Business

Investing In A Pandemic World

Launching an investment column in the midst of the biggest economic meltdown in investment history is a peculiar thing to do, and yet, here we are. Actually, the timing may be excellent: given the parameters and objectives of this column – how not to invest, as much as how to invest – what better time to wade in? If you’re a seasoned investor, the past few months most likely have you huddled in the basement under the stairs, sucking your thumb and rocking back and forth. The market has been pounded, and justifiably so – the strategy of governments to contain COVID-19 involves essentially shutting down large sectors of the economy. One can easily surmise that industries like tourism, air travel, etc. will be in big trouble; the problem is determining how far the rot goes – if an airline fails, or many of them, what industries does it take down with it? In a highly interconnected world, the answers are not clear.

Rather than panic and throw in the towel though (as some investors appear to have done), it is wise to stop hyperventilating if you can and consider the landscape without the lens of panic. First, the pounding in the stock market simply erased the extraordinary gains made in the past several years. As of writing, the S&P 500 Index ETF (exchange traded fund, which invests in a basket of stocks that mirrors the S&P 500 companies on behalf of individuals) is now back at a level of two years ago. Today’s data point might look like a disaster relative to the value of the portfolio 4 months ago, but that paper gain to the end of 2019 was a bit suspect anyway and most expected a market correction of some kind. Not quite like this one of course, but of some kind.

Second, governments around the world now have an arsenal of tools with which to stabilize economies. Or, more like they have a variety of smaller tools and one really big one: a great big freaking printing press to crank out money and shovel into the economy’s engines. There are many arguments as to why this is a bad idea in the long run, and they may all be right, but over the past few decades these strategies have become the norm. Government-led monetary tinkering, on ever-larger scales, saved the financial world in the 2008-9 Great Recession by flooding the world with bank-stabilizing money, and that success convinced those central bankers that this tool has no practical limits. The world is now so interlinked and dependent on central bankers’ policies that shouting about how they will destroy the financial world eventually is like a dog barking at a car. We need to think and act as though these policies aren’t going away. Because they’re not.

Governments, in this consumption-based world, can see the perils of allowing huge swathes of the global economy to perish. We may sneer = at a consumer-based culture, but we wet our pants when we consider the alternative. We need to learn to do things as cleanly as possible, but nowhere in the world does anyone want to see tourism grind to a halt, or people stop buying automobiles, or cosmetics, or any other mainstay of our economy.

As a result, those central banks and governments won’t let it happen. They will pump in money, and they will ease restrictions as soon as possible to get things back to work. It is a challenging time to consider putting money in the stock market (if you’re lucky enough to have some, and a job to boot), but some great companies are on sale in a huge way now. We can see, for example, that anything to do with the food/medicine/distribution systems is of critical importance. Given the fact that governments will print money to shove at anything the general population can’t live without, it is safe to assume those sectors will pull through. Same as natural gas and other industrially-critical materials – the whole climate change narrative has been stuffed in a trunk for the time being. No one wants to face next winter with a natural gas industry that’s gone out of business.

There is of course risk that the markets would continue to fall, based on the fact that there is so much uncertainty in the world with respect to demand erosion and recovery timing. But if the big blue-chip companies that provide our industrial lifelines go defunct and irreparably damage your portfolio, well, we’ll all have much bigger problems to worry about.

For more stories, visit Todayville Calgary

2025 Federal Election

POLL: Canadians want spending cuts

By Gage Haubrich

By Gage Haubrich

The Canadian Taxpayers Federation released Leger polling showing Canadians want the federal government to cut spending and shrink the size and cost of the bureaucracy.

“The poll shows most Canadians want the federal government to cut spending,” said Gage Haubrich, CTF Prairie Director. “Canadians know they pay too much tax because the government wastes too much money.”

