Business

Ignore Ottawa’s talking points—Canada is a highly indebted country

From the Fraser Institute

By Jake Fuss

Canada falls 21 positions in international rankings after switching from net debt to gross debt, the largest change by far of any country.

The Trudeau government has claimed that Canada “continues to have an enviable fiscal and debt position relative to international peers” because we have the lowest net debt-to-GDP ratio in the G7. But this is misleading. In reality, Canada is actually a highly indebted country relative to our international peers.

The government’s claim originates from the International Monetary Fund (IMF), which notes that Canada has the lowest level of net debt (as a share of its economy) among G7 countries including Germany, Italy, Japan, France, the United Kingdom and the United States. But this specific measure of debt subtracts financial assets from total government debt.

Here’s why that’s a problem.

Again, when calculating net debt, you subtract financial assets because you assume those assets could be used to offset debt. The glaring problem here is that Canada’s financial assets include the assets of Canada Pension Plan (CPP) and Quebec Pension Plan (QPP), which substantially reduce Canada’s net debt. Indeed, according to the latest data from Statistics Canada, there were net assets of $716.7 billion in the combined CPP and QPP as of Dec. 31, 2023.

But the assets of the CPP and QPP are used for payments to existing and future retirees and can’t be used to offset government debt without compromising the ability of the CPP and QPP to provide benefits to retirees. So, Canada having the lowest net debt-to-GDP in the G7 doesn’t mean much when CPP and QPP assets are incorrectly used to make us look less indebted than we actually are.

Thankfully, there’s a much more accurate way to measure of Canada’s indebtedness—gross debt-to-GDP. Gross debt, according to the IMF, includes all “liabilities that require future payment of interest and/or principal by the debtor to the creditor.” And extending the analysis to include a broader group of advanced countries provides a more accurate assessment of Canada’s comparative indebtedness.

According to a new study, among 32 industrialized countries, Canada slides from the 5th-lowest debt ranking when net debt is measured to 26th when gross debt is used. Further, Canada’s gross debt exceeds the total size of the national economy by nearly 5 percentage points. In other words, Canada falls 21 positions in international rankings after switching from net debt to gross debt, the largest change by far of any country.

The consequences of fiscal imprudence are clear. Just like households, governments must pay interest on debt. In 2024, Canada’s federal debt interest costs are expected to eclipse $54.0 billion—equal to the entire amount of revenue the government collects from the Goods and Services Tax (GST). And debt must be repaid by future generations of Canadians through tax increases or reduction in services.

When the Trudeau government claims that Canada is in an enviable position relative to our peers on government indebtedness, it is misleading Canadians. The data clearly show that Canada is among the most indebted advanced economies in the world. That’s not something to boast about.

Author:

Business

China, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

Sam Cooper

Sam Cooper

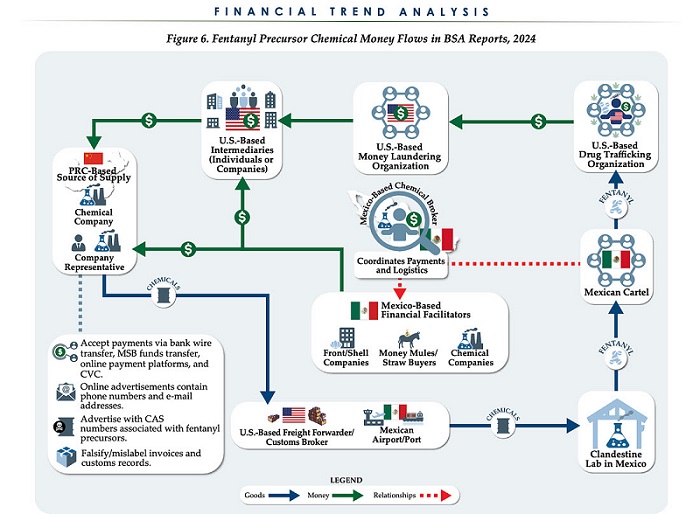

The U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) has identified $1.4 billion in fentanyl-linked suspicious transactions, naming China, Mexico, Canada, and India as key foreign touchpoints in the global production and laundering network. The analysis, based on 1,246 Bank Secrecy Act filings submitted in 2024, tracks financial activity spanning chemical purchases, trafficking logistics, and international money laundering operations.

