Business

Former Canadian broadcast regulator warns against Conservative-backed internet bill

Peter Menzies served as CRTC vice-chair after an extensive career in the newspaper industry

From LifeSiteNews

‘By all means, ensure the Criminal Code is enforced, but do not, under any circumstances, put some puffed-up public servant in charge of patrolling the online world. The state has no business in the WiFi of the nation,’ former CRTC vice-chair Peter Menzies wrote.

One of the past vice-chairs of Canada’s official broadcast regulator, Canada’s Radio-Television Commission (CRTC), has sounded the alarm over recent Conservative-backed federal legislation working its way through the system which looks to severely regulate the internet under the appearance of “protecting children.”

Peter Menzies, who served as the CRTC’s vice-chair for a time after an extensive career in the newspaper industry, and who is not known for being very conservative, wrote in a recent blog post in The Hub that the “[s]tate has no business in the WiFi of the nation,” criticizing in particular Senate Bill S-210.

He specifically used his ink space to criticize the Conservative Party of Canada (CPC) and its leader Pierre Poilievre for supporting Bill S-210.

“The Conservatives, as we speak, are backers of Independent Senator Julie Miville-Dechene’s private member’s Bill S-210. Its intent, like so many pieces of legislation, is virtuous, as it is trying to protect children from access to online pornography. But the road to regulatory hell is paved with good intentions, and the legislation is so clumsily constructed as to pose significant threats to privacy and free expression,” wrote Menzies.

Currently before Canada’s House of Commons for review is Senate Bill S-210, “An Act to restrict young persons’ online access to sexually explicit material.” The bill passed its second reading in the House of Commons last December, with CPC MPs lambasting most Liberal Party MPs for voting against a bill designed to protect children from accessing online pornography.

The creator of the the non-governmental law, Miville-Dechêne, was appointed to the Senate by Prime Minister Justin Trudeau in 2018. It was passed by the Senate in April 2023.

S-210 would create a framework to make it an offense for any organization that makes available “sexually explicit material” to anyone under the age 18 for commercial purposes. Anyone breaking the new rules would be fined $250,000 for the first offense and up to $500,000 for any subsequent offenses.

However, professor Dr. Michael Geist, who has been an open critic of already passed Trudeau government online censorship bills C-18 and C-11, as well as the newly introduced “Online Harms” Bill C-63, has warned that S-210 is an “avalanche” of bad news despite its good intentions.

“Bill S-210 isn’t a slippery slope. It’s an avalanche: Court ordered site blocking that can include lawful content and mandated age verification using facial recognition to access search or social media overseen by CRTC. Conservative MPs voted for this?!” Geist posted recently on X.

Menzies observed that if the Conservatives genuinely “Want to give us back control of our lives and make us the freest people on earth, they could start by stepping back from their recent alliance with Big Government solutions and instead find ways to help individuals take control of their lives by managing what comes into their homes.”

He called S-210 “So clumsily constructed as to pose significant threats to privacy and free expression.”

Menzies warned that Bill S-210, despite its seemingly good intentions, could result in Canadians being forced to use government-issued IDs to access many different internet services.

Menzies wrote that in his view, it makes no sense that the CPC under Poilievre oppose Trudeau’s new Online Harms Act, or Bill C-63, yet support Bill S-210.

As for Bill C-63, it was introduced in the House of Commons on February 26 and was immediately blasted by constitutional experts as very troublesome.

The new law will further regulate the internet and will allow a new digital safety commission to conduct “secret commission hearings” against those found to have violated the new law, raising “serious concerns for the freedom of expression” of Canadians online, one constitutional lawyer warned LifeSiteNews.

The Liberals under Trudeau claim Bill C-63 will target certain cases of internet content removal, notably those involving child sexual abuse and pornography.

The reality is, that the federal government under Trudeau has gone all in on radical transgender ideology, including the so-called “transitioning” of minors, while at the same time introducing laws that on the surface, appear to be about helping children.

Under Trudeau, the federal government has given millions of taxpayer money to fund LGBT groups of various kinds and aggressively pushes a pro-LGBT agenda.

Trudeau gov’t needs to ‘leave legal internet’ content alone

Menzies observed that what needs to happen instead is for governments to “[l]eave legal content on the internet alone,” and instead empower “parents” to have more control over what can be viewed online.

“By all means, ensure the Criminal Code is enforced, but do not, under any circumstances, put some puffed-up public servant in charge of patrolling the online world. The state has no business in the WiFi of the nation,” he wrote.

“Second, empower parents and families with the equipment they need to control their household’s internet access as they see fit and work with the people who really understand technology to do so.”

The CPC under its leader Poilievre has clarified that Conservatives “do not support any measures that would allow the imposition of a digital ID or infringe on the privacy of adults and their freedom to access legal content online,” when it comes to Bill S-210 or another other future law.

Campaign Life Coalition recently warned that Bill C-63, or the Online Harms Act, will stifle free speech and crush pro-life activism.

2025 Federal Election

Carney’s budget is worse than Trudeau’s

Liberal Leader Mark Carney is planning to borrow more money than former prime minister Justin Trudeau.

