached by criminalizing ordinary diaspora politics, networking and pandemic procurement.

On the defense view, much of what the government calls “direction and control” is better understood as routine back-and-forth involving a diaspora liaison in the governor’s office and community or trade groups with ties to China. None of the government’s evidence, they argue, amounts to an agreement to operate under the “direction or control” of a foreign principal — the core FARA requirement.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Business

Argentina’s Milei delivers results free-market critics said wouldn’t work

This article supplied by Troy Media.

Inflation is down, poverty is falling and Argentina’s economy is growing as Javier Milei pushes reforms many skeptics said would fail

Javier Milei recently passed the two-year mark as president of Argentina. While his personal popularity has been bumpy in recent months—the Americas Society/Council of the Americas suggested his approval rating was a little under 40 per cent this fall—the political climate is still very much in his favour.

His party, La Libertad Avanza, won almost 41 per cent of the vote in the October midterm elections, earning 13 of 24 Senate seats and 64 of the 127 contested lower-house seats.

Few would have expected a libertarian economist who supports small government, lower taxes, more individual rights and freedoms, private enterprise, trade liberalization and anarcho-capitalism to become a success in Argentine politics. The proof has been in the political pudding for quite some time, however.

“As of September, the economy is growing at five per cent on a yearly basis,” the Cato Institute’s Marcos Falcone wrote on Dec. 10. “Poverty, which exceeded 40 per cent before Milei took office and peaked at 52.9 per cent in the first half of 2024, is now down to 31.6 per cent. Monthly inflation, which often surpassed 10 per cent in the pre-Milei era and reached 25 per cent in December 2023, now hovers around two per cent. Both exports and imports are rising rapidly.”

These are all significant benefits for the Argentine economy. Milei wants to accomplish even more. Falcone noted that “the government has already called for special sessions in Congress for its new members to vote on labour, tax and criminal justice reform bills before the end of the year.” Some other legislative goals include “privatization of major state-owned enterprises, pension reform that allows for private retirement plans, the liberalization of education, and further deregulation of the economy, among others.”

Milei’s libertarian philosophy of anarcho-capitalism, which was largely the brainchild of the late American economist Murray Rothbard, rejects statism and socialism. He has worked hard to convince Argentines that free markets, private enterprise, open trade and more will lead to economic success for individuals, families and businesses alike.

That is why Milei remains a “breath of fresh air for Argentina,” as I wrote in a Nov. 20, 2023, National Post column, and “he’s exactly what the doctor ordered for this struggling and impoverished nation.”

He is also an eccentric fellow, to put it mildly. The Argentine president used to be a TV pundit known as El Loco, the madman, who was known for his “profane outbursts,” Time magazine noted on May 23, 2024. He also bragged about being a “tantric sex guru, brandished a chainsaw at rallies to symbolize his plans to slash government spending, dressed up as a superhero who sang about fiscal policy, and told voters that his five cloned English mastiffs, which he reportedly consults in telepathic conversations, are his ‘best strategists.’”

Milei even claimed to have met one of his beloved canines, Conan, in a previous life in the Roman Colosseum more than 2,000 years ago. He was a gladiator, and his four-legged companion was a lion.

Milei’s left-leaning critics have attempted to use these eccentricities to their advantage. They have also called Milei “far right” and claimed he was an Argentine version of U.S. President Donald Trump. None of this is true. Milei has always rejected fascism and totalitarian regimes. He is business-oriented and focused on getting Argentina back on the road to financial success. He wants his home country to be free from government interference, state control and the iron grip of Peronist fanatics. He is getting closer to this goal.

Falcone, the Cato Institute analyst, pointed out in his piece that “a key reform that is still part of Argentina’s unfinished agenda is dollarization.” Milei strongly “advocated” for this policy in 2023, and he has wanted to finish it off for some time. With his party in control of both houses, that time is now.

The Wall Street Journal reported on Dec. 15 that “Argentina’s central bank … would allow the peso to move more freely, responding to investors who have demanded President Javier Milei’s government correct an overvalued currency.” The new policy for the peso will “allow the band to expand at the rate of monthly inflation, which was 2.5 per cent in November, the central bank said. The band currently expands at a monthly rate of one per cent.”