The data reveals that Mexico and the People’s Republic of China were the two most frequently named foreign jurisdictions in financial intelligence gathered by FinCEN. Most of the flagged transactions originated in U.S. cities, the report notes, due to the “domestic nature” of Bank Secrecy Act data collection. Among foreign jurisdictions, Mexico, China, Hong Kong, and Canada were cited most often in fentanyl-related financial activity.

The FinCEN report points to Mexico as the epicenter of illicit fentanyl production, with Mexican cartels importing precursor chemicals from China and laundering proceeds through complex financial routes involving U.S., Canadian, and Hong Kong-based actors.

The findings also align with testimony from U.S. and Canadian law enforcement veterans who have told The Bureau that Chinese state-linked actors sit atop a decentralized but industrialized global fentanyl economy—supplying precursors, pill presses, and financing tools that rely on trade-based money laundering and professional money brokers operating across North America.

“Filers also identified PRC-based subjects in reported money laundering activity, including suspected trade-based money laundering schemes that leveraged the Chinese export sector,” the report says.

A point emphasized by Canadian and U.S. experts—including former U.S. State Department investigator Dr. David Asher—that professional Chinese money laundering networks operating in North America are significantly commanded by Chinese Communist Party–linked Triad bosses based in Ontario and British Columbia—is not explored in detail in this particular FinCEN report.¹

Chinese chemical manufacturers—primarily based in Guangdong, Zhejiang, and Hebei provinces—were repeatedly cited for selling fentanyl precursors via wire transfers and money service businesses. These sales were often facilitated through e-commerce platforms, suggesting that China’s global retail footprint conceals a lethal underground market—one that ultimately fuels a North American public health crisis. In many cases, the logistics were sophisticated: some Chinese companies even offered delivery guarantees and customs clearance for precursor shipments, raising red flags for enforcement officials.

While China’s industrial base dominates the global fentanyl supply chain, Mexican cartels are the next most prominent state-like actors in the ecosystem—but the report emphasizes that Canada and India are rising contributors.

“Subjects in other foreign countries—including Canada, the Dominican Republic, and India—highlight the presence of alternative suppliers of precursor chemicals and fentanyl,” the report says.

“Canada-based subjects were primarily identified by Bank Secrecy Act filers due to their suspected involvement in drug trafficking organizations allegedly sourcing fentanyl and other drugs from traditional drug source countries, such as Mexico,” it explains, adding that banking intelligence “identified activity indicative of Canada-based individuals and companies purchasing precursor chemicals and laboratory equipment that may be related to the synthesis of fentanyl in Canada. Canada-based subjects were primarily reported with addresses in the provinces of British Columbia and Ontario.”

FinCEN also flagged activity from Hong Kong-based shell companies—often subsidiaries or intermediaries for Chinese chemical exporters. These entities were used to obscure the PRC’s role in transactions and to move funds through U.S.-linked bank corridors.

Breaking down the fascinating and deadly world of Chinese underground banking used to move fentanyl profits from American cities back to producers, the report explains how Chinese nationals in North America are quietly enlisted to move large volumes of cash across borders—without ever triggering traditional wire transfers.

These networks, formally known as Chinese Money Laundering Organizations (CMLOs), operate within a global underground banking system that uses “mirror transfers.” In this system, a Chinese citizen with renminbi in China pays a local broker, while the U.S. dollar equivalent is handed over—often in cash—to a recipient in cities like Los Angeles or New York who may have no connection to the original Chinese depositor aside from their role in the laundering network. The renminbi, meanwhile, is used inside China to purchase goods such as electronics, which are then exported to Mexico and delivered to cartel-linked recipients.