That’s an odd plan for a former banker because the federal government is already spending more on debt interest payments than it spends on health-care transfers to the provinces.

Let’s take a deeper look at Carney’s plan.

Carney says that his government would “spend less, invest more.”

At first glance, that might sound better than the previous decade of massive deficits and increasing debt, but does that sound like a real change?

Because if you open a thesaurus, you’ll find that “spend” and “invest” are synonyms, they mean the same thing.

And Carney’s platform shows it. Carney plans to increase government spending by $130 billion. He plans to increase the federal debt by $225 billion over the next four years. That’s about $100 billion more than Trudeau was planning borrow over the same period, according to the most recent Fall Economic Statement.

Carney is planning to waste $5.6 billion more on debt interest charges than Trudeau. Interest charges already cost taxpayers more than $1 billion per week.

The platform claims that Carney will run a budget surplus in 2028, but that’s nonsense. Because once you include the $48 billion of spending in Carney’s “capital” budget, the tiny surplus disappears, and taxpayers are stuck with more debt.

And that’s despite planning to take even more money from Canadians in years ahead. Carney’s platform shows that his carbon tariff, another carbon tax on Canadians, will cost taxpayers $500 million.

The bottom line is that government spending, no matter what pile it is put into, is just government spending. And when the government spends too much, that means it must borrow more money, and taxpayers have to pay the interest payments on that irresponsible borrowing.

Canadians don’t even believe that Carney can follow through on his watered-down plan. A majority of Canadians are skeptical that Carney will balance the operational budget in three years, according to Leger polling.

All Carney’s plan means for Canadians is more borrowing and higher debt. And taxpayers can’t afford anymore debt.

When the Liberals were first elected the debt was $616 billion. It’s projected to reach almost $1.3 trillion by the end of the year, that means the debt has more than doubled in the last decade.

Every single Canadian’s individual share of the federal debt averages about $30,000.

Interest charges on the debt are costing taxpayers $53.7 billion this year. That’s more than the government takes in GST from Canadians. That means every time you go to the grocery store, fill up your car with gas, or buy almost anything else, all that federal sales tax you pay isn’t being used for anything but paying for the government’s poor financial decisions.

Creative accounting is not the solution to get the government’s fiscal house in order. It’s spending cuts. And Carney even says this.

“The federal government has been spending too much,” said Carney. He then went on to acknowledge the huge spending growth of the government over the last decade and the ballooning of the federal bureaucracy. A serious plan to balance the budget and pay down debt includes cutting spending and slashing bureaucracy.

But the Conservatives aren’t off the hook here either. Conservative Leader Pierre Poilievre has said that he will balance the budget “as soon as possible,” but hasn’t told taxpayers when that is.

More debt today means higher taxes tomorrow. That’s because every dollar borrowed by the federal government must be paid back plus interest. Any party that says it wants to make life more affordable also needs a plan to start paying back the debt.

Taxpayers need a government that will commit to balancing the budget for real and start paying back debt, not one that is continuing to pile on debt and waste billions on interest charges.

2025 Federal Election

As PM Poilievre would cancel summer holidays for MP’s so Ottawa can finally get back to work

From Conservative Party Communications

In the first 100 days, a new Conservative government will pass 3 laws:

1. Affordability For a Change Act—cutting spending, income tax, sales tax off homes

2. Safety For a Change Act to lock up criminals

3. Bring Home Jobs Act—that repeals C-69, sets up 6 month permit turnarounds for new projects

No summer holiday til they pass!

Conservative Leader Pierre Poilievre announced today that as Prime Minister he will cancel the summer holiday for Ottawa politicians and introduce three pieces of legislation to make life affordable, stop crime, and unleash our economy to bring back powerful paycheques. Because change can’t wait.

A new Conservative government will kickstart the plan to undo the damage of the Lost Liberal Decade and restore the promise of Canada with a comprehensive legislative agenda to reverse the worst Trudeau laws and cut the cost of living, crack down on crime, and unleash the Canadian economy with ‘100 Days of Change.’ Parliament will not rise until all three bills are law and Canadians get the change they voted for.

“After three Liberal terms, Canadians want change now,” said Poilievre. “My plan for ‘100 Days of Change’ will deliver that change. A new Conservative government will immediately get to work, and we will not stop until we have delivered lower costs, safer streets, and bigger paycheques.”

The ’100 Days of Change’ will include three pieces of legislation:

The Affordability–For a Change Act

Will lower food prices, build more homes, and bring back affordability for Canadians by:

- Cutting income taxes by 15%. The average worker will keep an extra $900 each year, while dual-income families will keep $1,800 more annually.

- Axing the federal sales tax on new homes up to $1.3 million. Combined with a plan to incentivize cities to lower development charges, this will save homebuyers $100,000 on new homes.

- Axing the federal sales tax on new Canadian cars to protect auto workers’ jobs and save Canadians money, and challenge provinces to do the same.

- Axing the carbon tax in full. Repeal the entire carbon tax law, including the federal industrial carbon tax backstop, to restore our industrial base and take back control of our economy from the Americans.

