Alberta

Half of Red Deer COVID-19 cases recovered. Central Alberta COVID death occurred in Camrose (April 6 Update)

Information from covid19stats.alberta.ca

On Monday, April 6 the province made some interesting changes and additions of the provincial COVID-19 stats website.

Red Deer is no longer separated into 3 quadrants. But the report now indicates how many cases are active and how many are recovered.

Across Central Alberta there are 66 cases.

- Red Deer City – 25 cases – 13 active – 12 recovered

- Red Deer County – 13 cases – 11 active – 2 recovered

- Wetaskiwin City – 7 cases – 3 active – 4 recovered

- Mountain View County – 5 cases – 4 active – 1 recovered

- Lacombe County – 4 cases – 1 active – 3 recovered

- Lacombe City – 2 cases – 0 active – 2 recovered

- Camrose City – 2 cases – 0 active – 1 recovered – 1 death

- Beaver County – 2 cases – 2 active

- Camrose County – 1 case – 1 recovered

- Windburn County – 1 case – 1 recovered

- Vermilion River County – 1 case – 1 recovered

- Ponoka County – 1 case – 1 active

- Stettler County – 1 case – 1 active

- Kneehill County – 1 case – 1 active

- Clearwater County – 1 case – 1 active

In this graph you can see that Central and Southern Alberta zones have been very fortunate in the amount of cases per 100,000

This graph makes it look like all the regions in Alberta “might” be flattening the curve. Experts say it takes up to 5 days in a row to indicate this trend. It currently looks promising.

This graph compares the age categories in both actual number of cases, and as a rate per 100,000 people in each category.

Here are the total numbers for the province. In recent days the percentage of cases in Central Alberta has dropped from 8 to 5.

From the Province of Alberta

Latest updates

- A total of 953 cases are laboratory confirmed and 395 are probable cases (symptomatic close contacts of laboratory confirmed cases). Laboratory positivity rates remain consistent at two per cent.

- Cases have been identified in all zones across the province:

- 817 cases in the Calgary zone

- 351 cases in the Edmonton zone

- 89 cases in the North zone

- 66 cases in the Central zone

- 22 cases in the South zone

- Three cases in zones yet to be confirmed

- Of these cases, there are currently 40 people in hospital, 16 of whom have been admitted to intensive care units (ICU).

- Of the 1,348 total cases, 204 are suspected of being community acquired.

- There are now a total of 361 confirmed recovered cases.

- One additional death has been reported in the Calgary zone. There have been 15 deaths in the Calgary zone, four in the Edmonton zone, four in the North zone, and one in the Central zone.

- Strong outbreak measures have been put in place at continuing care facilities. To date, 112 cases have been confirmed at these facilities.

- There have been 64,183 people tested for COVID-19 and a total of 65,914 tests performed by the lab. There have been 821 tests completed in the last 24 hours.

- Aggregate data, showing cases by age range and zone, as well as by local geographic areas, is available online at alberta.ca/covid19statistics.

- All Albertans need to work together to help prevent the spread and overcome COVID-19.

- Restrictions remain in place for all gatherings and close-contact businesses, dine-in restaurants and non-essential retail services. A full list of restrictions is available online.

- Alberta Health Services (AHS) has announced further restrictions for visitors to Alberta hospitals.

- AHS has expanded its testing criteria for COVID-19 to include symptomatic individuals in the following roles or age groups:

- Group home and shelter workers

- First responders, including firefighters

- Those involved in COVID-19 enforcement, including police, peace officers, bylaw officers, environmental health officers, and Fish and Wildlife officers

- Correctional facility staff, working in either a provincial or federal facility

- Starting April 7, individuals over the age of 65

- Anyone among these groups is urged to use the AHS online assessment tool for health-care workers, enforcement and first responders.