FinCEN reports that US-based money couriers—often Chinese visa holders—were observed depositing large amounts of cash into bank accounts linked to everyday storefront businesses, including nail salons and restaurants. Some of the cash was then used to purchase cashier’s checks, a common method used to obscure the origin and destination of the funds. To banks, the activity might initially appear consistent with a legitimate business. However, modern AI-powered transaction monitoring systems are increasingly capable of flagging unusual patterns—such as small businesses conducting large or repetitive transfers that appear disproportionate to their stated operations.

On the Mexican side, nearly one-third of reports named subjects located in Sinaloa and Jalisco, regions long controlled by the Sinaloa Cartel and Cartel Jalisco Nueva Generación. Individuals in these states were often cited as recipients of wire transfers from U.S.-based senders suspected of repatriating drug proceeds. Others were flagged as originators of payments to Chinese chemical suppliers, raising alarms about front companies and brokers operating under false pretenses.

The report outlines multiple cases where Mexican chemical brokers used generic payment descriptions such as “goods” or “services” to mask wire transfers to China. Some of these transactions passed through U.S.-based intermediaries, including firms owned by Chinese nationals. These shell companies were often registered in unrelated sectors—like marketing, construction, or hardware—and exhibited red flags such as long dormancy followed by sudden spikes in large transactions.

Within the United States, California, Florida, and New York were most commonly identified in fentanyl-related financial filings. These locations serve as key hubs for distribution and as collection points for laundering proceeds. Cash deposits and peer-to-peer payment platforms were the most cited methods for fentanyl-linked transactions, appearing in 54 percent and 51 percent of filings, respectively.

A significant number of flagged transactions included slang terms and emojis—such as “blues,” “ills,” or blue dots—in memo fields. Structured cash deposits were commonly made across multiple branches or ATMs, often linked to otherwise legitimate businesses such as restaurants, salons, and trucking firms.

FinCEN also tracked a growing number of trade-based laundering schemes, in which proceeds from fentanyl sales were used to buy electronics and vaping devices. In one case, U.S.-based companies owned by Chinese nationals made outbound payments to Chinese manufacturers, using funds pooled from retail accounts and shell companies. These goods were then shipped to Mexico, closing the laundering loop.

Another key laundering method involved cryptocurrency. Nearly 10 percent of all fentanyl-related reports involved virtual currency, with Bitcoin the most commonly cited, followed by Ethereum and Litecoin. FinCEN flagged twenty darknet marketplaces as suspected hubs for fentanyl distribution and cited failures by some digital asset platforms to catch red-flag activity.

Overall, FinCEN warns that fentanyl-linked funds continue to enter the U.S. financial system through loosely regulated or poorly monitored channels, even as law enforcement ramps up enforcement. The Drug Enforcement Administration reported seizures of over 55 million counterfeit fentanyl pills in 2024 alone.

The broader pattern is unmistakable: precursor chemicals flow from China, manufacturing occurs in Mexico, Canada plays an increasing role in chemical acquisition and potential synthesis, and drugs and proceeds flood into the United States, supported by global financial tools and trade structures. The same infrastructure that enables lawful commerce is being manipulated to sustain the deadliest synthetic drug crisis in modern history.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

2025 Federal Election

Canada drops retaliatory tariffs on automakers, pauses other tariffs

MxM News

MxM News

Quick Hit:

Canada has announced it will roll back retaliatory tariffs on automakers and pause several other tariff measures aimed at the United States. The move, unveiled by Finance Minister François-Philippe Champagne, is designed to give Canadian manufacturers breathing room to adjust their supply chains and reduce reliance on American imports.

Key Details:

- Canada will suspend 25% tariffs on U.S. vehicles for automakers that maintain production, employment, and investment in Canada.

- A broader six-month pause on tariffs for other U.S. imports is intended to help Canadian sectors transition to domestic sourcing.

- A new loan facility will support large Canadian companies that were financially stable before the tariffs but are now struggling.

Diving Deeper:

Ottawa is shifting its approach to the escalating trade war with Washington, softening its economic blows in a calculated effort to stabilize domestic manufacturing. On Tuesday, Finance Minister François-Philippe Champagne outlined a new set of trade policies that provide conditional relief from retaliatory tariffs that have been in place since March. Automakers, the hardest-hit sector, will now be eligible to import U.S. vehicles duty-free—provided they continue to meet criteria that include ongoing production and investment in Canada.