This announcement has been met favourably. “The changes go in the right direction,” Pablo Guidotti, an economist at the Torcuato Di Tella University in Buenos Aires, told the Wall Street Journal. “If the economy expands, this will contribute to higher peso demand allowing Argentina, together with access to capital markets, to accumulate international reserves.”

The quest to achieve dollarization in Argentina has begun.

In summation, Milei’s economic program “is serious and one of the most radical doses of free-market medicine since Thatcherism,” The Economist noted in a Nov. 28, 2024, piece. While the political left “detests him” and the “Trumpian right embraces him,” he does not belong in either camp. “He has shown that the continual expansion of the state is not inevitable,” The Economist continued, and he is a “principled rebuke to opportunistic populism, of the sort practised by Donald Trump. Mr. Milei believes in free trade and free markets, not protectionism; fiscal discipline, not reckless borrowing; and, instead of spinning popular fantasies, brutal public truth-telling.”

There is much that world leaders can learn from the strange, quirky anarcho-capitalist president of Argentina. They should start to take note—and, more importantly, take notes.

Michael Taube is a political commentator, Troy Media syndicated columnist and former speechwriter for Prime Minister Stephen Harper. He holds a master’s degree in comparative politics from the London School of Economics, lending academic rigour to his political insights.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Automotive13 hours ago

Automotive13 hours agoPoliticians should be honest about environmental pros and cons of electric vehicles

-

Agriculture2 days ago

Agriculture2 days agoWhy is Canada paying for dairy ‘losses’ during a boom?

-

Business2 days ago

Business2 days agoCanada Hits the Brakes on Population

-

Daily Caller2 days ago

Daily Caller2 days ago‘Almost Sounds Made Up’: Jeffrey Epstein Was Bill Clinton Plus-One At Moroccan King’s Wedding, Per Report

-

Crime2 days ago

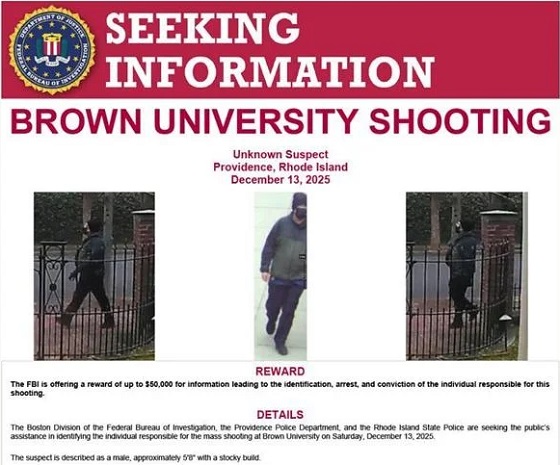

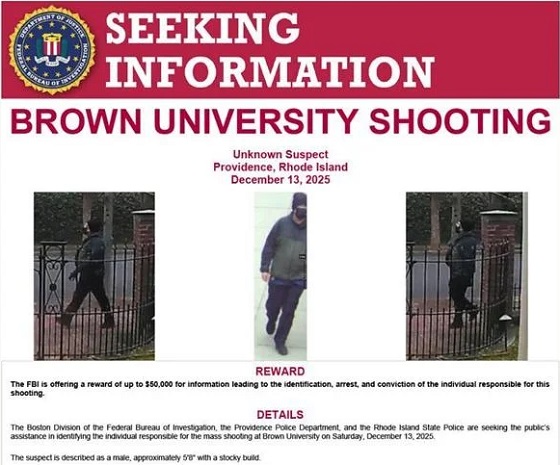

Crime2 days agoBrown University shooter dead of apparent self-inflicted gunshot wound

-

Business2 days ago

Business2 days agoTrump signs order reclassifying marijuana as Schedule III drug

-

Bruce Dowbiggin23 hours ago

Bruce Dowbiggin23 hours agoHunting Poilievre Covers For Upcoming Demographic Collapse After Boomers

-

Alberta1 day ago

Alberta1 day agoAlberta’s new diagnostic policy appears to meet standard for Canada Health Act compliance