- Scrapping Liberal fuel regulations and electricity taxes to lower the cost of heating, gas, and fuel.

- Letting working seniors earn up to $34,000 tax-free.

- Axing the escalator tax on alcohol and reset the excise duty rates to those in effect before the escalator was passed.

- Scrapping the plastics ban and ending the planned food packaging tax on fresh produce that will drive up grocery costs by up to 30%.

We will also:

- Identify 15% of federal buildings and lands to sell for housing in Canadian cities.

The Safe Streets–For a Change Act

Will end the Liberal violent crime wave by:

- Repealing all the Liberal laws that caused the violent crime wave, including catch-and-release Bill C-75, which lets rampant criminals go free within hours of their arrest.

- Introducing a “three strikes, you’re out” rule. After three serious offences, offenders will face mandatory minimum 10-year prison sentences with no bail, parole, house arrest, or probation.

- Imposing life sentences for fentanyl trafficking, illegal gun trafficking, and human trafficking. For too long, radical Liberals have let crime spiral out of control—Canada will no longer be a haven for criminals.

- Stopping auto theft, extortion, fraud, and arson with new minimum penalties, no house arrest, and a new more serious offence for organized theft.

- Give police the power to end tent cities.

- Bringing in tougher penalties and a new law to crack down on Intimate Partner Violence.

- Restoring consecutive sentences for multiple murderers, so the worst mass murderers are never let back on our streets.

The Bring Home Jobs–For a Change Act

This Act will be rocket fuel for our economy. We will unleash Canada’s vast resource wealth, bring back investment, and create powerful paycheques for workers so we can stand on our own feet and stand up to Trump from a position of strength, by:

- Repealing the Liberal ‘No Development Law’, C-69 and Bill C-48, lifting the cap on Canadian energy to get major projects built, unlock our resources, and start selling Canadian energy to the world again.

- Bringing in the Canada First Reinvestment Tax Cut to reward Canadians who reinvest their earnings back into our country, unlocking billions for home building, manufacturing, and tools, training and technology to boost productivity for Canadian workers.

- Creating a One-Stop-Shop to safely and rapidly approve resource projects, with one simple application and one environmental review within one year.

Poilievre will also:

- Call President Trump to end the damaging and unjustified tariffs and accelerate negotiations to replace CUSMA with a new deal on trade and security. We need certainty—not chaos, but Conservatives will never compromise on our sovereignty and security.

- Get Phase 2 of LNG Canada built to double the project’s natural gas production.

- Accelerate at least nine other projects currently snarled in Liberal red tape to get workers working and Canada building again.

“After the Lost Liberal Decade of rising costs and crime and a falling economy under America’s thumb, we cannot afford a fourth Liberal term,” said Poilievre. “We need real change, and that is what Conservatives will bring in the first 100 days of a new government. A new Conservative government will get to work on Day 1 and we won’t stop until we have delivered the change we promised, the change Canadians deserve, the change Canadians voted for.”

-

Business2 days ago

Business2 days agoIs Government Inflation Reporting Accurate?

-

2025 Federal Election2 days ago

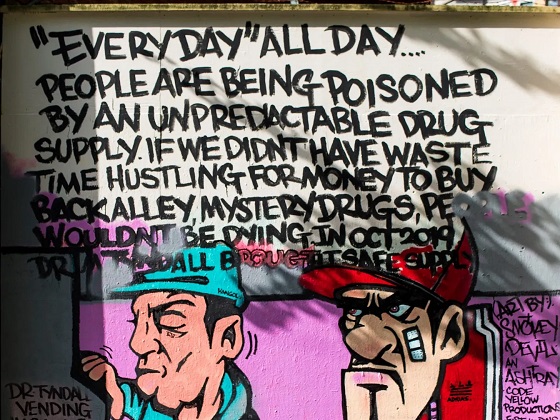

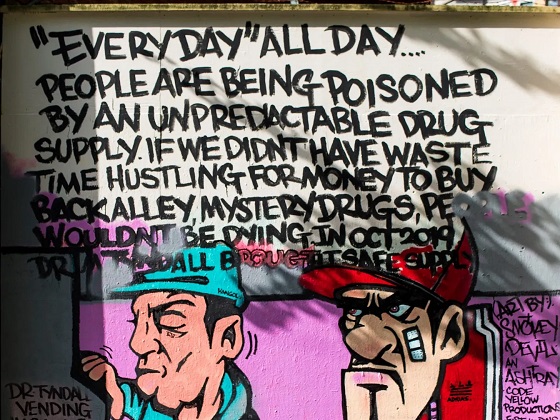

2025 Federal Election2 days agoStudy links B.C.’s drug policies to more overdoses, but researchers urge caution

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPolls say Canadians will give Trump what he wants, a Carney victory.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre’s Conservatives promise to repeal policy allowing male criminals in female jails

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney Liberals pledge to follow ‘gender-based goals analysis’ in all government policy

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoTrump Has Driven Canadians Crazy. This Is How Crazy.

-

Entertainment1 day ago

Entertainment1 day agoPedro Pascal launches attack on J.K. Rowling over biological sex views

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre Campaigning To Build A Canadian Economic Fortress