“From day one, the government has reacted with strength and determination to the unjust tariffs imposed by the United States on Canadian goods,” Champagne stated. “We’re giving Canadian companies and entities more time to adjust their supply chains and become less dependent on U.S. suppliers.”

The tariff battle, which escalated in April with Canada slapping a 25% tax on U.S.-imported vehicles, had caused severe anxiety within Canada’s auto industry. John D’Agnolo, president of Unifor Local 200, which represents Ford employees in Windsor, warned the BBC the situation “has created havoc” and could trigger a recession.

Speculation about a possible Honda factory relocation to the U.S. only added to the unrest. But Ontario Premier Doug Ford and federal officials were quick to tamp down the rumors. Honda Canada affirmed its commitment to Canadian operations, saying its Alliston facility “will operate at full capacity for the foreseeable future.”

Prime Minister Mark Carney reinforced the message that the relief isn’t unconditional. “Our counter-tariffs won’t apply if they (automakers) continue to produce, continue to employ, continue to invest in Canada,” he said during a campaign event. “If they don’t, they will get 25% tariffs on what they are importing into Canada.”

Beyond the auto sector, Champagne introduced a six-month tariff reprieve on other U.S. imports, granting time for industries to explore domestic alternatives. He also rolled out a “Large Enterprise Tariff Loan Facility” to support big businesses that were financially sound prior to the tariff regime but have since been strained.

While Canada has shown willingness to ease its retaliatory measures, there’s no indication yet that the U.S. under President Donald Trump will reciprocate. Nevertheless, Ottawa signaled its openness to further steps to protect Canadian businesses and workers, noting that “additional measures will be brought forward, as needed.”

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP Whistleblowers Accuse Members of Mark Carney’s Inner Circle of Security Breaches and Surveillance

-

Also Interesting2 days ago

Also Interesting2 days agoBetFury Review: Is It the Best Crypto Casino?

-

Autism2 days ago

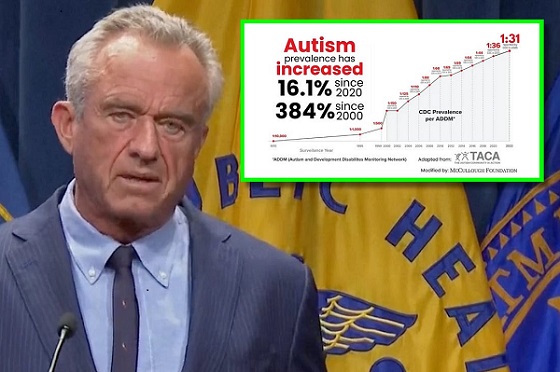

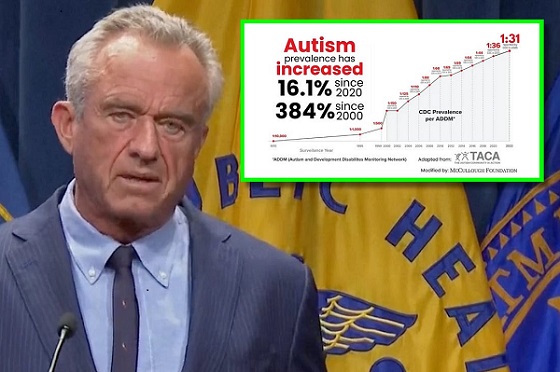

Autism2 days agoRFK Jr. Exposes a Chilling New Autism Reality

-

COVID-192 days ago

COVID-192 days agoCanadian student denied religious exemption for COVID jab takes tech school to court

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBureau Exclusive: Chinese Election Interference Network Tied to Senate Breach Investigation

-

International2 days ago

International2 days agoUK Supreme Court rules ‘woman’ means biological female

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoNeil Young + Carney / Freedom Bros

-

Health2 days ago

Health2 days agoWHO member states agree on draft of ‘pandemic treaty’ that could be adopted in May