- Medical masks and respirators must be kept for health-care workers and others providing direct care to COVID-19 patients. Those who choose to wear a non-medical face mask should:

- continue to follow all other public health guidance (staying two metres away from others, wash hands regularly, stay home when sick)

- wash their hands immediately before putting it on and immediately after taking it off (in addition to practising good hand hygiene while wearing it)

- ensure it fits well (non-gaping)

- not share it with others

- avoid touching the mask while wearing it

- change masks as soon they get damp or soiled

- As Albertans look forward to the upcoming holiday weekend, they are being reminded to:

- avoid gatherings outside of their immediate household

- find ways to connect while being physically separated

- worship in a way that does not put people at risk, including participating in virtual or live-streamed religious celebrations

——————————————-

Alberta minister says patience running short for federal energy industry aid

Alberta

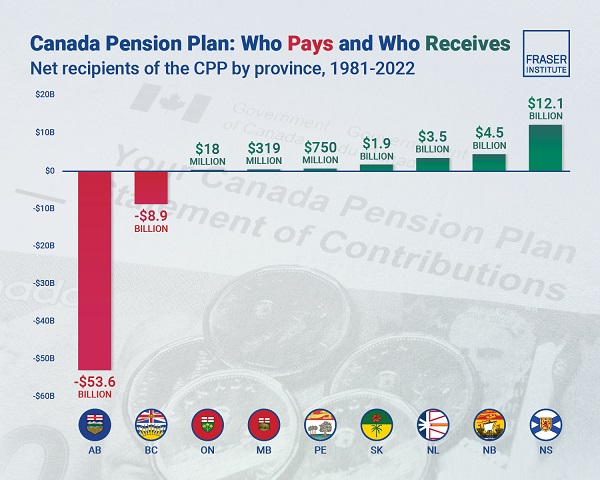

Albertans have contributed $53.6 billion to the retirement of Canadians in other provinces

From the Fraser Institute

By Tegan Hill and Nathaniel Li

Albertans contributed $53.6 billion more to CPP then retirees in Alberta received from it from 1981 to 2022

Albertans’ net contribution to the Canada Pension Plan —meaning the amount Albertans paid into the program over and above what retirees in Alberta

received in CPP payments—was more than six times as much as any other province at $53.6 billion from 1981 to 2022, finds a new report published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Albertan workers have been helping to fund the retirement of Canadians from coast to coast for decades, and Canadians ought to know that without Alberta, the Canada Pension Plan would look much different,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Understanding Alberta’s Role in National Programs, Including the Canada Pension Plan.

From 1981 to 2022, Alberta workers contributed 14.4 per cent (on average) of the total CPP premiums paid—Canada’s compulsory, government- operated retirement pension plan—while retirees in the province received only 10.0 per cent of the payments. Alberta’s net contribution over that period was $53.6 billion.

Crucially, only residents in two provinces—Alberta and British Columbia—paid more into the CPP than retirees in those provinces received in benefits, and Alberta’s contribution was six times greater than BC’s.

The reason Albertans have paid such an outsized contribution to federal and national programs, including the CPP, in recent years is because of the province’s relatively high rates of employment, higher average incomes, and younger population.

As such, if Alberta withdrew from the CPP, Alberta workers could expect to receive the same retirement benefits but at a lower cost (i.e. lower payroll tax) than other Canadians, while the payroll tax would likely have to increase for the rest of the country (excluding Quebec) to maintain the same benefits.

“Given current demographic projections, immigration patterns, and Alberta’s long history of leading the provinces in economic growth, Albertan workers will likely continue to pay more into it than Albertan retirees get back from it,” Hill said.

Understanding Alberta’s Role in National Programs, Including the Canada Pension Plan

- Understanding Alberta’s role in national income transfers and other important programs is crucial to informing the broader debate around Alberta’s possible withdrawal from the Canada Pension Plan (CPP).

- Due to Alberta’s relatively high rates of employment, higher average incomes, and younger population, Albertans contribute significantly more to federal revenues than they receive back in federal spending.

- From 1981 to 2022, Alberta workers contributed 14.4 percent (on average) of the total CPP premiums paid while retirees in the province received only 10.0 percent of the payments. Albertans net contribution was $53.6 billion over the period—approximately six times greater than British Columbia’s net contribution (the only other net contributor).