Between 2019 and 2024, federal government spending increased 26 per cent even after accounting for inflation. Leger asked Canadians what they think should happen to federal government spending in the next five years. Results of the poll show:

- 43 per cent say reduce spending

- 20 per cent say increase spending

- 16 per cent say maintain spending

- 20 per cent don’t know

The federal government added 108,000 bureaucrats and increased the cost of the bureaucracy 73 per cent since 2016. Leger asked Canadians what they think should happen to the size and cost of the federal bureaucracy. Results of the poll show:

- 53 per cent say reduce

- 24 per cent say maintain

- 4 per cent say increase

- 19 per cent don’t know

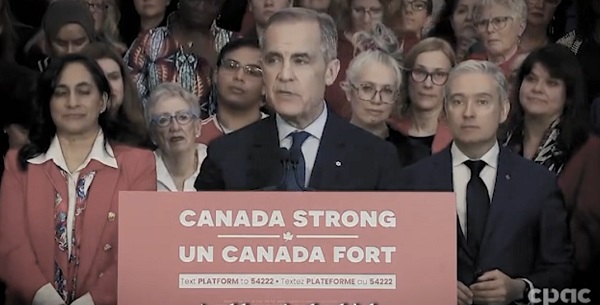

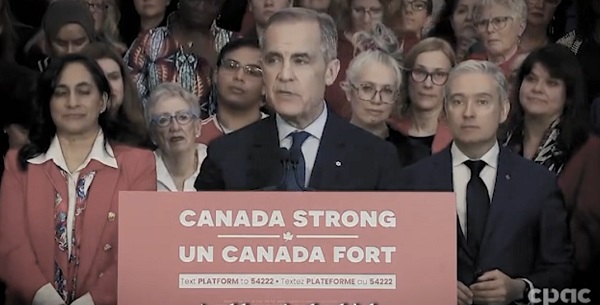

Liberal Leader Mark Carney promised to “balance the operating budget in three years.” Leger asked Canadians if they believed Carney’s promise to balance the budget. Results of the poll show:

- 58 per cent are skeptical

- 32 per cent are confident

- 10 per cent don’t know

“Any politician that wants to fix the budget and cut taxes will need to shrink the size and cost of Ottawa’s bloated bureaucracy,” Haubrich said. “The polls show Canadians want to put the federal government on a diet and they won’t trust promises about balancing the budget unless politicians present credible plans.”

2025 Federal Election

Carney’s budget means more debt than Trudeau’s

The Canadian Taxpayers Federation is criticizing Liberal Party Leader Mark Carney’s budget plan for adding another $225 billion to the debt.

“Carney plans to borrow even more money than the Trudeau government planned to borrow,” said Franco Terrazzano, CTF Federal Director. “Carney claims he’s not like Trudeau and when it comes to the debt, here’s the truth: Carney’s plan is billions of dollars worse than Trudeau’s plan.”

Today, Carney released the Liberal Party’s “fiscal and costing plan.” Carney’s plan projects the debt to increase consistently.

Here is the breakdown of Carney’s annual budget deficits:

- 2025-26: $62 billion

- 2026-27: $60 billion

- 2027-28: $55 billion

- 2028-29: $48 billion

Over the next four years, Carney plans to add an extra $225 billion to the debt. For comparison, the Trudeau government planned on increasing the debt by $131 billion over those years, according to the most recent Fall Economic Statement.

Carney’s additional debt means he will waste an extra $5.6 billion on debt interest charges over the next four years. Debt interest charges already cost taxpayers $54 billion every year – more than $1 billion every week.

“Carney’s debt binge means he will waste $1 billion more every year on debt interest charges,” Terrazzano said. “Carney’s plan isn’t credible and it’s even more irresponsible than the Trudeau plan.

“After years of runaway spending Canadians need a government that will cut spending and stop wasting so much money on debt interest charges.”

-

Alberta2 days ago

Alberta2 days agoProvince to expand services provided by Alberta Sheriffs: New policing option for municipalities

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoIs HNIC Ready For The Winnipeg Jets To Be Canada’s Heroes?

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNo Matter The Winner – My Canada Is Gone

-

Alberta2 days ago

Alberta2 days agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

Health2 days ago

Health2 days agoHorrific and Deadly Effects of Antidepressants

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCampaign 2025 : The Liberal Costed Platform – Taxpayer Funded Fiction

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoA Perfect Storm of Corruption, Foreign Interference, and National Security Failures