- Given current demographic projections, immigration patterns, and Alberta’s long history of leading the provinces in economic growth and income levels, Alberta’s central role in funding national programs is unlikely to change in the foreseeable future.

- Due to Albertans’ disproportionate net contribution to the CPP, the current base CPP contribution rate would likely have to increase to remain sustainable if Alberta withdrew from the plan. Similarly, Alberta’s stand-alone rate would be lower than the current CPP rate.

Tegan Hill

Director, Alberta Policy, Fraser Institute

Alberta

Alberta Institute urging Premier Smith to follow Saskatchewan and drop Industrial Carbon Tax

From the Alberta Institute

Axe Alberta’s Industrial Carbon Tax

Aside from tariffs, carbon taxes have been the key topic of the election campaign so far, with Mark Carney announcing that the Liberals would copy the Conservatives’ long-standing policy to axe the tax – but with a big caveat.

You see, it’s misleading to talk about the carbon tax as if it were a single policy.

In fact, that’s what the Liberals would like you to think because it helps them hide all the other carbon taxes they’ve forced on Canadians and on the Provinces.

Broadly speaking, there are actually four types of carbon taxes in place in Canada:

- A federal consumer carbon tax

- A federal industrial carbon tax

- Various provincial consumer carbon taxes

- Various provincial industrial carbon taxes

Alberta was actually the first jurisdiction anywhere in North America to introduce a carbon tax in 2007, when Premier Ed Stelmach introduced a provincial industrial carbon tax.

Then, as we all know, the Alberta NDP introduced a provincial consumer carbon tax in 2017.

The provincial consumer carbon tax was short-lived, as the UCP repealed it in 2019.

But, unfortunately, the UCP failed to repeal the provincial industrial carbon tax at the same time.

Worse, by then, the federal Liberals had introduced a federal consumer carbon tax and a federal industrial carbon tax as well!

Flash forward to 2025, and the political calculus has changed dramatically.

Mark Carney might only be promising to get rid of the federal consumer carbon tax, but Pierre Poilievre is promising to get rid of both the federal consumer carbon tax and the federal industrial carbon tax.

This is a clear opportunity, and yesterday, Scott Moe jumped on it.

He announced that Saskatchewan will also be repealing its provincial industrial carbon tax.

Saskatchewan never had a provincial consumer carbon tax, which means that, within just a few weeks, people in Saskatchewan could be paying ZERO carbon tax of ANY kind.

Alberta needs to follow Saskatchewan’s lead.

The Alberta government should immediately repeal Alberta’s provincial industrial carbon tax.

There’s no excuse for our provincial government to continue burdening our industries with unnecessary costs that hurt competitiveness and deter investment.

These taxes make it harder for businesses to thrive, grow, and create jobs, especially when other provinces are taking action to eliminate similar policies.

Premier Danielle Smith must act now and eliminate the provincial industrial carbon tax in Alberta.

If you agree, please sign our petition calling on the Alberta government to Axe Alberta’s Industrial Carbon Tax today:

After you’ve signed, please send the petition to your friends, family, and wider network, so that every Albertan can have their voice heard!

– The Alberta Institute Team

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre refuses to bash Trump via trick question, says it’s possible to work with him and be ‘firm’

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre to let working seniors keep more of their money

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoVoters should remember Canada has other problems beyond Trump’s tariffs

-

COVID-191 day ago

COVID-191 day ago17-year-old died after taking COVID shot, but Ontario judge denies his family’s liability claim

-

Community1 day ago

Community1 day agoSupport local healthcare while winning amazing prizes!

-

Daily Caller2 days ago

Daily Caller2 days agoCover up of a Department of Energy Study Might Be The Biggest Stain On Biden Admin’s Legacy

-

International2 days ago

International2 days agoVice President Vance, Second Lady to visit Greenland on Friday

-

Business1 day ago

Business1 day agoWhile “Team Canada” attacks Trump for election points, Premier Danielle Smith advocates for future trade relations